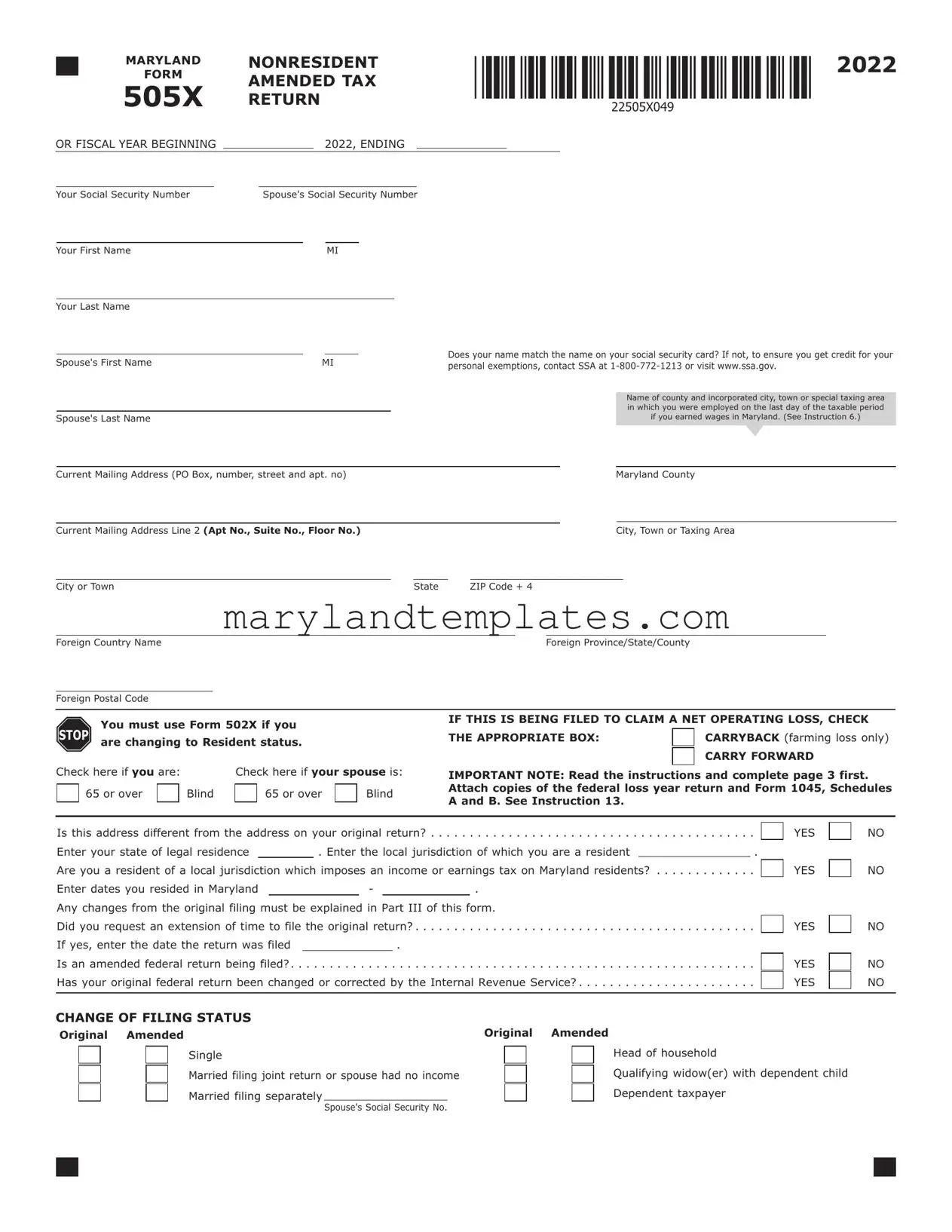

Printable Maryland 505X Template

The Maryland 505X form serves as an important tool for nonresidents seeking to amend their state tax returns. This form is specifically designed for individuals who have previously filed a Maryland nonresident tax return but need to make corrections or adjustments to their reported income, deductions, or credits. Key sections of the form require personal information, including Social Security numbers and current mailing addresses, ensuring accurate identification and correspondence. It also prompts users to indicate any changes from their original filing, such as changes in income or filing status. Notably, the 505X form includes detailed calculations for determining Maryland adjusted gross income, taxable net income, and any applicable credits or deductions. Furthermore, it addresses specific situations, such as claiming a net operating loss or changes necessitated by adjustments from the Internal Revenue Service. By providing a structured format, the 505X form facilitates the process of rectifying tax-related discrepancies, ultimately helping taxpayers comply with Maryland tax laws while ensuring they receive the appropriate credits and refunds.

Maryland 505X Preview

|

MARYLAND |

NONRESIDENT |

|

|

|

|

|

|

2022 |

||||||||||||||||||||

|

FORM |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

AMENDED TAX |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

505X |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

OR FISCAL YEAR BEGINNING |

|

|

|

|

|

2022, ENDING |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Social Security Number |

|

Spouse's Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Your First Name |

|

|

|

|

|

|

|

MI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Your Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Does your name match the name on your social security card? If not, to ensure you get credit for your |

||||||||||

Spouse's First Name |

|

|

|

|

|

|

MI |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

personal exemptions, contact SSA at |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of county and incorporated city, town or special taxing area |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in which you were employed on the last day of the taxable period |

|||

Spouse's Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if you earned wages in Maryland. (See Instruction 6.) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Current Mailing Address (PO Box, number, street and apt. no) |

|

|

|

|

|

|

|

|

|

|

|

Maryland County |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Current Mailing Address Line 2 (Apt No., Suite No., Floor No.) |

|

|

|

|

|

|

|

|

|

|

|

City, Town or Taxing Area |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City or Town |

