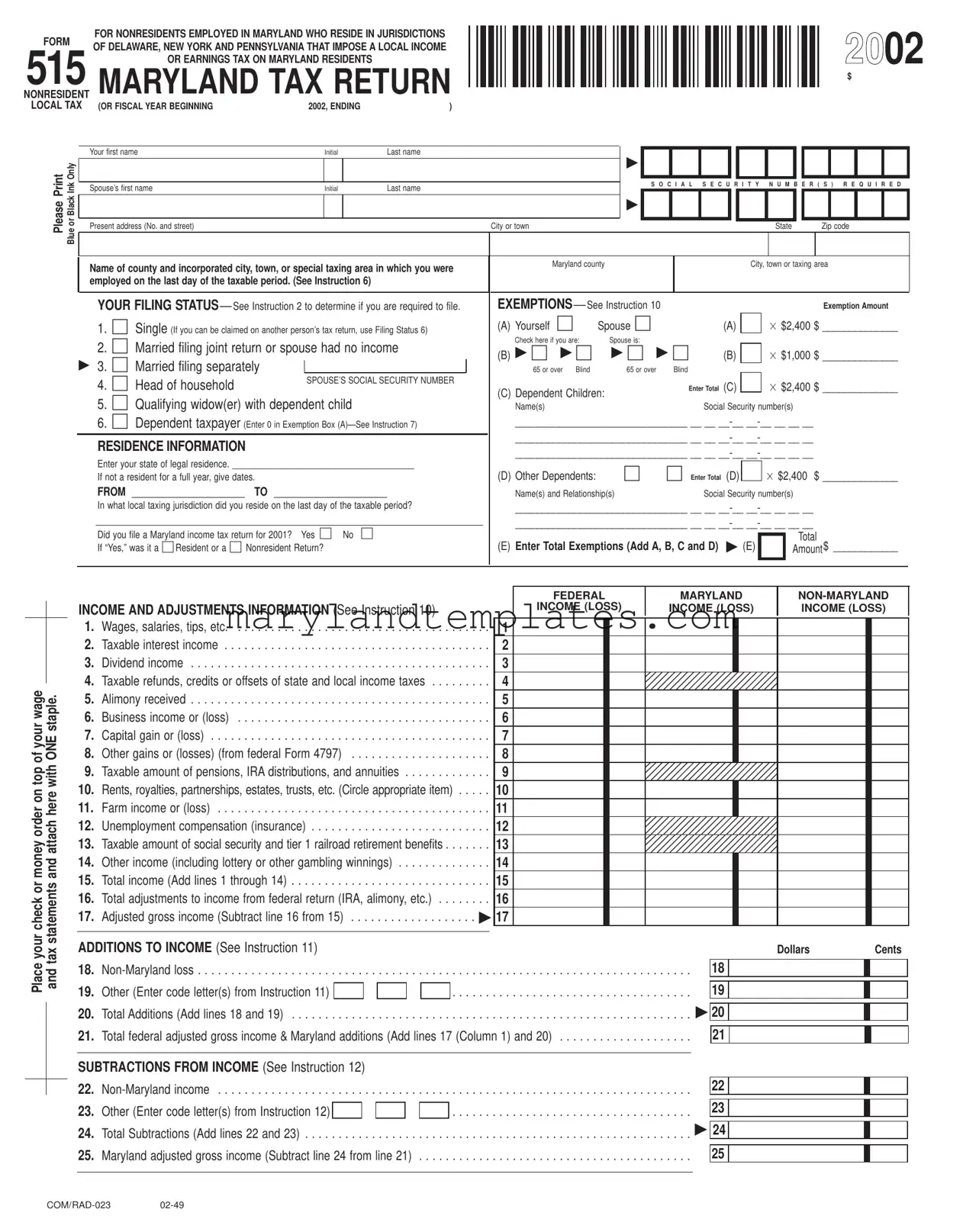

Printable Maryland 515 Template

The Maryland Form 515 serves as a crucial document for nonresidents who work in Maryland but reside in neighboring jurisdictions such as Delaware, New York, and Pennsylvania. This form is specifically designed for individuals who are subject to local income or earnings taxes imposed by their home jurisdictions on Maryland residents. It allows these workers to report their income earned in Maryland while also accounting for any local taxes that may apply. The form requires detailed personal information, including the taxpayer's name, address, and filing status, which can be single, married, or head of household. Additionally, it prompts the taxpayer to provide information about their residence and employment locations, ensuring that all relevant local tax jurisdictions are accurately captured. Exemptions and adjustments to income are also addressed, allowing taxpayers to reduce their taxable income based on specific criteria, such as age or blindness. This form not only facilitates the calculation of Maryland state taxes owed but also incorporates local tax computations, ensuring that individuals meet their tax obligations comprehensively. As such, understanding the nuances of the Maryland Form 515 is essential for nonresidents to navigate their tax responsibilities effectively.

