Fillable Maryland Loan Agreement Template

When considering a loan in Maryland, understanding the Maryland Loan Agreement form is crucial for both lenders and borrowers. This document serves as a formal contract outlining the terms and conditions of the loan, ensuring that both parties are on the same page. Key elements include the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, it specifies the rights and responsibilities of each party, helping to protect their interests throughout the loan period. The form also addresses what happens in the event of a default, providing clarity on potential consequences. By clearly detailing these aspects, the Maryland Loan Agreement promotes transparency and helps foster a trusting relationship between the lender and borrower.

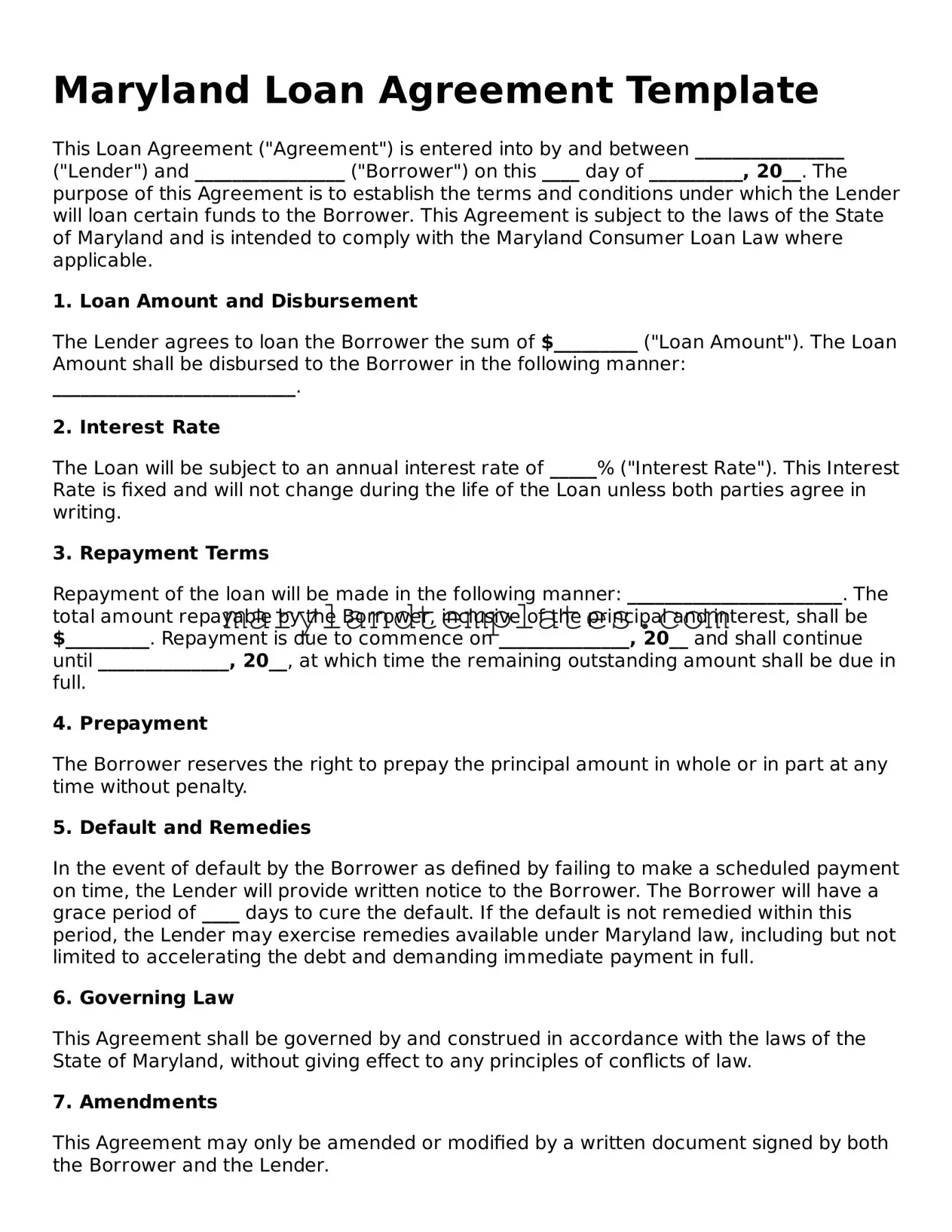

Maryland Loan Agreement Preview

Maryland Loan Agreement Template

This Loan Agreement ("Agreement") is entered into by and between ________________ ("Lender") and ________________ ("Borrower") on this ____ day of __________, 20__. The purpose of this Agreement is to establish the terms and conditions under which the Lender will loan certain funds to the Borrower. This Agreement is subject to the laws of the State of Maryland and is intended to comply with the Maryland Consumer Loan Law where applicable.

1. Loan Amount and Disbursement

The Lender agrees to loan the Borrower the sum of $_________ ("Loan Amount"). The Loan Amount shall be disbursed to the Borrower in the following manner: __________________________.

2. Interest Rate

The Loan will be subject to an annual interest rate of _____% ("Interest Rate"). This Interest Rate is fixed and will not change during the life of the Loan unless both parties agree in writing.

3. Repayment Terms

Repayment of the loan will be made in the following manner: _______________________. The total amount repayable by the Borrower, inclusive of the principal and interest, shall be $_________. Repayment is due to commence on ______________, 20__ and shall continue until ______________, 20__, at which time the remaining outstanding amount shall be due in full.

4. Prepayment

The Borrower reserves the right to prepay the principal amount in whole or in part at any time without penalty.

5. Default and Remedies

In the event of default by the Borrower as defined by failing to make a scheduled payment on time, the Lender will provide written notice to the Borrower. The Borrower will have a grace period of ____ days to cure the default. If the default is not remedied within this period, the Lender may exercise remedies available under Maryland law, including but not limited to accelerating the debt and demanding immediate payment in full.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Maryland, without giving effect to any principles of conflicts of law.

7. Amendments

This Agreement may only be amended or modified by a written document signed by both the Borrower and the Lender.

8. Signatures

Both parties affirm their understanding and agreement to the terms outlined in this Agreement by their signatures below:

Lender Signature: _________________________ Date: ____________

Borrower Signature: ________________________ Date: ____________

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Maryland Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Maryland. |

| Parties Involved | The form requires the names and contact information of both the lender and the borrower. |

| Loan Amount | The specific amount being loaned must be clearly stated in the agreement. |

| Interest Rate | The interest rate applicable to the loan must be disclosed, including whether it is fixed or variable. |

| Repayment Terms | The form outlines the repayment schedule, including due dates and any penalties for late payments. |

Additional Maryland Templates

Bill of Sale for Car Maryland - Buyers should verify the information on the form matches the actual vehicle, particularly the VIN, to avoid potential fraud.

To ensure a hassle-free process when transferring ownership of a motorcycle, you can easily access and complete the necessary documentation through WA Documents, which provides a user-friendly experience for filling out the Washington Motorcycle Bill of Sale form.

Maryland Real Estate Sales Contract - Lays the groundwork for transferring ownership, ensuring all legal hurdles are addressed.