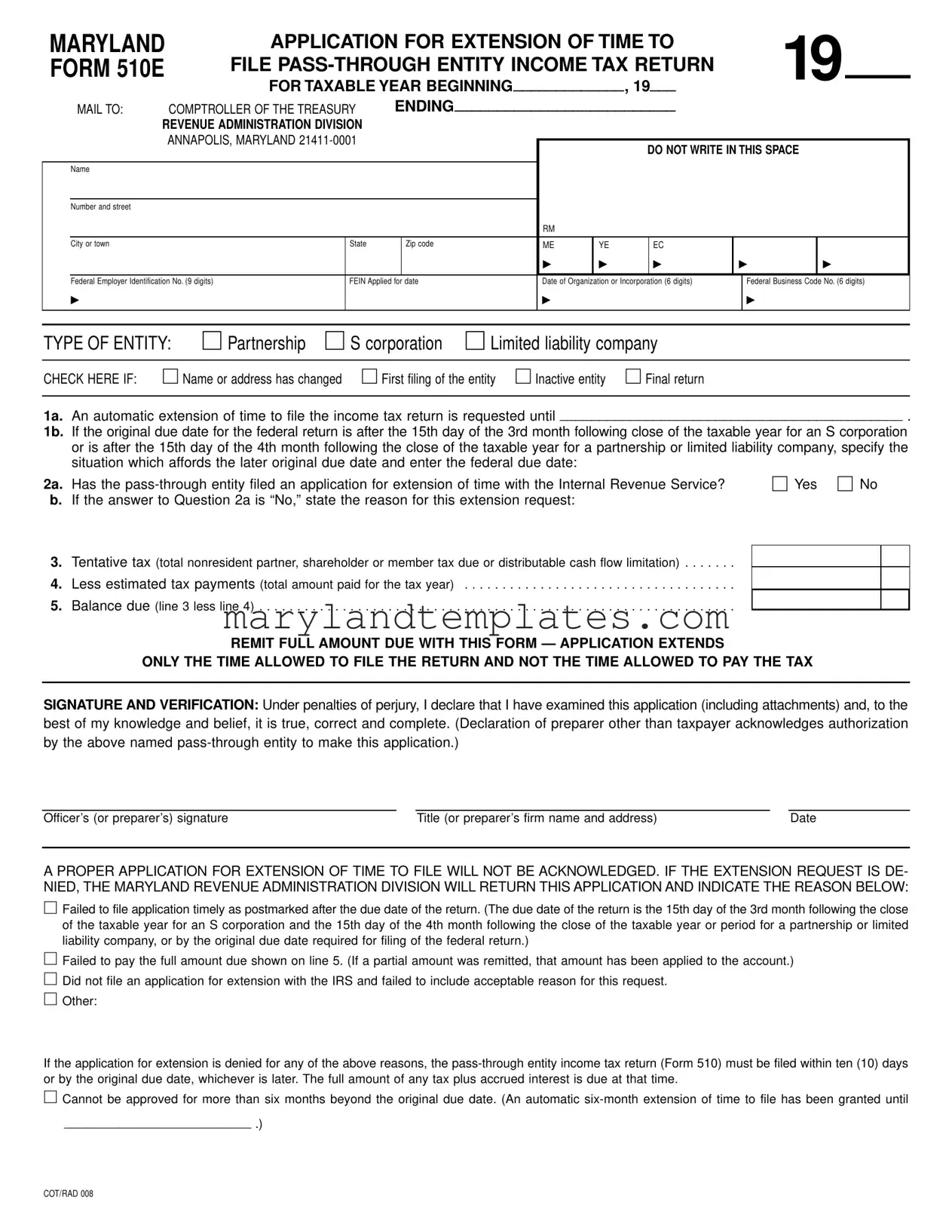

Printable Maryland 510E Template

The Maryland 510E form serves as an essential tool for pass-through entities seeking an extension of time to file their income tax returns. This application is particularly relevant for partnerships, S corporations, and limited liability companies, allowing them to request an extension while ensuring compliance with state tax regulations. The form requires entities to provide specific information, including their federal employer identification number, the dates marking the beginning and end of the taxable year, and details about any changes in the entity's name or address. Importantly, the form distinguishes between different types of entities and outlines the conditions under which an extension may be granted. For instance, S corporations can automatically receive a six-month extension, while partnerships and limited liability companies may qualify for a three-month extension. However, it is crucial to note that the 510E form does not extend the time allowed to pay any taxes due. Therefore, a balance due must be calculated and submitted alongside the application. The form also mandates a signature from an authorized officer or preparer, affirming the accuracy of the information provided. Failing to adhere to the filing requirements can result in the denial of the extension request, underscoring the importance of careful completion and timely submission of the form to the Comptroller of the Treasury in Annapolis.

Maryland 510E Preview

MARYLAND |

APPLICATION FOR EXTENSION OF TIME TO |

|

|

19 |

|

|||||||||||

FORM 510E |

FILE |

|

|

|

||||||||||||

|

|

FOR TAXABLE YEAR BEGINNING_____________, 19___ |

|

|

|

|||||||||||

|

MAIL TO: |

COMPTROLLER OF THE TREASURY |

ENDING__________________________ |

|

|

|

|

|

||||||||

|

REVENUE ADMINISTRATION DIVISION |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

ANNAPOLIS, MARYLAND |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

DO NOT WRITE IN THIS SPACE |

|||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number and street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or town |

|

|

State |

|

Zip code |

|

ME |

YE |

|

EC |

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

▶ |

|

▶ |

▶ |

|

▶ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Federal Employer Identification No. (9 digits) |

|

FEIN Applied for date |

|

Date of Organization or Incorporation (6 digits) |

|

Federal Business Code No. (6 digits) |

|||||||||

|

▶ |

|

|

|

|

|

|

▶ |

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||||||

TYPE OF ENTITY: ☐ Partnership |

