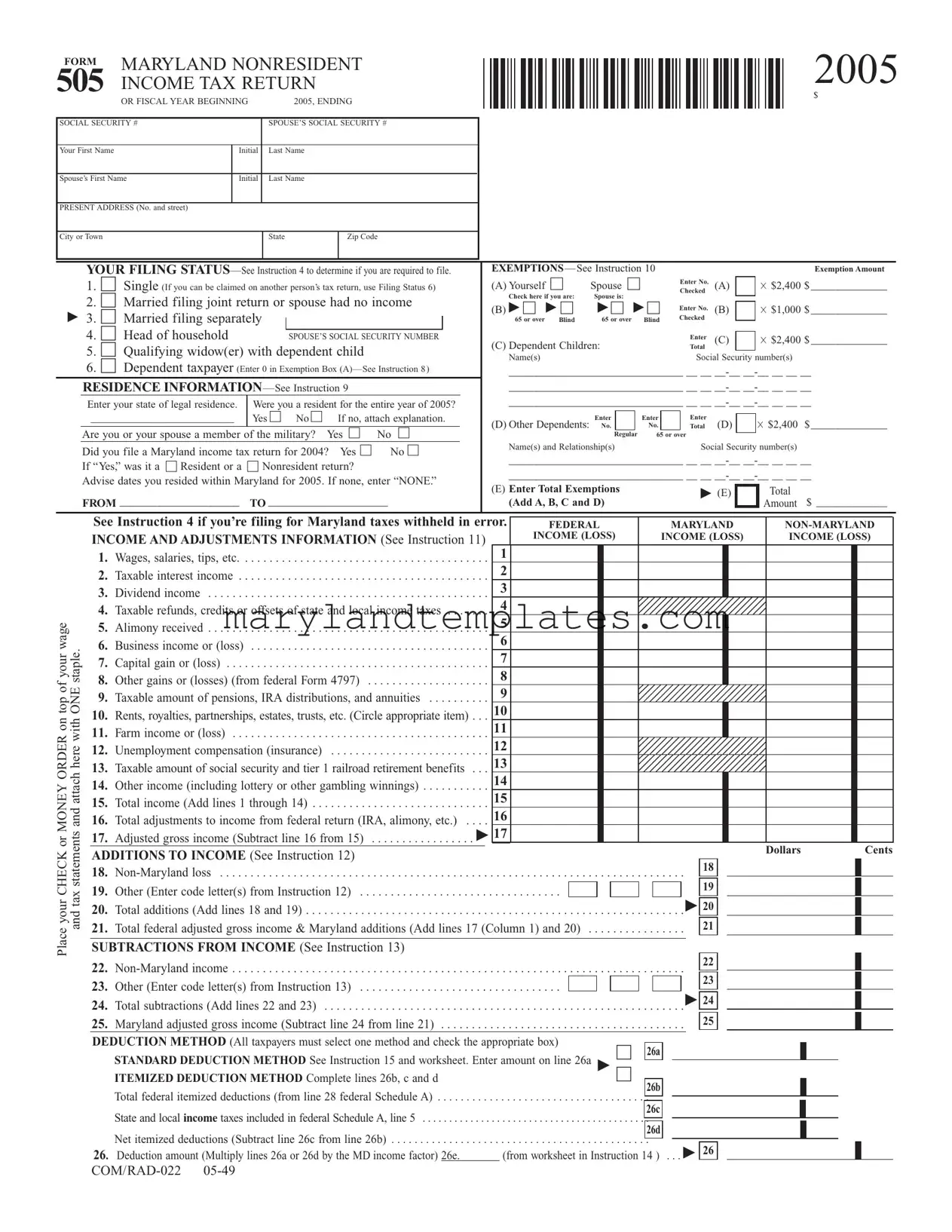

Printable Maryland 505 Template

The Maryland Nonresident 505 Income Tax Return form is an essential document for individuals who earned income in Maryland but are not residents of the state. This form helps nonresidents report their income, claim exemptions, and calculate their tax liability. It includes sections for personal information, such as names and Social Security numbers, as well as details about filing status and exemptions. Taxpayers can choose between standard and itemized deduction methods, which can significantly affect their taxable income. The form also requires reporting various types of income, including wages, interest, and dividends, along with any applicable adjustments. Additionally, it provides a space for taxpayers to claim credits and contributions, ensuring they receive any benefits they may be eligible for. Completing the Maryland 505 form accurately is crucial for compliance and can help avoid penalties while ensuring that taxpayers pay only what they owe. Understanding its components is vital for anyone navigating the tax landscape in Maryland.

Maryland 505 Preview

FORM MARYLAND NONRESIDENT 505 INCOME TAX RETURN

OR FISCAL YEAR BEGINNING |

2005, ENDING |

2005

$

SOCIAL SECURITY # |

|

SPOUSE’S SOCIAL SECURITY # |

|

|

|

|

|

Your First Name |

Initial |

Last Name |

|

|

|

|

|

Spouse’s First Name |

Initial |

Last Name |

|

|

|

|

|

PRESENT ADDRESS (No. and street) |

|

|

|

|

|

|

|

City or Town |

|

State |

Zip Code |

|

|

|

|

|

YOUR FILING |

|

EXEMPTIONS — See Instruction 10 |

|

|

|

|

|

|

Exemption Amount |

|

||||||||||||

|

1. ☐ Single (If you can be claimed on another person’s tax return, use Filing Status 6) |

|

(A) Yourself ☐ |

Spouse ☐ |

|

|

Enter No. |

(A) |

|

× $2,400 |

$ ______________ |

|

|||||||||||

|

|

|

|

Checked |

|

|

|||||||||||||||||

|

2. ☐ Married filing joint return or spouse had no income |

|

Check here if you are: |