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code + 4 |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Foreign Country Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Province/State/County |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Foreign Postal Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You must use Form 502X if you |

|

|

|

|

|

IF THIS IS BEING FILED TO CLAIM A NET OPERATING LOSS, CHECK |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

STOP are changing to Resident status. |

|

|

|

|

|

THE APPROPRIATE BOX: |

|

|

|

CARRYBACK (farming loss only) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CARRY FORWARD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Check here if you are: |

|

|

|

Check here if your spouse is: |

IMPORTANT NOTE: Read the instructions and complete page 3 first. |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

65 or over |

|

|

Blind |

|

65 or over |

|

|

Blind |

Attach copies of the federal loss year return and Form 1045, Schedules |

|||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

A and B. See Instruction 13. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is this address different from the address on your original return? |

. . . . . . . . . . . . . . . |

|||||||||

Enter your state of legal residence |

|

. Enter the local jurisdiction of which you are a resident |

|

. |

||||||

Are you a resident of a local jurisdiction which imposes an income or earnings tax on Maryland residents? |

||||||||||

Enter dates you resided in Maryland |

|

|

- |

|

|

. |

|

|

||

Any changes from the original filing must be explained in Part III of this form. |

|

|||||||||

Did you request an extension of time to file the original return? |

. . . . . . . . . . . . . . . |

|||||||||

If yes, enter the date the return was filed |

|

|

. |

|

|

|

||||

Is an amended federal return being filed?. . . |

. . . . . . |

. . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . |

||||||

Has your original federal return been changed or corrected by the Internal Revenue Service? . . . . . . . . . . . . . . . . . . . . . . .

YES

YES

YES

YES YES

NO

NO

NO

NO NO

CHANGE OF FILING STATUS

Original Amended

Single

Married filing joint return or spouse had no income

Married filing separately

Original Amended

Head of household

Qualifying widow(er) with dependent child

Dependent taxpayer

Spouse's Social Security No.

MARYLAND NONRESIDENT

FORM AMENDED TAX 505X RETURN

Last Name |

|

SSN |

|

|

|

|

|

|

|

|

|||

IMPORTANT NOTE: Read the instructions and |

A. As originally reported or |

B. Net change – increase |

||||

|

complete page 3 first. |

as previously adjusted |

or |

|||

|

|

|

(See instructions.) |

explain on page 4. |

||

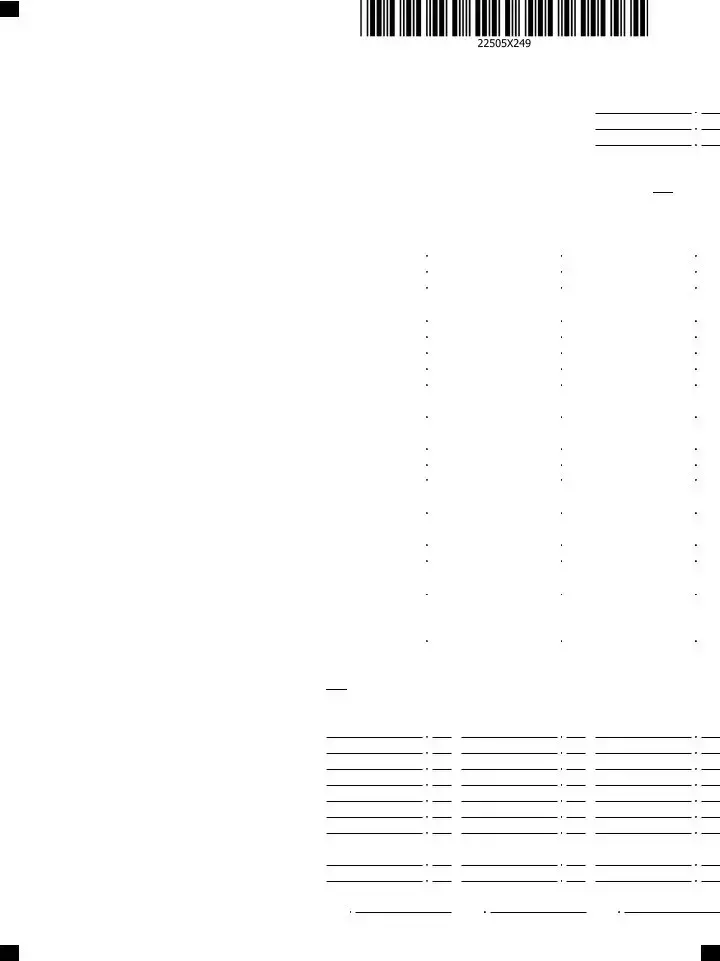

1. Federal adjusted gross income . . . . . . . . . . . . . . . . . . 1.

2. Additions to income . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Total (Add lines 1 and 2.). . . . . . . . . . . . . . . . . . . . . . 3.

4. Subtractions from income . . . . . . . . . . . . . . . . . . . . . . 4.

5.Total Maryland adjusted gross income (Subtract line 4

from line 3.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. CHECK ONLY ONE METHOD (See Instruction 5.)

STANDARD DEDUCTION METHOD

ITEMIZED DEDUCTION METHOD Enter total MD itemized deductions from Part II,

on page 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. 7. Net income (Subtract line 6 from line 5.). . . . . . . . . . . 7.