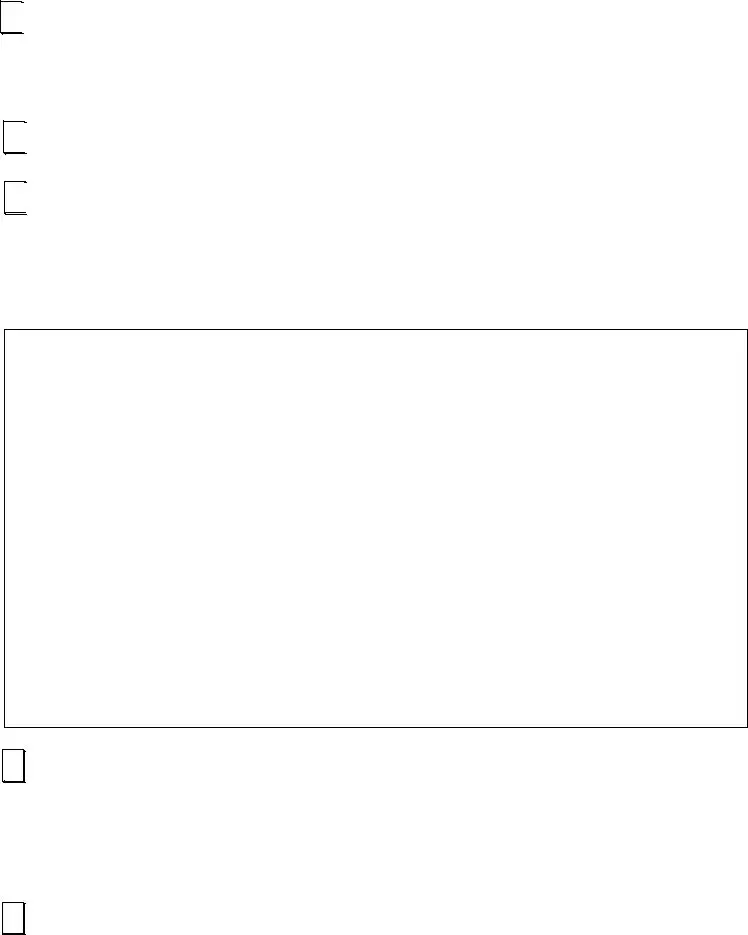

Maryland 515 Preview

FORM |

FOR NONRESIDENTS EMPLOYED IN MARYLAND WHO RESIDE IN JURISDICTIONS |

|||||||

OF DELAWARE, NEW YORK AND PENNSYLVANIA THAT IMPOSE A LOCAL INCOME |

||||||||

NONRESIDENT515 |

||||||||

OR EARNINGS TAX ON MARYLAND RESIDENTS |

|

|||||||

MARYLAND TAX RETURN |

||||||||

LOCAL TAX (OR FISCAL YEAR BEGINNING |

2002, ENDING |

) |

||||||

|

|

|

Your first name |

|

Initial |

Last name |

||

PrintPlease InkBlackorBlueOnly |

|

|

Spouse’s first name |

|

|

|

Last name |

|

|

|

Initial |

||||||

|

|

|

|

|||||

Present address (No. and street)

Name of county and incorporated city, town, or special taxing area in which you were employed on the last day of the taxable period. (See Instruction 6)

YOUR FILING STATUS— See Instruction 2 to determine if you are required to file.

1.☐ Single (If you can be claimed on another person’s tax return, use Filing Status 6)

2.☐ Married filing joint return or spouse had no income

▶3. ☐ Married filing separately

4. ☐ Head of household |

SPOUSE’S SOCIAL SECURITY NUMBER |

|

5.☐ Qualifying widow(er) with dependent child

6.☐ Dependent taxpayer (Enter 0 in Exemption Box

RESIDENCE INFORMATION

Enter your state of legal residence. _______________________________________

If not a resident for a full year, give dates.

