Printable Maryland 500Dm Template

The Maryland 500DM form serves a critical role for taxpayers in the state by addressing specific federal tax provisions that Maryland has opted to decouple from. This form is particularly relevant for individuals and entities affected by certain federal tax benefits, such as the Special Depreciation Allowance introduced by the Job Creation and Worker Assistance Act of 2002, the five-year net operating loss carryback provisions, and the increased Section 179 depreciation deductions established under the Jobs and Growth Tax Relief Reconciliation Act of 2003. By utilizing the 500DM form, taxpayers can accurately calculate the necessary modifications to their Maryland tax returns, ensuring compliance with state regulations while reflecting the impact of these federal provisions. The form requires users to fill out a worksheet that compares the federal return as filed with the return adjusted for the decoupling provisions, ultimately determining the net decoupling modification. This modification, whether an addition or subtraction, must be reported correctly on the Maryland return, along with appropriate code designations. Understanding the nuances of the 500DM form is essential for Maryland taxpayers to navigate their state tax obligations effectively.

Maryland 500Dm Preview

Maryland |

DECOUPLING |

YEAR |

OR FISCAL YEAR |

FORM |

_ (ENDING __________, ______) |

||

|

|

|

BEGINNING _______, ______ |

500DM |

MODIFICATION |

|

|

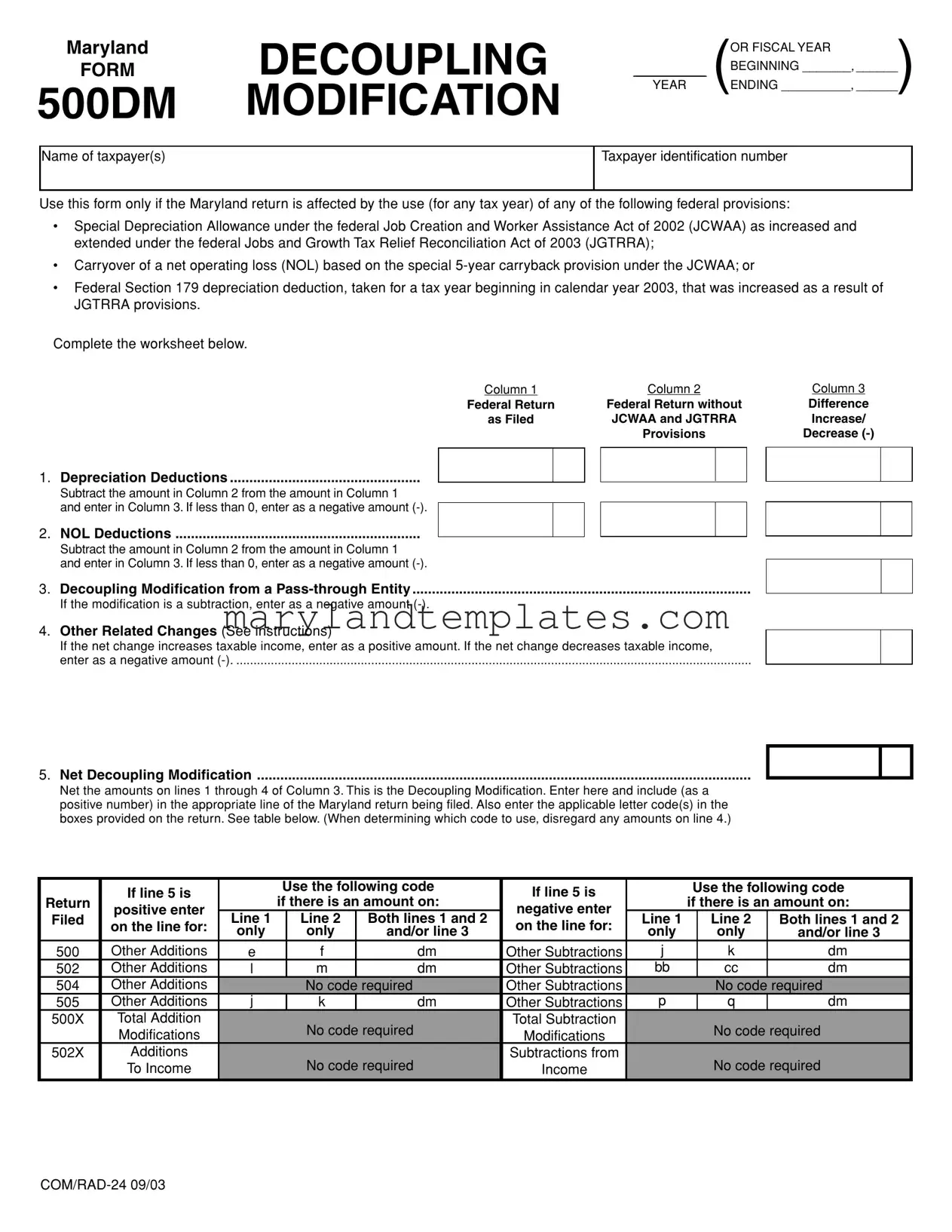

Name of taxpayer(s)

Taxpayer identification number

Use this form only if the Maryland return is affected by the use (for any tax year) of any of the following federal provisions:

•Special Depreciation Allowance under the federal Job Creation and Worker Assistance Act of 2002 (JCWAA) as increased and extended under the federal Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA);

•Carryover of a net operating loss (NOL) based on the special

•Federal Section 179 depreciation deduction, taken for a tax year beginning in calendar year 2003, that was increased as a result of JGTRRA provisions.

