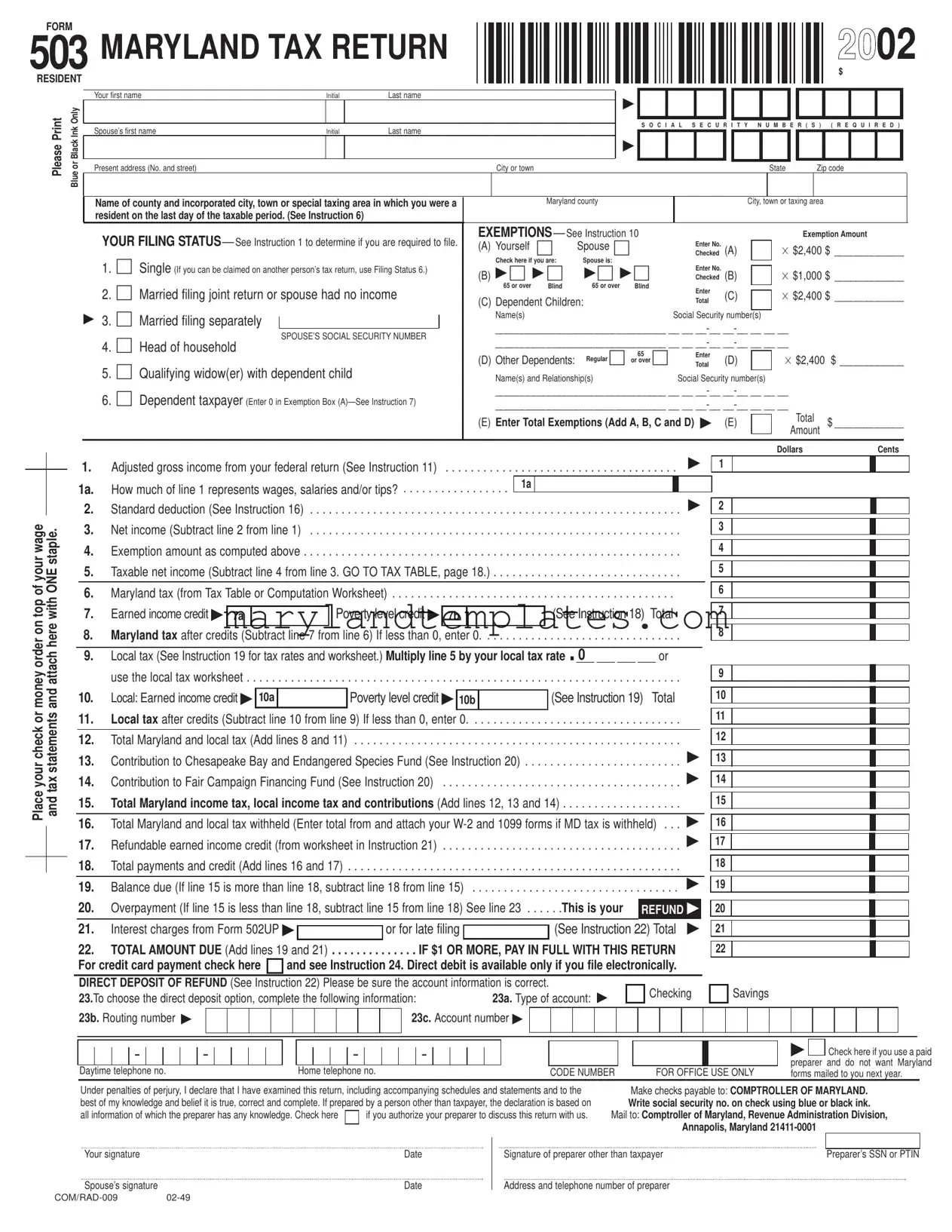

Printable Maryland 503 Template

The Maryland 503 form is a crucial document for residents filing their state income tax returns. Designed for simplicity, it streamlines the reporting process for individuals with straightforward tax situations. This form requires basic personal information, including names, addresses, and Social Security numbers, ensuring that all taxpayers are accurately identified. It also categorizes filing status options, such as single, married filing jointly, or head of household, which can significantly impact tax calculations. Exemptions play a vital role in determining taxable income; therefore, taxpayers must carefully assess their eligibility for personal and dependent exemptions. The form guides users through calculating their adjusted gross income, standard deductions, and ultimately their taxable income. Additionally, it incorporates local tax rates and credits, allowing for a comprehensive overview of the taxpayer's financial obligations. By following the structured layout of the Maryland 503, individuals can efficiently navigate their tax responsibilities while maximizing potential refunds or minimizing liabilities.

Maryland 503 Preview

FORM

503 MARYLAND TAX RETURN

RESIDENT

|

|

|

Your first name |

|

Initial |

|

Last name |

PrintPlease |

InkBlackorBlueOnly |

|

Spouse’s first name |

|

Initial |

|

Last name |

|

|

|

|||||

|

|

|

Present address (No. and street) |

|

|

|

City or town |

|

|

|

|

|

|

2002

2002

$

▶

S O C I A L S E C U R I T Y N U M B E R ( S ) ( R E Q U I R E D )

▶

State Zip code

Name of county and incorporated city, town or special taxing area in which you were a |

Maryland county |

City, town or taxing area |

resident on the last day of the taxable period. (See Instruction 6) |

|

|

YOUR FILING STATUS — See Instruction 1 to determine if you are required to file.

1.☐ Single (If you can be claimed on another person’s tax return, use Filing Status 6.)

2.☐ Married filing joint return or spouse had no income

▶ 3. ☐ Married filing separately

