Printable Maryland 510D Template

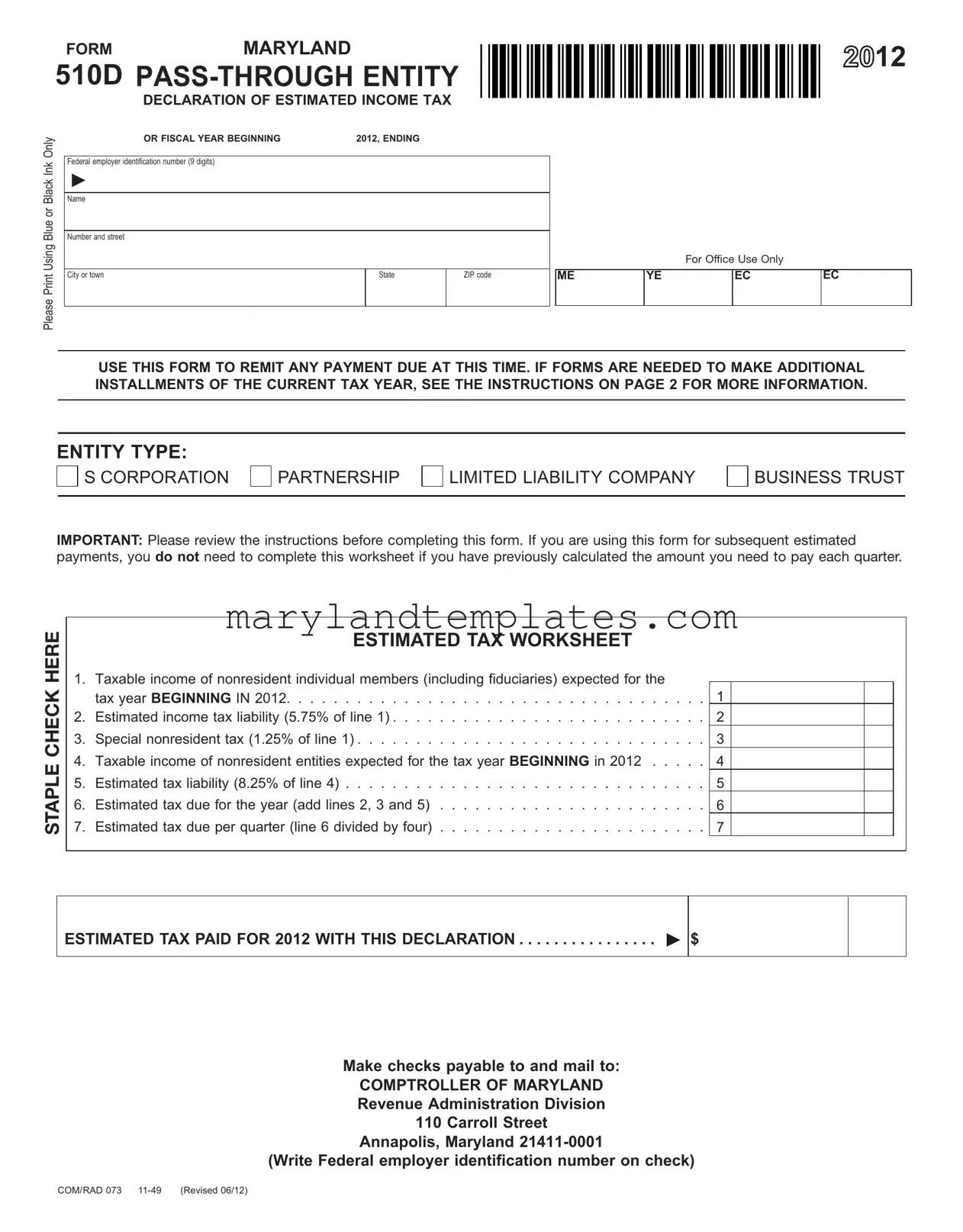

The Maryland 510D form is an important document for pass-through entities (PTEs) that need to declare and remit estimated income tax on behalf of their nonresident members. This form is particularly relevant for entities such as S corporations, partnerships, limited liability companies, and business trusts. It requires detailed information including the federal employer identification number and the entity's name and address. The 510D form facilitates the calculation of estimated tax liabilities based on the expected taxable income of nonresident individual members and nonresident entities, with specific tax rates applied to each. For nonresident individuals, the tax rate is currently set at 5.75%, while a special nonresident tax of 1.25% is also applicable. Nonresident entities face a higher rate of 8.25%. It is essential for PTEs to make quarterly estimated payments if their expected tax exceeds $1,000, ensuring that they remit at least 90% of the current year's tax or 110% of the previous year's tax to avoid penalties. The form must be filed according to specific deadlines that vary depending on the type of entity, and any payments should be accompanied by the appropriate checks or money orders. By understanding the requirements and deadlines associated with the Maryland 510D form, PTEs can effectively manage their tax obligations and ensure compliance with state regulations.

Maryland 510D Preview

FORMMARYLAND

510D

DECLARATION OF ESTIMATED INCOME TAX

Only |

OR FISCAL YEAR BEGINNING |

2012, ENDING |

|

|

|

|

|

|

|

Ink |

Federal employer identification number (9 digits) |

|

|

|

|

|

|

|

|

Black |

|

|

|

|

Name |

|

|

|

|

or |

|

|

|

|

Blue |

|

|

|

|

Number and street |

|

|

|

|

Using |

|

|

|

|

City or town |

|

State |

ZIP code |

|

|

|

|

|

|

Please |

|

|

|

|

|

|

|

|

|

ME

12

12

For Office Use Only

YE |

EC |

EC |

|

|

|

USE THIS FORM TO REMIT ANY PAYMENT DUE AT THIS TIME . IF FORMS ARE NEEDED TO MAKE ADDITIONAL INSTALLMENTS OF THE CURRENT TAX YEAR, SEE THE INSTRUCTIONS ON PAGE 2 FOR MORE INFORMATION .

ENTITY TYPE:

S CORPORATION

PARTNERSHIP

LIMITED LIABILITY COMPANY

BUSINESS TRUST

