Printable Maryland 129 Template

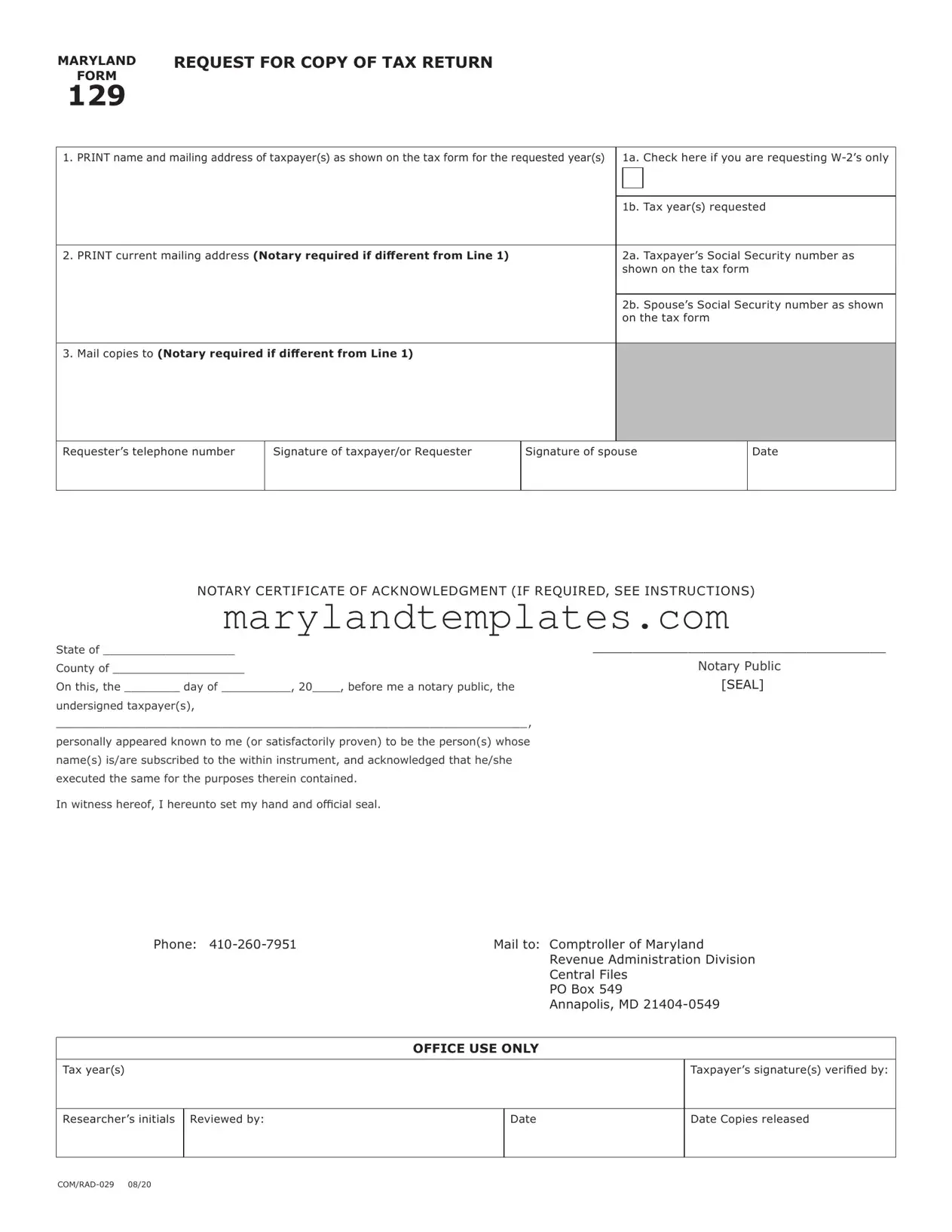

The Maryland Request for Copy of Tax Return Form 129 serves as a crucial tool for taxpayers seeking to obtain copies of their filed tax returns or W-2 forms from the Comptroller of Maryland. This form is particularly important for individuals who need to access their tax documents for various reasons, such as applying for loans, verifying income, or preparing for audits. To successfully complete Form 129, taxpayers must provide specific information, including their name, mailing address, and Social Security numbers, as well as the tax years for which they are requesting documents. If the request is being made for W-2 forms only, there is an option to indicate that on the form. Additionally, if the current mailing address differs from the one on the original tax return, a notary's acknowledgment may be required. The form can be submitted either in person, with valid identification, or by mail, ensuring that the original signed and notarized form reaches the appropriate office. Understanding the intricacies of this form, including when notarization is necessary and how to properly fill it out, can make the process smoother and more efficient for those in need of their tax documents.

Maryland 129 Preview

MARYLAND |

REQUEST FOR COPY OF TAX RETURN |

|

|

FORM |

|

|

|

129 |

|

|

|

|

|

|

|

1. PRINT name and mailing address of taxpayer(s) as shown on the tax form for the requested year(s) |

1a. |

Check here if you are requesting |

|

|

|

|

|

|

|

1b. |

Tax year(s) requested |

|

|

|

|

2. PRINT current mailing address (Notary required if different from Line 1) |

2a. |

Taxpayer’s Social Security number as |

|

|

|

shown on the tax form |

|

|

|

|

|

|

|

2b. |

Spouse’s Social Security number as shown |

|

|

on the tax form |

|

3.Mail copies to (Notary required if different from Line 1)

Requester’s telephone number

Signature of taxpayer/or Requester

Signature of spouse

Date

NOTARY CERTIFICATE OF ACKNOWLEDGMENT (IF REQUIRED, SEE INSTRUCTIONS)

State of ___________________

County of ___________________

On this, the ________ day of __________, 20____, before me a notary public, the

undersigned taxpayer(s),

