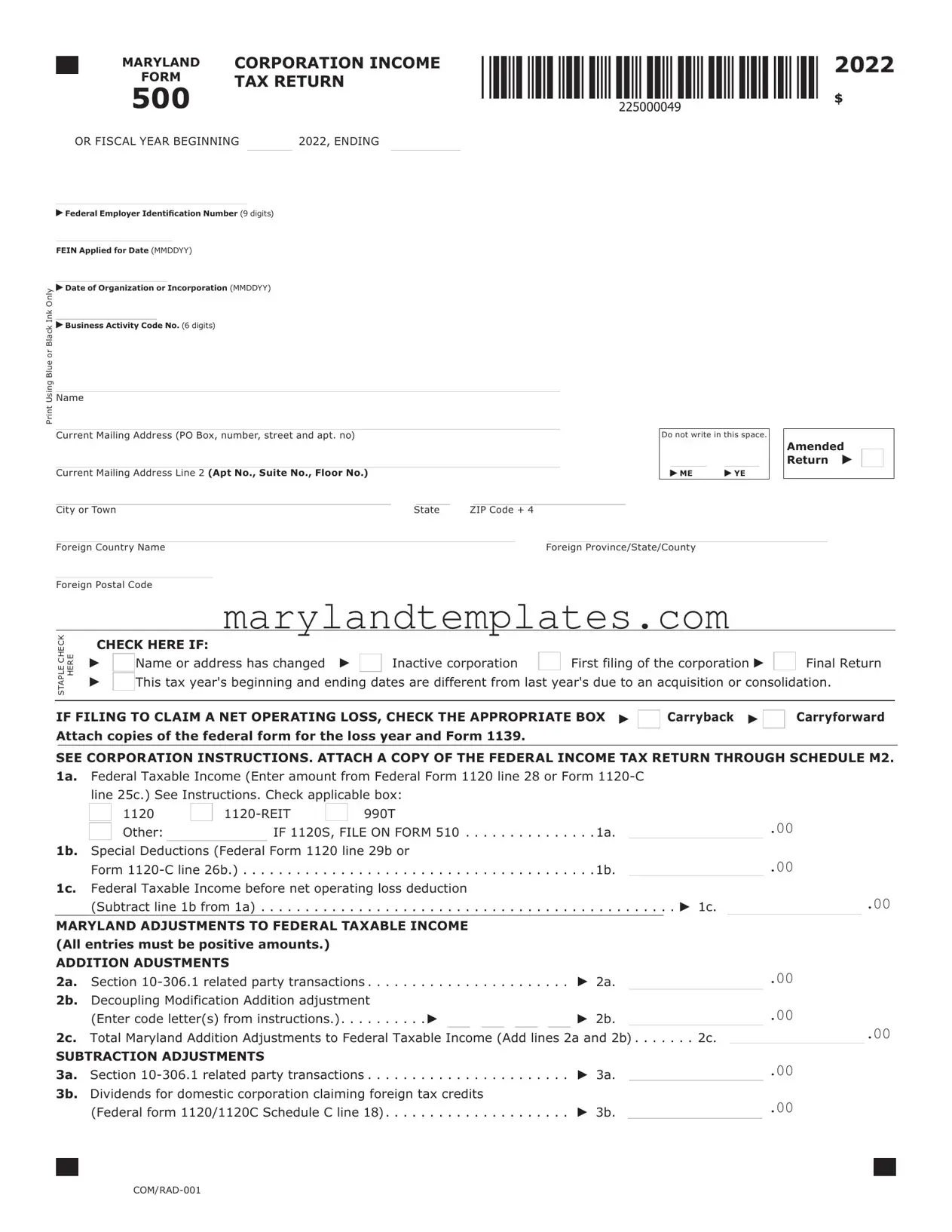

Printable Maryland 500 Template

The Maryland 500 form is a crucial document for corporations operating in Maryland, serving as the state income tax return for businesses. It is essential for reporting federal taxable income, making necessary adjustments, and calculating state tax liabilities. The form requires the Federal Employer Identification Number (FEIN), along with specific details about the corporation, including its organization date and business activity code. Corporations must indicate if they are filing an amended return or if there have been any changes in their name or address. The form also allows for the claiming of net operating losses and includes sections for various adjustments to federal taxable income, both additions and subtractions. Additionally, corporations must compute their Maryland adjusted income and determine their tax due based on the applicable rates. For multistate corporations, the form includes a section for apportioning income, ensuring that taxes are fairly allocated based on business activities within Maryland. Completing the Maryland 500 accurately is vital for compliance and can influence a corporation's financial standing in the state.

