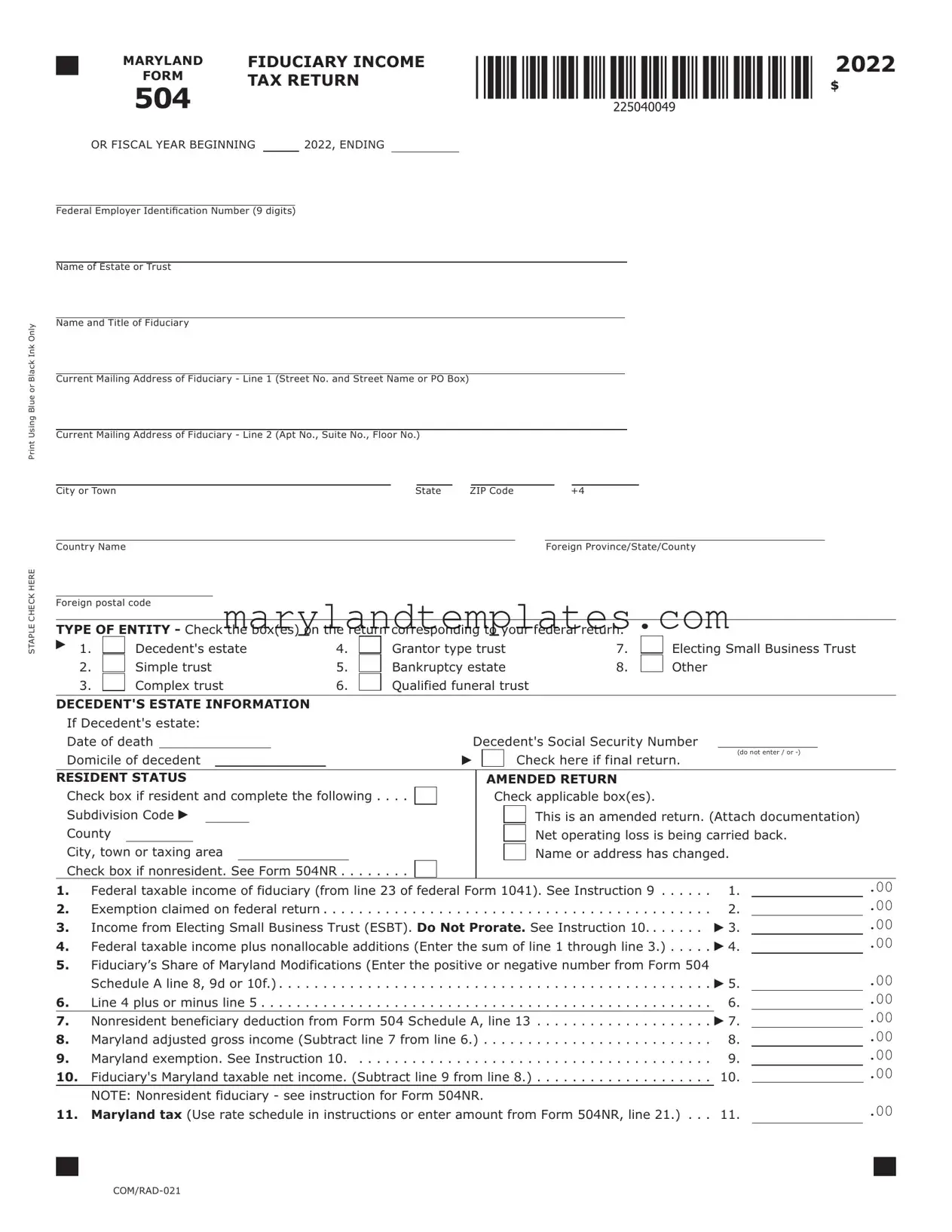

Printable Maryland 504 Template

The Maryland 504 form is a crucial document for fiduciaries managing estates or trusts in the state. This form, known as the Fiduciary Income Tax Return, is used to report income generated by estates and various types of trusts, including simple, complex, and grantor-type trusts. It requires the fiduciary to provide essential information, such as the federal employer identification number, the name and address of the estate or trust, and the fiduciary's contact details. Additionally, the form includes sections to indicate the type of entity involved, whether it is a decedent's estate or a qualified funeral trust, among others. Notably, it also addresses the residency status of the fiduciary and any beneficiaries, allowing for necessary deductions and modifications based on Maryland tax laws. The form must be completed accurately to calculate the Maryland taxable net income, which is essential for determining the tax owed. Furthermore, it provides options for contributions to various state funds, ensuring that fiduciaries can support local initiatives while fulfilling their tax obligations. Overall, the Maryland 504 form plays a vital role in the financial management of estates and trusts, ensuring compliance with state tax regulations.