8. Exemption amount (See Instruction 5.) . . . . . . . . . . . . 8.

9. Taxable net income (Subtract line 8 from line 7.) . . . . . 9.

10.Maryland tax from line 16 of revised

Form 505NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11.Special Nonresident tax from line 17 of

|

revised Form 505NR |

. . . . . . . . . . . . . . . |

. . . . 11. |

|

12. |

Total Maryland tax (Add lines 10 and 11.) |

. . . . 12. |

||

12a. |

Credits: |

|

|

|

|

Poverty Level Credit |

|

|

|

|

Personal Credit |

|

|

|

|

Business Credit |

X X X X X X X X X X |

|

|

|

Enter total credits |

. . . . . . . . . . . . . . . |

. . . 12a. |

|

12b. |

Maryland tax after credits (Subtract line 12a |

|

||

|

from line 12.) If less than 0, enter 0 |

. . . 12b. |

||

13.Contribution: 13a. 13b. 13c.

13d.

Enter total contributions (See Instruction 8.) . . . . . . . 13.

14.Total Maryland income tax and contribution (Add lines

12b and 13.) . . . . . . . . . . . . .. . . . . . . . . . . . . . . . 14.

15. Total Maryland tax withheld. . . . . . . . . . . . . . . . . 15.

16.Estimated tax payments and payments made

with Form PV and Form MW506NRS . . . . . . . . . . . . . 16.

17. Nonresident tax paid by

18.Refundable income tax credits

(Attach Form 502CR and/or 502S.) . . . . . . . . . . . . . 18.

19.Total payments and credits (Add lines 15

through 18.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

20. Balance due (If line 14 is more than line 19, subtract line 19 from line 14.) . . . . . . . . . . . . . . . . . . . . . . . . . 20.

21. Overpayment (If line 14 is less than line 19, subtract line 14 from line 19.) . . . . . . . . . . . . . . . . . . . . . . . . . 21.

22.Tax paid with original return, plus additional tax paid after it was filed

(Do not include any interest or penalty.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.

23. Prior overpayment (Total all refunds previously issued.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.

24.REFUND (If line 20 is less than line 22, subtract line 20 from line 22) (If line 23 is less than

line 21, subtract line 23 from line 21.) (Add line 21 to line 22.) (See Instruction 10.) . . . . . . . . . . REFUND 24.

2022

Page 2

C. Corrected amount.

MARYLAND NONRESIDENT

FORM AMENDED TAX 505X RETURN

Name |

|

SSN |

||

|

|

|

|

|

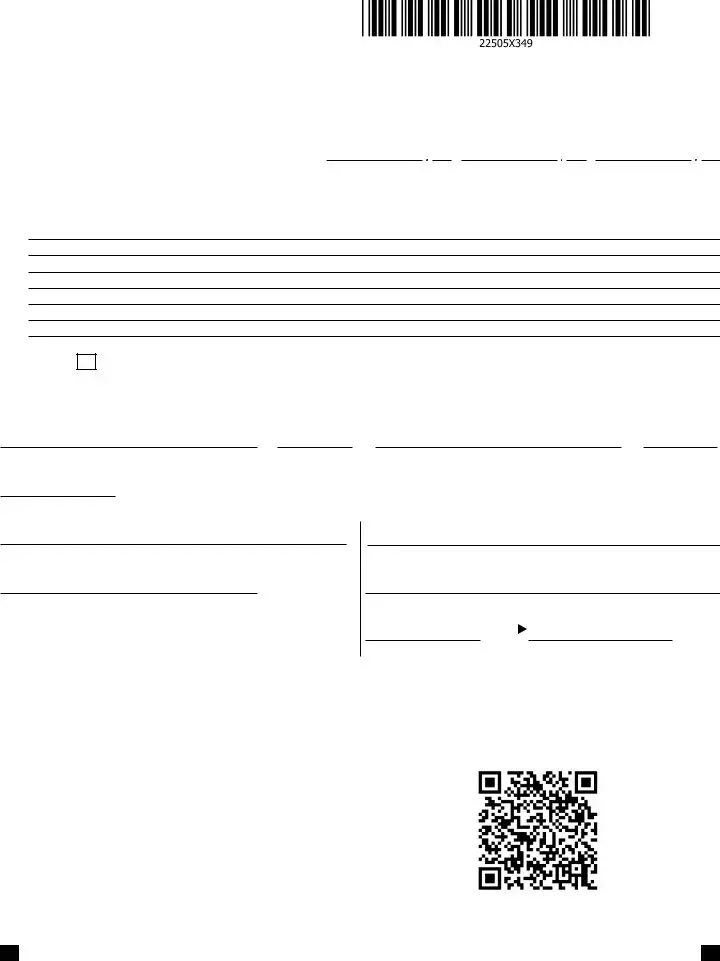

25.BALANCE DUE (If line 20 is more than line 22, subtract line 22 from line 20.) (Add line 20 to

line 23.) (If line 21 is less than line 23, subtract line 21 from line 23.) (See Instruction 10.) . . . . . . . . . . . . . 25.

26. Interest and/or penalty charges on tax due and/or from Form 502UP (See Instruction 11.) . . . . . . . . . . . . . . 26.

27. TOTAL AMOUNT DUE (Add line 25 and line 26.) . . . . . . . . . . . . . . . . .PAY IN FULL WITH THIS RETURN 27.

2022

Page 3

I. INCOME AND ADJUSTMENTS TO INCOME: You must complete the following using the amounts from your federal income tax return including any supporting schedules. If there are no changes to the amounts claimed on your original Maryland return, check here  and complete Column A and line 17 of Column C.

and complete Column A and line 17 of Column C.

