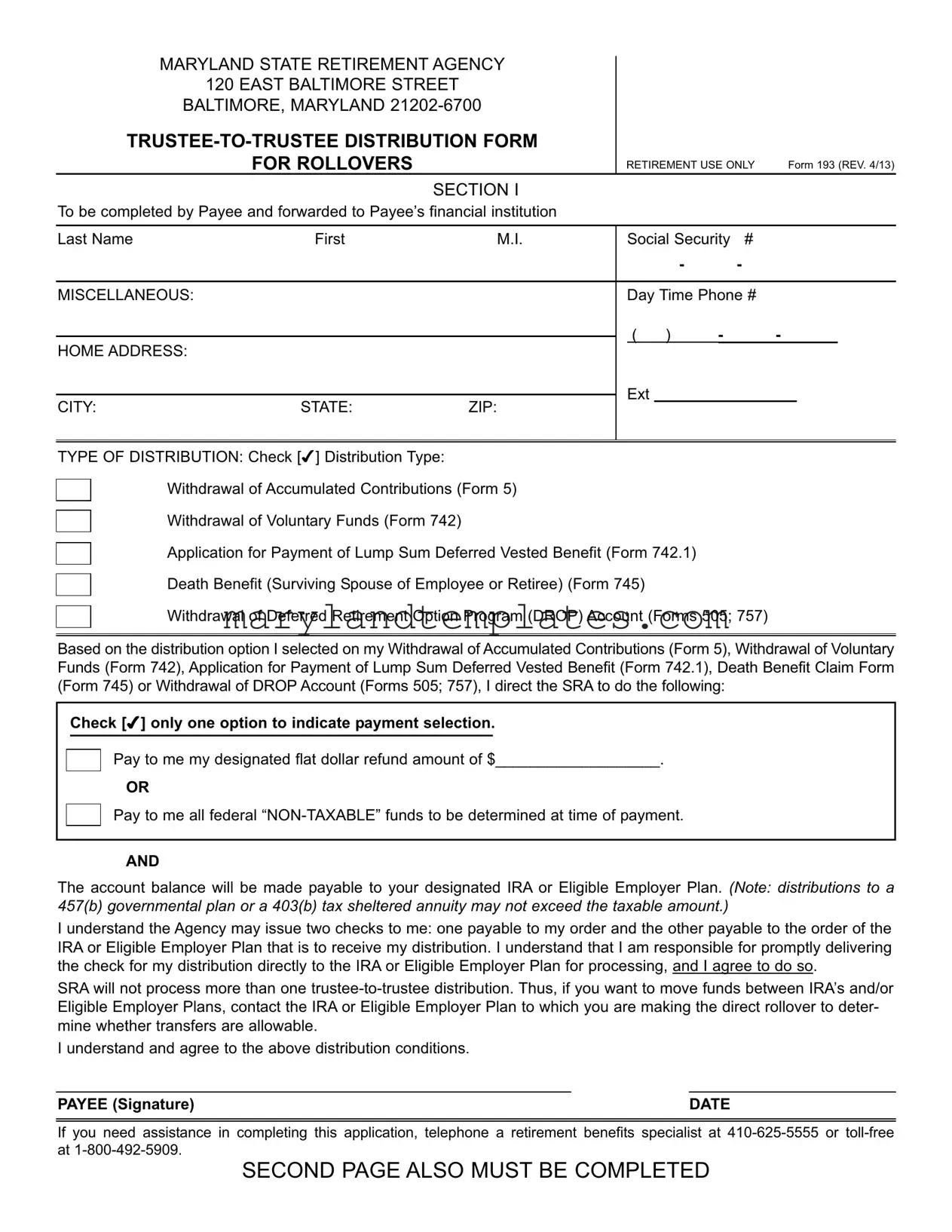

Printable Maryland 193 Template

The Maryland 193 form, officially known as the Trustee-to-Trustee Distribution Form for Rollovers, plays a vital role in managing retirement funds for individuals in the state. Designed primarily for those looking to transfer retirement assets from one financial institution to another, this form facilitates a seamless rollover process. It requires the payee, or the individual receiving the funds, to provide essential personal information, including their name, social security number, and contact details. Additionally, the form outlines various distribution types, allowing the payee to specify their chosen method of withdrawal, whether it be accumulated contributions, voluntary funds, or a lump-sum benefit. Notably, the form also emphasizes the importance of directing payments to the appropriate retirement accounts, such as an Individual Retirement Account (IRA) or an Eligible Employer Plan, ensuring compliance with federal regulations. By clearly delineating the responsibilities of both the payee and the financial institution, the Maryland 193 form aims to simplify the complexities associated with retirement fund rollovers, thereby promoting financial security for Maryland residents.