FROM _____________________ TO _____________________

In what local taxing jurisdiction did you reside on the last day of the taxable period?

Did you file a Maryland income tax return for 2001? Yes ☐ No ☐

If “Yes,” was it a ☐ Resident or a ☐ Nonresident Return?

2002

$

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

S O C I A L |

S E C U R I T Y |

N U M B E R ( S ) R E Q U I R E D |

||||||||||||

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or town |

|

|

|

|

|

|

|

|

|

State |

Zip code |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland county |

|

|

|

|

City, town or taxing area |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

EXEMPTIONS— See Instruction 10 |

|

|

|

|

|

|

|

|

|

|

Exemption Amount |

||||||

(A) Yourself ☐ |

Spouse ☐ |

|

|

(A) |

|

|

× $2,400 |

$ ______________ |

|||||||||

Check here if you are: |

Spouse is: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(B) ▶ ☐ ▶ ☐ |

▶ ☐ ▶ ☐ |

(B) |

|

|

× $1,000 |

$ ______________ |

|||||||||||

65 or over Blind |

|

65 or over |

|

Blind |

|

|

|

|

|

|

|

|

|

|

|

|

|

(C) Dependent Children: |

|

Enter Total (C) |

|

|

× $2,400 |

$ ______________ |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name(s) |

|

|

|

|

|

Social Security number(s) |

|

|

|

|

|||||||

________________________________ __ __ |

|

|

|

|

|||||||||||||

________________________________ __ __ |

|

|

|

|

|||||||||||||

________________________________ __ __ |

|

|

|

|

|||||||||||||

(D) Other Dependents: |

|

☐ |

☐ Enter Total (D) |

|

|

× $2,400 |

$ ______________ |

||||||||||

Name(s) and Relationship(s) |

|

|

Social Security number(s) |

|

|

|

|

||||||||||

________________________________ __ __ |

|

|

|

|

|||||||||||||

________________________________ __ __ |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

(E) Enter Total Exemptions (Add A, B, C and D) ▶ (E) |

|

|

Amount$ ____________ |

||||||||||||||

|

|

|

|

|

FEDERAL |

MARYLAND |

||

|

|

INCOME AND ADJUSTMENTS INFORMATION (See Instruction 10) |

|

INCOME (LOSS) |

INCOME (LOSS) |

INCOME (LOSS) |

||

|

|

1. |

Wages, salaries, tips, etc |

1 |

|

|

|

|

|

|

2. |

Taxable interest income |

. . |

2 |

|

|

|

|

|

3. |

Dividend income |

. . |

3 |

|

|

|

yourof wage |

|

4. |

Taxable refunds, credits or offsets of state and local income taxes |

. . |

4 |

|

|

|

ONEstaple. |

5. |

Alimony received |

. . |

5 |

|

|

|

|

8. |

Other gains or (losses) (from federal Form 4797) |

. . |

8 |

|

|

|

||

|

|

6. |

Business income or (loss) |

. . |

6 |

|

|

|

|

|

7. |

Capital gain or (loss) |

. . |

7 |

|

|

|

top |

with |

9. |

Taxable amount of pensions, IRA distributions, and annuities |

|

9 |

|

|

|

|

|

. . |

|

|

|

|||

ordermoneyon |

attachandhere |

10. |

Rents, royalties, partnerships, estates, trusts, etc. (Circle appropriate item) . . . |

. . |

10 |

|

|

|

11. |

Farm income or (loss) |

. . |

11 |

|

|

|

||

12. |

Unemployment compensation (insurance) |

|

12 |

|

|

|

||

|

|

. . |

|

|

|

|||

|

|

13. |

Taxable amount of social security and tier 1 railroad retirement benefits |

. . |

13 |

|

|

|

|

|

14. |

Other income (including lottery or other gambling winnings) |

. . |

14 |

|

|

|

orcheckyourPlace |

statementstaxand |

15. |

Total income (Add lines 1 through 14) |

. . |

15 |

|

|

|

16. |

Total adjustments to income from federal return (IRA, alimony, etc.) . . . |

|

16 |

|

|

|

||

|

|

. . |

|

|

|

|||

|

|

17. |

Adjusted gross income (Subtract line 16 from 15) |

▶ 17 |

|

|

|

|

|

|

ADDITIONS TO INCOME (See Instruction 11) |

|

|

|

Dollars |

Cents |

|

|

|

18. |

. . . |

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . 18 |

|

|

|

|

|

19. |

Other (Enter code letter(s) from Instruction 11). . . . |

. . . |

. . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . 19 |

|

|

|

|

20. |

Total Additions (Add lines 18 and 19) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . ▶ 20 |

|

|

|

|

|

21. |

Total federal adjusted gross income & Maryland additions (Add lines 17 (Column 1) and 20) |

