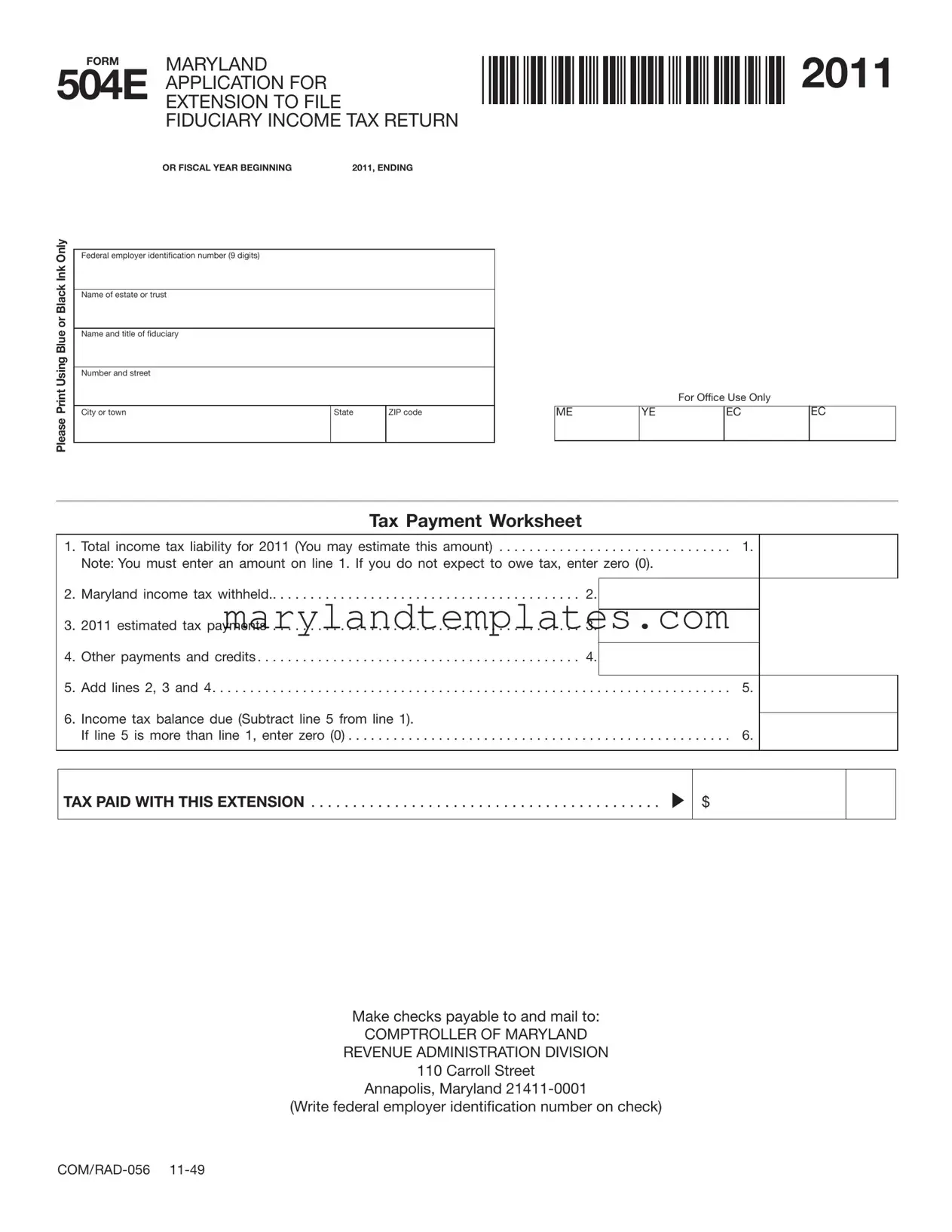

Printable Maryland 504E Template

The Maryland 504E form serves as a crucial tool for fiduciaries seeking an extension to file their income tax returns. This form allows individuals managing estates or trusts to request an automatic six-month extension for filing the necessary tax documentation. To utilize this extension, fiduciaries must complete the form accurately, submit it by the due date, and ensure that any tax balance due is paid in full. The form requires the federal employer identification number and basic information about the estate or trust, including the name and address of the fiduciary. It also includes a worksheet for calculating total income tax liability, Maryland income tax withheld, and any estimated tax payments made. Importantly, while the 504E provides additional time to file, it does not extend the deadline for tax payments. Therefore, any unpaid tax will accrue interest and may incur penalties if not settled by the original due date. Understanding the requirements and deadlines associated with the 504E form is essential for fiduciaries to avoid unnecessary financial consequences.

