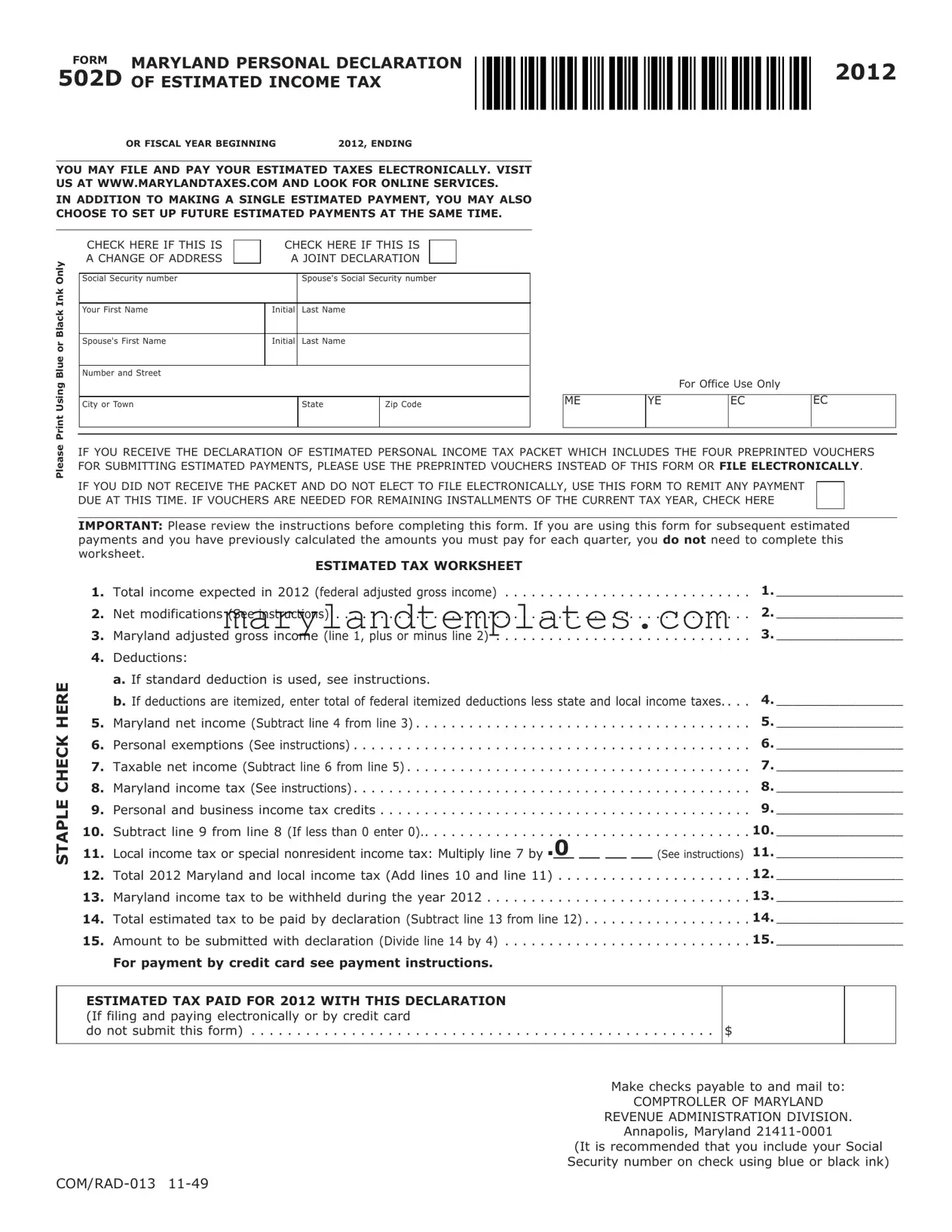

Printable 502D Maryland Template

The 502D Maryland form, known as the Personal Declaration of Estimated Income Tax, plays a crucial role in the state's tax collection process. This form is designed for individuals who expect to owe more than $500 in Maryland income tax after accounting for withholding. By filing this declaration, taxpayers can make estimated payments throughout the year, thus adhering to Maryland's pay-as-you-go tax system. The form allows for both electronic filing and payment, providing flexibility for those who prefer digital transactions. It includes a detailed worksheet to help taxpayers estimate their total income, deductions, and taxable net income for the year. Additionally, it outlines the specific due dates for quarterly payments and offers instructions for those who may need to adjust their estimated tax based on changes in income or exemptions. Whether filing individually or jointly, it is essential to follow the guidelines carefully to avoid penalties and ensure compliance with state tax laws.