INCOME AND ADJUSTMENTS INFORMATION |

|

|

(See Instruction 4.) (Use a minus sign ( - ) to indicate a loss.) |

|

|

1. |

Wages, salaries, tips, etc |

1. |

2. |

Taxable interest income |

2. |

3. |

Dividend income |

3. |

4.Taxable refunds, credits or offsets of state and local

|

income taxes |

4. |

5. |

Alimony received |

5. |

6. |

Business income or loss |

6. |

7. |

Capital gain or loss |

7. |

8. |

Other gains or losses (from federal Form 4797) |

8. |

9.Taxable amount of pensions, IRA distributions,

and annuities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10.Rents, royalties, partnerships, estates, trusts, etc. (Circle

appropriate item.) . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Farm income or loss. . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Unemployment compensation . . . . . . . . . . . . . . . . . . 12.

13.Taxable amount of Social Security and Tier 1 Railroad

Retirement benefits. . . . . . . . . . . . . . . . . . . . . . . . . 13.

14.Other income (including lottery or other gambling

winnings) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Total income (Add lines 1 through 14.) . . . . . . . . . . . 15.

16.Total adjustments to income from federal return (IRA,

alimony, etc.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17.Adjusted gross income (Subtract line 16 from 15.) (Carry

the amount from line 17, column A, to page 1, line 1, column C.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

A. Federal income |

B. Maryland income |

|

C. |

|||||||

or loss ( - ) as corrected |

or loss ( - ) as corrected |

|

or loss ( - ) as corrected |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II.ITEMIZED DEDUCTIONS: If you itemized deductions on your Maryland return, you must complete the following. If there are no changes to the

amounts claimed on your original Maryland return, check here  and complete Column A and line 11 of Column C.

and complete Column A and line 11 of Column C.

A. As originally reported |

B. Net increase |

C. Corrected amount |

or as previously adjusted |

or decrease ( - ) |

|

1. Medical and dental expense . . . . . . . . . . . . . . . . . . . . 1.

2.Taxes.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Casualty or theft losses. . . . . . . . . . . . . . . . . . . . . . . 5.

6. Miscellaneous . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7.Enter total itemized deductions from federal Schedule A 7.

8.Enter state and local income taxes included on

line 2 or from worksheet (See Instruction 4.) . . . . . . . 8.

9. Net deductions (Subtract line 8 from line 7.). . . . . . . . 9.

10.AGI factor (See Instruction 14 of the

nonresident instructions.) . . . . . . . . . . . . . . . . . . . . 10.

|

|

MARYLAND |

NONRESIDENT |

|

2022 |

|||

|

|

FORM |

|

|||||

|

|

AMENDED TAX |

|

Page 4 |

||||

|

|

505X |

|

|||||

|

|

RETURN |

|

|

||||

Name |

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. As originally reported |

B. Net increase |

C. Corrected amount |

|

|

|

|

|

|

or as previously adjusted |

or decrease ( - ) |

|

|

11.Total Maryland deductions (Multiply line 9 by line 10.) (Enter on page 2, in each appropriate column of line 6.) 11.

III.EXPLANATION OF CHANGES TO INCOME, DEDUCTIONS AND CREDITS: Enter the line number from page 1 and 2 for each item you are changing and give the reason for each change. Attach any required supporting forms and schedules for items changed.

Check here

if you authorize your preparer to discuss this return with us.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the declaration is based on all information of which the preparer has any knowledge.

Your signature |

Date |

Spouse’s signature |

Date |

Taxpayer(s)' Daytime telephone no.

Printed name of the Preparer/Firm's name

Signature of preparer other than taxpayer (Required by Law)

Street address of preparer or Firm's address

City, State, ZIP Code + 4 |

|

Telephone number of preparer |

Preparer’s PTIN (Required by Law) |

Make checks payable to and mail to:

Comptroller of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, MD

It is recommended that you include your Social Security Number on check in blue or black ink.

To make an online payment, scan the QR code below and follow instructions.

MARYLAND |

NONRESIDENT |

|

FORM |

AMENDED TAX RETURN |

|

505X |

||

INSTRUCTIONS |

You must file your Amended Form 505X electronically to claim, or change information related to, business income tax credits from Form 500CR.

Changes made as part of an amended return are subject to audit for up to three years from the date that the amended return is filed.

WHEN AND WHERE TO FILE

Generally, Form 505X must be filed within three years from the date the original return was due (including extensions) or filed. The following exceptions apply.

•A claim filed after three years, but within two years from the time the tax was paid is limited to the amount paid within the two years immediately before filing the claim.

•A claim for refund based on a federal net operating loss carryback must be filed within 3 years after the due date (including extensions) of the return for the tax year of the net operating loss.

•If the claim for refund or credit for overpayment resulted from a final determination made by an administrative board or an appeal of a decision of an administrative board, that is more than three years from the date of filing the return or more than two years from the time the tax was paid, the claim for refund must be filed within one year of the date of the final decision of the administrative board or final decision of the highest court to which an appeal of the administrative board is taken.

•If the Internal Revenue Service issues a final determination of adjustments that would result in a decrease to Maryland taxable income, file an amended return within one year after the final adjustment report or the final court decision if appealed.

•If the Internal Revenue Service issued a final determination of adjustments that would result in an increase to Maryland taxable income, file the amended return within ninety days after the final determination.

Do not file an amended return until sufficient time has passed to allow the original return to be processed. For current year returns, allow at least six weeks. Note that no refund for less than $1.00 will be issued.