Spouse is: |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

(B) ▶ ☐ ▶ ☐ |

▶ ☐ ▶ ☐ |

Enter No. |

(B) |

|

× $1,000 |

$ ______________ |

|

||||||||||||||

▶ 3. ☐ Married filing separately |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

65 or over |

Blind |

65 or over |

Blind |

Checked |

|

|

|

|

|

|

||||||

|

4. ☐ Head of household |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

SPOUSE’S SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

|

|

Enter |

|

|

|

× $2,400 |

$ ______________ |

|

||||||

|

|

|

(C) Dependent Children: |

|

|

(C) |

|

|

|||||||||||||||

|

5. ☐ Qualifying widow(er) with dependent child |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

Name(s) |

|

|

|

|

|

|

Social Security number(s) |

|

|

|||||||||

|

6. ☐ Dependent taxpayer (Enter 0 in Exemption Box |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

________________________________ __ __ |

|

||||||||||||||||||||

|

RESIDENCE |

|

|

|

|

________________________________ __ __ |

|

||||||||||||||||

|

Enter your state of legal residence. |

Were you a resident for the entire year of 2005? |

|

________________________________ __ __ |

|

||||||||||||||||||

_____________________________ |

Yes ☐ No ☐ |

If no, attach explanation. |

|

(D) Other Dependents: |

Enter |

|

|

Enter |

|

Enter |

(D) |

|

× $2,400 |

$ ______________ |

|

||||||||

|

|

|

|

|

|

|

|

|

No. |

|

|

No. |

|

Total |

|

|

|||||||

|

Are you or your spouse a member of the military? Yes ☐ |

No ☐ |

|

|

|

||||||||||||||||||

|

|

|

|

|

Regular |

65 or over |

|

|

|

|

|

|

|||||||||||

|

Did you file a Maryland income tax return for 2004? |

Yes ☐ |

No ☐ |

|

Name(s) and Relationship(s) |

|

|

Social Security number(s) |

|

|

|||||||||||||

|

|

________________________________ __ __ |

|

||||||||||||||||||||

|

If “Yes,” was it a ☐ Resident or a ☐ Nonresident return? |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