502D Maryland Preview

FORM |

MARYLAND PERSONAL DECLARATION |

502D |

OF ESTIMATED INCOME TAX |

2012

OR FISCAL YEAR BEGINNING |

2012, ENDING |

YOU MAY FILE AND PAY YOUR ESTIMATED TAXES ELECTRONICALLY. VISIT US AT WWW.MARYLANDTAXES.COM AND LOOK FOR ONLINE SERVICES.

IN ADDITION TO MAKING A SINGLE ESTIMATED PAYMENT, YOU MAY ALSO CHOOSE TO SET UP FUTURE ESTIMATED PAYMENTS AT THE SAME TIME.

Print Using Blue or Black Ink Only

CHECK HERE IF THIS IS |

|

|

CHECK HERE IF THIS IS |

|

|

||

A CHANGE OF ADDRESS |

|

|

A JOINT DECLARATION |

|

|

||

|

|

|

|

|

|

|

|

Social Security number |

|

|

|

Spouse's Social Security number |

|

||

|

|

|

|

|

|

|

|

Your First Name |

|

|

Initial |

Last Name |

|

|

|

|

|

|

|

|

|

|

|

Spouse's First Name |

|

|

Initial |

Last Name |

|

|

|

|

|

|

|

|

|

|

|

Number and Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or Town |

|

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

ME

For Office Use Only

YE |

EC |

EC |

|

|

|

Please

IF YOU RECEIVE THE DECLARATION OF ESTIMATED PERSONAL INCOME TAX PACKET WHICH INCLUDES THE FOUR PREPRINTED VOUCHERS FOR SUBMITTING ESTIMATED PAYMENTS, PLEASE USE THE PREPRINTED VOUCHERS INSTEAD OF THIS FORM OR FILE ELECTRONICALLY.

IF YOU DID NOT RECEIVE THE PACKET AND DO NOT ELECT TO FILE ELECTRONICALLY, USE THIS FORM TO REMIT ANY PAYMENT DUE AT THIS TIME. IF VOUCHERS ARE NEEDED FOR REMAINING INSTALLMENTS OF THE CURRENT TAX YEAR, CHECK HERE

STAPLE CHECK HERE

IMPORTANT: Please review the instructions before completing this form. If you are using this form for subsequent estimated payments and you have previously calculated the amounts you must pay for each quarter, you do not need to complete this worksheet.

|

ESTIMATED TAX WORKSHEET |

|

1. |

Total income expected in 2012 (federal adjusted gross income) |

1.________________ |

2. |

Net modifications (See instructions) |

2.________________ |

3. |

Maryland adjusted gross income (line 1, plus or minus line 2) |

3.________________ |

4.Deductions:

a. If standard deduction is used, see instructions.

|

b. If deductions are itemized, enter total of federal itemized deductions less state and local income taxes.. . . |

4. |

________________ |

||||||

5. |

Maryland net income (Subtract line 4 from line 3) |

5. |

________________ |

||||||

6. |

Personal exemptions (See instructions) |

6. |

________________ |

||||||

7. |

Taxable net income (Subtract line 6 from line 5) |

7. |

________________ |

||||||

8. |

Maryland income tax (See instructions) |

8. |

________________ |

||||||

9. |

Personal and business income tax credits |

9. |

________________ |

||||||

10. |

Subtract line 9 from line 8 (If less than 0 enter 0) |

10. |

________________ |

||||||

11. |

Local income tax or special nonresident income tax: Multiply line 7 by .0 |

|

|

|

|

|

(See instructions) |

11. |

________________ |

12. |

Total 2012 Maryland and local income tax (Add lines 10 and line 11) |

________________ |

|||||||

13. |

Maryland income tax to be withheld during the year 2012 |

13. |

________________ |

||||||

14. |

Total estimated tax to be paid by declaration (Subtract line 13 from line 12) |

14. |

________________ |

||||||

15. |

Amount to be submitted with declaration (Divide line 14 by 4) |

15. |

________________ |

||||||

|

For payment by credit card see payment instructions. |

|

|

|

|

||||

ESTIMATED TAX PAID FOR 2012 WITH THIS DECLARATION (If filing and paying electronically or by credit card

do not submit this form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Make checks payable to and mail to:

COMPTROLLER OF MARYLAND

REVENUE ADMINISTRATION DIVISION.

Annapolis, Maryland

(It is recommended that you include your Social Security number on check using blue or black ink)

FORM |

MARYLAND PERSONAL DECLARATION |

PAGE 2 |

502D |

OF ESTIMATED INCOME TAX |

|

2012 |

INSTRUCTIONS |

|

Purpose of declaration The filing of a declaration of estimated Maryland income tax is a part of the

Who must file a declaration You must file a declaration of estimated tax if you are required to file a Maryland income tax return AND your gross income would be expected to develop a tax of more than $500 in excess of your Maryland withholding.

You must file a declaration with payment in full within 60 days of receiving $500 or more of income from awards, prizes, lotteries or raffles, whether paid in cash or property if Maryland tax has not been withheld. A husband and wife may file a joint declaration.

When to file a declaration You must pay at least

Overpayment of tax If you overpaid your 2011 income tax (Form 502 or 505) you may apply all or part of the overpayment to your 2012 estimated tax. If the overpayment applied equals or exceeds the estimated tax liability for the first quarterly payment, you are not required to file the declaration. If the overpayment applied is less than the estimated tax liability, you should file the declaration and pay the balance of the first installment. Preprinted vouchers will be mailed to you for the remaining payments.

How to estimate your 2012 tax The worksheet on page 1 is designed to develop an estimate of your 2012 Maryland and local income tax. Be as accurate as you can in forecasting your 2012 income. You may use your 2011 income and tax as a guide, but if you will receive more income than you did in 2011, you must pay at least 110% of your prior year tax to avoid interest for underpayment of estimated tax. For the purpose of estimating, rounding all amounts to the nearest dollar is recommended.

Nonresidents may use the Nonresident Estimated Tax Calculator at www.marylandtaxes.com.

Specific Instructions:

Line 1. Total income expected in 2012 is your estimated federal adjusted gross income.

Line 2. Net modifications. You must add certain items to your federal adjusted gross income. See Instruction 12 of the tax booklet. You may subtract certain items from federal adjusted gross income. See Instruction 13 of the tax booklet. Enter on this line the net result of additions and subtractions.

Line 4. Deductions. You may compute your tax using the standard deduction method or the itemized deduction method.

Standard deduction. Compute 15% of line 3.

For Filing Status 1, 3, 6: if the amount computed is less than $1,500, enter $1,500; if the amount is between $1,500 and $2,000, enter that amount; if the amount is more than $2,000, enter $2,000.

For Filing Status 2, 4, 5: if the amount computed is less than $3,000, enter $3,000; if the amount is between $3,000 and $4,000, enter that amount; if the amount is more than $4,000, enter $4,000.

Itemized deductions. Enter the total of federal itemized deductions less state and local income taxes.

Line 6. Personal exemptions. If your FAGI will be $100,000 or less, you are allowed:

a. $3,200 each for taxpayer and spouse.

b. $1,000 each for taxpayer and spouse if age 65 or over and/or blind.

c. $3,200 for each allowable dependent, other than taxpayer and spouse. The amount is doubled for allowable dependents age 65 or over.