The amended return must be filed with the

Comptroller of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, MD

For more information regarding refund limitations, see Administrative Release 20.

PROTECTIVE CLAIMS

A protective claim is a claim for a specific amount of refund filed on an amended return with a request that the Comptroller delay acting on the refund request. The claim for refund may not be based on a federal audit. The delay requested must be due to a pending decision by a state or federal court which will affect the outcome of the refund, or for reasonable cause. The protective claim must be filed in accordance with the limitations outlined in the section WHEN AND WHERE TO FILE. The Comptroller may accept or reject a protective claim. If rejected, the taxpayer will be informed of a right to a hearing. We cannot accept a protective claim unless an original return has been filed.

PENALTIES

There are severe penalties for failing to file a tax return, failing to pay any tax when due, filing false or fraudulent returns or making a false certification. The penalties include criminal fines, imprisonment and a penalty on your taxes. In addition, interest is charged on amounts not paid when due.

2022

Page 1

To collect unpaid taxes, the Comptroller is directed to enter liens against the salary, wages or property of delinquent taxpayers.

PRIVACY ACT INFORMATION

The Revenue Administration Division requests information on tax returns to administer the income tax laws of Maryland, including determination and collection of correct taxes. If you fail to provide all or part of the requested information, the exemptions, exclusions, credits, deductions or adjustments may be dis- allowed and you may owe more tax. In addition, the law provides penalties for failing to supply information required by law or regulations.

You may look at any records held by the Revenue Administration Division which contain personal information about you. You may inspect such records, and you have certain rights to amend or correct them.

As authorized by law, information furnished to the Revenue Administration Division may be given to the Internal Revenue Service, a proper official of any state that exchanges tax information with Maryland and to an officer of this state having a right to the information in that officer’s official capacity. The information also may be obtained with a proper legislative or judicial order.

USE OF FEDERAL RETURN

Most changes to your federal return will result in changes on your Maryland return and you will need the information from your federal amendment to complete your Maryland amended return. Therefore, complete your federal return first. Maryland law requires that your income and deductions be entered on your Maryland return exactly as they were reported on your federal return and schedules. However, all items reported on your Maryland return are subject to verification, audit and revision by the Comptroller’s Office.

If you are amending your federal return, attach a photocopy of the federal Form 1040X and any revised schedules to your Maryland Form 505X. If your tax has been increased by the Internal Revenue Service, you must report this increase to the Revenue Administration Division within 90 days from the final IRS determination.

1NAME AND ADDRESS INFORMATION.

Enter the Social Security number, correct name and cur- rent address on the lines. Be sure to check the appropriate box if you or your spouse are 65 or over or blind on the last day of the tax year. If your address is different from the address on your original return, be sure to answer “Yes” to the first question.

If using a foreign address, complete the lines indicated for Country Name, Province/State/County, and Postal Code.

2QUESTIONS.

Answer all of the questions and attach copies of any fed- eral notices, amended forms and schedules. If filing your amended return for a Net Operating Loss Carryback or Carryforward, check the appropriate box. Provide the dates you resided in Maryland for the tax year and explain any changes from your original filing in Part III of Form 505X.

3FILING STATUS.

Enter the filing status you used on your original return and show any change of filing status. Your filing status should

correspond to the filing status used on your federal return.

Generally, you may not change from married filing joint to mar- ried filing separately after the original due date of the return. Any change in filing status to or from married filing joint requires the

2022

Page 2

LINE 6 – Method of computation.

Standard deduction method. The standard deduction is 15% of the Maryland adjusted gross income with the following mini- mums and maximums.

signature of both spouses. Enter a complete explanation in Part III of Form 505X.

4COMPLETE PAGES 3 AND 4 OF FORM 505X.

PART I

Enter the amount of income (or loss) from your federal return as corrected in Column A. Enter the amount of your Maryland income (or loss) as corrected in Column B. Enter the amount of your

PART II

Filing Status

Single

Married filing separately

Dependent taxpayer

Filing Status

Married filing joint or spouse had no income

Head of household

Qualifying widow(er) with dependent child

–Minimum of $1,600 and maximum of $2,400

–Minimum of $3,200 and maximum of $4,850

If you itemized deductions, enter your original or previously adjusted amounts in Column A. Enter any increase (or decrease) in Column B and enter the corrected amounts in Column C.

Any amount deducted as contributions of Preservation and Conservation Easements for which a credit is claimed on Form 502CR must be included on line 8. On line 10, enter the adjusted gross income factor from the worksheet in Instruction 5.

PART III

Use this section to provide a detailed explanation of the changes being made on the amended return. A filing status change must be fully explained here.

Enter the line number from pages 1 and 2 for each item you are changing and state the reason for the change. Be sure to attach revised Form 505NR and any other required schedules or forms.

NOW COMPLETE PAGES 1 AND 2 OF FORM 505X.

COLUMNS

In Column A, enter the amounts from your return as originally filed or as previously adjusted or amended.

In Column B, enter the net increase or net decrease for each line you are changing. Use a minus sign ( - ) to indicate a decrease. Explain each change in Part III of Form 505X and attach any related schedule or form. If you need more space, show the required information on an attached statement. For Column C, add the increase in Column B to the amount in Column A, or subtract the Column B decrease from Column A. For any item you do not change, enter the amount from Column A in Column C.

5FIGURE YOUR MARYLAND AND SPECIAL NONRESIDENT TAX.