____________________________________________________________________,

personally appeared known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness hereof, I hereunto set my hand and official seal.

_____________________________________

Notary Public [SEAL]

Phone: |

Mail to: Comptroller of Maryland |

|

Revenue Administration Division |

|

Central Files |

|

PO Box 549 |

|

Annapolis, MD |

|

|

|

OFFICE USE ONLY |

Tax year(s)

Taxpayer’s signature(s) verified by:

Researcher’s initials

Reviewed by:

Date

Date Copies released

MARYLAND |

REQUEST FOR COPY OF TAX RETURN |

FORM |

INSTRUCTIONS |

129 |

GENERAL INSTRUCTIONS

Purpose of Form. The purpose of Form 129 is to request a copy of a Maryland tax return and/or

INSTRUCTIONS. Tax return information is confidential as stated by the

In person with valid photo identification to any office of the Comptroller of Maryland. Do not sign Form 129 until you are instructed to do so by a representative of the Comptroller of Maryland, Revenue Administration

Division.

By mail send the original Form 129 signed by the taxpayer and notarized. The branch office receiving the form must have the original notarized Form 129 before the request is completed. Exception: Form 129 does not need to be notarized if the address in line 2 is the same as the address in line 1.

NOTE: A copy of a tax return will not be emailed, scanned or faxed to the requestor but sent via U.S. Postal Service. It may also be picked up in person at one of our branch offices listed.

Where to File:

Taxpayers can mail their requests to:

Comptroller of Maryland

Revenue Administration Division

Central Files

PO Box 549

Annapolis, MD

You can also submit Form 129 to any of the branch offices. Offices are open Monday – Friday, 8:30 a.m. - 4:30 p.m.

Specific Instructions - This form must be completed in its entirety.

Line 1. Enter the taxpayer’s name and mailing address as shown on the original filed tax return.

If a joint tax return was filed, also enter spouse’s name, listed on

the tax return.

Line 1a. Check this box if you are requesting

Line 1b. Enter the tax year(s) requested on the provided lines. Line 2. Enter your current mailing address.

Line 2a. Enter the taxpayer’s Social Security number as shown on the original filed tax return.

Line 2b. FOR JOINT FILERS: Enter spouse’s Social Security number as shown on the original filed tax return.