☐ S corporation |

☐ Limited liability company |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

||||||||||

CHECK HERE IF: ☐ Name or address has changed ☐ First filing of the entity ☐ Inactive entity |

☐ Final return |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1a. |

An automatic extension of time to file the income tax return is requested until ____________________________________________ . |

|

1b. |

If the original due date for the federal return is after the 15th day of the 3rd month following close of the taxable year for an S corporation |

|

|

or is after the 15th day of the 4th month following the close of the taxable year for a partnership or limited liability company, specify the |

|

|

situation which affords the later original due date and enter the federal due date: |

|

2a. |

Has the |

☐ Yes ☐ No |

b.If the answer to Question 2a is “No,” state the reason for this extension request:

3.Tentative tax (total nonresident partner, shareholder or member tax due or distributable cash flow limitation) . . . . . . .

4.Less estimated tax payments (total amount paid for the tax year) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Balance due (line 3 less line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

REMIT FULL AMOUNT DUE WITH THIS FORM — APPLICATION EXTENDS

ONLY THE TIME ALLOWED TO FILE THE RETURN AND NOT THE TIME ALLOWED TO PAY THE TAX

SIGNATURE AND VERIFICATION: Under penalties of perjury, I declare that I have examined this application (including attachments) and, to the best of my knowledge and belief, it is true, correct and complete. (Declaration of preparer other than taxpayer acknowledges authorization by the above named

Officer’s (or preparer’s) signature |

Title (or preparer’s firm name and address) |

Date |

A PROPER APPLICATION FOR EXTENSION OF TIME TO FILE WILL NOT BE ACKNOWLEDGED. IF THE EXTENSION REQUEST IS DE- NIED, THE MARYLAND REVENUE ADMINISTRATION DIVISION WILL RETURN THIS APPLICATION AND INDICATE THE REASON BELOW:

☐Failed to file application timely as postmarked after the due date of the return. (The due date of the return is the 15th day of the 3rd month following the close of the taxable year for an S corporation and the 15th day of the 4th month following the close of the taxable year or period for a partnership or limited liability company, or by the original due date required for filing of the federal return.)

☐Failed to pay the full amount due shown on line 5. (If a partial amount was remitted, that amount has been applied to the account.)

☐Did not file an application for extension with the IRS and failed to include acceptable reason for this request.