________________________________ __ __ |

|

|||||||||||||||||

|

Advise dates you resided within Maryland for 2005. If none, enter “NONE.” |

|

|

||||||||||||||||||||

|

|

(E) Enter Total Exemptions |

|

|

▶ (E) |

|

|

Total |

|

|

|||||||||||||

|

FROM _____________________ |

TO _____________________ |

|

|

|

|

|

$ _____________ |

|

||||||||||||||

|

|

(Add A, B, C and D) |

|

|

|

|

|

|

Amount |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Instruction 4 if you’re filing for Maryland taxes withheld in error. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

FEDERAL |

|

MARYLAND |

|

||||||||||||||||||

|

INCOME AND ADJUSTMENTS INFORMATION (See Instruction 11) |

|

INCOME (LOSS) |

|

INCOME (LOSS) |

INCOME (LOSS) |

|

||||||||||||||||

|

|

1. |

Wages, salaries, tips, etc |

|

1 |

|

|

|

|

. . |

|

|

|

||

|

|

2. |

Taxable interest income |

|

2 |

|

|

|

|

. . |

|

|

|

||

|

|

3. |

Dividend income |

|

3 |

|

|

|

|

. . |

|

|

|

||

|

|

4. |

Taxable refunds, credits or offsets of state and local income taxes . . . . |

|

4 |

|

|

|

|

. . |

|

|

|

||

wageyouroftop |

staple.ONE |

5. |

Alimony received |

|

5 |

|

|

|

|

. . |

|

|

|

||

|

|

6. |

Business income or (loss) |

|

6 |

|

|

|

|

. . |

|

|

|

||

|

|

7. |

Capital gain or (loss) |

|

7 |

|

|

|

|

. . |

|

|

|

||

|

|

8. |

Other gains or (losses) (from federal Form 4797) |

|

8 |

|

|

|

|

. . |

|

|

|

||

|

|

9. |

Taxable amount of pensions, IRA distributions, and annuities |

|

9 |

|

|

|

|

. . |

|

|

|

||

ORDERMONEYorCHECKyourPlaceon |

hereattachandstatementstaxandwith |

10. |

Rents, royalties, partnerships, estates, trusts, etc. (Circle appropriate item) |

|

10 |

|

|

. . |

|

|

|

||||

11. |

Farm income or (loss) |

|

11 |

|

|

||

. . |

|

|

|

||||

12. |

Unemployment compensation (insurance) |

|

12 |

|

|

||

|

|

. . |

|

|

|

||

|

|

13. |

Taxable amount of social security and tier 1 railroad retirement benefits |

|

13 |

|

|

|

|

. . |

|

|

|

||

|

|

14. |

Other income (including lottery or other gambling winnings) |

|

14 |

|

|

|

|

. . |

|

|

|

||

|

|

15. |

Total income (Add lines 1 through 14) |

|

15 |

|

|

|

|

. . |

|

|

|

||

|

|

16. |

Total adjustments to income from federal return (IRA, alimony, etc.) . . . . |

16 |

|

|

|

|

|

17. |

Adjusted gross income (Subtract line 16 from 15) |

▶ 17 |

|

|

|

|

|

|

|

|

|

||

|

|

ADDITIONS TO INCOME (See Instruction 12) |

|

|

Dollars |

Cents |

|

|

|

|

|

|

|

||

|

|

18. |

|

|

18 |

|

|

|

|

. . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

||

|

|

19. |

Other (Enter code letter(s) from Instruction 12) |

|

|

19 |

|

|

|

. . . |

. . . . . . . . . . . |

|

|

||

|

|

20. |

Total additions (Add lines 18 and 19) |

|

▶ |

20 |

|

|

|

. . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

||

|

|

21. |

Total federal adjusted gross income & Maryland additions (Add lines 17 (Column 1) and 20) |