. . . . 21 |

|

|

||

SUBTRACTIONS FROM INCOME (See Instruction 12)

22.

23. Other (Enter code letter(s) from Instruction 12)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23

24. Total Subtractions (Add lines 22 and 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

25. Maryland adjusted gross income (Subtract line 24 from line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25

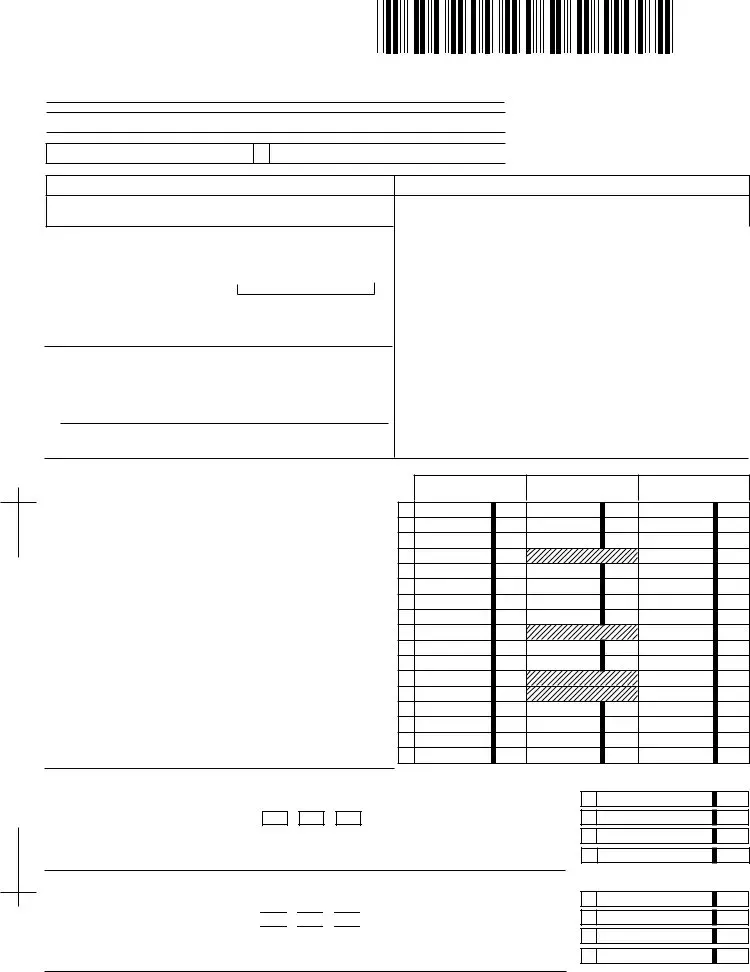

2002 MARYLAND FORM 515

PAGE 2

DollarsCents

26. Amount from line 25 (Maryland adjusted gross income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

DEDUCTION METHOD (All taxpayers must select one method and check the appropriate box)

26

27. STANDARD DEDUCTION METHOD |

See Instruction 14 and enter amount |

▶ |

☐ |

▶ |

ITEMIZED DEDUCTION METHOD |

See Instruction 15 and enter amount |

|

☐ |

|

27

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

|

|

|

28. |

Net income (Subtract line 27 from line 26.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

. . . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29. |

Total exemption amount (from EXEMPTIONS area, page 1). See Instruction 17 |

|

29 |

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30. |

Enter your Maryland income factor (from the worksheet in Instruction 13) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

||||||||

. . . |

. . . . |

. . . . |

. . . . |

. |

. . . . . . . . |

. |

. . . . |

. |

. . . . . |

. |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31. |

Maryland exemption allowance (Multiply line 29 by line 30.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

|

|

||||||

. . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32. |

Taxable net income (Subtract line 31 from line 28.) Figure tax on this amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

|

|

|

|

||||||||

. . . |

. . . . |

. . . . |

. . . . |

. |

. . . . . . . . |

. |

. . . . |

. |

. . . . . |

. |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARYLAND TAX COMPUTATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