If your AGI will be more than $100,000, see chart below to determine the amount of exemption you can claim for items a and c above.

|

|

If you will ile your tax return |

||

|

|

|

|

|

|

|

Single or |

Joint, Head of |

|

If Your federal AGI is |

Household |

|||

Married Filing |

||||

|

|

or Qualifying |

||

|

|

Separately |

||

|

|

Widow(er) |

||

|

|

Your |

||

|

|

Your |

||

|

|

Exemption is |

||

|

|

Exemption is |

||

|

|

|

|

|

$100,000 or less |

$3,200 |

$3,200 |

||

|

|

|

|

|

Over |

But not |

|

|

|

over |

|

|

||

|

|

|

||

|

|

|

|

|

$100,000 |

$125,000 |

$1,600 |

$3,200 |

|

|

|

|

|

|

$125,000 |

$150,000 |

$800 |

$3,200 |

|

|

|

|

|

|

$150,000 |

$175,000 |

$0 |

$1,600 |

|

|

|

|

|

|

$175,000 |

$200,000 |

$0 |

$800 |

|

|

|

|

|

|

In excess of $200,000 |

$0 |

$0 |

||

|

|

|

|

|

Line 8. Maryland income tax. Use the tax rate schedules below to compute your tax on the amount on line 7.

For taxpayers filing as Single, Married Filing Separately, or as Dependent Taxpayers. This rate is also used for taxpayers filing as Fiduciaries.

Tax Rate Schedule I

If taxable net income is: |

Maryland Tax is: |

||||

At least: |

but not over: |

|

|

|

|

$0 |

$1,000 |

|

|

2.00% |

of taxable net income |

$1,000 |

$2,000 |

$20.00 |

plus |

3.00% |

of excess over $1,000 |

$2,000 |

$3,000 |

$50.00 |

plus |

4.00% |

of excess over $2,000 |

$3,000 |

$100,000 |

$90.00 |

plus |

4.75% |

of excess over $3000 |

$100,000 |

$125,000 |

$4,697.50 |

plus |

5.00% |

of excess over $100,000 |

$125,000 |

$150,000 |

$5,947.50 |

plus |

5.25% |

of excess over $125,000 |

$150,000 |

$250,000 |

$7,260.00 |

plus |

5.50% |

of excess over $150,000 |

$250,000 |

$12,760.00 |

plus |

5.75% |

of excess over $250,000 |

|

For taxpayers iling Joint Returns, Head of Household, or for Qualifying Widows/Widowers.

Tax Rate Schedule II

If taxable net income is: |

Maryland Tax is: |

||||

At least: |

but not over: |

|

|

|

|

$0 |

$1,000 |

|

|

2.00% |

of taxable net income |

$1,000 |

$2,000 |

$20.00 |

plus |

3.00% |

of excess over $1,000 |

$2,000 |

$3,000 |

$50.00 |

plus |

4.00% |

of excess over $2,000 |

$3,000 |

$150,000 |

$90.00 |

plus |

4.75% |

of excess over $3000 |

$150,000 |

$175,000 |

$7,072.50 |

plus |

5.00% |

of excess over $150,000 |

$175,000 |

$225,000 |

$8,322.50 |

plus |

5.25% |

of excess over $175,000 |

$225,000 |

$300,000 |

$10,947.50 |

plus |

5.50% |

of excess over $225,000 |

$300,000 |

$15,072.50 |

plus |

5.75% |

of excess over $300,000 |

|

FORM |

MARYLAND PERSONAL DECLARATION |

PAGE 3 |

502D |

OF ESTIMATED INCOME TAX |

|

2012 |

INSTRUCTIONS |

|

Line 11. Local or special nonresident income tax. Maryland counties and Baltimore City levy an income tax on residents that is a percentage of taxable net income. The amount you entered on line 7 is your taxable net income. Multiply that amount by your local tax rate (see below) and enter on line 11.