Maryland 504 Preview

|

|

MARYLAND |

FIDUCIARY INCOME |

|

|||||

|

|

|

|||||||

|

|

FORM |

TAX RETURN |

|

|||||

|

|

|

|||||||

|

504 |

|

|

|

|

|

|

|

|

|

|

OR FISCAL YEAR BEGINNING |

2022, ENDING |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Federal Employer Identification Number (9 digits) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

Name of Estate or Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Black Ink Only |

Name and Title of Fiduciary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Current Mailing Address of Fiduciary - Line 1 (Street No. and Street Name or PO Box) |

|

||||||||

Using Blue or |

|

|

|

|

|

||||

Current Mailing Address of Fiduciary - Line 2 (Apt No., Suite No., Floor No.) |

|

||||||||

|

|

|

|

|

|

|

|

|

|

2022

$

STAPLE CHECK HERE

|

City or Town |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

|

+4 |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Country Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Province/State/County |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

TYPE OF ENTITY - Check the box(es) on the return corresponding to your federal return. |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

1. |

|

Decedent's estate |

4. |

|

|

|

|

Grantor type trust |

7. |

|

|

|

Electing Small Business Trust |

|

|

|

||||||||||||||||||||||||

|

|

2. |

|

Simple trust |

5. |

|

|

|

|

Bankruptcy estate |

8. |

|

|

|

Other |

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

3. |

|

Complex trust |

6. |

|

|

|

|

Qualified funeral trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DECEDENT'S ESTATE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

If Decedent's estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Date of death |

|

|

|

|

|

|

|

|

|

|

|

Decedent's Social Security Number |

|

|

|

|

|

|

|

||||||||||||||||||||||

|

Domicile of decedent |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if final return. |

(do not enter / or |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RESIDENT STATUS |

|

|

|

|

|

|

|

|

|

|

|

AMENDED RETURN |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Check box if resident and complete the following |

|

|

|

|

|

Check applicable box(es). |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Subdivision Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This is an amended return. (Attach documentation) |

|

|

|

||||||||||||||||||||||

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net operating loss is being carried back. |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

City, town or taxing area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name or address has changed. |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Check box if nonresident. See Form 504NR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

1. |

Federal taxable income of fiduciary (from line 23 of federal Form 1041). See Instruction 9 |

1. |

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||||

2. |

Exemption claimed on federal return |

2. |

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||||

3. |

.. .Income from Electing Small Business Trust (ESBT). Do Not Prorate. See Instruction 10 |

3. |

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||||

4. |

Federal taxable income plus nonallocable additions (Enter the sum of line 1 through line 3.) |

.. . . . . |

4. |

|

|

|

.00 |

|

||||||||||||||||||||||||||||||||||

5. |

Fiduciary’s Share of Maryland Modifications (Enter the positive or negative number from Form 504 |