SPOUSE’S SOCIAL SECURITY NUMBER

4. ☐ Head of household

5. ☐ Qualifying widow(er) with dependent child

6. ☐ Dependent taxpayer (Enter 0 in Exemption Box

EXEMPTIONS — See Instruction 10 |

|

|

|

Exemption Amount |

|||

(A) Yourself |

☐ |

Spouse ☐ |

Checked |

(A) |

|

× $2,400 |

$ _____________ |

|

|

|

Enter No. |

|

|

|

|

Check here if you are: |

Spouse is: |

Enter No. |

|

|

|

|

|

|

|

|

|

||||

(B) ▶ ☐ ▶ ☐ |

▶ ☐ ▶ ☐ |

(B) |

|

× $1,000 |

$ _____________ |

||

Checked |

|

||||||

65 or over |

Blind |

65 or over Blind |

Enter |

(C) |

|

× $2,400 |

$ _____________ |

|

|||||||

(C) Dependent Children: |

Total |

|

|||||

|

|

|

|

||||

|

|

|

|

|

|

|

|

Name(s) |

|

|

Social Security number(s) |

|

|

||

________________________________ __ __ |

|

||||||

________________________________ __ __ |

|

||||||

|

|

65 |

Enter |

|

|

|

|

(D) Other Dependents: |

Regular ☐ or over ☐ |

Total |

(D) |

|

× $2,400 |

$ ____________ |

|

Name(s) and Relationship(s) |

Social Security number(s) |

|

|

||||

________________________________ __ __ |

|

||||||

________________________________ __ __ |

|

||||||

(E) Enter Total Exemptions (Add A, B, C and D) ▶ (E) |

|

Total |

$ _____________ |

||||

|

|||||||

|

Amount |

||||||

|

|

|

|

|

|

|

|

of your wage |

ONE staple. |

money order on top |

and attach here with |

Place your check or |

and tax statements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dollars |

|

|

|

|

Cents |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

1. |

|

Adjusted gross income from your federal return (See Instruction 11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

. |

|

. . . . |

. . . |

. . . |

. |

. |

. |

. |

. |

. . |

. . |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1a. |

|

How much of line 1 represents wages, salaries and/or tips? |

|

1a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Standard deduction (See Instruction 16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

