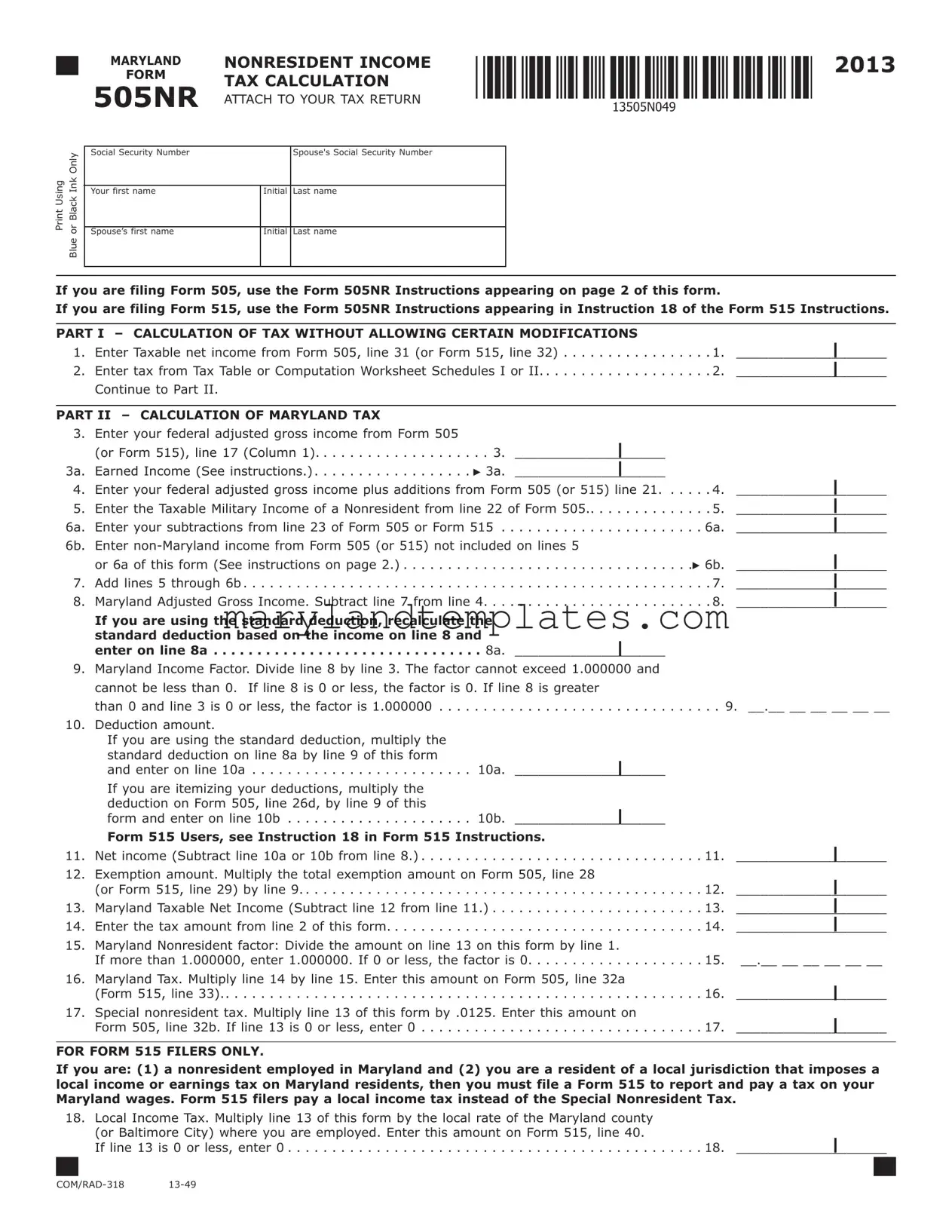

Printable Maryland 505Nr Template

The Maryland 505NR form is a crucial document for nonresidents who earn income in Maryland. This form is specifically designed to calculate the state income tax owed by individuals who do not reside in Maryland but have taxable income sourced from the state. It is essential for those who file either Form 505 or Form 515, as the 505NR serves as a supplemental form that helps determine the appropriate tax amount based on various income sources. The form includes multiple sections, starting with the calculation of taxable net income and moving through adjustments for federal adjusted gross income, military income, and deductions. Each line requires careful attention to detail, ensuring that all income, including any non-Maryland earnings, is accurately reported. Additionally, the form addresses the unique tax implications for nonresidents, such as the special nonresident tax and local income tax obligations, which can vary depending on the jurisdiction of employment. Understanding how to navigate the 505NR is vital for compliance and to avoid potential penalties. By following the structured instructions provided, taxpayers can effectively determine their Maryland tax liability and fulfill their obligations with confidence.

Maryland 505Nr Preview

|

|

MARYLAND |

NONRESIDENT INCOME |

2013 |

||

|

|

FORM |

||||

|

|

TAX CALCULATION |

|

|||

|

|

505NR |

|

|||

|

|

ATTACH TO YOUR TAX RETURN |

|

|||

|

|

|

|

|

|

|

Only |

|

Social Security Number |

|

|

Spouse's Social Security Number |

|

|

|

|

|

|

|

|

PrintUsing Blackor Ink |

|

|

|

|

|

|

|

Spouse’s first name |

|

Initial |

Last name |

|

|

|

|

Your first name |

|

Initial |

Last name |

|

Blue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you are filing Form 505, use the Form 505NR Instructions appearing on page 2 of this form.

If you are filing Form 515, use the Form 505NR Instructions appearing in Instruction 18 of the Form 515 Instructions.