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||||

|

|

Schedule A line 8, 9d or 10f.) |

. . . . . . . . . |

|

. . . 對 |

5. |

|

|

|

|

||||||||||||||||||||||||||||||||

6. |

Line 4 plus or minus line 5 |

6. |

|

|

|

.00 |

|

|||||||||||||||||||||||||||||||||||

7. |

Nonresident beneficiary deduction from Form 504 Schedule A, line 13 |

|

|

|

|

|

|

|

|

7. |

|

|

|

.00 |

|

|||||||||||||||||||||||||||

.. |

. |

. . |

. . . . . . . . |

. . . |

|

. . . . . |

|

|

|

|

||||||||||||||||||||||||||||||||

8. |

.. . . . . . . .Maryland adjusted gross income (Subtract line 7 from line 6.) |

. . |

. . . . . . . . |

. . . |

|

. . . . . |

8. |

|

|

|

.00 |

|

||||||||||||||||||||||||||||||

9. |

. .. . .Maryland exemption. See Instruction 10 |

. |

. . . |

. . |

. . |

. . |

. |

|

. . . |

. |

. |

. . |

. |

. . |

. . . . . . . . |

. . . |

|

. . . . . |

9. |

|

|

|

.00 |

|

||||||||||||||||||

10. |

Fiduciary's Maryland taxable net income. (Subtract line 9 from line 8.) |

.. |

. |

. . |

. . . . . . . . |

. . . |

|

. . . . . |

10. |

|

|

|

|

.00 |

|

|||||||||||||||||||||||||||

|

|

NOTE: Nonresident fiduciary - see instruction for Form 504NR. |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||||||||

11. |

Maryland tax (Use rate schedule in instructions or enter amount from Form 504NR, line 21.) .. . . |

11. |

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

MARYLAND |

FIDUCIARY INCOME |

2022 |

||

|

|

|

|

|

|

|

|

|

FORM |

TAX RETURN |

page 2 |

||

|

||||||

504 |

|

|

|

|

||

NAME |

|

|

FEIN |

|

|

|

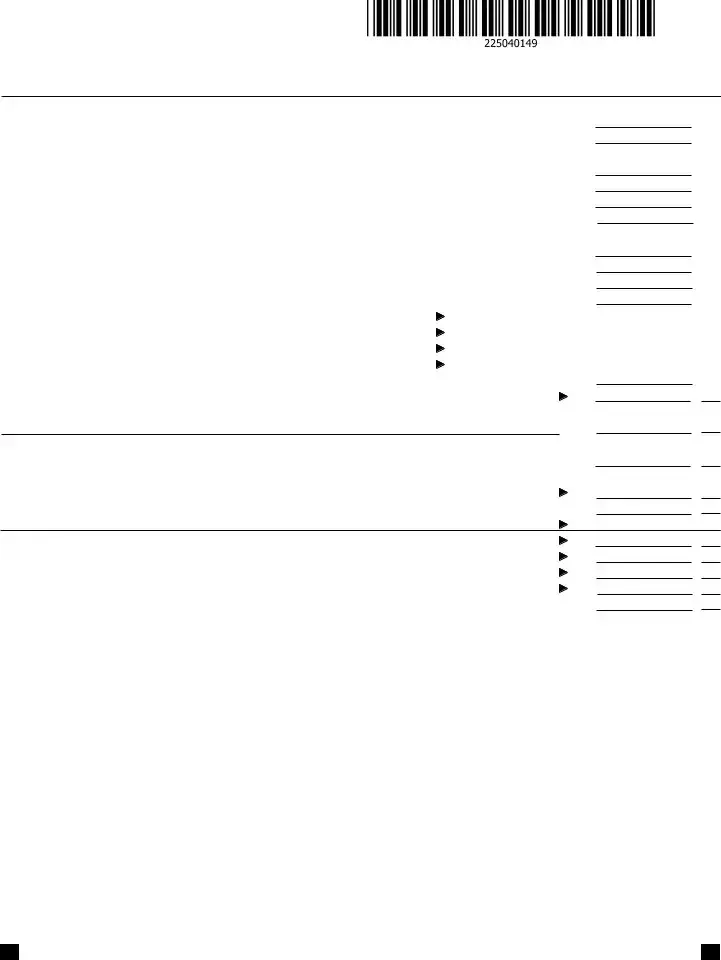

12.Special nonresident tax Nonresidents: Enter the amount from Form 504NR, line 22.

(See Instruction 14.) Residents: Enter zero. .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Total Maryland tax (Add lines 11 and 12.).. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14.Credit for fiduciary income tax paid to another state and/or credit for preservation and conservation

easements from Part AA, line 1 and Part AA, line 6 of Form 502CR (Attach Form 502CR.).. . . . 14.

15. Enter the Nonrefundable Business Tax Credits from Part AAA of Form 504CR. . . . . . . . . . . . . . .  15.

15.

16. Total credits (Add lines 14 and 15).. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. Maryland Tax after credits (Subtract line 16 from line 13, if less than zero, enter zero)... . . . . . . 17.

