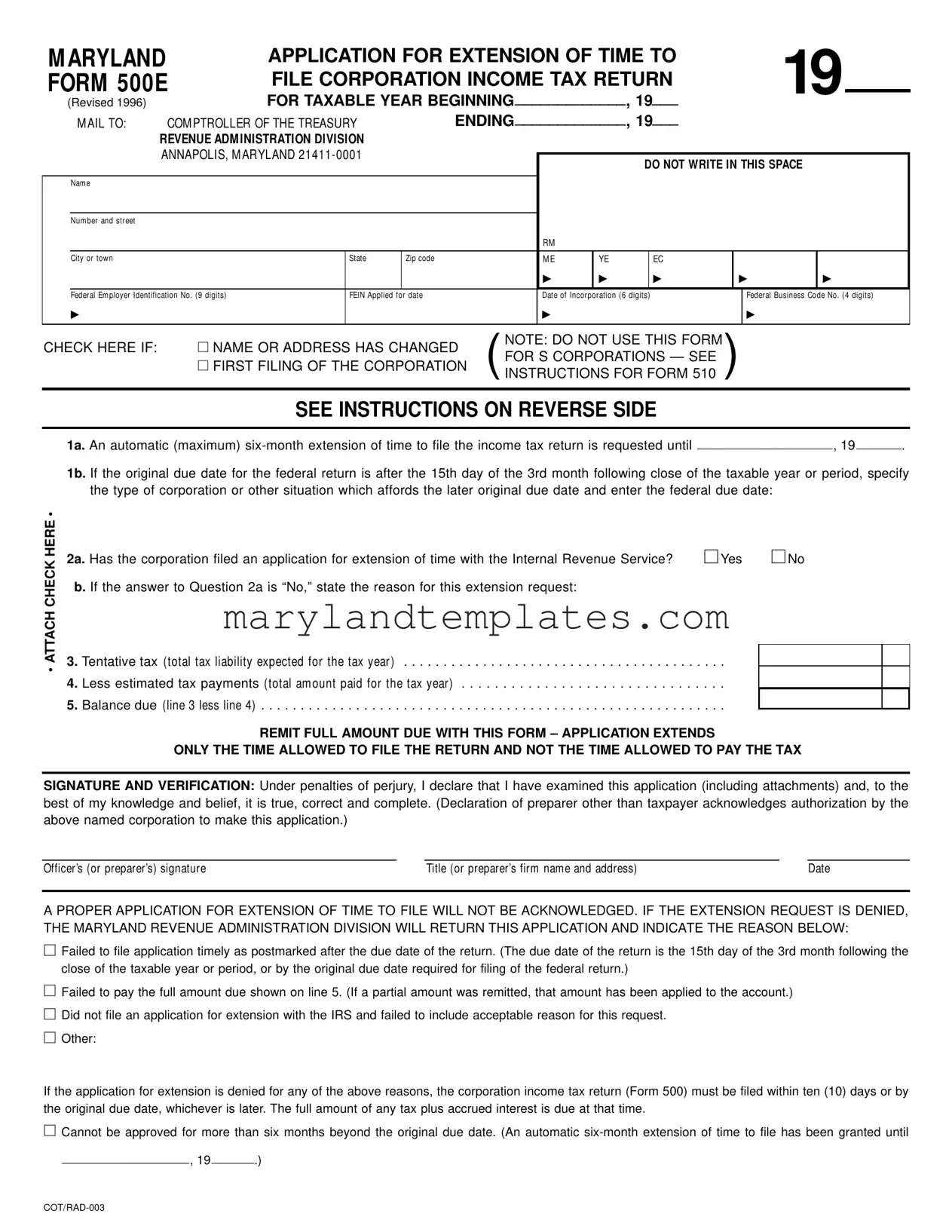

Printable Maryland 500E Template

The Maryland 500E form is a crucial document for corporations seeking an extension of time to file their income tax returns. This application allows businesses to request an automatic six-month extension, provided it is submitted by the original due date. Completing the form requires specific information, including the corporation's name, address, and Federal Employer Identification Number (FEIN). Corporations must also indicate their expected tax liability and any estimated tax payments already made. It is essential to understand that while the 500E form extends the time to file the return, it does not extend the time to pay any taxes owed. Therefore, full payment must accompany the application to avoid penalties and interest. The form must be mailed to the Comptroller of the Treasury in Annapolis, Maryland, and should not be used for S corporations or to remit employer withholding tax. Failure to comply with the filing requirements can result in the denial of the extension request, making it vital for corporations to follow the instructions carefully.