33. |

Maryland tax (from Tax Table or Computation Worksheet) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

|

|

||||||

. . . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

34. |

Earned income credit (1⁄2 of federal earned income credit). See Instruction 19. . . . |

. . . |

. . . . |

. . . . |

. . . . |

. |

. . . . . . . . |

. |

. . . . |

. |

. . . . . |

. |

|

▶ |

|

34 |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35. |

Poverty level credit (See Instruction 19.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

35 |

|

|

|

|

|||||||

. . . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36. |

Personal Income tax credits from Part H, line 9 of Form 502CR. (Attach Form 502CR.) |

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|||||||||||||||||||

|

▶ |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

37. |

Business tax credits (Attach Form 500CR.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

||||||||

. . . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38. |

Total credits (Add lines 34 through 37.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

||||||

. . . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

39. |

Maryland tax after credits (Subtract line 38 from line 33.) If less than 0, enter 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

||||||||

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOCAL TAX COMPUTATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

40. |

Local tax (from Local Tax Worksheet in Instruction 20). Enter local tax rate used |

|

|

|

|

0 |

|

|

|

|

|

|

. . . . . . . |

|

|

|

|

40 |

|

|

|

|

|||||||||||

. . . . . . |

. . . .. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41. |

Local earned income credit (from Local Earned Income Credit Worksheet in Instruction 20) |

|

|

|

|

|

▶ |

|

41 |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42. |

Local poverty level credit (from Local Poverty Credit Level Worksheet in Instruction 20) |

|

|

|

|

|

▶ |

|

42 |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43. |

Total credits (Add lines 41 and 42.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

|

|

|

|

|||

. . . . . . . . . . . . . . |

. |

. . . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44. |

Local tax after credits (Subtract line 43 from line 40.) If less than 0, enter 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44 |

|

|

|

|

||||||||

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45. |

Total Maryland and local tax (Add lines 39 and 44.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45 |

|

|

|

|

||||||

. . . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

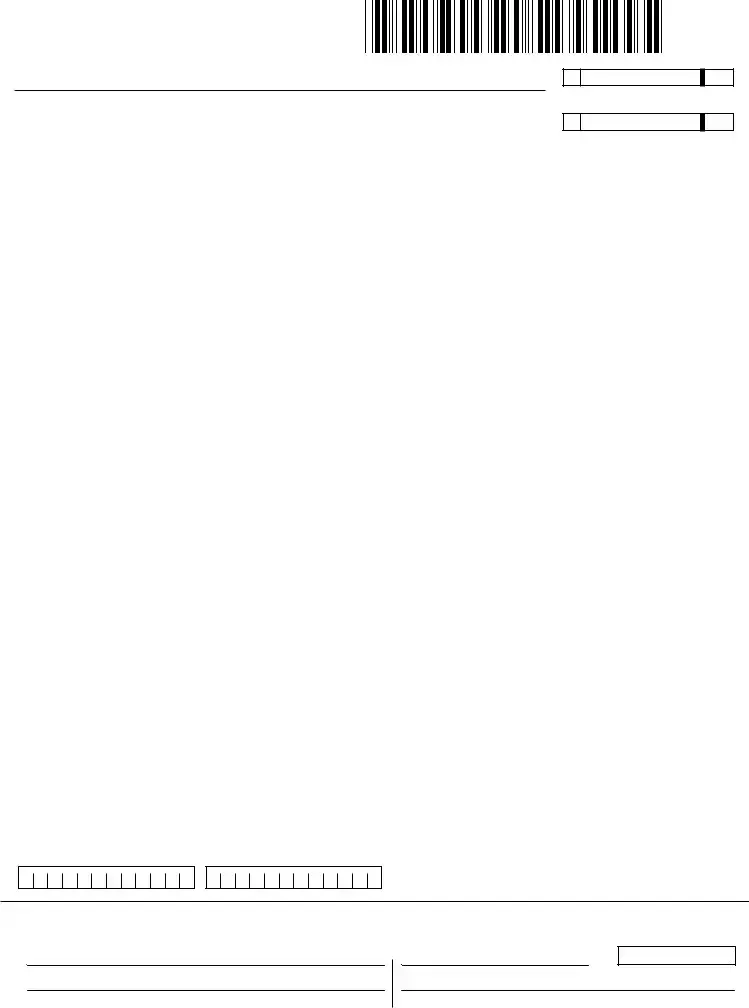

46. |

Contribution to Chesapeake Bay and Endangered Species Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