Baltimore City. . . . . . . . . . . . . . . .0320

Allegany County . . . . . . . . . . . . . .0305

Anne Arundel County . . . . . . . . . .0249

Baltimore County . . . . . . . . . . . . .0283

Calvert County . . . . . . . . . . . . . . .0280

Caroline County . . . . . . . . . . . . . .0263

Carroll County. . . . . . . . . . . . . . . .0305

Cecil County . . . . . . . . . . . . . . . . .0280

Charles County . . . . . . . . . . . . . . .0290

Dorchester County . . . . . . . . . . . .0262

Frederick County. . . . . . . . . . . . . .0296

Garrett County . . . . . . . . . . . . . . .0265

Harford County . . . . . . . . . . . . . . .0306

Howard County . . . . . . . . . . . . . . .0320

Kent County . . . . . . . . . . . . . . . . .0285

Montgomery County . . . . . . . . . . .0320

Prince George’s County . . . . . . . . .0320

Queen Anne’s County . . . . . . . . . .0320

St. Mary’s County . . . . . . . . . . . . .0300

Somerset County . . . . . . . . . . . . .0315

Talbot County . . . . . . . . . . . . . . . .0225

Washington County . . . . . . . . . . . .0280

Wicomico County. . . . . . . . . . . . . .0310

Worcester County . . . . . . . . . . . . .0125

Nonresidents use. . . . . . . . . . . .0125

Filing a return instead of fourth payment Instead of making the fourth declaration payment on or before January 15, 2013, you may file your 2012 personal income tax return, provided you file it on or before January 31, 2013 and pay in full with the return any balance of tax due.

Farmers and fishermen If your estimated gross income from farming or fishing is at least

Changes in income or exemptions Your situation may not require you to file a declaration on April 15, 2012. However, a large increase in income after that date may require you to file a declaration. If at any time during the year you need to amend your original declaration, simply increase or decrease the remaining payments.

Forms and information Declaration of estimated tax forms and any additional information may be obtained from the Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, Maryland

Electronic filing You may file and pay your 2012 estimated taxes electronically. When you use our iFile program, we give you the ability to make a single estimated tax payment, as well as providing the convenience of scheduling all of your payments at one time. These scheduled payments will be deducted from your bank account on the dates that you specify. Visit us at www.marylandtaxes.com and look for

Payment by credit card You may pay your balance by using your MasterCard, Discover, American Express or Visa. Credit card payments may be made by telephone or over the Internet. The internet option is available to everyone. You must have filed a 2010 Maryland income tax return to use the telephone option.

Both options will be processed by Official Payments Corporation who will charge a convenience fee on the amount of your payment. The State will not receive this fee. You will be told the amount of the fee before you complete your transaction. Do not include the amount of the convenience fee as part of the tax payment.

To make a credit card payment call

Payment by check or money order Make your check or money order payable to “Comptroller of Maryland.” Write the type of tax, year of tax, and tax being paid on your check. It is recommended that you include your Social Security number on check using blue or black ink.

DO NOT SEND CASH.

Mailing instructions Mail your declaration of estimated tax to: Comptroller of Maryland

Revenue Administration Division 110 Carroll Street Annapolis, Maryland

Penalties and interest If you are required by law to file a declaration of estimated tax for any tax year and you either (1) fail to file on the date prescribed, (2) fail to pay the installment or installments when due or

(3)estimate a tax less than ninety (90) percent of the developed tax shown on the return for the current taxable year and which estimate was less than 110% of the tax that was developed for the prior year, you will be subject to the penalties and interest as provided by law for the failure to file a return and the failure to pay a tax when due.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The 502D form is used for declaring estimated Maryland income tax, allowing taxpayers to pay taxes on income not subject to withholding. |

| Who Must File | Individuals must file if their gross income is expected to exceed $500 in tax liability beyond Maryland withholding. |

| Filing Deadlines | First payment is due by April 15, 2012, with subsequent payments due on June 15, September 15, and January 15 of the following year. |

| Governing Laws | This form is governed by Maryland tax laws, which align closely with federal tax regulations regarding estimated tax payments. |

Other PDF Forms

What Is the Sales Tax in Maryland - The certificate acts as a blanket agreement for transactions, simplifying the tax exemption process on multiple orders from the same supplier.

When buying or selling a motorcycle in Washington State, it is important to utilize the Washington Motorcycle Bill of Sale form to ensure that both parties are protected and the details of the transaction are clearly documented. For an easy-to-use template, visit WA Documents where you can find the essential form to facilitate your sale.

Maryland Mountains - Form 746 must be submitted to the State Retirement Agency at 120 East Baltimore Street, Baltimore, Maryland.

Motion for Modification of Sentence - Pathway for individuals in Maryland’s correctional system to argue for a sentence that includes specialized health treatment.