18.Local tax (Multiply the fiduciary's Maryland taxable net income from line 10 by

19. |

.0 |

|

). See Instruction 15. |

. . . |

. . . . . . . . . . . |

18. |

|

|

|

|

|||||

Local Credit for fiduciary income tax paid to another state from Part BB of Form 502CR |

19. |

||||||

20. |

Local tax after credit. (Subtract line 19 from line 18.) If less than zero, enter zero |

20. |

|||||

21. |

Total Maryland and local tax. (Add lines 17 and 20.) |

. . . |

. . . . . . . . . . . |

21. |

|||

22. |

Contribution to Chesapeake Bay and Endangered Species Fund |

22. |

|

|

.00 |

||

23. |

. . . .Contribution to Developmental Disabilities Services and Support Fund |

23. |

|

|

.00 |

||

24. |

Contribution to Maryland Cancer Fund |

24. |

|

|

.00 |

||

25. |

.. . . . . . . . . . . . . . . . . . . .Contribution to Fair Campaign Financing Fund |

25. |

|

|

.00 |

||

26. |

Total Maryland income tax, local income tax and contributions (Add lines 21 through 25.). |

26. |

|||||

27. |

Maryland and local tax withheld. See Instruction 17 |

. . . |

. . . . . . . . . . . |

27. |

|||

28.Estimated tax payments and payments made with extension request and

with Form MW506NRS.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .  28.

28.

29.Nonresident tax paid by

(Attach Maryland Schedule  29.

29.

30.Refundable Business and/or Heritage Structure Rehabilitation tax credits

|

(Attach Form 504CR and/or Form 502S.) |

. . . . . . . . . . |

. |

. . . . . . . . . . |

|

30. |

||

31. |

Total payments and credits (Add lines 27 through 30.) |

. . . . . . . . . . |

|

31. |

||||

32. |

Balance due (If line 26 is more than line 31, enter the difference.) |

. . . . . . . . . . |

|

32. |

||||

33. |

Overpayment (If line 26 is less than line 31, enter the difference.) |

. . . . . . . . . . |

|

33. |

||||

34. Amount of overpayment to be applied to 2023 estimated tax |

34. |

|||||||

35. |

.. . . . . . .Amount of overpayment to be refunded (Subtract line 34 from line 33.) |

REFUND |

|

35. |

||||

36. |

Interest charges from Form 504UP |

|

or for late filing |

|

|

. . . . Total |

36. |

|

|

|

|||||||

37. |

TOTAL AMOUNT DUE (Add lines 32 and 36.) |

. . . . . . . . . . |

. |

. . . . . . . . . . |

|

37. |

||

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.

.

.

.

.

.

.

.

.

.

.

AMENDED RETURNS

If you are filing an amended fiduciary income tax return, check the applicable boxes and draw a line through any bar codes on the front. Explain the changes you are making in the space below. Attach a copy of the amended federal Form 1041 if the federal return is being amended, and any other required documentation.