☐Other:

If the application for extension is denied for any of the above reasons, the

☐Cannot be approved for more than six months beyond the original due date. (An automatic

___________________________ .)

COT/RAD 008

INSTRUCTIONS FOR MARYLAND FORM 510E (Revised 1999)

APPLICATION FOR EXTENSION OF TIME

TO FILE

INCOME TAX RETURN

GENERAL INSTRUCTIONS

Purpose of Form Form 510E is used by a

General Requirements Maryland law provides for an extension of time to file, but in no case can an extension be granted for more than six months beyond the original due date. A request for exten- sion of time to file will be granted auto- matically for six months for S corporations and three months for partnerships and limited liability companies if:

1)Form 510E is properly filed and submitted by the original due date (S corporation: 15th day of the 3rd month following close of the tax year or period. Partnerships and limited liability companies: 15th day of the 4th month following close of the tax year or period.);

2)full payment of any balance due is submitted with Form 510E; and

3)an application for extension of time has been filed with the Internal Revenue Service or an acceptable reason has been provided with Form 510E.

An additional

A proper application for extension of time to file will not be acknowledged. If the extension request is denied, the

Form 510E does not extend the time allowed a

When and Where to File File Form 510E by the 15th day of the 3rd month following the close of the taxable year or period if an S corporation; by the 15th day of the 4th month following the close of the taxable year or period if a partnership or limited liability company. The return must be filed with the Comptroller of the Treasury, Revenue Administration Division, Annapolis, Maryland

SPECIFIC INSTRUCTIONS

Taxable Year or Period Enter the beginning and ending dates of the tax- able year in the space provided at the top of Form 510E.

Name, Address and Other Information

Type or print the required information in the designated area. DO NOT USE THE LABEL FROM THE TAX BOOKLET COVER.

Enter the exact

Enter the Federal Employer Identifica- tion Number (FEIN). If a FEIN has not been secured, enter “APPLIED FOR” followed by the date of application. If a FEIN has not been applied for, do so immediately.

Be sure to check the applicable box to indicate the type of

Check the applicable box if: (1) the name or address has changed; (2) this is the first filing of the

(3)this is an inactive

Tentative Tax Enter the total amount of income tax liability expected for the tax year on line 3.

Estimated Tax Payments Enter on line 4 the total amounts paid with Form 510D - Declaration of Estimated Pass- Through Entity Nonresident Tax for the taxable year or period.

Balance Due Enter the amount of tax due on line 5 and remit full payment with this form.

Signature and Verification An author- ized officer or the paid preparer must sign and date Form 510E indicating the officer’s title or preparer firm name and address.

Payment Instructions Include a check or money order made payable to the Comptroller of the Treasury for the full amount of any balance due. All payments must indicate the Federal Employer Identi- fication Number, type of tax and tax year beginning and ending dates. DO NOT SEND CASH.

Mailing Instructions Use the enve- lope provided in the tax booklet and place an “X” in the appropriate box in the lower left corner to indicate the type of document enclosed. Also, be sure to read and follow the reminders listed on the back of the envelope.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose of Form | The Maryland 510E form is used by pass-through entities to request an extension of time to file their income tax return (Form 510). |

| Filing Deadline | Form 510E must be filed by the 15th day of the 3rd month following the close of the taxable year for S corporations, and by the 15th day of the 4th month for partnerships and limited liability companies. |

| Extension Duration | An automatic extension is granted for six months for S corporations and three months for partnerships and limited liability companies, provided the application is properly submitted. |

| Governing Law | Maryland law regulates the extension of time to file, stipulating that no extension can exceed six months beyond the original due date. |

Other PDF Forms

Maryland Charitable Solicitation Registration - Enables detailed reporting of functional expenses, helping organizations to track their operational spending efficiently.

For those looking to finalize their vehicle sale, the Texas Motor Vehicle Bill of Sale form can be conveniently accessed online at https://texasdocuments.net/printable-motor-vehicle-bill-of-sale-form/, providing a straightforward way to document your transaction and ensure all necessary details are captured accurately.

Maryland New Hire Registry - Key to the form’s utility is its role in tracking employment trends and enforcing child support orders in Maryland.

Maryland Police Report - Personal details of involved drivers and passengers, including names, addresses, and injuries, are recorded.