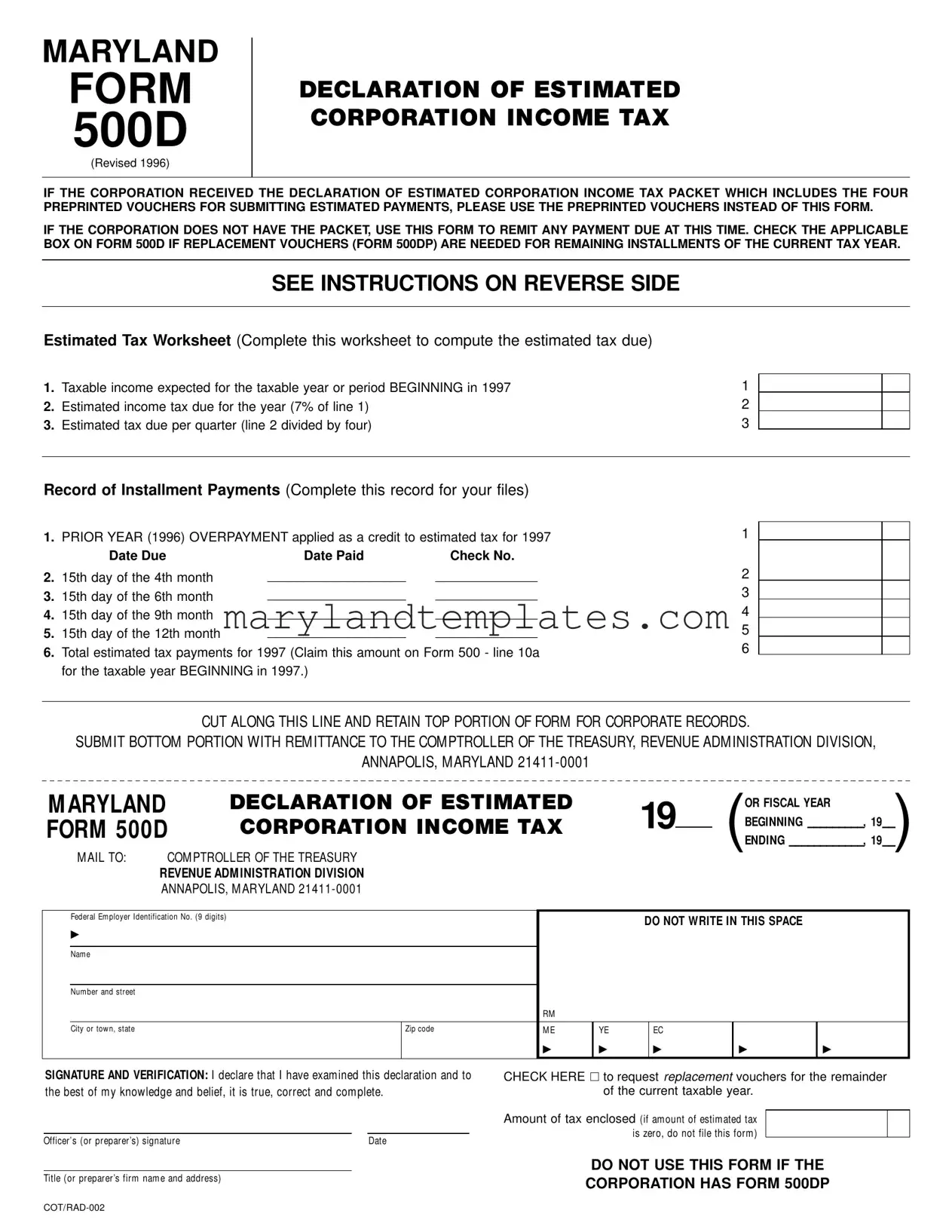

Printable Maryland 500D Template

The Maryland Form 500D serves as a crucial tool for corporations to declare and remit their estimated corporation income tax when the preprinted Form 500DP is unavailable. This form is essential for any corporation anticipating a tax liability exceeding $1,000 for the taxable year. It requires the corporation to estimate its taxable income and calculate the corresponding tax, which is set at 7% of the projected income. Corporations must submit payments in four installments, with at least 25% of the total estimated tax due by each deadline. If a corporation has received the Declaration of Estimated Corporation Income Tax Packet, it is advised to use the preprinted vouchers included instead of Form 500D. The form also includes a section for recording installment payments and provides a mechanism to apply any prior year overpayments as credits toward the current year's estimated tax. Proper completion and timely filing of Form 500D are critical, as failure to comply can result in penalties and interest charges. The form must be submitted to the Comptroller of the Treasury in Annapolis, Maryland, along with full payment, ensuring that the corporation adheres to the designated filing timelines.