PART I – CALCULATION OF TAX WITHOUT ALLOWING CERTAIN MODIFICATIONS |

|

||||

1. |

Enter Taxable net income from Form 505, line 31 (or Form 515, line 32) |

. . . . . . . . . . .1. |

| |

||

2. |

Enter tax from Tax Table or Computation Worksheet Schedules I or II |

. . . . . . . . . . . 2. |

| |

||

|

Continue to Part II. |

|

|

|

|

|

|

|

|

|

|

PART II – CALCULATION OF MARYLAND TAX |

|

|

|

|

|

3. |

Enter your federal adjusted gross income from Form 505 |

|

|

|

|

|

(or Form 515), line 17 (Column 1) |

3. |

|

| |

|

|

___________________ |

|

|||

3a. |

Earned Income (See instructions.) |

3a. |

|

| |

|

___________________ |

|

||||

4. |

Enter your federal adjusted gross income plus additions from Form 505 (or 515) line 21. . . . . .4. |

| |

|||

___________________ |

|||||

5. |

Enter the Taxable Military Income of a Nonresident from line 22 of Form 505.. . . . . . . . . . . . . .5. |

| |

|||

___________________ |

|||||

6a. |

Enter your subtractions from line 23 of Form 505 or Form 515 |

|

. . . . . . . . . . 6a. |

| |

|

. . . . . . . . . . . |

___________________ |

||||

6b. |

Enter |

|

|

||

|

or 6a of this form (See instructions on page 2.) |

|

. . . . . . . . . 6b. |

| |

|

|

. . . . . . . . . . . |

___________________ |

|||

7. |

Add lines 5 through 6b |

|

. . . . . . . . . . .7. |

| |

|

. . . . . . . . . . . |

___________________ |

||||

8. |

Maryland Adjusted Gross Income. Subtract line 7 from line 4 |

|

|

. . . . . . . . . . .8. |

| |

. . . . . . . . . . . |

___________________ |

||||

|

If you are using the standard deduction, recalculate the |

|

|

|

|

|

standard deduction based on the income on line 8 and |

|

|

| |

|

|

enter on line 8a |

8a. |

|

|

|

9.Maryland Income Factor. Divide line 8 by line 3. The factor cannot exceed 1.000000 and cannot be less than 0. If line 8 is 0 or less, the factor is 0. If line 8 is greater

than 0 and line 3 is 0 or less, the factor is 1.000000 . . . . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . 9. __.__ __ __ __ __ __ |