Maryland 500 Preview

|

MARYLAND |

CORPORATION INCOME |

2022 |

|||

|

|

|

|

|

|

|

|

FORM |

TAX RETURN |

|

|||

|

|

|||||

500 |

|

|||||

|

|

|

|

$ |

||

|

|

|

|

|

|

|

OR FISCAL YEAR BEGINNING |

|

2022, ENDING |

|

|

||

Print Using Blue or Black Ink Only

Federal Employer Identification Number (9 digits)

Federal Employer Identification Number (9 digits)

FEIN Applied for Date (MMDDYY)

Date of Organization or Incorporation (MMDDYY)

Date of Organization or Incorporation (MMDDYY)

Business Activity Code No. (6 digits)

Business Activity Code No. (6 digits)

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Current Mailing Address (PO Box, number, street and apt. no) |

|

|

|

|

|

|

|

|

Do not write in this space. |

|

Amended |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return |

|

|

|

Current Mailing Address Line 2 (Apt No., Suite No., Floor No.) |

|

|

|

|

|

|

|

|

|

ME |

YE |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City or Town |

State |

ZIP Code + 4 |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Foreign Country Name |

|

|

|

|

Foreign Province/State/County |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Postal Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STAPLE CHECK HERE

CHECK HERE IF: |

|

|

|

Name or address has changed |

Inactive corporation |

First filing of the corporation |

Final Return |

This tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.

IF FILING TO CLAIM A NET OPERATING LOSS, CHECK THE APPROPRIATE BOX

Carryback Attach copies of the federal form for the loss year and Form 1139.

Carryback Attach copies of the federal form for the loss year and Form 1139.

Carryforward

SEE CORPORATION INSTRUCTIONS. ATTACH A COPY OF THE FEDERAL INCOME TAX RETURN THROUGH SCHEDULE M2.

1a. |

Federal Taxable Income (Enter amount from Federal Form 1120 line 28 or Form |

|

|

|

|

|

|

|

|||||||||||||

|

line 25c.) See Instructions. Check applicable box: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

1120 |

990T |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Other: |

|

IF 1120S, FILE ON FORM 510 |

|

|

|

|

. . .1a. |

|

|

|

|

.00 |

|

|

||||||

|

|

. . . . . . |

|

|

|

|

|

|

|

||||||||||||

1b. |

Special Deductions (Federal Form 1120 line 29b or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Form |

|

|

|

|

|

|

|

|

. . .1b. |

|

|

|

.00 |

|

|

|||||

|

. . . . . . . . . . . . |

. |

. . . . |

. . . . . . |

|

|

|

|

|

|

|

||||||||||

1c. |

Federal Taxable Income before net operating loss deduction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(Subtract line 1b from 1a) |

|

|

|

|

|

|

|

|

|

|

. |

. 1c. |

.00 |

|||||||

|

. . . . . . . . . . . . |

. |

. . . . |

. . . . . . |

. . . . . . . |

|

. . . |

|

|

|

|

||||||||||

MARYLAND ADJUSTMENTS TO FEDERAL TAXABLE INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

(All entries must be positive amounts.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ADDITION ADUSTMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2a. |

Section |

|

|

|

|

2a. |

|

|

|

.00 |

|

|

|||||||||

|

|

|

|

|

|

|

|||||||||||||||

2b. |

Decoupling Modification Addition adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(Enter code letter(s) from instructions.) |

|

|

|

|

|

|

|

|

2b. |

|

|

|

.00 |

|

|

|||||

|

. . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2c. Total Maryland Addition Adjustments to Federal Taxable Income (Add lines 2a and 2b) . |