Complete the worksheet below.

Column 1 |

Column 2 |

Column 3 |

Federal Return |

Federal Return without |

Difference |

as Filed |

JCWAA and JGTRRA |

Increase/ |

|

Provisions |

Decrease |

1. Depreciation Deductions .................................................

Subtract the amount in Column 2 from the amount in Column 1

and enter in Column 3. If less than 0, enter as a negative amount

2.NOL Deductions ...............................................................

Subtract the amount in Column 2 from the amount in Column 1

and enter in Column 3. If less than 0, enter as a negative amount

3.Decoupling Modification from a

If the modification is a subtraction, enter as a negative amount

4.Other Related Changes (See instructions)

If the net change increases taxable income, enter as a positive amount. If the net change decreases taxable income,

enter as a negative amount

5.Net Decoupling Modification ...............................................................................................................................

Net the amounts on lines 1 through 4 of Column 3. This is the Decoupling Modification. Enter here and include (as a positive number) in the appropriate line of the Maryland return being filed. Also enter the applicable letter code(s) in the boxes provided on the return. See table below. (When determining which code to use, disregard any amounts on line 4.)

|

If line 5 is |

|

Use the following code |

If line 5 is |

|

Use the following code |

||||

Return |

|

if there is an amount on: |

|

if there is an amount on: |

||||||

positive enter |

|

negative enter |

|

|||||||

Filed |

Line 1 |

|

Line 2 |

Both lines 1 and 2 |

Line 1 |

|

Line 2 |

Both lines 1 and 2 |

||

on the line for: |

|

on the line for: |

|

|||||||

|

only |

|

only |

and/or line 3 |

only |

|

only |

and/or line 3 |

||

|

|

|

|

|

||||||

500 |

Other Additions |

e |

|

f |

dm |

Other Subtractions |

j |

|

k |

dm |

502 |

Other Additions |

l |

|

m |

dm |

Other Subtractions |

bb |

|

cc |

dm |

504 |

Other Additions |

|

|

No code required |

Other Subtractions |

|

|

No code required |

||

505 |

Other Additions |

j |

|

k |

dm |

Other Subtractions |

p |

|

q |

dm |

500X |

Total Addition |

|

|

No code required |

Total Subtraction |

|

|

No code required |

||

|

Modifications |

|

|

Modifications |

|

|

||||

502X |

Additions |

|

|

No code required |

Subtractions from |

|

|

No code required |

||

|

To Income |

|

|

Income |

|

|

||||

INSTRUCTIONS FOR |

PAGE 2 |

MARYLAND FORM 500DM |

|

DECOUPLING MODIFICATION

General Instructions

Purpose of Form

Maryland has decoupled from certain federal provisions, as listed at the top of Form 500DM, by enacting addition and subtraction modifications which eliminate the effect of the changes on Maryland and local taxes. This form is used to determine the amount of the required modification.

Use of Pro Forma Returns

Separate (pro forma) federal and Maryland returns must be prepared for use in completing Form 500DM. In addition to calculating depreciation and NOL deductions without the benefits afforded under the Job Creation and Worker Assistance Act of 2002 (JCWAA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA), pro forma returns will also help to determine other related items that affect Maryland and local income tax liability (e.g., income items, addition and subtraction modifications, deductions and credits).

Additional Information

For more information regarding these modifications, see Administrative Release 38 which is available on our website at www.marylandtaxes.com or from any office of the Comptroller.

Specific Instructions

Column 1 – Federal Return as Filed

Column 1 (lines 1 and 2) is used for the amounts reported on the federal return which include the impacts of the Special Depreciation Allowance, the special

Column 2 – Federal Return Without JCWAA and JGTRRA Provisions

Examples of items affected by decoupling are:

¥Gain or loss on sale of property

¥Recapture of depreciation

¥Passive loss

¥Maryland itemized deductions

Line 5 – Total

Net the amounts from lines 1 through 4 and enter on line 5. If line 5 is positive, include this amount in the appropriate line of the Maryland tax return being filed. Also enter the appropriate code letter(s) in the box(es) provided for the type of addition modification (either depreciation or NOL, or both).

If line 5 is negative, include this amount as a positive number in the appropriate line of the Maryland tax return being filed. Enter the appropriate code letter(s) in the box(es) provided for the type of subtraction modification (either depreciation or NOL, or both).