. |

|

. . |

. |

|

. . |

. |

|

. . |

|

. . . |

. |

. . |

. |

. |

|

|

. . |

. |

. . . |

. . |

. . |

. |

. |

. |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

3. |

Net income (Subtract line 2 from line 1) |

. |

|

. . |

. |

|

. . |

. |

|

. . |

|

. . . |

. |

. . |

. |

. |

|

|

. . |

. |

. . . |

. . |

. . |

. |

. |

. |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

4. |

Exemption amount as computed above |

. |

|

. . |

. |

|

. . |

. |

|

. . |

|

. . . |

. |

. . |

. |

. |

|

|

. . |

. |

. . . |

. . |

. . |

. |

. |

. |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

5. |

Taxable net income (Subtract line 4 from line 3. GO TO TAX TABLE, page 18.) |

. |

. |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Maryland tax (from Tax Table or Computation Worksheet) |

. |

. . |

. |

. |

|

|

. . |

. |

. . . |

. . |

. . |

. |

. |

. |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

7. |

Earned income credit ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Poverty level credit ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(See Instruction 18) Total |

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

7a |

|

|

|

|

|

|

|

|

7b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

8. |

Maryland tax after credits (Subtract line 7 from line 6) If less than 0, enter 0 |

. |

|

. . . . . . . . . . . . . . . . .. . . |

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

9. |

Local tax (See Instruction 19 for tax rates and worksheet.) Multiply line 5 by your local tax rate .0 |

___ ___ ___ or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

use the local tax worksheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

. . |

|

. . . |

. . |

. |

. |

. |

. . |

. |

|

. . |

. |

|

. . |

. |

|

. . |

|

. . . |

. |

. . |

. |

. |

|

|

. . |

. |

. . . |

. . |

. . |

. |

. |

. |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Local: Earned income credit ▶ |

10a |

|

|

|

|

|

|

|

|

Poverty level credit ▶ |

10b |

|

|

|

|

|

|

(See Instruction 19) Total |

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Local tax after credits (Subtract line 10 from line 9) If less than 0, enter 0 |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Total Maryland and local tax (Add lines 8 and 11) |

. |

. |

|

. . |

. |

|

. . |

. |

|

. . |

|

. . . |

. |

. . |

. |

. |

|

|

. . |

. |

. . . |

. . |

. . |

. |

. |

. |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

13. |

Contribution to Chesapeake Bay and Endangered Species Fund (See Instruction 20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

. |

. |

. |

. |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

14. |

Contribution to Fair Campaign Financing Fund (See Instruction 20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

15. |

Total Maryland income tax, local income tax and contributions (Add lines 12, 13 and 14) |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

Total Maryland and local tax withheld (Enter total from and attach your |

▶ |

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Refundable earned income credit (from worksheet in Instruction 21) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

18. |

Total payments and credit (Add lines 16 and 17) |

. . |

. |

|

. . |

. |

|

. . |

. |

|

. . |

|

. . . |

. |

. . |

. |

. |

|

|

. . |

. |

. . . |

. . |

. . |

. |

. |

. |

|

. . . . |

. . . |

. . . . |

|

. |

. |

. |

. |

. . . |

. . . |

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

Balance due (If line 15 is more than line 18, subtract line 18 from line 15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

. . |

|

. |

. . . |

. . . . |

. . . |

|

. . |

. |

. |

. |

. . |

. . |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

20. |

Overpayment (If line 15 is less than line 18, subtract line 15 from line 18) See line 23 |