IMPORTANT: Please review the instructions before completing this form. If you are using this form for subsequent estimated payments, you do not need to complete this worksheet if you have previously calculated the amount you need to pay each quarter.

STAPLE CHECK HERE

ESTIMATED TAX WORKSHEET

1.Taxable income of nonresident individual members (including fiduciaries) expected for the

tax year BEGINNING IN 2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1. . BEGINNING in 2011

2.Estimated income tax liability (5.75% of line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. .

3.Special nonresident tax (1.25% of line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. .

4.Taxable income of nonresident entities expected for the tax year BEGINNING in 2012 . . . . . .4. .

5.Estimated tax liability (8.25% of line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5. .

6.Estimated tax due for the year (add lines 2, 3 and 5) . . . . . . . . . . . . . . . . . . . . . . . .6. .

7.Estimated tax due per quarter (line 6 divided by four) . . . . . . . . . . . . . . . . . . . . . . . .7. .

ESTIMATED TAX PAID FOR 2012 WITH THIS DECLARATION |

$ |

|

|

|

|

Make checks payable to and mail to:

COMPTROLLER OF MARYLAND Revenue Administration Division 110 Carroll Street

Annapolis, Maryland

(Write Federal employer identification number on check)

COM/RAD 073

INSTRUCTIONS MARYLAND

FOR |

DECLARATION OF ESTIMATED INCOME TAX |

|

FORM 510D |

||

|

||

2012 |

|

Purpose of Form Form 510D is used by a pass- through entity (PTE) to declare and remit estimated tax.

General Requirements PTEs are required to pay tax on behalf of all nonresident members. For nonresident members that are individuals or nonresident fiduciaries, the tax is 5.75% in addition to the special nonresident tax of 1.25% of the nonresident member’s distributive or pro rata share of income. For nonresident entity members, the tax is 8.25% of the nonresident member’s distributive or pro rata share of income. A nonresident entity is an entity that is not formed under the laws of Maryland; and is not qualified by, or registered with the Department of Assessments and Taxation to do business in Maryland. The amount of tax due may be limited based on the distributable cash flow limitation. The Distributable Cash Flow Limitation worksheet is available in our PTE income tax booklet, which can be downloaded at www . marylandtaxes .com.