LINE 1 – Income and adjustments from federal return. Copy the amounts from your federal amended return or as cor- rected by the IRS. Be sure to reconcile this figure to Part 1 of Form 505X and enter a complete explanation of the changes in Part III.

LINE 2 – Additions to income. For decoupling and tax prefer- ence items and amounts to be added when credits are claimed, include corrected Form(s) 500DM, 502TP, 502CR or 500CR. In addition, enter the amount equal to a tax credit claimed for tax paid on distributive or

LINE 4 – Subtractions from income. Enter items such as child care expenses and any other subtractions as shown in the 2022 Nonresident Income Tax Return Instructions. Enter an explana- tion of the changes in Part III and attach any corrected forms.

Itemized deduction method. Check the box and enter your total Maryland itemized deductions.

LINE 8 – Exemptions. The personal exemption is $3,200. This exemption amount is reduced once the taxpayer's federal adjust- ed gross income exceeds $100,000. ($150,000 if filing Joint, Head of Household or Qualifying Widow(er) with Dependent Child). If you are subject to this reduction, see the exemption chart in the 2022 Nonresident Income Tax Return Instructions. Taxpayers 65 years or over or blind get an additional exemption of $1,000.

Multiply the exemption amount by the AGI factor in the ADJUSTED GROSS INCOME FACTOR WORKSHEET to calculate the amount of the exemption to enter in column C. Use the exemption amount that you had claimed on your original return (or as previously adjusted) in Column A of line 8. The difference between these two figures should be entered in Column B of line 8.

Attach amended Form 502B if you are changing dependent infor- mation.

Adjusted Gross Income (AGI) Factor. You must adjust your standard or itemized deductions and exemptions using the AGI factor calculated in the worksheet below. Carry this amount to six decimal places. NOTE: If Mary- land adjusted gross income before subtractions (line 2) is 0 or less, use 0 as your factor. If your federal adjusted gross income (line 1) is 0 or less and line 2 is greater than 0, use 1 as your factor.

ADJUSTED GROSS INCOME FACTOR WORKSHEET (5)

1.Enter your federal adjusted gross

income (from line 17, column 1) . . . . .1 _____________

2.Enter your Maryland adjusted gross income before subtraction of

3. AGI factor. Divide line 2 by line 1 . . . .3 .

LINE 10 – Computing the tax. Complete Form 505NR follow- ing the instructions in the nonresident booklet using corrected figures to determine the tax. Line 16 of the revised Form 505NR is entered on line 10 of Form 505X. Line 17 of the revised Form 505NR is entered on line 11 of Form 505X.

6POVERTY LEVEL CREDIT, CREDITS FOR INDIVIDUALS AND BUSINESS TAX CREDITS.

Enter each credit being claimed on the appropriate line on line 12a.

You may claim a credit on line 12a equal to 5% of your earned income. If your income is less than the poverty level guidelines, refer to the nonresident instructions and worksheet to compute the allowable credit. You must prorate the poverty level credit using the Maryland income factor.

Personal income tax credits from Form 502CR and business tax credits from Form 500CR should be entered in the appropriate field on line 12a. If these amounts are different from the original return, be sure to attach the completed Form 502CR and/or Form 500CR with appropriate documentation or certifications.

If the total credits on line 12a are greater than the tax on line 12, enter zero on line 12b. The credits entered on line 12a are nonrefundable. For information concerning refundable credits, see Instruction 9.

You must file your amended return electronically to claim a business tax credit from Form 500CR.

7SPECIAL NONRESIDENT INCOME TAX.

The special nonresident tax is calculated on line 17 of revised Form 505NR.

8CONTRIBUTIONS TO THE CHESAPEAKE BAY AND ENDANGERED SPECIES FUND, DEVELOPMENTAL DISABILITIES SERVICES AND SUPPORT FUND, MARYLAND CANCER FUND AND FAIR CAMPAIGN FINANCING FUND.

Enter the amounts of your contribution in 13a for the Chesapeake Bay and Endangered Species Fund, 13b for the Developmental Disabilities Services and Support Fund, 13c for the Maryland Cancer Fund and 13d for the Fair Campaign Financing Fund. Any contribution will increase your balance due or reduce your refund. Enter the total of your contributions in the appropriate columns. Additional information concerning the funds is con- tained in the Maryland tax instructions for the tax year of the amended return.

9TAXES PAID AND CREDITS.

Write your taxes paid and credits on lines

Enter the correct amounts on lines 15 through 18 and attach any additional or corrected

Refundable Income Tax Credits. Enter the total of your refundable income tax credits on line 18. Attach Form 502CR and/or 502S.

1.STUDENT LOAN DEBT RELIEF TAX CREDIT. If you have incurred at least $20,000 in undergraduate or graduate stu- dent loan debt, you may qualify for this credit. A copy of the required certification from the Maryland Higher Education Commission must be included with Form 502CR.

2.HERITAGE STRUCTURE REHABILITATION TAX CREDIT. A credit is allowed for a percentage of qualified rehabilitation expenditures as certified by the Maryland Historical Trust. Attach a copy of Form 502S and certification.

2022

Page 3

3.REFUNDABLE BUSINESS INCOME TAX CREDIT. Form 500CR Instructions are available online at www.maryland- taxes.gov. You must file Form 500CR electronically to claim a business income tax credit.

4.IRC SECTION 1341 REPAYMENT. If you repaid an amount this year reported as income on a prior year federal tax return that was greater than $3,000, you may be eligible for an IRC Section 1341 repayment credit. See Administrative Release 40.