. |

. |

. |

. |

|

. .This is your |

|

|

REFUND ▶ |

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

21. |

Interest charges from Form 502UP ▶ |

|

|

|

|

|

|

|

|

|

or for late filing |

|

|

|

|

|

|

|

|

|

(See Instruction 22) Total |

|

▶ |

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

22. |

TOTAL AMOUNT DUE (Add lines 19 and 21) . . . |

. . |

. |

. . |

|

. |

. . |

|

. |

. . |

IF $1 OR MORE, PAY IN FULL WITH THIS RETURN |

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

For credit card payment check here |

|

|

and see Instruction 24. Direct debit is available only if you file electronically. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

DIRECT DEPOSIT OF REFUND (See Instruction 22) Please be sure the account information is correct. |

|

|

|

|

|

|

|

|

Checking |

|

|

|

|

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

23.To choose the direct deposit option, complete the following information: |

|

|

|

|

|

|

|

|

|

|

|

|

23a. Type of account: ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

23b. Routing number ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23c. Account number ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you use a paid |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

preparer and do not want Maryland |

|||||||||||

|

Daytime telephone no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home telephone no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CODE NUMBER |

|

|

|

FOR OFFICE USE ONLY |

|

|

forms mailed to you next year. |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements and to the |

|

|

|

Make checks payable to: COMPTROLLER OF MARYLAND. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the declaration is based on |

|

|

|

Write social security no. on check using blue or black ink. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

all information of which the preparer has any knowledge. Check here |

|

|

|

if you authorize your preparer to discuss this return with us. |

Mail to: Comptroller of Maryland, Revenue Administration Division, |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annapolis, Maryland |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your signature |

Date |

Signature of preparer other than taxpayer |

Preparer’s SSN or PTIN |

Spouse’s signature |

Date |

Address and telephone number of preparer

2002 MARYLAND FORM 503

WHO MAY USE THIS FORM?

You may use this short form (Form 503) if you answer “NO” to ALL of these questions

PAGE 2

YES NO

1.☐ ☐ Will you have any Additions to Income or Subtractions from Income on your Maryland return? If you are eligible for a subtraction, such as the pension exclusion, it will be to your benefit to use Form 502. If you have a state pickup amount on your Form

2.☐ ☐ Do you want to itemize deductions?

3.☐ ☐ Did you make estimated payments in 2002, have part or all of your 2001 refund applied to your

2002 estimated account or make a payment with an extension request, Form 502E?

4.☐ ☐ Are you claiming a tax credit on Maryland Form 500CR or Form 502CR?

YES NO

5.☐ ☐ Were you a nonresident of Maryland?

6.☐ ☐ Were you a

7.☐ ☐ Does your return cover less than a 12 month period?

8.☐ ☐ Were you a fiscal year taxpayer?

9.☐ ☐ Will you want part or all of your refund credited to next year’s estimated account?

Form Attributes

| Fact Name | Details |

|---|---|

| Form Purpose | The Maryland 503 form is a tax return specifically designed for residents of Maryland. It allows individuals to report their income and calculate their state tax obligations. |

| Eligibility Criteria | Taxpayers can use Form 503 if they answer "NO" to specific questions regarding income additions or subtractions, itemizing deductions, and certain credits. |

| Filing Status Options | Form 503 provides multiple filing status options, including Single, Married Filing Jointly, and Head of Household, among others. |

| Exemptions | Taxpayers can claim exemptions for themselves, their spouses, and dependents, with specific amounts outlined in the form. |

| Governing Law | The Maryland 503 form is governed by the Maryland Tax Code, which outlines the requirements for filing state income taxes. |

| Submission Details | Taxpayers must mail the completed form to the Comptroller of Maryland, Revenue Administration Division, ensuring all necessary documents, such as W-2s, are attached. |

Other PDF Forms

Maryland Dc 70 - The form necessitates detailing the method of service, typically through first-class mail, including the postage date.

To ensure that your proprietary information remains secure and to facilitate clear communication between involved parties, consider utilizing the resources available at WA Documents for drafting your Washington Non-disclosure Agreement.

Tangible Net Benefit - Facilitates a borrower's understanding of how refinancing could potentially adjust their mortgage insurance requirements.