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

|

|

MARYLAND |

FIDUCIARY INCOME |

2022 |

||

|

|

|

|

|

|

|

|

|

FORM |

TAX RETURN |

page 3 |

||

|

||||||

504 |

|

|

|

|

||

NAME |

|

|

FEIN |

|

|

|

|

|

|

|

|||

________________________________________________________________________________________________________

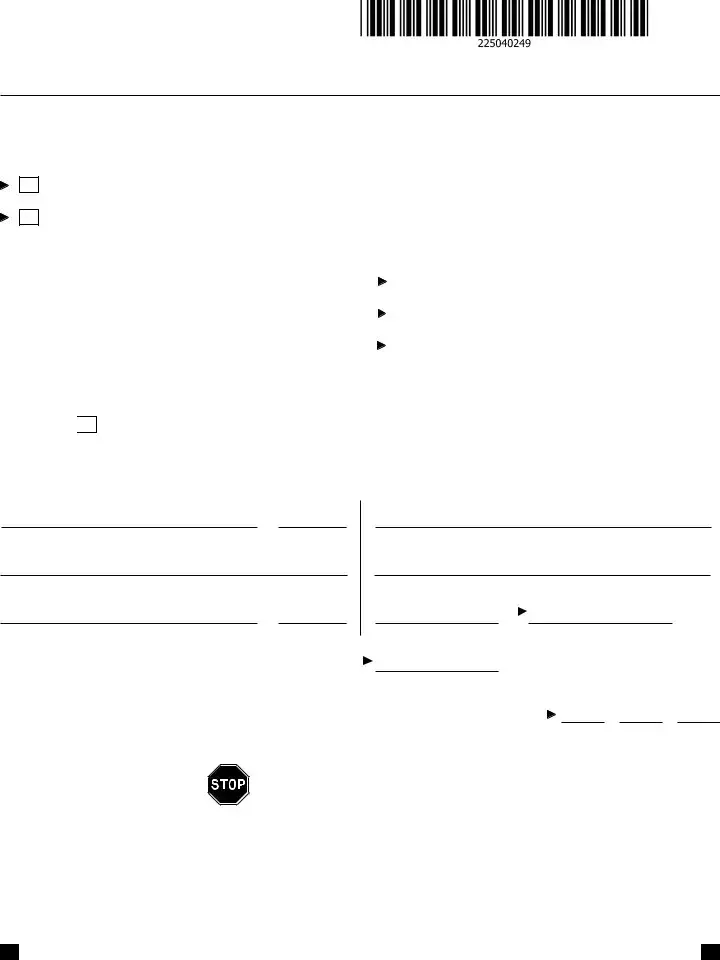

DIRECT DEPOSIT OF REFUND (see Instruction 18)

Verify that all account information is correct and clearly legible. If you are requesting direct deposit of your refund, com- plete the following. For Splitting Direct Deposit, use Form 588.

Check here if this refund will go to an account outside of the United States.

Check here if you authorize the State of Maryland to issue your refund by direct deposit.

38.For the direct deposit option, complete the following information clearly and legibly:

38a. |

Type of account: |

38a. |

|

Checking |

|

Savings |

||

38b. |

Routing Number |

38b. |

|

|

|

|

|

|

38c. |

Account number: |

38c. |

|

|

|

|

|

|

38d. |

Name(s) as it appears on the bank account |

. 38d. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

SIGNATURE AND VERIFICATION

Check here

if you authorize your preparer to discuss this return with us.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the declaration is based on all information of which the preparer has any knowledge.

Signature of Fiduciary or Officer representing Fiduciary |

Date |

Printed name of the Preparer / or Firm's name |

|

Street address of Preparer or Firm's address

City, State, ZIP Code + 4

Signature of preparer other than fiduciary (Required by Law) |

Date |

Telephone number of preparer |

Preparer’s PTIN (Required by Law) |

Daytime telephone number (Fiduciary)

CODE NUMBERS (3 digits per line)

Nonresidents must include Form 504NR.

Make checks payable to and mail to:

Comptroller Of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, Maryland

(Write Your Federal Employer Identification Number On Check Using Blue Or Black Ink.)

Form Attributes

| Fact Name | Description |

|---|---|

| Form Purpose | The Maryland 504 form is used to file the fiduciary income tax return for estates and trusts in Maryland. |

| Governing Laws | This form is governed by the Maryland Tax-General Article, specifically sections relating to fiduciary income taxation. |

| Filing Requirements | Fiduciaries must file this form if the estate or trust has taxable income for the year. |

| Entity Types | Various entity types can use this form, including decedent’s estates, simple trusts, complex trusts, and grantor-type trusts. |

| Amended Returns | If changes are needed after filing, an amended return can be submitted by checking the appropriate box on the form. |

| Payment Options | Taxpayers can choose to have their refunds directly deposited into their bank accounts by providing account information on the form. |

Other PDF Forms

Maryland Llc Tax Filing Requirements - Entities are required to report their principal place of business and where their tax records are kept.

Filling out the Texas Motor Vehicle Bill of Sale form is crucial for documenting the sale and ensuring that all necessary information is included, as you can see at texasdocuments.net/printable-motor-vehicle-bill-of-sale-form, which provides a comprehensive guide to making the process seamless.

Maryland 502x Instructions - The 504E form requires that all due taxes (as calculated on the form) are paid by the original return's due date to avoid interest and penalties.

Maryland Lottery Winner Anonymous - It highlights the state's commitment to consumer protection and responsible gaming, with applicants needing to demonstrate their ability to uphold these values.