. . . 2c. |

.00 |

|||||||||||||||||||

|

|

|

|

||||||||||||||||||

SUBTRACTION ADJUSTMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3a. |

Section |

|

|

|

|

3a. |

|

|

|

.00 |

|

|

|||||||||

|

|

|

|

|

|

|

|||||||||||||||

3b. |

Dividends for domestic corporation claiming foreign tax credits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(Federal form 1120/1120C Schedule C line 18) |

|

|

|

|

3b. |

|

|

|

|

.00 |

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

CORPORATION INCOME |

|

2022 |

MARYLAND |

|

|

|

FORM |

|

|

|

500 |

TAX RETURN |

|

page 2 |

NAME |

FEIN |

|

|

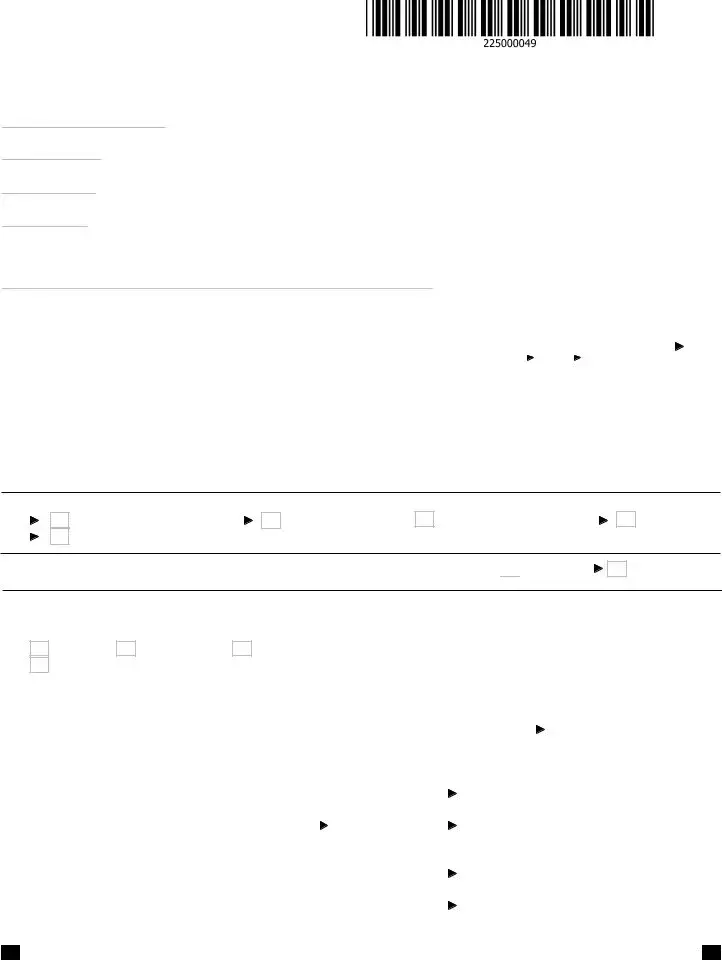

3c. Dividends from related foreign corporations |

|

|

|

(Federal form 1120/1120C Schedule C line 14, 16b and 16c) |

3c. |

.00 |

|

3d. Decoupling Modification Subtraction adjustment |

|

|

|

(Enter code letter(s) from instructions.) |

3d. |

.00 |

|

3e. Total Maryland Subtraction Adjustments to Federal Taxable Income |

|

|

|

(Add lines 3a through 3d.) |

. . . . . . . . . . . 3e. |

.00 |

|

4.Maryland Adjusted Federal Taxable Income before NOL deduction is applied

(Add lines 1c and 2c, and subtract line 3e.) |

4. |

.00 |

5.Enter Adjusted Federal NOL

FDSC |

5. |

.00 |

6.Maryland Adjusted Federal Taxable Income (If line 4 is less than or equal to zero, enter amount from line 4.) (If line 4 is greater than zero, subtract line 5 from line 4 and

|

enter result. If result is less than zero, enter zero.) |

. .6 |

|

|

|

|

.00 |

||||||||||||||

MARYLAND ADDITION MODIFICATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

(All entries must be positive amounts.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

7a. |

State and local income tax |

. 7a. |

.00 |

|

|

|

|||||||||||||||

7b. |

Dividends and interest from another state, local or federal tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

exempt obligation |

. 7b. |

.00 |

|

|

|

|||||||||||||||

7c. |

Net operating loss modification recapture (Do not enter NOL carryover. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

See instructions.) |

. 7c. |

|

.00 |

|

|

|

||||||||||||||

7d. |

Domestic Production Activities Deduction |

. 7d. |

|

.00 |

|

|

|

||||||||||||||

7e. |

Deduction for Dividends paid by captive REIT |

. 7e. |

.00 |

|

|

|

|||||||||||||||

7f. |

Other additions (Enter code letter(s) from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

instructions and attach schedules) |

|

|

|

|

|

|

|

7f. |

|

.00 |

|

|

|

|||||||

7g. |

Total Addition Modifications (Add lines 7a through 7f) |

. . . . . . 7g. |

.00 |

||||||||||||||||||

MARYLAND SUBTRACTION MODIFICATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