21 |

|

||

|

|

SUBTRACTIONS FROM INCOME (See Instruction 13) |

|

|

|

|

|

|

|

|

22 |

22. |

|

|

|

|

|

|

23 |

23. |

Other (Enter code letter(s) from Instruction 13) |

|

|

|

|

▶ |

24 |

24. |

Total subtractions (Add lines 22 and 23) |

|

|

25. |

Maryland adjusted gross income (Subtract line 24 from line 21) |

|

25 |

DEDUCTION METHOD (All taxpayers must select one method and check the appropriate box)

☐ 26a

STANDARD DEDUCTION METHOD See Instruction 15 and worksheet. Enter amount on line 26a ▶

ITEMIZED DEDUCTION METHOD Complete lines 26b, c and d☐

26b

Total federal itemized deductions (from line 28 federal Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26c

State and local income taxes included in federal Schedule A, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26d

Net itemized deductions (Subtract line 26c from line 26b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26. Deduction amount (Multiply lines 26a or 26d by the MD income factor) 26e. |

(from worksheet in Instruction 14 ) . . . |

▶ |

|

|

|

|

|

26

FORM |

MARYLAND NONRESIDENT |

||

505 |

|||

INCOME TAX RETURN |

|||

|

2005 |

|

|

|

|

Name ___________________________________________ SS# ____________________________________________ |

|

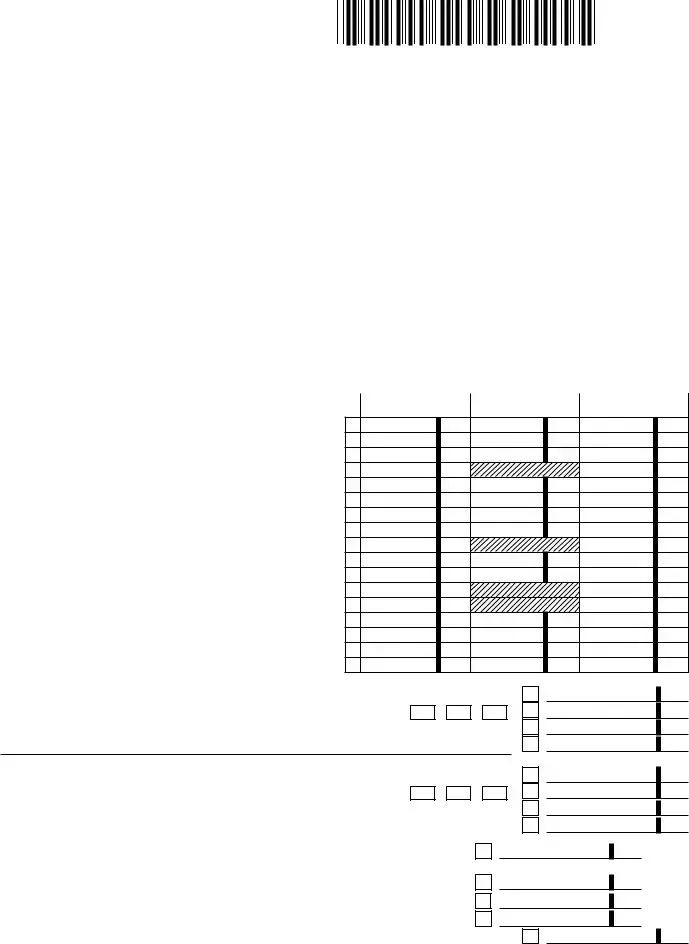

27. |

Net income (Subtract line 26 from line 25) |

||

28. |

Total exemption amount (from EXEMPTIONS area, page 1) See Instruction 10 |

||

29. |

Enter your Maryland income factor (from worksheet in Instruction 14) |

||

30. |

Maryland exemption allowance (Multiply line 28 by line 29) |

||

31. |

Taxable net income (Subtract line 30 from line 27) Figure tax on this amount |

||

MARYLAND TAX COMPUTATION

32a. Maryland tax (from Tax Table or Computation Worksheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32b. Special nonresident tax. Multiply line 31 by .0125 (1.25%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32c. Total Maryland tax. (Add lines 32a and 32b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