Maryland 193 Preview

MARYLAND STATE RETIREMENT AGENCY

120 EAST BALTIMORE STREET

BALTIMORE, MARYLAND

|

|

|

|

|

|

|

|||

|

FOR ROLLOVERS |

|

RETIREMENT USE ONLY Form 193 (REV. 4/13) |

||||||

|

|

SECTION I |

|

|

|

|

|

|

|

To be completed by Payee and forwarded to Payee’s financial institution |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Last Name |

First |

M.I. |

Social Security |

# |

|

|

|||

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

MISCELLANEOUS: |

|

|

Day Time Phone # |

||||||

|

|

|

( ) |

- |

- |

|

|

||

HOME ADDRESS: |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Ext |

|

|

|

|

||

CITY: |

STATE: |

ZIP: |

|

|

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYPE OF DISTRIBUTION: Check [4] Distribution Type:

Withdrawal of Accumulated Contributions (Form 5)

Withdrawal of Voluntary Funds (Form 742)

Application for Payment of Lump Sum Deferred Vested Benefit (Form 742.1)

Death Benefit (Surviving Spouse of Employee or Retiree) (Form 745)

Withdrawal of Deferred Retirement Option Program (DROP) Account (Forms 505; 757)

Based on the distribution option I selected on my Withdrawal ofAccumulated Contributions (Form 5), Withdrawal of Voluntary Funds (Form 742), Application for Payment of Lump Sum Deferred Vested Benefit (Form 742.1), Death Benefit Claim Form (Form 745) or Withdrawal of DROPAccount (Forms 505; 757), I direct the SRAto do the following:

Check [4] only one option to indicate payment selection.

Pay to me my designated flat dollar refund amount of $___________________.

Pay to me my designated flat dollar refund amount of $___________________.

OR

Pay to me all federal

Pay to me all federal

AND

The account balance will be made payable to your designated IRA or Eligible Employer Plan. (Note: distributions to a 457(b) governmental plan or a 403(b) tax sheltered annuity may not exceed the taxable amount.)

I understand the Agency may issue two checks to me: one payable to my order and the other payable to the order of the IRA or Eligible Employer Plan that is to receive my distribution. I understand that I am responsible for promptly delivering the check for my distribution directly to the IRA or Eligible Employer Plan for processing, and I agree to do so.

SRA will not process more than one

I understand and agree to the above distribution conditions.

PAYEE (Signature) |

DATE |

If you need assistance in completing this application, telephone a retirement benefits specialist at

SECOND PAGE ALSO MUST BE COMPLETED

SECTION II

(TO BE COMPLETED BY FINANCIAL INSTITUTION FOR PURPOSE OF ROLLOVER)

Verify Information in Section I.

Send completed form to: State Retirement Agency, 120 East Baltimore Street, Baltimore, Maryland

Payee’s Name: ______________________________________ Payee’s Social Security No. _________________- -

NAME AND ADDRESS OF FINANCIAL INSTITUTION/ACCOUNT

Name: ___________________________________________________________________________________

Address: _________________________________________________________________________________

City: _________________________________________ State: ________________ Zip: __________________

DEPOSITORACCOUNTTITLE:Inordertoproperlypreparethecheck,theRetirementAgencyneedsthenameofthefinancialinsti- tution/account into which the check will be made payable. Enter in the spaces below this information, up to 34 characters.The check payable to your designated financial institution/account will carry the notation “DIRECT ROLLOVER,” and will contain the name for the individual indicated in Section I. For IRA’s, the check will read payable to: [Information Below] as trustee of IND. RET. ACCT of [Payee in Section I]. For Eligible Employer Plans, the check will read payable to: [Information Below] FBO [Payee in Section I].

ENTER THE PAYEE’S ACCOUNT NUMBER (OPTIONAL): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