Line 3. If the copy of your tax return(s) are to be sent to someone other than the taxpayer, enter their name, address and phone number.

Signature. Form 129 must be signed and dated by the taxpayer listed on

line 1, a personal representative or a taxpayer’s representative.

Jointly filed returns. Copies of a joint tax return may be issued to either spouse. Sign exactly as your name appears on the original filed tax return. If you changed your name, also sign with your current name.

Notary Certificate of Acknowledgment. Form 129 does not need to be notarized if the address in Line 2 is the same as the address in line 1.

Deceased taxpayers. A personal representative of the estate may sign Form 129 when requesting a copy of a tax return for the deceased taxpayer. A copy of the letter of administration must be included with the request.

Reporting Agent. A reporting agent for the taxpayer can sign Form 129 if the authority has been specifically delegated to the representative on Maryland Form 548P. A copy of the signed Maryland Form 548P must be included with Form 129.

FOR ADDITIONAL INFORMATION OR SPECIAL ASSISTANCE

Visit our Web site at www.marylandtaxes.gov or call

Maryland Relay Service (MRS) . . . . . . . . . . . . . . . . . . . . . . 711

BRANCH OFFICES

Annapolis

60 West Street

Suite 102

Annapolis, MD

Baltimore

State Office Building

301 W. Preston Street, Rm. 206

Baltimore, MD

Cumberland

3 Pershing Street, Ste 101

Cumberland, MD

Elkton

Upper Chesapeake Corporate Center

103 Chesapeake Blvd., Suite D

Elkton, MD

Frederick

Courthouse/Multiservice Center

100 West Patrick Street, Rm. 2603

Frederick, MD

Greenbelt

Triangle Centre

6401 Golden Triangle Drive, Suite 100

Greenbelt, MD

Hagerstown

Crystal Building

1850 Dual Hwy., Suite 201

Hagerstown, MD

Salisbury

Sea Gull Square

1306 South Salisbury Blvd., Unit 182

Salisbury, MD

Towson

Hampton Plaza

300 East Joppa Road, Ste. Plaza Level

Towson, MD

Upper Marlboro

Prince George’s County Courthouse

14735 Main Street, Rm. 083B

Upper Marlboro, MD

Waldorf

1036 St. Nicholas Dr., Unit 202

Waldorf, MD

Wheaton

Westfield Wheaton South Building

11002 Veirs Mill Road, Suite 408

Wheaton, MD

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of Form | The Maryland 129 form is used to request a copy of a Maryland tax return and/or W-2s as originally filed with the Comptroller of Maryland. |

| Governing Law | This form is governed by the Tax-General Article of the Maryland Annotated Code, Section 13-202, which ensures the confidentiality of tax return information. |

| Submission Methods | Form 129 can be submitted in person with valid photo identification or by mail as a signed and notarized document. |

| Notary Requirement | A notary is required if the current mailing address differs from the address listed on the tax form. |

| Tax Year Specification | Requesters must specify the tax year(s) for which they are seeking copies on the form. |

| Social Security Numbers | Taxpayer and spouse’s Social Security numbers must be provided as shown on the original filed tax return. |

| Office Hours | Branch offices of the Comptroller of Maryland are open Monday to Friday from 8:30 a.m. to 4:30 p.m. |

| Mailing Address | Requests can be mailed to the Comptroller of Maryland, Revenue Administration Division, Central Files, PO Box 549, Annapolis, MD 21404-0549. |

| Deceased Taxpayers | A personal representative may sign the form to request copies for deceased taxpayers, provided a letter of administration is included. |

| Reporting Agents | A reporting agent can sign the form if specifically authorized, and must include a signed Maryland Form 548P with the request. |

Other PDF Forms

Maryland 502x Instructions - Corporations must select their type of entity accurately on Form 510E to ensure proper processing of their extension request.

For those looking to streamline the ownership transfer process, the WA Documents offers a convenient solution that ensures all necessary details are captured accurately, making the transaction as straightforward as possible.

Maryland Boat Title Transfer - A form used in Maryland to provide proof of purchase and transfer of ownership for a boat.