Printable Maryland 4B Template

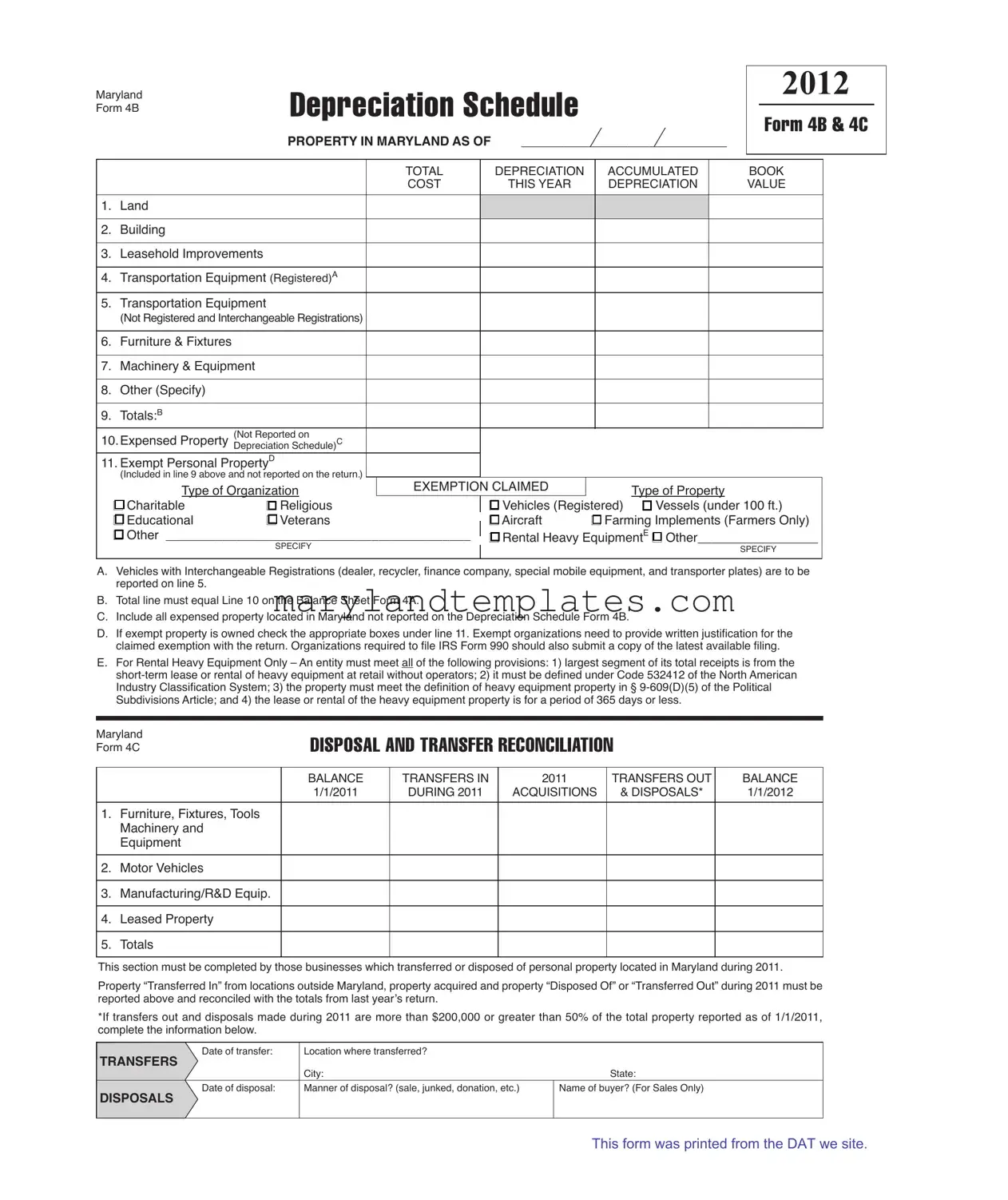

The Maryland 4B form plays a crucial role in the assessment and reporting of property depreciation for businesses operating within the state. Designed for property owners, this form requires detailed information about various asset categories, including land, buildings, leasehold improvements, transportation equipment, and machinery. Each category must reflect the accumulated depreciation and book cost for the current year, allowing businesses to accurately track their financial standing. Additionally, the form addresses expensed property not reported elsewhere and includes a section for claiming exemptions, which is essential for organizations that qualify under charitable, educational, or religious classifications. The Maryland 4B form also connects with Form 4C, which reconciles disposals and transfers of property, ensuring that all transactions are properly documented and accounted for. By providing a comprehensive overview of property assets and their depreciation, the Maryland 4B form helps businesses maintain compliance with state regulations while also offering a clear picture of their financial health.