Maryland 500D Preview

MARYLAND

FORM

500D

(Revised 1996)

DECLARATION OF ESTIMATED CORPORATION INCOME TAX

IF THE CORPORATION RECEIVED THE DECLARATION OF ESTIMATED CORPORATION INCOME TAX PACKET WHICH INCLUDES THE FOUR PREPRINTED VOUCHERS FOR SUBMITTING ESTIMATED PAYMENTS, PLEASE USE THE PREPRINTED VOUCHERS INSTEAD OF THIS FORM.

IF THE CORPORATION DOES NOT HAVE THE PACKET, USE THIS FORM TO REMIT ANY PAYMENT DUE AT THIS TIME. CHECK THE APPLICABLE BOX ON FORM 500D IF REPLACEMENT VOUCHERS (FORM 500DP) ARE NEEDED FOR REMAINING INSTALLMENTS OF THE CURRENT TAX YEAR.

SEE INSTRUCTIONS ON REVERSE SIDE

Estimated Tax Worksheet (Complete this worksheet to compute the estimated tax due)

1. |

Taxable income expected for the taxable year or period BEGINNING in 1997 |

1 |

|

|

|

|

|||

2. |

Estimated income tax due for the year (7% of line 1) |

2 |

|

|

|

|

|||

3. |

Estimated tax due per quarter (line 2 divided by four) |

3 |

|

|

|

|

|||

|

|

|

|

|

Record of Installment Payments (Complete this record for your files)

1. |

PRIOR YEAR (1996) OVERPAYMENT applied as a credit to estimated tax for 1997 |

1 |

||

|

||||

|

Date Due |

Date Paid |

Check No. |

|

2. |

15th day of the 4th month |

___________________ |

______________ |

2 |

3. |

15th day of the 6th month |

___________________ |

______________ |

3 |

4. |

15th day of the 9th month |

___________________ |

______________ |

4 |

5. |

15th day of the 12th month |

___________________ |

______________ |

5 |

6. |

Total estimated tax payments for 1997 (Claim this amount on Form 500 - line 10a |

6 |

||

|

||||

for the taxable year BEGINNING in 1997.)

CUT ALONG THIS LINE AND RETAIN TOP PORTION OF FORM FOR CORPORATE RECORDS.

SUBMIT BOTTOM PORTION WITH REMITTANCE TO THE COMPTROLLER OF THE TREASURY, REVENUE ADMINISTRATION DIVISION,

ANNAPOLIS, MARYLAND

M ARYLAND |

DECLARATION OF ESTIMATED |

|

|

|

|

|

OR FISCAL YEAR |

|

|

||||

FORM 500D |

CORPORATION INCOME TAX |

|

19 |

|

(ENDINGBEGINNING_____________________,, |

1919____) |

|||||||

|

|

||||||||||||

|

M AIL TO: COM PTROLLER OF THE TREASURY |

|

|

|

|

|

|

|

|

|

|

||

|

REVENUE ADM INISTRATION DIVISION |

|

|

|

|

|

|

|

|

|

|

||

|

ANNAPOLIS, M ARYLAND |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Em ployer Identification No. (9 digits) |

|

|

|

|

DO NOT WRITE IN THIS SPACE |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nam e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Num ber and street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or tow n, state |

|

Zip code |

M E |

YE |

|

EC |

|

|

|

|

|

|

|

|

|

|

▶ |

▶ |

|

▶ |

|

▶ |

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE AND VERIFICATION: I declare that I have exam ined this declaration and to the best of m y knowledge and belief, it is true, correct and com plete.

Officer’s (or preparer’s) signature |

Date |

CHECK HERE □ to request replacement vouchers for the remainder of the current taxable year.

Amount of tax enclosed (if am ount of estim ated tax is zero, do not file this form )

Title (or preparer’s firm nam e and address)

DO NOT USE THIS FORM IF THE CORPORATION HAS FORM 500DP

INSTRUCTIONS FOR MARYLAND FORM 500D (Revised 1996)

DECLARATION OF ESTIMATED CORPORATION INCOME TAX

GENERAL INSTRUCTIONS

Purpose of Form Form 500D is used by a corporation to declare and remit estimated income tax when the preprinted Form 500DP is unavailable.

Corporations expected to be subject to estimated tax require- ments should have received a Declaration of Estimated Corporation Income Tax Packet. The estimated tax packet includes a work- sheet, record of payments, four preprinted vouchers (Form 500DP) and instructions. Please use the Form 500DP which contains pre- printed taxpayer information and provides for prompt and accurate processing of the declaration payment.