10. Deduction amount. |

|

|

If you are using the standard deduction, multiply the |

|

|

standard deduction on line 8a by line 9 of this form |

___________________ |

| |

and enter on line 10a |

10a. |

|

If you are itemizing your deductions, multiply the |

|

|

deduction on Form 505, line 26d, by line 9 of this |

___________________ |

| |

form and enter on line 10b |

10b. |

|

Form 515 Users, see Instruction 18 in Form 515 Instructions. |

|

|

11. |

Net income (Subtract line 10a or 10b from line 8.) |

11. |

___________________| |

12. |

Exemption amount. Multiply the total exemption amount on Form 505, line 28 |

|

| |

|

(or Form 515, line 29) by line 9 |

12. |

|

|

___________________ |

||

13. |

Maryland Taxable Net Income (Subtract line 12 from line 11.) |

13. |

| |

___________________ |

|||

14. |

Enter the tax amount from line 2 of this form |

14. |

| |

___________________ |

|||

15. |

Maryland Nonresident factor: Divide the amount on line 13 on this form by line 1. |

|

|

|

If more than 1.000000, enter 1.000000. If 0 or less, the factor is 0 |

15. |

__.__ __ __ __ __ __ |

16. |

Maryland Tax. Multiply line 14 by line 15. Enter this amount on Form 505, line 32a |

|

___________________| |

|

(Form 515, line 33) |

16. |

|

17. |

Special nonresident tax. Multiply line 13 of this form by .0125. Enter this amount on |

|

___________________| |

|

Form 505, line 32b. If line 13 is 0 or less, enter 0 |

17. |

FOR FORM 515 FILERS ONLY.

If you are: (1) a nonresident employed in Maryland and (2) you are a resident of a local jurisdiction that imposes a local income or earnings tax on Maryland residents, then you must file a Form 515 to report and pay a tax on your Maryland wages. Form 515 filers pay a local income tax instead of the Special Nonresident Tax.

18. Local Income Tax. Multiply line 13 of this form by the local rate of the Maryland county (or Baltimore City) where you are employed. Enter this amount on Form 515, line 40.

If line 13 is 0 or less, enter 0 |

| |

|

18. ___________________ |

||

|

|

|

MARYLAND |

NONRESIDENT INCOME |

|

FORM |

TAX CALCULATION |

|

505NR |

||

INSTRUCTIONS |

||

2013 |

|

Using Form 505NR, Nonresident Income Tax Calculation, follow the

Line 1. Enter the taxable net income from Form 505, line 31.

Line 2. Find the income range in the tax table that applies to the amount on line 1 of Form 505NR. Find the Maryland tax corresponding to your income range. Enter the tax amount from the tax table. If your taxable income on line 1 is $50,000 or more, use the Maryland Tax Computation Worksheet schedules at the end of the tax table.

Line 3. Enter your federal adjusted gross income (FAGI) from Form 505, line 17 (column 1).

Line 3a. If you are claiming a federal earned income credit (EIC), enter the earned income you used to calculate your federal EIC.

Earned income includes wages, salaries, tips, professional fees and other compensation received for personal services you performed. It also includes any amount received as a scholarship that you must include in your federal AGI.

Line 4. Enter the amount from Form 505, line 21.

Line 5. Taxable Military Income of a nonresident, if applicable.

Line 6a. Enter the amount of your subtractions from line 23 of Form 505.

Line 6b. Enter any

Important Note: Make sure that you follow the instruction for line 6b above to arrive at the correct amount. The

Be sure to include the following items if not already included on line 5 or 6a.

•Maryland salaries and wages should be included if you are a resident of a reciprocal state.

•Income subject to tax as a resident when required to file both Forms 502 and 505 should be included.

•Line 17 of column 3 on Form 505 (or 515) should also include income for wages earned in Maryland by a nonresident rendering police, fire, rescue or emergency services in an area covered under a state of emergency declared by the Maryland Governor, if the wages are paid by a nonprofit organization not registered to do business in the state and not otherwise doing business in the state, or by a state, county or political subdivision of a state, other than the State of Maryland.