46 |

|

|

|

|

|||||||||

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47. |

Contribution to Fair Campaign Financing Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

47 |

|

|

|

|

|||||||

. . . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48. |

Total Maryland income tax, local income tax and contributions (Add lines 45, 46 and 47.) |

|

|

|

|

|

|

|

|

48 |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

49. |

Total Maryland and local tax withheld (Enter total from and attach your |

. |

|

▶ |

|

49 |

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50. |

2002 estimated tax payments, amount applied from 2001 return and payment made with an extension request Form 502E |

|

|

|

|

|

▶ |

|

50 |

|

|

|

|

||||||||||||||||||||

. |

. |

. . . . . |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51. |

Refundable earned income credit (from worksheet in Instruction 19) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

51 |

|

|

|

|

|||||||||

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

52. |

Enter amount of Maryland tax from line 39 if Pennsylvania resident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

52 |

|

|

|

|

|||||||||

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

53. |

Refundable personal income tax credits from Part J, line 4 of Form 502CR (Attach Form 502CR. See Instruction 21) |

|

|

|

|

|

|

|

|

53 |

|

|

|

|

|||||||||||||||||||

. |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54. |

Total payments and credits (Add lines 49 through 53.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54 |

|

|

|

|

||||||

. . . . . . . . . . . . . |

. . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55. |

Balance due (If line 48 is more than line 54, subtract line 54 from line 48.) . . . . |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

▶ |

|

55 |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

56. |

Overpayment (If line 48 is less than line 54, subtract line 48 from line 54.) |

. . . |

. . . |

. . . . . |

|

. . . . . . . . |

. |

. . . |

. |

. . . . . . . . . . |

. |

|

▶ |

|

56 |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

57. |

Amount of overpayment TO BE APPLIED TO 2003 ESTIMATED TAX |

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

58. |

Amount of overpayment TO BE REFUNDED TO YOU (Subtract line 57 from line 56.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

58 |

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or for late filing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

59. |

Interest charges from Form 502UP ▶ |

|

|

|

|

|

|

|

. . |

. . . . . . . . |

. |

. . . |

. |

. |

|

|

▶ |

|

59 |

|

|

|

|

||||||||||

60. |

TOTAL AMOUNT DUE (Add line 55 and line 59.) |

. . . . . . . . . .IF $1 OR MORE, PAY IN FULL WITH THIS RETURN. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

60 |

|

|

|

|

||||||||||||||||||||||||

|

|

For credit card payment check here |

|

and see Instruction 24. Direct Debit is not available. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

- -

Daytime telephone no.

- -

Home telephone no.