Certain PTEs meeting certain reporting requirements are exempt from the requirement to pay nonresident tax on behalf of its nonresident members. See instructions for Form 510 for more information.

When the tax is expected to exceed $1,000 for the tax year, the PTE must make quarterly estimated payments. The total estimated tax payments for the year must be at least 90% of the tax developed for the current tax year or 110% of the tax that was developed for the prior tax year to avoid interest and penalty.

In the case of a short tax period the total estimated tax required is the same as for a regular tax year: 90% of the tax that was developed for the current (short) tax year or 110% of the tax that was developed for the prior tax year. The minimum estimated tax for each of the installment due dates is the total estimated tax required divided by the number of installment due dates occurring during the short tax year. However, if the

Maryland law provides for the accrual of interest and imposition of penalty for failure to pay any tax when due.

If it is necessary to amend the estimate, recalculate the amount of estimated tax required using the estimated tax worksheet provided. Adjust the amount of the next installment to reflect any previous underpayment or overpayment. The remaining installments must be at least 25% of the amended estimated tax due for the year.

The PTE must issue a statement to each nonresident member showing the amount of tax paid on their behalf. Nonresident members must include the statement with their own income tax returns (Form 500, 504, 505 or 510) to claim credit for taxes paid on their behalf.

Tax Rate The current 2012 tax rate for nonresident individual members is 5.75% at the time this form was created. It is possible that the Maryland Legislature may change this tax when in session. Please check our Web site for updates at www .marylandtaxes .com.

When to File File Form 510D on or before the 15th day of the 4th, 6th, 9th and 12th months following the beginning of the tax year or period for S corporations or by the 4th, 6th, 9th and 13th months following the beginning of the tax year for partnerships, LLCs and business trusts.

Tax Year or Period The tax year is shown at the top of Form 510D. The form used for filing must reflect the preprinted tax year in which the PTE’s tax year begins.

If the tax year of the PTE is other than a calendar year, enter the beginning and ending dates of the fiscal year in the space provided at the top of Form 510D.

Name, Address, and Other Information Type or print the required information in the designated area.

Enter the exact PTE name with any “Trading As” (T/A) name if applicable.

Enter the federal employer identification number (FEIN). If the FEIN has not been secured, enter “APPLIED FOR” followed by the date of application. If a FEIN has not been applied for, do so immediately.

Filing electronically using Modernized Electronic Filing method (software provider must be approved by the IRS and Revenue Administration Division). If filed electronically, do not mail 510D; retain it with company’s records .

If you need to make additional payments for the current tax year you may file electronically, or you can go to

www.marylandtaxes .comand download another Form 510D. We have discontinued the use of preprinted quarterly estimated tax vouchers for PTEs.

Payment Instructions Include a check or money order made payable to Comptroller of Maryland. All payments must indicate the FEIN, type of tax and tax year beginning and ending dates. DO NOT SEND CASH.

Mailing Instructions Mail the completed Form 510D and payment to:

Comptroller of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, MD

COM/RAD 073

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of Form | The Maryland 510D form is used by pass-through entities (PTEs) to declare and remit estimated income tax on behalf of nonresident members. |

| Tax Rates | For nonresident individual members, the tax rate is 5.75%. Nonresident entities face a higher rate of 8.25% on their distributive shares of income. |

| Filing Deadlines | Form 510D must be filed by the 15th day of the 4th, 6th, 9th, and 12th months for S corporations. For partnerships, LLCs, and business trusts, the deadlines are slightly different. |

| Governing Laws | This form is governed by Maryland tax laws, which mandate that PTEs must pay tax on behalf of nonresident members and establish penalties for late payments. |

Other PDF Forms

Do Employees Pay Futa Tax - A summary of the contribution report is provided for review before final submission, ensuring accuracy.

When planning for the future, understanding the importance of a well-crafted Prenuptial Agreement can be crucial for couples. This legal document can provide significant benefits in outlining the financial responsibilities each party agrees to before marriage. For more guidance, explore the available resources on how to create a robust Prenuptial Agreement document at key elements of a Prenuptial Agreement.

Maryland Uniform Credentialing - Assists new providers in establishing themselves within the Maryland healthcare system.