See the table at the bottom of Form 500DM for the line numbers and code letters to use.

Credits

For Maryland income tax credits affected by electing JCWAA and/or JGTRRA treatment, enter on the return to be filed, credits as calculated on the Maryland pro forma return without JCWAA and/or JGTRRA treatment.

Note: If a credit for a tax paid to another state was claimed on the original return and the tax liability to the other state and/or Maryland changes as a result of the treatment of the JCWAA and/or JGTRRA provisions in either state, a revised Form 502CR must be completed using the Maryland and the other stateÕs returns to be filed including all amendments and modifications.

Column 2 (lines 1 and 2) is for the amounts which would have been reported on the federal return using federal law in effect prior to enactment of the JCWAA and JGTRRA (without regard to the Special Depreciation Allowance, the special

Column 3 – Change – increase/decrease

Lines 1 and 2 — Subtract the amount in Column 2 from the amount in Column 1. Enter in Column 3. Line 4 is for the change to taxable income in other related items (calculated before and after application of the JCWAA and JGTRRA provisions) that would affect taxable income. If the change decreases taxable income, enter the amount with a minus sign

Line 1 – Depreciation Deductions

Use line 1 only for the depreciation expense deductions.

Line 2 – NOL Deductions

Use line 2 for NOL deductions. For Columns 1 and 2, limit the deductions as follows: For a corporation, the deduction may not exceed the federal taxable income. For all others, the deduction may not exceed the federal modified taxable income as determined on federal Form 1045, Schedule B.

Line 3 – Decoupling Modification from a

Use line 3 for decoupling modifications reported by a

Line 4 – Other Related Changes

If the entity is a PTE (partnership,

Income from a PTE

Each partner, shareholder or member that has a decoupling modification from a PTE must also complete Form 500DM. Enter the decoupling modification from the PTE on line 3 of Form 500DM. Also use this amount to adjust the income from the PTE on the pro forma federal return to determine if other related changes exist. These changes would be entered on line 4 of Form 500DM. Do not include any decoupling modification on the Maryland pro forma return.

Attachment of Forms

¥Original Return Attach the completed Form 500DM to the Maryland income tax return to be filed. Pro forma returns used to complete this form are not to be filed with the Comptroller or the IRS, but should be retained with your tax records.

¥Amended Return Attach the completed Form 500DM, schedules and pro forma returns to amended return to be filed.

For questions concerning Form 500DM contact:

Revenue Administration Division

Annapolis, Maryland

www.marylandtaxes.com

Decoupling may also affect other items included in federal adjusted gross income (AGI) allowable itemized deductions, as well as Maryland addition and subtraction modifications. Because these items also affect Maryland taxable income, the decoupling modification must include an adjustment for these changes. If the net change for these items reduces taxable income, enter as a negative amount

07/03

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose of Form | The Maryland 500DM form is used to calculate modifications for Maryland tax returns that are affected by certain federal tax provisions. |

| Governing Laws | This form is governed by Maryland tax laws that decouple from the federal Job Creation and Worker Assistance Act of 2002 and the Jobs and Growth Tax Relief Reconciliation Act of 2003. |

| Eligibility | Taxpayers should use this form if their Maryland return is influenced by federal provisions related to depreciation, net operating losses, or Section 179 deductions. |

| Columns Overview | The form includes three columns: Federal Return as Filed, Federal Return without JCWAA and JGTRRA Provisions, and the Difference. |

| Decoupling Modifications | Modifications can be either additions or subtractions, depending on how federal provisions impact Maryland taxable income. |

| Worksheet Requirement | Taxpayers must complete a worksheet on the form to calculate the necessary modifications based on their federal returns. |

| Pass-Through Entities | Partners or shareholders of pass-through entities must report their share of decoupling modifications on the 500DM form. |

| Attachment to Returns | Form 500DM must be attached to the Maryland income tax return when filing. Pro forma returns used for calculations should not be submitted. |

| Credits Impact | Any Maryland income tax credits affected by the JCWAA or JGTRRA must be calculated based on the pro forma return without those provisions. |

| Contact Information | For questions about Form 500DM, taxpayers can contact the Revenue Administration Division in Annapolis, Maryland. |

Other PDF Forms

Maryland Form 510d - Certain pass-through entities may be exempt from nonresident tax payments, subject to specific reporting requirements.

When transferring ownership of a motorcycle, it's important to utilize the correct documentation, such as the Washington Motorcycle Bill of Sale. To ensure clarity and protect both parties involved, you can find the necessary resources at WA Documents, which offers a fillable form to streamline the process.

What Does It Mean to Be Exempt From Withholding - Sections on the MW507 allow individuals to claim exemption from state withholding if they meet specific criteria, such as not owing Maryland income tax.

Maryland W4 - Adherence to the form's guidelines ensures that retirees' tax withholding preferences are communicated and implemented effectively.