If the corporation does not have the estimated tax packet, use Form 500D to remit any payment due.

NOTE: Do not use this form for

General Requirements Every corporation having Maryland taxable income which will develop a tax in excess of $1,000 for the taxable year or period must make estimated income tax pay- ments. The total estimated tax payments for the year must be at least 90% of the tax developed for the current taxable year or 100% of the tax developed for the prior tax year. At least 25% of the total estimated tax must be remitted by each of the four installment due dates.

In the case of a short tax period the total estimated tax required is the same as for a regular taxable year, 90% of the tax developed for the current (short) taxable year or 100% of the tax developed for the prior tax year. The minimum estimated tax for each of the installment due dates is the total estimated tax required divided by the number of installment due dates occurring during the short tax year.

Maryland law provides for the accrual of interest and imposition of penalty for failure to pay any tax when due.

If it is necessary to amend the estimated, recalculate the amount of estimated tax required using the estimated tax worksheet provided on this form. Adjust the amount of the next installment to reflect any previous underpayment or overpayment. The remaining installments must be at least 25% of the amended estimated tax due for the year.

Consolidated returns are not allowed under Maryland law. Affiliated corporations which file a consolidated federal return must file separate Maryland declarations for each member corporation.

When and Where to File File Form 500D on or before the 15th day of the 4th, 6th, 9th and 12th months following the beginning

of the taxable year or period. In addition to payment with Form 500DP or 500D, the corporation may partially or fully apply any overpayment from the prior year Form 500 – Corporation Income Tax Return to the estimated tax obligation for this year.

The estimated tax must be filed with the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland

SPECIFIC INSTRUCTIONS

Name, Address and Other Information Type or print the required information in the designated area. DO NOT USE THE LABEL FROM THE TAX BOOKLET COVER.

Enter the name exactly as specified in the Articles of Incorpo- ration, or as amended, and continue with any “Trading As” (T/A) name if applicable.

Enter the Federal Employer Identification Number (FEIN). If the FEIN has not been secured, enter “APPLIED FOR” followed by the date of application. If a FEIN has not been applied for, do so immediately.

Check the box to request replacement vouchers for the remainder of the current taxable year. Do not check the box to request vouchers for the next taxable year; a packet including vouchers will be issued automatically.

Taxable Year or Period ENTER THE BEGINNING AND END-

ING DATES OF THE TAXABLE YEAR IN THE SPACE PROVIDED ON FORM 500D.

The same taxable year or period used for the federal return must be used for Form 500D.

Amount of Tax Enclosed Enter the amount of tax due in the space provided and remit full payment with this form.

Signature and Verification An authorized officer or the paid preparer must sign and date Form 500D indicating the corporate title or preparer firm name and address.

Payment Instructions Include a check or money order made payable to the Comptroller of the Treasury for the full amount due. All payments must indicate the Federal Employer Identification Number, type of tax and tax year beginning and ending dates.

DO NOT SEND CASH.

Mailing Instructions Use the envelope provided in the tax booklet and place an “X” in the appropriate box in the lower left corner to indicate the type of document enclosed. Also, be sure to read and follow the reminders listed on the back of the envelope.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | Form 500D is used by corporations to declare and remit estimated income tax when preprinted vouchers are unavailable. |

| Eligibility | Every corporation with Maryland taxable income exceeding $1,000 must make estimated income tax payments. |

| Payment Requirements | Corporations must remit at least 90% of the current year's tax or 100% of the prior year's tax to avoid penalties. |

| Filing Deadlines | File Form 500D on or before the 15th day of the 4th, 6th, 9th, and 12th months following the beginning of the taxable year. |

| Replacement Vouchers | Corporations can request replacement vouchers for the remainder of the current taxable year by checking a box on Form 500D. |

| Governing Law | Maryland law mandates the accrual of interest and penalties for failure to pay taxes when due, as outlined in the Maryland Tax Code. |

Other PDF Forms

Md Resale Certificate - Upholding the integrity of resale transactions, this certificate protects against misuse of tax exemption privileges.

For convenience, you can download the necessary documentation for your vehicle transaction, including the Texas Motor Vehicle Bill of Sale form, which can be found at https://texasdocuments.net/printable-motor-vehicle-bill-of-sale-form/, ensuring that all details are clearly documented for both parties involved.

Baltimore Gun Laws - Emphasizes accountability and legal responsibility of both the applicant and instructor through signatures.