|

|

|

|

|

▶ ☐ Check here if you use a paid |

|

|

|

|

|

preparer and do not want Maryland |

CODE NUMBER |

|

FOR OFFICE USE ONLY |

forms mailed to you next year. |

||

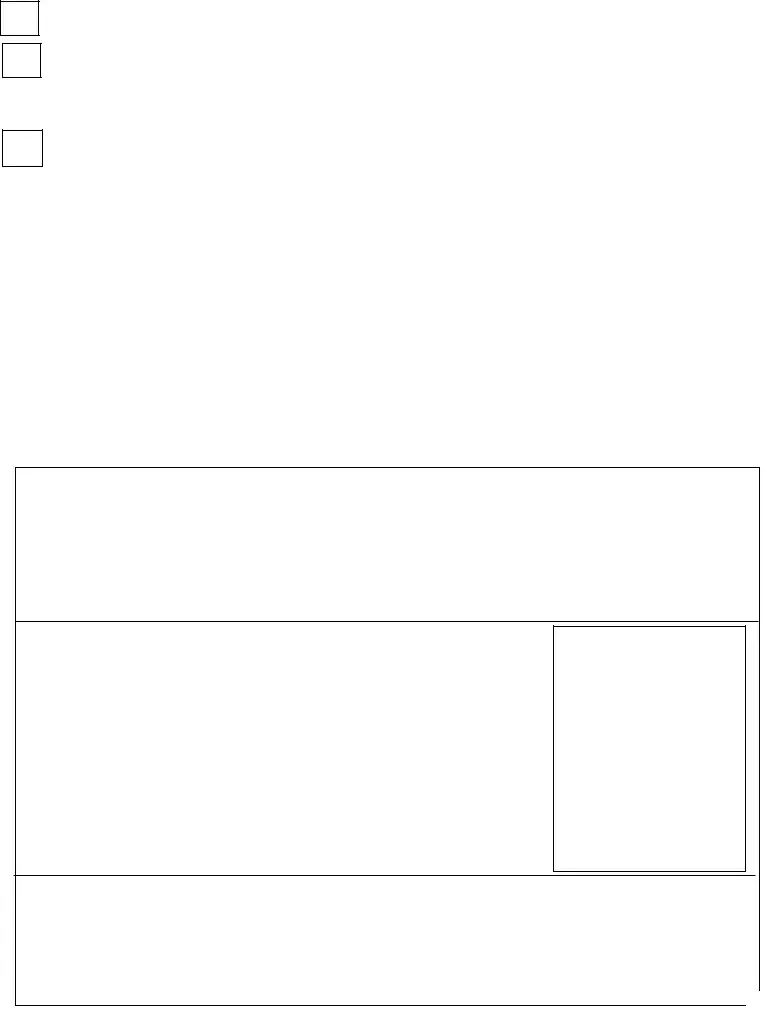

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements |

Make checks payable to: COMPTROLLER OF MARYLAND. |

and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the |

Write social security no. on check using blue or black ink. |

declaration is based on all information of which the preparer has any knowledge. Check here ☐ if you authorize your |

Mail to: Comptroller of Maryland, Revenue Administration Division, |

preparer to discuss this return with us. |

Annapolis, Maryland |

Your signature |

Date |

Spouse’s signature |

Date |

▶

Signature of preparer other than taxpayer |

Preparer’s SSN or PTIN |

Address and telephone number of preparer

MARYLAND INCOME TAX RETURN

FORM 515

For nonresidents employed in Maryland

who reside in jurisdictions of Delaware, New York and Pennsylvania that impose a local income or earnings tax on Maryland residents.

I N S T R U C T I O N S

2 0 0 2

IMPORTANT NOTES

DUE DATE

Your return is due by April 15, 2003.

COMPLETING THE RETURN

You must use blue or black ink when completing your return. DO NOT use pencil or red ink. Submit the original return, not a photocopy. If no entry is needed for a specif- ic line, leave blank. Do not enter words such as “none” or “zero” and do not draw a line to indicate no entry.

You may round off all cents to the near-

est whole dollar. Fifty cents and above should be rounded to the next higher dollar. State calculations are rounded to the near- est penny.

PENALTIES

There are severe penalties for failing to file a tax return, failing to pay any tax when due, filing a false or fraudulent return or making a false certification. The penalties include criminal fines, imprisonment and a penalty on your taxes. In addition, interest is charged on amounts not paid.

To collect unpaid taxes, the Comptroller is directed to enter liens against the salary, wages or property of delinquent taxpayers.

EXPLANATION OF TAX

The individual’s employer shall withhold the Maryland local income tax. The individ- ual shall not be required to file a Maryland return, nor the employer withhold the tax, if the Comptroller determines that the locality in which the individual resides does not impose a tax on Maryland residents with respect to income from salary, wages or other compensation for personal services performed in the locality or, if it does impose such a tax, that it provides an exemption, credit or other procedure whereby the in- come of residents of Maryland is rendered free of taxation and withholding.

1 Who is a nonresident? In general, every individual other than a resident of Maryland is a nonresident.

You are a nonresident if you do not have your permanent home in Maryland and did not maintain a place of abode (that is, a place to live) in Maryland for more than six

months of the tax year.

If you establish or abandon legal resi- dence in Maryland during the taxable year, you are taxable as a resident for the portion

of the year during which your legal resi- dence was in Maryland. (See Form 502 Instructions.)