5.CATALYTIC REVITALIZATION PROJECTS AND HISTORIC REVITALIZATION TAX CREDIT. If you are an individual, business entity, or nonprofit organization, you may claim a tax credit in an amount equal to 20% of the amount stated in the final tax credit certificate issued by the Secretary of this sub- title for 5 consecutive taxable years beginning with the Catalytic Revitalization Projects is completed. See Form 502CR instructions.

7.CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES If your Maryland credit for child and dependent care expenses exceeds your Maryland Tax, you may qualify for this credit.

9.PTE TAX PAID ON MEMBERS’ DISTRIBUTIVE OR PRO RATA SHARES OF INCOME TAX CREDIT If you are the ben- eficiary of a trust or a Qualified Subchapter S Trust which elected to pay the tax imposed with respect to members’ dis- tributive or pro rata shares, you may be entitled to a credit for your share of that tax. Enter the amount on this line and attach the Maryland Schedule

If you are a member of a PTE

10 BALANCE DUE OR OVERPAYMENT.

Calculate the balance due or overpayment by subtracting the total on line 19 from the amount on line 14 and enter the result on either line 20 or line 21.

Enter the tax paid with the original return plus any additional tax paid after filing on line 22 (do not enter interest or penalty paid) OR enter the overpayment from your original return plus any additional overpayments from prior amendments or adjustments on line 23.

If there is an amount on line 20:

•and line 20 is more than line 22, you owe additional tax. Enter the difference on line 25 and compute the interest due using the interest rates in Instruction 11.

|

|

|

|

|

2022 Tax Rate Schedules |

|

|

|

|

|||

|

|

Tax Rate Schedule I |

|

|

Tax Rate Schedule II |

|||||||

For taxpayers filing as Single, Married Filing Separately, or as |

For taxpayers filing Joint, Head of Household, or for Qualifying |

|||||||||||

Dependent Taxpayers. This rate is also used for taxpayers filing as |

Widows/Widowers. |

|

|

|

||||||||

Fiduciaries. |

|

|

|

|

|

|

|

|

|

|

||

If taxable net income is: |

|

Maryland Tax is: |

If taxable net income is: |

|

Maryland Tax is: |

|||||||

|

At least: |

but not over: |

|

|

|

|

||||||

At least: |

but not over: |

|

|

|

|

|

|

|

|

|||

|

|

|

|

$0 |

$1,000 |

|

|

2.00% of taxable net income |

||||

$0 |

$1,000 |

|

|

2.00% |

of taxable net income |

|

|

|||||

|

|

$1,000 |

$2,000 |

$20.00 |

plus |

3.00% |

of excess over $1,000 |

|||||

$1,000 |

$2,000 |

$20.00 |

plus |

3.00% |

of excess over $1,000 |

|||||||

$2,000 |

$3,000 |

$50.00 |

plus |

4.00% |

of excess over $2,000 |

|||||||

$2,000 |

$3,000 |

$50.00 |

plus |

4.00% |

of excess over $2,000 |

|||||||

$3,000 |

$150,000 |

$90.00 |

plus |

4.75% |

of excess over $3,000 |

|||||||

$3,000 |

$100,000 |

$90.00 |

plus |

4.75% |

of excess over $3,000 |

|||||||

$150,000 |

$175,000 |

$7,072.50 |

plus |

5.00% |

of excess over $150,000 |

|||||||

$100,000 |

$125,000 |

$4,697.50 |

plus |

5.00% |

of excess over $100,000 |

|||||||

$175,000 |

$225,000 |

$8,322.50 |

plus |

5.25% |

of excess over $175,000 |

|||||||

$125,000 |

$150,000 |

$5,947.50 |

plus |

5.25% |

of excess over $125,000 |

|||||||

$225,000 |

$300,000 |

$10,947.50 |

plus |

5.50% |

of excess over $225,000 |

|||||||

$150,000 |

$250,000 |

$7,260.00 |

plus |

5.50% |

of excess over $150,000 |

|||||||

$300,000 |

|

$15,072.50 |

plus |

5.75% |

of excess over $300,000 |

|||||||

$250,000 |

|

$12,760.00 |

plus |

5.75% |

of excess over $250,000 |

|

||||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

•and there is also an amount on line 23, you owe additional tax. Add the two together and enter the total on line 25. Compute the interest due. See Instruction 11.

•and line 20 is less than line 22, you are due a refund. Enter the difference on line 24.

If there is an amount on line 21:

•and line 21 is more than line 23, you are due an additional refund. Enter the difference on line 24.

•and there is also an amount on line 22, you are due an addi- tional refund. Add the two together and enter on line 24.

•and line 21 is less than line 23, you owe additional tax. Enter the difference on line 25 and compute the interest due using the interest rates in Instruction 11.

Previous interest and penalty

Interest and/or penalty charges for the year you are amending, whether previously paid or still outstanding, may be adjusted as a result of your amendment. Any payments made on the account have been applied first to penalty, then to interest and lastly to tax due. These payments may require reallocation depending on the result of the amendment. We will notify you of the net bal- ance due or refund when we have completed processing your Form 505X.

NOTE: If all or part of the overpayment on your original return was credited to an estimated tax account for next year, we can- not reduce or remove this credit without specific authorization from you. If you have a balance due, and wish to apply monies credited to a 2023 estimated tax account, attach written autho- rization for the amount to be removed. Interest charges are assessed even if the balance due is removed from the 2023 account.

11 INTEREST ON TAX DUE AND INTEREST FOR

UNDERPAYMENT OF ESTIMATED TAX.