▶

33. |

Earned income credit from worksheet in Instruction 20 |

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||

34. |

Poverty level credit from worksheet in Instruction 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|||

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||||

35. |

Other income tax credits for individuals from Part G, line 8 of Form 502CR. (Attach Form 502CR) |

|

|

|

|

|

|

||||||||||||

36. |

Business tax credits (Attach Form 500CR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|||

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||||

37. |

Total credits (Add lines 33 through 36) |

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||

38. |

Maryland tax after credits (Subtract line 37 from line 32c) If less than 0, enter 0. . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

39. |

Contribution to Chesapeake Bay and Endangered Species Fund (See Instruction 21) |

|

|

|

|

|

|

|

|

|

|||||||||

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

||||||||||||

40. |

Contribution to Fair Campaign Financing Fund (See Instruction 21) |

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

||||

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||||

41. |

Contribution to Maryland Cancer Fund (See Instruction 21) |

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

||||

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||||

42. |

Total Maryland income tax and contributions (Add lines 38 through 41) |

|

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

43. |

Total Maryland tax withheld (Enter total from and attach your |

|

|

|

|||||||||||||||

|

. . |

|

|

||||||||||||||||

44. |

2005 estimated tax payments, amount applied from 2004 return and payment made with an extension request Form 502E |

|

|

|

|

▶ |

|

||||||||||||

|

. . |

|

|

||||||||||||||||

45. |

Refundable earned income credit from worksheet in Instruction 20 |

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

||||

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||||

46. |

Nonresident tax paid by |

|

|

|

▶ |

|

|||||||||||||

|

|

||||||||||||||||||

47. |

Refundable income tax credits from Part H, line 5 of Form 502CR (Attach Form 502CR. See Instruction 22) |

|

. . |

|

|

||||||||||||||

48. |

Total payments and credits (Add lines 43 through 47) |

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

49. |

Balance due (If line 42 is more than line 48, subtract line 48 from line 42) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||||

50. |

Overpayment (If line 42 is less than line 48, subtract line 42 from line 48) |

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

||||

. |

. . . |

. . . . . |

. . . |

. . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

|

. . |

|

|

|||||||||

51. |

Amount of overpayment TO BE APPLIED TO 2006 ESTIMATED TAX |

|

|

|

▶ |

51 |

|

|

|

|

|

|

|

|

|

||||

. |

. . . . |

. |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52. |

Amount of overpayment TO BE REFUNDED TO YOU (Subtract line 51 from line 50) |

REFUND ▶ |

|

||||||||||||||||

|

|

|

|

|

|

||||||||||||||

53. |

Interest charges from Form 502UP |

|

|

or for late filing |

|

|

|

|

|

|

|

(See Instruction 23) Total |

|

|

▶ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

54. |

TOTAL AMOUNT DUE (Add line 49 and line 53) |

IF $1 OR MORE, PAY IN FULL WITH THIS RETURN. |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

For credit card payment check here |

|

|

and see Instruction 25. Direct debit is available only if you file electronically. |