(All entries must be positive amounts.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

8a. |

Income from US Obligations |

. 8a. |

.00 |

|

|

|

|||||||||||||||

8b. |

Other subtractions (Enter code letter(s) from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

instructions and attach schedule) |

|

|

|

|

|

|

|

8b. |

|

|

.00 |

|

|

|

||||||

|

If you are claiming subtraction H, enter your state medical cannabis business license number: |

|

|

|

|

|

|

||||||||||||||

8c. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Total Subtraction Modifications (Add lines 8a and 8b) |

. . . . . . 8c. |

.00 |

|||||||||||||||||||

NET MARYLAND MODIFICATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

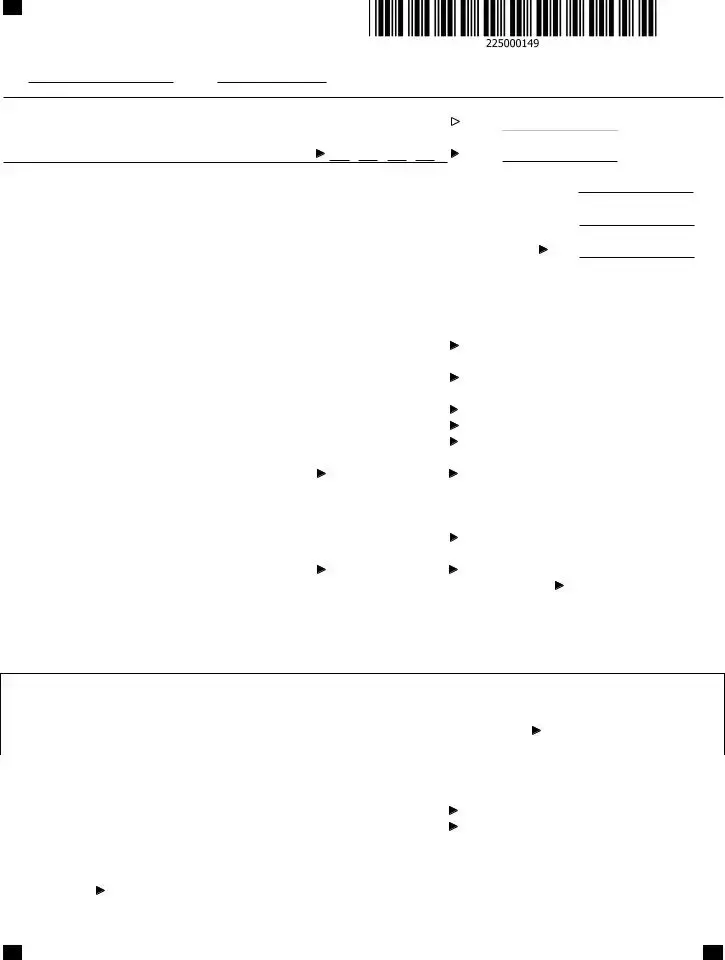

9.Total Maryland Modifications (Subtract line 8c from 7g. If less than zero,

enter negative amount.) |

. 9. |

|

.00 |

10. Maryland Modified Income (Add lines 6 and 9.) |

10. |

.00 |

|

|

|

||

APPORTIONMENT OF INCOME

(To be completed by multistate corporations whose apportionment factor is less than 1, otherwise skip to line 13.)

11.Maryland apportionment factor (from page 4 of this form)

|

(If factor is zero, enter .000000.) |

. . . . . . . . . |

11. |

|

|

. |

|

|

|

|

||||

12. |

Maryland apportionment income (Multiply line 10 by line 11.) |

|

. |

12. |

.00 |

|

||||||||

. . . . . . . . . . |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Maryland taxable income (from line 10 or line 12, whichever is applicable.) |

|

. |

13. |

.00 |

|

||||||||

. . . . . . . . . . |

|

|

|

|

|

|

|

|

||||||

14. |

Tax (Multiply line 13 by 8.25%.) |

|

. |

14. |

.00 |

|

||||||||

. . . . . . . . . . |

|

|

|

|

|

|

|

|

||||||

15a. |

Estimated tax paid with Form 500D, Form MW506NRS and/or credited |

|

|

|

|

|

|

|

|

|

|

|

||

|

from 2021 overpayment |

15a. |

|

|

.00 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

15b. |

Tax paid with an extension request (Form 500E) |

15b. |

|

|

.00 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||||

15c. |

Nonrefundable business income tax credits from Part AAA. (See instructions for Form 500CR.) |

