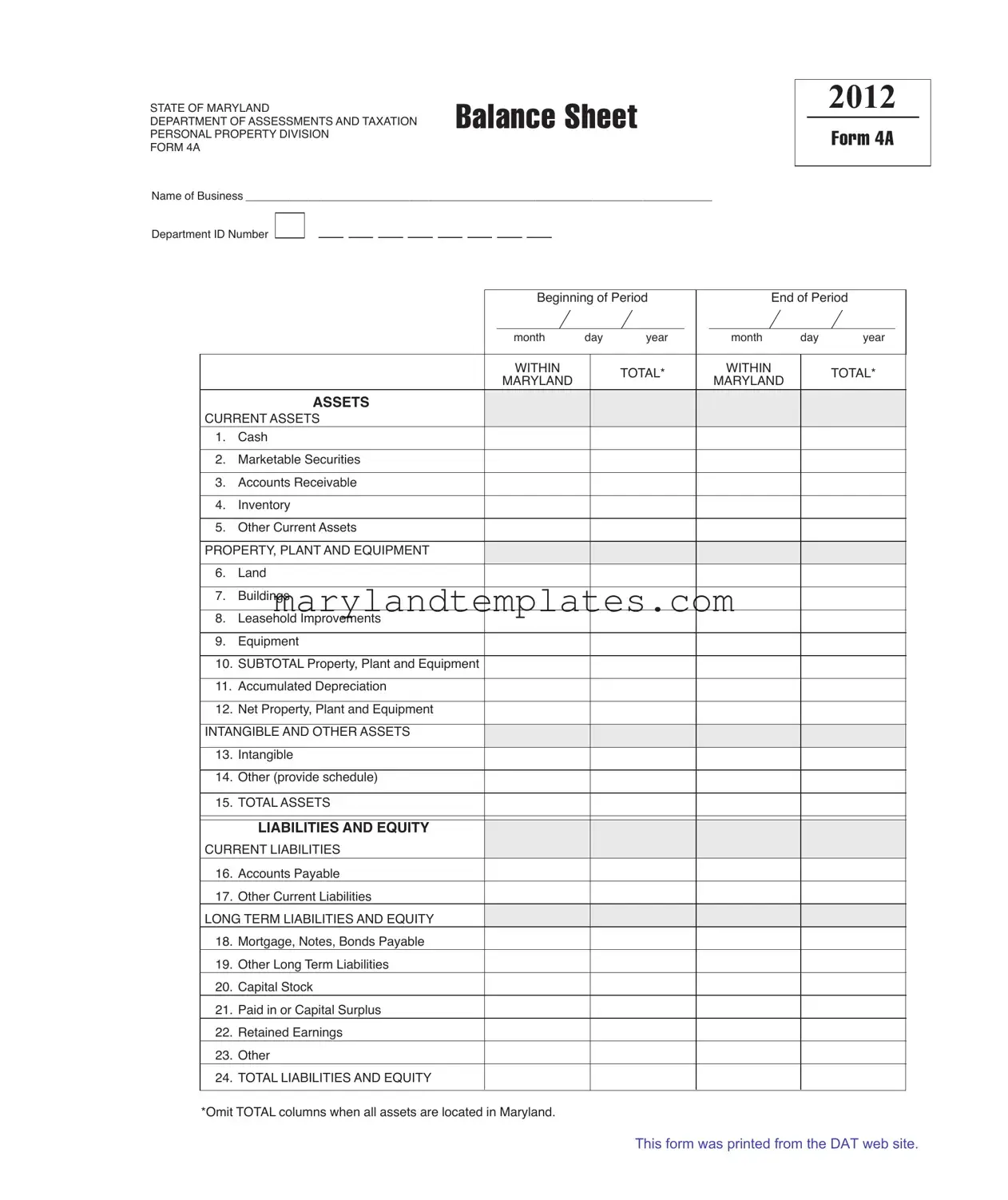

Printable Maryland 4A Template

The Maryland 4A form serves as a crucial tool for businesses operating within the state, particularly for those required to report their personal property. This balance sheet, issued by the Department of Assessments and Taxation, captures a comprehensive snapshot of a business's financial position at two distinct points in time—the beginning and the end of a specified period. The form is designed to outline various categories of assets, such as current assets, property, plant, and equipment, as well as intangible assets. It also details liabilities and equity, ensuring that all financial obligations and ownership stakes are clearly represented. Key components include cash, accounts receivable, inventory, and accumulated depreciation, among others. By filling out the Maryland 4A form, businesses not only comply with state regulations but also gain valuable insights into their financial health. Understanding this form is essential for maintaining transparency and fostering trust with stakeholders, making it a fundamental aspect of business management in Maryland.

Maryland 4A Preview

STATE OF MARYLAND |

BALANCE SHEET |

DEPARTMENT OF ASSESSMENTS AND TAXATION |

|

PERSONAL PROPERTY DIVISION |

|

FORM 4A |

|

Name of Business __________________________________________________________________________

Department ID Number

2012

FORM 4A

Beginning of Period |

|

End of Period |

|

||

month |

day |

year |

month |

day |

year |

WITHIN |

|

|

|

WITHIN |

|

|

|

TOTAL* |

|

TOTAL* |

|||

MARYLAND |

|

|

MARYLAND |

|

||

|

|

|

|

|

||

|

|

|

|

ASSETS

CURRENT ASSETS

1.Cash

2.Marketable Securities

3.Accounts Receivable

4.Inventory

5.Other Current Assets

PROPERTY, PLANT AND EQUIPMENT

6.Land

7.Buildings

8.Leasehold Improvements

9.Equipment

10.SUBTOTAL Property, Plant and Equipment

11.Accumulated Depreciation

12.Net Property, Plant and Equipment

INTANGIBLE AND OTHER ASSETS

13.Intangible

14.Other (provide schedule)

15.TOTAL ASSETS

lIABIlITIES AND EQUITY

CURRENT LIABILITIES

16.Accounts Payable

17.Other Current Liabilities

LONG TERM LIABILITIES AND EQUITY

18.Mortgage, Notes, Bonds Payable

19.Other Long Term Liabilities

20.Capital Stock

21.Paid in or Capital Surplus

22.Retained Earnings

23.Other

24.TOTAL LIABILITIES AND EQUITY

*Omit TOTAL columns when all assets are located in Maryland.

This form was printed from the DAT web site.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Maryland 4A form is used to report personal property for assessment purposes. |

| Governing Law | This form is governed by the Maryland Code, Tax-Property Article, Title 8. |

| Filing Requirement | Businesses must file this form annually to ensure accurate assessment of personal property. |

| Assets Reporting | The form requires detailed reporting of current assets, property, plant, and equipment, as well as intangible assets. |

| Liabilities and Equity | It also includes sections for reporting current liabilities, long-term liabilities, and equity components. |

Other PDF Forms

Maryland Confidential Morbidity Report - Sections are devoted to identifying the patient’s workplace or school to assess the potential for wider exposure and to aid in the notification of others possibly at risk.

The Texas Motor Vehicle Power of Attorney form is a valuable tool for individuals who need to grant someone else the authority to manage their vehicle-related affairs. This legal document simplifies tasks like title transfers or registration renewals, ensuring that important transactions can still occur even in the owner's absence. To effortlessly obtain the form and start the process, visit texasdocuments.net/printable-motor-vehicle-power-of-attorney-form/.

Maryland Lottery Winner Anonymous - Applicants will find specific clauses related to the responsible conduct of gambling, aiming to prevent problem gambling and ensure integrity in operations.