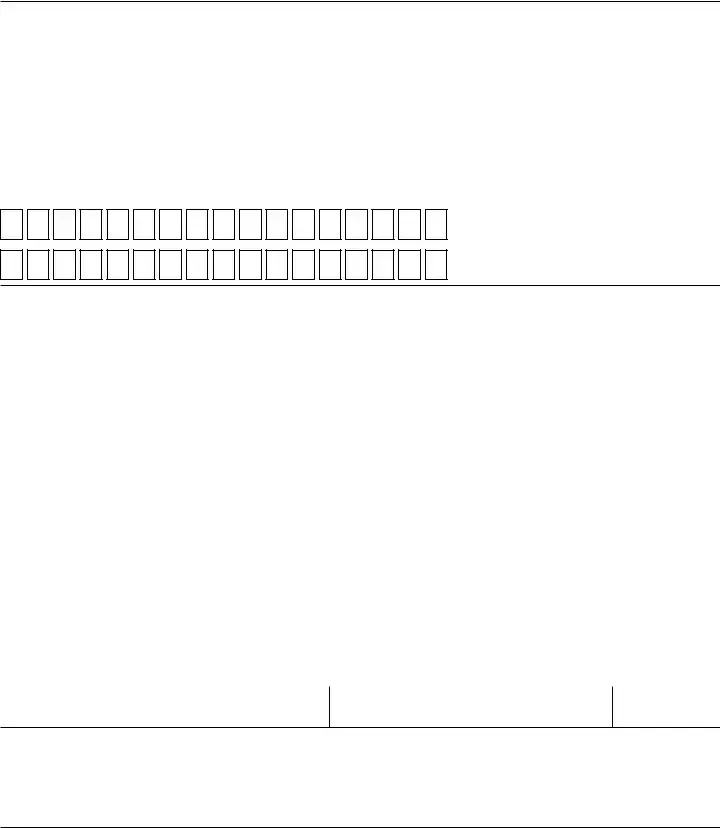

The arrangement selected by the Payee is: (Check [4] one): |

|

|

|

|

|

|

|

Check [4] Box to Affirm that Plan Separately |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Traditional IRA |

|

|

|

|

|

|

|

Eligible Employer Plan |

|

|

|

|

|

|

|

Accounts for |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qualified plan under §401(a), including |

|

|

|

|

|

|

|

Check indicates plan separately accounts |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a 401(k) plan |

|

|

|

|

|

|

|

for |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

§403(a) qualified annuity |

|

|

|

|

|

|

|

Check indicates plan separately accounts |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

Roth IRA |

|

|

|

|

|

|

|

|

|

|

|

for |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

§403(b) tax sheltered annuity |

|

|

|

|

|

|

|

Plan may NOT accept |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

tions from a 401(a) qualified plan |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

§457(b) governmental plan |

|

|

|

|

|

|

|

Plan may not accept |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I confirm that the payee, account number and title are correct. Further, I confirm that the plan designated by the payee is (or is intended to be) an IRA, or an Eligible Employer Plan which includes a plan qualified under section 401(a) of the Internal Revenue Code, including a 401(k) plan, profit sharing plan, defined benefit plan, stock bonus plan, and money purchase plan; a section 403(a) annuity plan; a section 403(b) tax sheltered annuity; or an eligible section 457(b) plan maintained by a governmental employer (governmental 457 plan), that the plan designated may accept such payment (including any

PRINT OR TYPE REPRESENTATIVE’S NAME

SIGNATURE OF REPRESENTATIVE

DATE

AREA CODE/TELEPHONE #: |

- |

- |

|

|

|

|

|

PLEASE READ THIS CAREFULLY

All information on this form, including the individual’s social security number, is required. The information is confidential and will be used only to process payment data from the Maryland State RetirementAgency to the financial institution and its agent. Failure to provide the requested information may prevent or delay release or payment.

If you need assistance in completing this application, telephone a retirement benefits specialist at

FORM 193 (4/13) Pg. 2

Form Attributes

| Fact Name | Details |

|---|---|

| Form Purpose | The Maryland 193 form is used for trustee-to-trustee distributions for rollovers related to retirement accounts. |

| Governing Law | This form is governed by the Maryland State Retirement and Pension System laws. |

| Completion Requirement | Payees must complete Section I and submit it to their financial institution for processing. |

| Distribution Types | Available distribution types include withdrawal of accumulated contributions, voluntary funds, and death benefits. |

| Check Issuance | The State Retirement Agency may issue two checks: one to the payee and another to the designated IRA or employer plan. |

| Contact Information | If assistance is needed, payees can call the retirement benefits specialist at 410-625-5555 or 1-800-492-5909. |

Other PDF Forms

Court Forms - Discover how the Maryland Intake Sheet is your key tool for a straightforward and compliant land instrument submission process.

Exploring the nuances of an effective Prenuptial Agreement can significantly aid couples in Arizona in planning their financial futures. By understanding the requirements and implications, their marital assets can be better protected. For further details, refer to this informative Prenuptial Agreement guide.

Police Polygraph - Applicants are asked about any connections to foreign governments, military service, or intelligence agencies to ensure national security.