You must file this form electronically to |

|

|||||||||||

15d. |

Refundable business income tax credits from Part DDD. (See instructions for Form 500CR.) |

claim business tax credits from Form 500CR. |

|

|||||||||||

15e. |

The Heritage Structure Rehabilitation Tax Credit is claimed on line 1 of Part DDD on Form 500CR. |

|

|

|

|

|

|

|

|

|||||

|

Check here |

|

if you are a |

|

|

|

|

|

|

|

|

|

|

|

|

|

MARYLAND |

CORPORATION INCOME |

2022 |

|||

|

|

|

|

|

|

|

|

|

|

FORM |

TAX RETURN |

page 3 |

|||

|

|||||||

500 |

|||||||

NAME |

|

|

FEIN |

|

|

|

|

15f. |

Nonresident tax paid on behalf of the corporation by |

|

|

|||||

|

(Attach Maryland Schedule 510/511 |

. . . . . . . . . . . . . . . . . . . . . |

15f. |

|||||

15g. |

If amending, total payments made with original plus additional tax paid |

|

|

|||||

|

after original was filed |

15g. |

||||||

15h. |

Total payments and credits (add lines 15a through 15g) |

. . . . . .15h. |

||||||

16. |

Balance of tax due (If line 14 exceeds line 15h enter the difference.) |

. . . . . 16 |

||||||

17. |

Overpayment (If line 15h exceeds line 14, enter the difference.) |

17. |

||||||

17a. If amending prior overpayment (Total all refunds previously issued.) |

. . . . . |

. . . . . . 17a. |

||||||

18. |

Interest and/or penalty from Form 500UP |

|

|

or late payment interest |

||||

19. |

|

|

for original return. . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . 18 |

|||

Total balance due (Add lines 14, 17a and 18. |

Subtract line 15h.) |

. . . . . 19 |

||||||

20.Amount of overpayment from original return to be applied to estimated tax for 2023

(not to exceed the net of lines 17 minus 17a and 18.) . . . . . . . . . . . . . . . . . . . . . . . . . . . .  20.

20.

21.Amount of overpayment TO BE REFUNDED

(Add lines 18 and 20, and subtract the total from line 17.)

(If amending subtract lines 17a and 18 from line 17.). . . . . . . . . . . . . . . . . . . . . . . . . . .  21.

21.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

DIRECT DEPOSIT OF REFUND (See Instructions.) Verify that all account information is correct and clearly legible. If you are requesting direct deposit of your refund, complete the following.

Check here if you authorize the State of Maryland to issue your refund by direct deposit.

Check here if this refund will go to an account outside of the United States.

22a. Type of account: |

|

Checking |

|

Savings |

22b. Routing Number

22c. Account number:

22d. Name as it appears on the bank account:

INFORMATIONAL PURPOSES ONLY (LINES 23 & 24)

23.NOL generated in Current Year - Carryforward 20 years and carry back 2 years (farming loss ONLY).

(If line 6 is less than zero, enter on line 23.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.

24.NAM generated in Current Year - Carried Forward/Back with Loss on Line 23 per Section

amount from line 9 on line 24.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.

FOR USE IF AMENDING THE RETURN

.00

.00

Explanation of Changes to Income, Modifications, Apportionment Factor and Credits. Show the computation in detail and attach schedules as necessary. Check the box or boxes that reflect the reason for filing this amended return and explain in the space

provided below the checkboxes. If more space is needed, you may attach additional pages.

1. Amended to claim a Net Operating Loss Deduction

2. Amended to report a federal adjustment or an RAR (Revenue Agent Report)

3.Amended to claim Business Tax Credit.