|

|

|

|

|

|

||||||||||

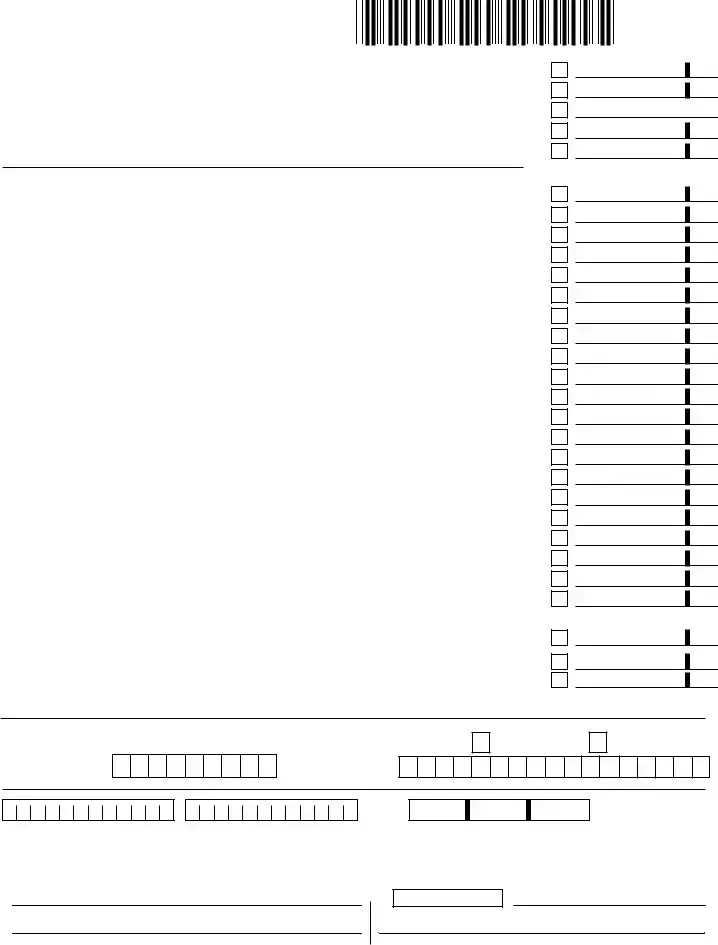

DollarsCents

27

28

29

30

31

32a

32b

32c

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

52

53

54

DIRECT DEPOSIT OF REFUND (See Instruction 23) Please be sure the account information is correct.

55. To choose the direct deposit option, complete the following information: |

55a. Type of account: ▶ |

Checking

Savings

55b. Routing number ▶

55c. Account number ▶

-

-

-

-

Daytime telephone no. |

Home telephone no. |

CODE NUMBERS (3 digits per box) |

||

|

|

|||

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and |

Make checks payable to: COMPTROLLER OF MARYLAND. |

|||

statements and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person |

It is recommended that you include your social security no. on |

|||

other than taxpayer, the declaration is based on all information of which the preparer has any knowledge. Check |

check using blue or black ink. Mail to: Comptroller of Maryland, |

|||

here |

|

if you authorize your preparer to discuss this return with us. |

Revenue Administration Division, Annapolis, Maryland |

|

|

|

|

|

|

Your signature |

Date |

▶

Preparer’s SSN or PTIN |

Signature of preparer other than taxpayer |

Spouse’s signature |

Date |

Address and telephone number of preparer

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Maryland 505 form is used by nonresidents to file their income tax return for the state of Maryland. |

| Filing Year | This form is specifically for the fiscal year beginning and ending in 2005. |

| Governing Law | The form is governed by the Maryland Tax Code, specifically under Title 10 of the Tax-General Article. |

| Social Security Numbers | Taxpayers must provide their Social Security number and their spouse's, if applicable, on the form. |

| Filing Status | There are multiple filing statuses available, including single, married filing jointly, and head of household. |

| Exemptions | Taxpayers can claim exemptions for themselves, their spouse, and dependents, with specific amounts outlined in the form. |

| Income Reporting | The form requires reporting various types of income, including wages, dividends, and business income. |

| Deductions | Taxpayers must choose between the standard deduction and itemized deductions, with specific calculations required for each. |

| Tax Computation | Maryland tax is calculated based on the taxable net income, and there are specific tax tables for this purpose. |

| Filing Instructions | Instructions are provided within the form, guiding taxpayers on how to complete each section accurately. |

Other PDF Forms

Maryland State Tax Forms - Joint filers in Maryland use Form 502D to collectively estimate and remit their state income tax, simplifying the process for married couples.

When considering marriage, understanding the significance of a well-crafted comprehensive Prenuptial Agreement can be crucial. This document not only delineates asset distribution but also helps in managing expectations and responsibilities for both parties involved. Familiarizing oneself with this important legal tool can lead to better financial harmony in the future.

Can I Register My Car in Maryland With an Out of State License - It's an eco-friendly option for vehicle registration, offering an online submission feature that speeds up the process while reducing paperwork.