PAGE 2

Line 7. Add lines 5 through 6b.

Line 8. Subtract line 7 from line 4. This is your Maryland Adjusted Gross Income.

Line 8a. If you are using the standard deduction amount, recalculate the standard deduction (line 8) based on the Maryland adjusted gross income.

Line 9. Compute your Maryland income factor by dividing line 8 by line 3. Carry the factor to six decimal places. The factor cannot exceed 1.000000 and cannot be less than 0. If line 8 is 0 or less, the factor is 0. If line 8 is greater than 0 and line 3 is 0 or less, the factor is 1.000000.

Line 10a. If you are using the standard deduction, multiply the standard deduction on line 8a by the Maryland Income Factor (line 9) and enter on line 10a.

Line 10b. If you are itemizing your deductions, multiply the deduction on Form 505 line 26d by the Maryland Income Factor (line 9) and enter on line 10b.

Line 11. If you are using the standard deduction, subtract line 10a from line 8. If you are using itemized deductions, subtract line 10b from line 8.

Line 12. Multiply the total exemption amount |

on |

Form |

|

|

505, line 28 by the factor on line 9. |

|

|

Line 13. Subtract line 12 from line 11. This |

is |

your |

|

|

Maryland taxable net income. |

|

|

Line 14. |

Enter the tax from line 2 of this form. |

|

|

Line 15. |

Divide the amount on line 13 of this form by the |

||

|

amount on line 1. Carry this Maryland nonresident |

||

|

factor to six decimal places. If more than |

||

|

1.000000, enter 1.000000. If 0 or less, enter 0. |

||

Line 16. |

Multiply line 14 by line 15 to arrive at your |

||

|

Maryland tax. Enter this amount on line 16 and |

||

|

on Form 505, line 32a. |

|

|

Line 17. |

Multiply line 13 by .0125. Enter this amount on |

||

|

line 17 and on Form 505, line 32b. If line 13 is |

||

|

0 or less, enter 0. |

|

|

On Form 505, add lines 32a and 32b and enter the total on line 32c.

Note: If you are using Form 505NR with Form 505, follow the instructions above. If you are using Form 505NR with

Form 515, please follow Instruction 18 in the Form 515 instructions.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Maryland 505NR form is used for calculating nonresident income tax in Maryland. |

| Governing Law | This form is governed by Maryland tax laws, specifically Title 10 of the Maryland Tax-General Article. |

| Eligibility | Nonresidents who earn income in Maryland must use this form to report their state tax obligations. |

| Filing Requirements | Taxpayers must attach the 505NR form to their Maryland tax return, either Form 505 or Form 515. |

| Income Calculation | Taxable net income is calculated using the amounts from Form 505 or Form 515. |

| Tax Rates | Tax amounts are determined using a tax table or computation worksheet specific to the taxpayer's income range. |

| Standard Deduction | Taxpayers can choose between a standard deduction or itemizing deductions based on their situation. |

| Maryland Income Factor | This factor is calculated by dividing Maryland Adjusted Gross Income by federal adjusted gross income. |

| Special Nonresident Tax | A special nonresident tax applies to certain nonresidents, calculated as 1.25% of Maryland taxable net income. |

Other PDF Forms

Maryland Estimated Tax Payments 2023 - Highlights the need for accurate social security number entry, ensuring the taxpayer’s information is correctly processed.

The Texas Motor Vehicle Power of Attorney form is an indispensable tool for individuals who need to delegate vehicle-related tasks when they are unavailable. Whether it's for title transfers or registration renewals, this legal document ensures that another trusted person can act on your behalf. To simplify the process of acquiring this form, you can visit texasdocuments.net/printable-motor-vehicle-power-of-attorney-form/ and get started without any hassle.

How Many Hours Can a Minor Work in Illinois - Assists young Maryland residents in obtaining employment legally, with a focus on protection and compliance.

How to Start a Lab Business - Allows laboratories to update their Federal CLIA number, essential for compliance with federal testing standards.