Maryland 504E Preview

FORM |

MARYLAND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

APPLICATION FOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

504E EXTENSION TO FILE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

FIDUCIARY INCOME TAX RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR FISCAL YEAR BEGINNING |

2011, ENDING |

OnlyInk |

|

|

|

|

|

Federal employer identification number (9 digits) |

|

|

|

|

|

|

|

|

Blackor |

|

|

|

|

|

Name of estate or trust |

|

|

|

|

|

|

|

|

Blue |

Name and title of fiduciary |

|

|

|

|

|

|

||

UsingPrint |

|

|

|

|

Number and street |

|

|

||

|

|

|

|

|

|

|

|

|

|

Please |

City or town |

State |

ZIP code |

|

|

|

|

||

|

|

|

||

ME

For Office Use Only

YE |

EC |

EC |

|

|

|

Tax Payment Worksheet

1. |

Total income tax liability for 2011 (You may estimate this amount) |

. . . . . . . . . . . . . . . . .. . .1. |

|

|

|

Note: You must enter an amount on line 1. If you do not expect to owe tax, enter zero (0). |

|

||

2. |

Maryland income tax withheld |

2. |

|

|

|

|

|||

3. |

2011 estimated tax payments |

3. |

|

|

|

|

|||

4. |

Other payments and credits |

4. |

|

|

|

|

|||

|

|

|

|

|

5. |

Add lines 2, 3 and 4 |

. . .5 |

|

|

6. |

Income tax balance due (Subtract line 5 from line 1). |

|

|

|

|

|

|

||

|

If line 5 is more than line 1, enter zero (0) |

. . .6 |

|

|

|

|

|

|

|

TAX PAID WITH THIS EXTENSION |

|

|

$ |

|

. |

|

|

||

|

|

|

|

|

Make checks payable to and mail to:

COMPTROLLER OF MARYLAND

REVENUE ADMINISTRATION DIVISION

110 Carroll Street

Annapolis, Maryland

(Write federal employer identification number on check)

INSTRUCTIONS FOR

FORM 504E 2011

MARYLAND

APPLICATION FOR EXTENSION TO FILE FIDUCIARY INCOME TAX RETURN

PAGE 2

GENERAL INSTRUCTIONS

Purpose of Form

Use Form 504E to receive an automatic six month extension to file Form 504.

To get the extension you MUST:

1.fill in Form 504E correctly AND

2.file it by the due date of your return AND

3.pay ALL of the amount shown on line 6.

Fiduciaries requesting an extension of more than six months must enter on this application the reason for the request. No extension request will be granted for more than six months, except in the case of a fiduciary who is out of the United States. In no case will an extension be granted for more than one year from the due date for submitting the fiduciary tax return. See Administrative Release 4.

When to File Form 504E

File Form 504E by April 15, 2012. If you are filing on a fiscal year basis, file by the regular due date of your return.

Where to File

Mail this form to the Maryland Revenue Administra- tion Division, 110 Carroll Street, Annapolis, MD

Filing Your Tax Return

You may file Form 504 at any time before the end of the extension period. Remember, Form 504E does not extend the time to pay taxes. If you do not pay the amount due by the regular due date, you will owe interest and be subject to a penalty.

Interest

You will owe interest on tax not paid by the regular due date of your return. The interest will accrue until you pay the tax. Even if you had a good reason not to pay on time, you will still owe interest.

Penalty

If tax and interest is not paid promptly, a penalty will be assessed on the tax.

How to Claim Credit for Payment Made with This Form

When you file your return, show the amount of any payment (line 6) sent with Form 504E on line 31 of your return.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose of Form | Form 504E is used to request an automatic six-month extension to file the fiduciary income tax return, Form 504. |

| Filing Deadline | The form must be filed by April 15, 2012, or by the regular due date of the return if on a fiscal year basis. |

| Payment Requirement | To obtain the extension, all amounts shown on line 6 must be paid by the due date of the return. |

| Extension Limitations | Extensions beyond six months require a reason for the request and are only granted under specific circumstances. |

| Interest Accrual | Interest will accrue on any unpaid tax from the regular due date until the tax is paid, regardless of circumstances. |

| Penalty for Late Payment | A penalty will be assessed if the tax and interest are not paid promptly. |

| Where to File | The completed form should be mailed to the Maryland Revenue Administration Division at 110 Carroll Street, Annapolis, MD 21411-0001. |

| Claiming Credit | When filing Form 504, any payment made with Form 504E should be reported on line 31 of the return. |

| Governing Laws | This form is governed by the Maryland Tax Code and Administrative Release 4. |

| Form Identification | The form is officially identified as FORM MARYLAND 2011 APPLICATION FOR 504E EXTENSION TO FILE FIDUCIARY INCOME TAX RETURN. |

Other PDF Forms

Motion for Reconsideration Maryland - It underscores the irreversible nature of the charging document once issued by a commissioner.

Completing the Washington Motorcycle Bill of Sale form is an important step in documenting the transfer of ownership, and for those looking for a reliable resource, the WA Documents website offers a comprehensive fillable version to facilitate the process, ensuring all necessary details are correctly recorded for both parties’ protection.

Maryland State 100 Application - Encourages applicants to mention how they became aware of the job opening, aiding in evaluating the effectiveness of recruitment channels.