4.Amended to claim nonresident PTE Tax Credit

5.Amended to report income omitted on previous filing

6.Amended to change apportionment factor

7.Amended for another reason

Explanation of Changes: ___________________________________________________________________

_________________________________________________________________________________________

_________________________________________________________________________________________

|

|

MARYLAND |

CORPORATION INCOME |

2022 |

|||

|

|

|

|

|

|

|

|

|

|

FORM |

TAX RETURN |

page 4 |

|||

|

|||||||

500 |

|||||||

NAME |

|

|

FEIN |

|

|

|

|

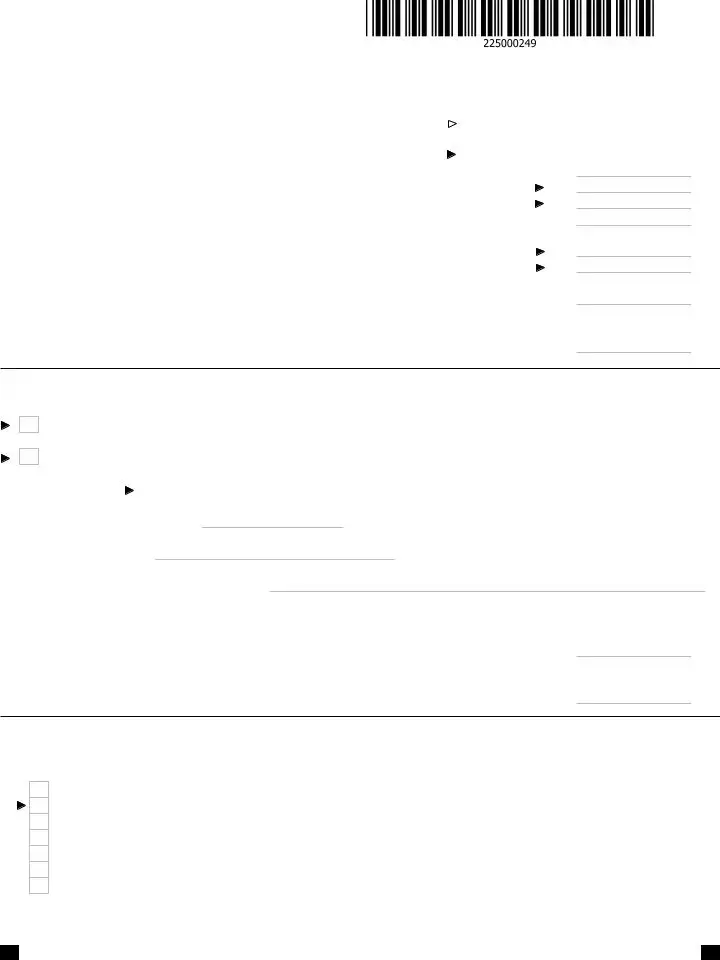

Schedule A - COMPUTATION OF APPORTIONMENT FACTOR (Applies only to multistate corporations. See instructions.)

|

|

Column 1 |

Column 2 |

|

|

Column 3 |

||

|

NOTE: Rental/leasing companies, financial institutions, |

TOTALS WITHIN |

TOTALS WITHIN |

DECIMAL FACTOR |

||||

|

transportation companies, and worldwide headquartered |

MARYLAND |

AND WITHOUT |

(Column 1 ÷ Column 2 |

||||

|

companies see instructions on Special Apportionment. |

|

MARYLAND |

rounded to six places) |

||||

|

|

|

|

|

|

|

|

|

|

1. Receipts a.Gross receipts or sales less returns and |

|

|

|

|

|

|

|

|

allowances |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b.Dividends |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. Interest |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d.Gross rents |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e.Gross royalties |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f. Capital gain net income |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g.Other income (Attach schedule.) |

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

h.Total receipts (Add lines 1(a) through 1(g), |

|

|

|

|

|

|

|

|

for Columns 1 and 2.) |

.00 |

.00 |

|

|

. |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Report this factor on line 4 unless you use a special apportionment formula or alternative apportionment formula.

2. Property a.Inventory . . . . . . . . . . . . . . . . . . . . . . .

b.Machinery and equipment . . . . . . . . . . .

c. Buildings . . . . . . . . . . . . . . . . . . . . . . .

d.Land . . . . . . . . . . . . . . . . . . . . . . . . . .

e.Other tangible assets (Attach schedule.) . f. Rent expense capitalized

(multiply by eight) . . . . . . . . . . . . . . . . .

g.Total property (Add lines 2a through 2f, for Columns 1 and 2) . . . . . . . . . . . . . .

3. Payroll a. Compensation of officers . . . . . . . . . . . .

b.Other salaries and wages . . . . . . . . . . . .

c. Total payroll (Add lines 3a and 3b, for Columns 1 and 2.) . . . . . . . . . . . . . . . .