Maryland 500E Preview

M ARYLAND |

|

APPLICATION FOR EXTENSION OF TIME TO |

|

|

|

19 |

|

||||||||||

FORM 500E |

|

FILE CORPORATION INCOME TAX RETURN |

|

|

|

|

|||||||||||

(Revised 1996) |

|

|

FOR TAXABLE YEAR BEGINNING_____________, 19___ |

|

|

|

|

||||||||||

|

M AIL TO: |

COM PTROLLER OF THE TREASURY |

ENDING_____________, 19___ |

|

|

|

|

|

|

||||||||

|

|

REVENUE ADM INISTRATION DIVISION |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

ANNAPOLIS, M ARYLAND |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

DO NOT WRITE IN THIS SPACE |

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nam e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Num ber and street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or tow n |

|

|

|

State |

Zip code |

|

M E |

YE |

|

EC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

▶ |

|

▶ |

|

▶ |

|

▶ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Federal Em ployer Identification No. (9 digits) |

|

FEIN Applied for date |

|

Date of Incorporation (6 digits) |

|

|

Federal Business Code No. (4 digits) |

|||||||||

|

▶ |

|

|

|

|

|

|

▶ |

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECK HERE IF: |

|

☐ NAME OR ADDRESS HAS CHANGED |

NOTE: DO NOT USE THIS FORM |

) |

|

|

|

|

|||||||||

|

FOR S CORPORATIONS — SEE |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

☐ FIRST FILING OF THE CORPORATION |

(INSTRUCTIONS FOR FORM 510 |

|

|

|

|

|||||||||

SEE INSTRUCTIONS ON REVERSE SIDE

• ATTACH CHECK HERE •

1a. An automatic (maximum)

1b. If the original due date for the federal return is after the 15th day of the 3rd month following close of the taxable year or period, specify the type of corporation or other situation which affords the later original due date and enter the federal due date:

2a. Has the corporation filed an application for extension of time with the Internal Revenue Service? |

☐ Yes |

☐ No |

0b. If the answer to Question 2a is “No,” state the reason for this extension request:

3. Tentative tax (total tax liability expected for the tax year ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Less estimated tax payments (total am ount paid for the tax year) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Balance due (line 3 less line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

REMIT FULL AMOUNT DUE WITH THIS FORM – APPLICATION EXTENDS

ONLY THE TIME ALLOWED TO FILE THE RETURN AND NOT THE TIME ALLOWED TO PAY THE TAX

SIGNATURE AND VERIFICATION: Under penalties of perjury, I declare that I have examined this application (including attachments) and, to the best of my knowledge and belief, it is true, correct and complete. (Declaration of preparer other than taxpayer acknowledges authorization by the above named corporation to make this application.)

Officer’s (or preparer’s) signature |

Title (or preparer’s firm nam e and address) |

Date |

A PROPER APPLICATION FOR EXTENSION OF TIME TO FILE WILL NOT BE ACKNOWLEDGED. IF THE EXTENSION REQUEST IS DENIED, THE MARYLAND REVENUE ADMINISTRATION DIVISION WILL RETURN THIS APPLICATION AND INDICATE THE REASON BELOW:

☐Failed to file application timely as postmarked after the due date of the return. (The due date of the return is the 15th day of the 3rd month following the close of the taxable year or period, or by the original due date required for filing of the federal return.)

☐Failed to pay the full amount due shown on line 5. (If a partial amount was remitted, that amount has been applied to the account.)

☐Did not file an application for extension with the IRS and failed to include acceptable reason for this request.

☐Other:

If the application for extension is denied for any of the above reasons, the corporation income tax return (Form 500) must be filed within ten (10) days or by the original due date, whichever is later. The full amount of any tax plus accrued interest is due at that time.

☐Cannot be approved for more than six months beyond the original due date. (An automatic

__________________, 19 ______.)

INSTRUCTIONS FOR MARYLAND FORM 500E (Revised 1996)

APPLICATION FOR EXTENSION OF TIME

TO FILE CORPORATION INCOME TAX RETURN

GENERAL INSTRUCTIONS

Purpose of Form Form 500E is used by a corporation to request an extension of time to file the corporation income tax return (Form 500) and to remit any balance of tax due.

