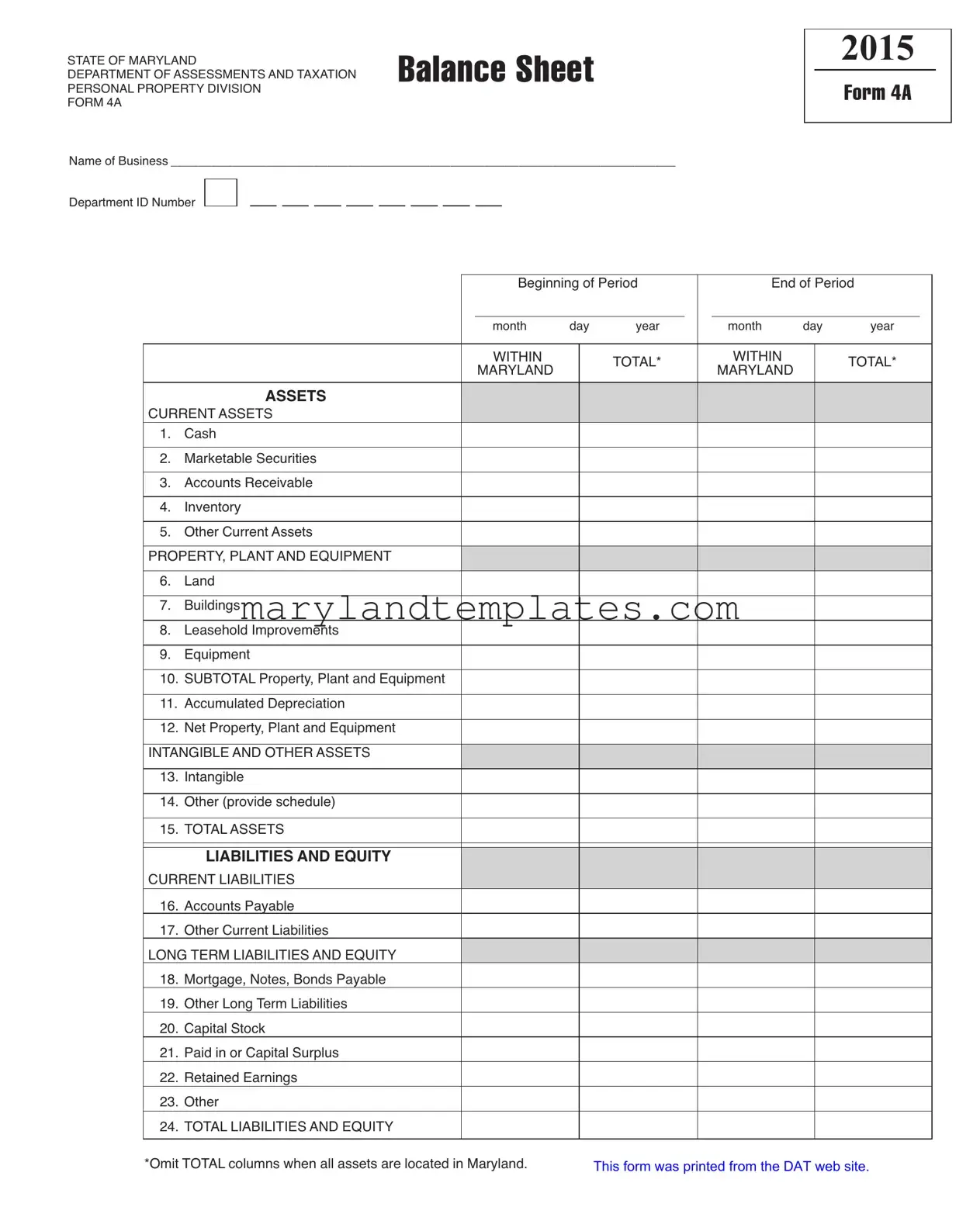

Printable 4A Maryland Template

The 4A Maryland form serves as a crucial financial reporting tool for businesses operating within the state. It captures a comprehensive snapshot of a company's financial position at two distinct points in time: the beginning and the end of a specified period. This form requires businesses to disclose a variety of financial data, including current assets such as cash, marketable securities, accounts receivable, inventory, and other current assets. Additionally, it encompasses property, plant, and equipment, detailing land, buildings, leasehold improvements, and equipment, while also accounting for accumulated depreciation. Intangible assets and other categories are included, ensuring a holistic view of the business's resources. On the liabilities and equity side, the form outlines current liabilities like accounts payable and other current obligations, alongside long-term liabilities such as mortgages and bonds payable. It also provides space for capital stock, paid-in capital surplus, and retained earnings. This structured approach not only aids businesses in organizing their financial information but also assists the Department of Assessments and Taxation in evaluating the overall economic landscape of Maryland.

4A Maryland Preview

STATE OF MARYLAND |

BALANCE SHEET |

2015 |

|

|

|

|

|

||

DEPARTMENT OFASSESSMENTSAND TAXATION |

|

|

|

|

PERSONAL PROPERTY DIVISION |

|

|

FORM 4A |

|

FORM 4A |

|

|

|

|

|

|

|

|

|

Name of Business__________________________________________________________________________

Department ID Number

|

|

Beginning of Period |

|

|

End of Period |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

month |

day |

year |

|

|

month |

day |

year |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WITHIN |

|

|

|

|

|

WITHIN |

|

|

|

|

|

|

|

TOTAL* |

|

|

|

TOTAL* |

|

|

|||

|

|

MARYLAND |

|

|

|

|

MARYLAND |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

ASSETS

CURRENTASSETS

1.Cash

2.Marketable Securities

3.Accounts Receivable

4.Inventory

5.Other CurrentAssets