.00 |

.00 |

|

|

.00 |

.00 |

|

|

.00 |

.00 |

|

|

.00 |

.00 |

|

|

.00 |

.00 |

|

|

.00 |

.00 |

|

|

.00 |

.00 |

|

|

.00 |

.00 |

|

|

.00 |

.00 |

|

|

.00 |

.00 |

|

|

.

.

4.Maryland apportionment factor Enter amount from Line 1 Column 3. If an alternative apportionment formula or a special apportionment formula is used, enter the alternative or special apportionment factor here. (If factor is zero, enter .000000 on line 11, page 2.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

Check here if special apportionment or alternative apportionment formula is used.

|

|

MARYLAND |

CORPORATION INCOME |

2022 |

|||

|

|

|

|

|

|

|

|

|

|

FORM |

TAX RETURN |

page 5 |

|||

|

|||||||

500 |

|||||||

NAME |

|

|

FEIN |

|

|

|

|

SCHEDULE B - ADDITIONAL INFORMATION REQUIRED (Attach a separate schedule if more space is necessary.)

1.Telephone number of corporation tax department:

2.Address of principal place of business in Maryland (if other than indicated on page 1):

3.Brief description of operations in Maryland:

4.Has the Internal Revenue Service made adjustments (for a tax year in which a Maryland return

was required) that were not previously reported to the Maryland Revenue Administration Division? . . . . |

|

Yes |

|

No |

||

|

|

|||||

If "yes", indicate tax year(s) here: |

|

and submit an amended return(s) together with a copy of the IRS |

|

|||

adjustment report(s) under separate cover. |

|

|

|

|

|

|

5.Did the corporation file employer withholding tax returns/forms with the Maryland Revenue

6. |

Administration Division for the last calendar year? |

|

Yes |

|

No |

||

Is this entity part of the federal consolidated filing? |

|

Yes |

|

No |

|||

|

If a multistate operation, provide the following: |

|

|

|

|

|

|

7. |

Is this entity a multistate corporation that is a member of a unitary group? |

|

Yes |

|

No |

||

8. |

|

|

|

|

|

|

|

Is this entity a multistate manufacturer with more than 25 employees? |

|

|

Yes |

|

|

No |

|

|

|

|

|

||||

SCHEDULE C - ADDITIONAL INFORMATION REQUIRED (Attach a separate schedule if more space is necessary.)

1.Subtraction for donations of certain disposable diapers, certain hygiene products, and certain monetary gifts. List the name(s) of the qualified charitable entity on the lines below.

MARYLAND |

CORPORATION INCOME |

2022 |

|

|

|

FORM |

TAX RETURN |

page 6 |

500 |

SIGNATURE AND VERIFICATION

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the declaration is based on all information of which the preparer has any knowledge.

Check here

if you authorize your preparer to discuss this return with us.

Officer's signature |

Date |

Officer's Name and Title

Preparer's signature (Required by Law) |

Date |

Printed name of the Preparer / or Firm's name

Street address of preparer or Firm's address

City, State, ZIP Code + 4

Telephone number of preparer |

|

Preparer’s PTIN (Required by Law) |

CODE NUMBERS (3 digits per line)

INCLUDE ALL REQUIRED PAGES OF FORM 500

Make checks payable to and mail to:

Comptroller Of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, Maryland

(Write Your FEIN On Check Using Blue Or Black Ink.)

Form Attributes

| Fact Name | Description |

|---|---|

| Form Purpose | The Maryland 500 form is used for filing the corporation income tax return in Maryland. |

| Governing Law | This form is governed by the Maryland Tax-General Article, Title 10. |

| Filing Requirement | Corporations doing business in Maryland must file this form annually, regardless of income. |

| Electronic Filing | To claim business tax credits, corporations are required to file the Maryland 500 electronically. |

| Net Operating Loss | Corporations can claim a net operating loss deduction on this form, which may be carried forward or back. |

| Amended Returns | Amendments to the original filing can be made using the same form, indicating the changes clearly. |

| Due Date | The form is typically due on the 15th day of the fourth month following the end of the tax year. |

Other PDF Forms

Maryland Mountains - To complete the form, recipients must provide their name and Social Security Number.

To ensure a seamless transfer of your motorcycle's ownership, it's important to utilize the appropriate documentation. The process can be simplified by obtaining the necessary forms, such as the one provided by WA Documents, which offers guidance and templates tailored for Washington State transactions.

Motion for Reconsideration Maryland - It serves as a legal tool to hold individuals accountable for financial deceit involving checks.