NOTE: Do not use this form for

General Requirements Maryland law provides for an extension of time to file, but in no case can an extension be granted for more than six months beyond the original due date. A request for exten- sion of time to file will be automatically granted for six months, provided that:

1)Form 500E is properly filed and submitted by the original due date (15th day of the 3rd month following close of the tax year or period, or by the original due date required for filing of the federal return);

2)full payment of any balance due is submitted with Form 500E; and

3)an application for extension of time has been filed with the Internal Revenue Service or an acceptable reason has been provided with Form 500E.

A proper application for extension of time to file will not be acknowledged. If the extension request is denied, the corporation will be notified.

Form 500E does not extend the time allowed to pay the tax. Maryland law provides for accrual of interest and imposition of penalty for failure to pay any tax when due.

Consolidated returns are not allowed under Maryland law. Affiliated corporations which file a consolidated federal return must file separate Maryland extension applications for each member corporation.

When and Where to File File Form 500E by the 15th day of the 3rd month following the close of the taxable year or period, or by the original due date required for filing the federal return. The application for extension of time must be filed with the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland

SPECIFIC INSTRUCTIONS

Name, Address and Other Information Type or print the required information in the designated area. DO NOT USE THE LABEL FROM THE TAX BOOKLET COVER.

Enter the name exactly as specified in the Articles of Incorpo- ration, or as amended, and continue with any “Trading As” (T/A) name if applicable.

Enter the Federal Employer Identification Number (FEIN). If a FEIN has not been secured, enter “APPLIED FOR” followed by the date of application. If a FEIN has not been applied for, do so immediately.

Check the applicable box if the name or address has changed or if this is the first filing of the corporation.

Taxable Year or Period ENTER THE BEGINNING AND END-

ING DATES OF THE TAXABLE YEAR IN THE SPACE PROVIDED AT THE TOP OF FORM 500E.

The same taxable year or period used for the federal return must be used for Form 500E.

Tentative Tax Enter the total amount of income tax liability expected for the tax year on line 3.

Estimated Tax Payments Enter on line 4 the total amounts paid with Form 500DP or 500D – Declaration of Estimated Corporation Income Tax for the taxable year or period. Also include any amount carried forward as a credit from the prior year Form 500 – Corporation Income Tax Return.

Balance Due Enter the amount of tax due on line 5 and remit full payment with this form.

Signature and Verification An authorized officer or the paid preparer must sign and date Form 500E indicating the corporate title or preparer firm name and address.

Payment Instructions Include a check or money order made payable to the Comptroller of the Treasury for the full amount of any balance due. All payments must indicate the Federal Employer Identification Number, type of tax and tax year beginning and ending dates. DO NOT SEND CASH.

Mailing Instructions Use the envelope provided in the tax booklet and place an “X” in the appropriate box in the lower left corner to indicate the type of document enclosed. Also, be sure to read and follow the reminders listed on the back of the envelope.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose of Form | The Maryland Form 500E is used by corporations to request an extension of time to file their corporation income tax return (Form 500) and to remit any balance of tax due. |

| Filing Deadline | Form 500E must be filed by the 15th day of the 3rd month following the close of the taxable year or by the original due date required for filing the federal return. |

| Governing Law | Maryland law allows for a maximum extension of six months to file, provided that certain conditions are met, including timely submission of Form 500E and payment of any balance due. |

| Important Note | Submitting Form 500E does not extend the time allowed to pay the tax. Interest and penalties may accrue for any unpaid tax when due. |

Other PDF Forms

What Is the Sales Tax in Maryland - Businesses must carefully manage these certificates, as misuse or inaccuracies can lead to tax penalties and legal repercussions.

Maryland Mountains - The document emphasizes the beneficiary's responsibility to understand their choices and the consequences thereof.

For those seeking to finalize their motorcycle purchase or sale, obtaining the necessary documentation is vital. To ensure all legal aspects are covered, you can find a comprehensive Motorcycle Bill of Sale form through WA Documents, which will guide you in accurately recording this important transaction.

State of Maryland Employee Health Insurance Premiums - An overview of the coordination of benefits if the employee has other vision insurance is provided.