PROPERTY, PLANTAND EQUIPMENT

6.Land

7.Buildings

8.Leasehold Improvements

9.Equipment

10.SUBTOTAL Property, Plant and Equipment

11.Accumulated Depreciation

12.Net Property, Plant and Equipment

INTANGIBLEANDOTHERASSETS

13.Intangible

14.Other(provideschedule)

15.TOTALASSETS

LIABILITIESANDEQUITY

CURRENTLIABILITIES

16.AccountsPayable

17.OtherCurrentLiabilities

LONGTERMLIABILITIESANDEQUITY

18.Mortgage,Notes,BondsPayable

19.OtherLongTermLiabilities

20.CapitalStock

21.PaidinorCapitalSurplus

22.RetainedEarnings

23.Other

24.TOTALLIABILITIESANDEQUITY

*Omit TOTAL columns when all assets are located in Maryland.

This form was printed from the DAT web site.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The 4A Maryland form is used to report the balance sheet of a business for personal property tax assessment purposes. |

| Governing Law | This form is governed by the Maryland Code, Tax-Property Article, Title 8, which outlines the assessment and taxation of personal property. |

| Assets Breakdown | The form categorizes assets into current assets, property, plant and equipment, and intangible assets, ensuring a comprehensive view of the business's financial position. |

| Liabilities and Equity | It also requires businesses to report their current and long-term liabilities, along with equity components, providing a complete financial overview. |

Other PDF Forms

How Many Hours Can a Minor Work in Illinois - Serves as a comprehensive guide, from application to the issuance of a work permit for minors in Maryland.

Maryland Form 502 Instructions - Flexible in accommodating various deduction methods, ensuring taxpayers can maximize their returns or minimize liabilities.

For those looking to safeguard their assets, the benefits of a well-structured Prenuptial Agreement cannot be overstated. Exploring a professionally designed Prenuptial Agreement template can provide couples with the necessary framework to discuss and delineate their financial expectations before tying the knot.

Maryland State 100 Application - Applicants are facilitated with the option to check preferred counties or indicate availability across the state.