INTEREST ON TAX DUE

Interest must be computed and paid on any balance of tax due. Interest is due from the date the return originally was due to be filed until the date the tax is paid. The annual interest rate is 9.5% through 12/31/22. The annual interest rate will change after 12/31/22.

For additional information, visit www.marylandtaxes.gov.

INTEREST ON UNDERPAYMENT OF ESTIMATED TAX

If you do not meet the requirement for avoidance of interest for underpayment of estimated tax, obtain Form 502UP online at www.marylandtaxes.gov or from any office of the Revenue Administration Division. Complete and attach it to your amended return. Enter any interest due on line 26 of Form 505X.

If you calculated and paid interest on underpayment of esti- mated tax with your original return, recalculate the interest based on your amended tax return, and attach a copy of a revised Form 502UP showing your recalculation.

12 SIGNATURE, ATTACHMENTS AND PAYMENT INSTRUCTIONS.

Sign and date your return on page 4 and attach all required forms, schedules and statements.

SIGNATURES

You must sign your return. Both spouses must sign a joint return. Your signature(s) signify that your return, including all attachments, is, to the best of your knowledge and belief, true, correct and complete, under the penalties of perjury.

TAX PREPARERS

If another person prepared your return, that person must also

2022

Page 4

print name, sign the return and enter their preparer’s tax identi- fication number (PTIN). The preparer declares that the return is based on all information required to be reported of which the preparer has knowledge, under the penalties of perjury. Penalties may be imposed for tax preparers who fail to sign the tax return and provide their preparers tax identification number.

ATTACHMENTS

Be sure to attach wage and tax statements (Forms

MAILING INSTRUCTIONS

Mail your return to:

Comptroller of Maryland

Revenue Administration Division

Amended Return Unit

110 Carroll Street

Annapolis, MD

PAYMENT INSTRUCTIONS

Make your check or money order payable to “Comptroller of Maryland.” Write the type of tax and year of tax being paid on your check. It is recommended that you include your Social Security Number on check using blue or black ink.

DO NOT SEND CASH.

13 NET OPERATING LOSS (NOL).

To claim a deduction for a federal NOL on the Maryland return, you must first calculate the NOL for federal pur- poses. A deduction will be allowed on the Maryland return for the amount of the loss actually utilized on the federal return. The amount of loss utilized for federal purposes is generally equal to the federal taxable income (before loss is used) or the federal modified taxable income as calcu- lated for the year of carryback or carryforward.

An addition or subtraction modification may be required in a car- ryback or carryforward year when the federal NOL, or the year to which the NOL is carried, includes items included in certain provisions of the Internal Revenue Code from which the State of Maryland has decoupled, including certain special depreciation allowances and

An NOL generated when an individual or a business entity is not subject to Maryland income tax law, in a tax year beginning on or after October 22, 2007, cannot be used as a deduction to offset Maryland income. For acquisitions or liquidations occurring on or after October 22, 2007, the acquiring business entity which is subject to Maryland income tax law cannot use the acquired or liquidated business entity’s NOL as a deduction to offset Maryland income, if the acquired or liquidated business entity was not subject to Maryland income tax law when its NOL was generated. An NOL being carried forward from tax years beginning before October 22, 2007 can be used until exhausted.

An addition to income may be required in a carryback or carry- forward year if the total Maryland additions to income exceeds the total Maryland subtractions from income in the loss year. The required addition to income represents a recapture of the excess additions over subtractions. The addition to income required is generally equal to the lesser of the NOL deduction in the carryback year or the net addition modification (NAM) in the loss year unless the loss year includes a decoupling modification. For more information regarding NAM, refer to Administrative Release 18.

If an election to forgo a carryback is made, a copy of the federal

2022

Page 5

election for the loss year must be attached with the Maryland amended return.

You must attach copies of federal Form 1045 or 1040X, whichever was used for federal purposes, and a copy of the federal income tax return for the year of the loss. Also include Schedules A and B of Form 1045 or the equivalent worksheets used to develop the federal NOL and show the amounts utilized on the federal return in the carryback or carryforward years. Check the appropriate box on the front of Form 505X located directly below the name and address.

14 INCOME TAX ASSISTANCE.

For more information, visit www.marylandtaxes.gov or email your question to: TAXHELP@marylandtaxes.gov. You may also call

REMINDER: Attach a revised Form 505NR to your 2022 Amended Nonresident Return.

Form Attributes

| Fact Name | Fact Details |

|---|---|

| Form Title | Maryland Nonresident 2021 Amended Tax 505X Return |

| Governing Law | Maryland Tax Code, Title 10, Subtitle 1 |

| Filing Requirement | Nonresidents must file if they earned income in Maryland. |

| Purpose | This form is used to amend a previously filed Maryland tax return. |

| Deadline | The amended return must be filed within 3 years of the original due date. |

| Exemptions | Taxpayers can claim personal exemptions for themselves and their spouses. |

| Income Adjustments | Taxpayers must report federal adjusted gross income and any changes. |

| Refund Process | Taxpayers can receive a refund if total payments exceed total tax due. |

Other PDF Forms

Md Form 502 Instructions - Details on how to properly calculate and update Maryland and local income taxes based on amendments are included to assist taxpayers.

To facilitate the ownership transfer of a vehicle, it is crucial to complete the Washington Motor Vehicle Bill of Sale accurately, as this document proves the transaction and includes vital vehicle information. For more details on how to fill out the form, visit WA Documents.

Donate Body to Science Maryland - Features a place for potential donors to provide personal and emergency contact information, facilitating communication with next of kin or legally authorized representatives.