Maryland 4B Preview

Maryland |

Depreciation Schedule |

|

Form 4B |

||

|

||

|

PROPERTY IN MARYlAND AS OF _____________________________ |

2012

Form 4B & 4C

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

DEPRECIATION |

|

|

ACCUMULATED |

|

BOOK |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

COST |

|

|

|

|

THIS YEAR |

|

|

DEPRECIATION |

|

VALUE |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

|

Land |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

Building |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

Leasehold Improvements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4. |

|

|

Transportation Equipment (Registered)A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

Transportation Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

(Not Registered and Interchangeable Registrations) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

Furniture & Fixtures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

|

|

Machinery & Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

Other (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

Totals:B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

10.Expensed Property |

(Not Reported on |

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

Depreciation Schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11. Exempt Personal PropertyD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

(Included in line 9 above and not reported on the return.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Type of Organization |

|

|

EXEMPTION CLAIMED |

|

|

Type of Property |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

n |

Charitable |

|

n |

Religious |

|

|

|

|

|

n |

|

Vehicles (Registered) |

n |

Vessels (under 100 ft.) |

||||||||||

|

|

|

|

Veterans |

|

|

|

|

|

|

|

Aircraft |

|

|

|

|

|

|

||||||||

|

|

|

n |

|

Educational |

|

n |

|

|

|

|

|

n |

|

|

n |

Farming Implements (Farmers Only) |

|||||||||

|

|

n |

Other ___________________________________________ |

|

|

n |

Rental Heavy EquipmentE |

n |

Other_________________ |

|||||||||||||||||

|

|

|||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

SPECIFY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPECIFY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A.Vehicles with Interchangeable Registrations (dealer, recycler, finance company, special mobile equipment, and transporter plates) are to be reported on line 5.

B.Total line must equal Line 10 on the Balance Sheet Form 4A.

C.Include all expensed property located in Maryland not reported on the Depreciation Schedule Form 4B.

D.If exempt property is owned check the appropriate boxes under line 11. Exempt organizations need to provide written justification for the claimed exemption with the return. Organizations required to file IRS Form 990 should also submit a copy of the latest available filing.

E.For Rental Heavy Equipment Only – An entity must meet all of the following provisions: 1) largest segment of its total receipts is from the

Maryland Form 4C

DISPOSAL AND TRANSFER RECONCILIATION

|

|

BALANCE |

TRANSFERS IN |

2011 |

TRANSFERS OUT |

BALANCE |

|

|

1/1/2011 |

DURING 2011 |

ACQUISITIONS |

& DISPOSALS* |

1/1/2012 |

|

|

|

|

|

|

|

1. |

Furniture, Fixtures, Tools |

|

|

|

|

|

|

Machinery and |

|

|

|

|

|

|

Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Motor Vehicles |

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Manufacturing/R&D Equip. |

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Leased Property |

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Totals |

|

|

|

|

|

|

|

|

|

|

|

|

This section must be completed by those businesses which transferred or disposed of personal property located in Maryland during 2011.

Property “Transferred In” from locations outside Maryland, property acquired and property “Disposed Of” or “Transferred Out” during 2011 must be reported above and reconciled with the totals from last year’s return.

*If transfers out and disposals made during 2011 are more than $200,000 or greater than 50% of the total property reported as of 1/1/2011, complete the information below.

Date of transfer: |

Location where transferred? |

|

TRANSFERS |

|

|

|

City: |

State: |

Date of disposal: |

Manner of disposal? (sale, junked, donation, etc.) |

Name of buyer? (For Sales Only) |

DISPOSAlS

This form was printed from the DAT we site.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Maryland 4B form is used to report the depreciation of personal property located in Maryland for tax purposes. |

| Governing Law | This form is governed by the Maryland Tax Code, specifically under the provisions related to personal property taxation. |

| Exemptions | Organizations claiming exemptions must provide justification and may need to submit IRS Form 990 along with the 4B form. |

| Property Types | The form covers various property types including land, buildings, machinery, and transportation equipment, among others. |

Other PDF Forms

What Does It Mean to Be Exempt From Withholding - Including a daytime phone number is mandatory for potential follow-ups from the Central Payroll Bureau.

For couples considering marriage, understanding the intricacies of a well-crafted Prenuptial Agreement can greatly enhance financial security. By utilizing resources such as the Arizona Prenuptial Agreement template, individuals can ensure their assets and responsibilities are clearly defined, fostering mutual respect and understanding from the outset of their union.

Ccs Maryland - Utilize the space for additional information to elaborate on circumstances that might impact your scholarship application.