Who must file? Decide if you must file a nonresident Maryland income tax return, Form 515. In general, you are liable for

2 local income tax and must file this return if you are a nonresident of Maryland AND you received salary, wages or other compensation for personal services performed in any county of Maryland or in Baltimore City AND you lived in jurisdictions of Delaware, New York and Pennsylvania that imposed a local or earnings tax on Maryland residents AND you are required to file a federal return.

TO DETERMINE IF YOU ARE REQUIRED

TO FILE A MARYLAND RETURN:

a.Add up all of your federal gross income (except any income which is exempt by law) to determine your total income.

b.Do not include social security or railroad retirement benefits in your total federal income.

c.Add to your total federal income any Maryland additions to income. Do not include any additions related to

d.If you are a dependent taxpayer, add to your total federal income any Maryland

additions and subtract any Maryland sub- tractions. (See Instructions 11 and 12.) This is your Maryland gross income. e. You must file a Maryland return if your Maryland gross income equals or

exceeds the income levels in Table 1.

f.If you or your spouse is 65 or over, use Table 2, “Minimum Filing Levels for Tax- payers 65 or Over” on this page.

MARYLAND TAX WITHHELD

IN ERROR:

If Maryland tax was withheld from your income, you must file to obtain a refund of the withholding. Complete all of the infor- mation at the top of the form through the

filing status, residence information and exemption areas. Enter your federal adjust- ed gross income on line 17 in both columns 1 and 3 and line 24. Then complete lines 34,

Sign the form and attach withholding statements (Form

Your form is then complete. You must file within three years of the original due date to receive any refund.

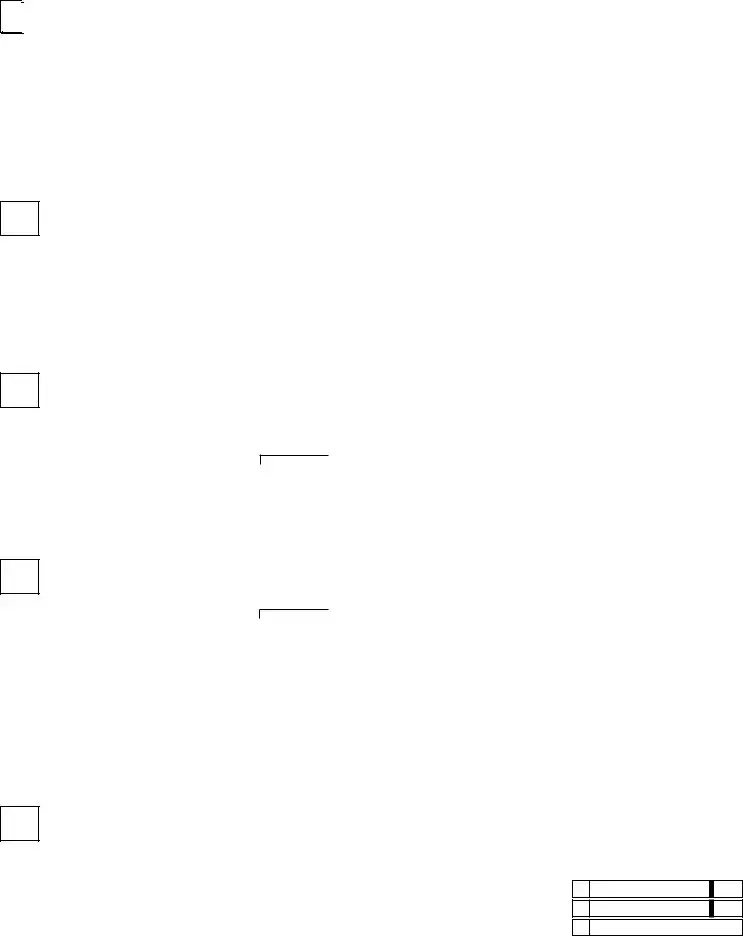

Table 1 |

Minimum Filing Level Tables |

Table 2 |

|

|

||

|

|

|

|

|

||

For taxpayers under 65 |

|

|

For taxpayers 65 or over |

|

|

|

Single persons (including dependent taxpayers) |

. . .$ 7,700 |

Single, age 65 or over . . |

. . . . . . . . . . . . . . . . . |

. .$ |

8,850 |

|

Joint return |

. . . |

. . . 13,850 |

Joint return, one spouse age 65 or over |

. . |

14,750 |

|

Married persons filing separately |

. . . |

. . . 3,000 |

Joint return, both spouses age 65 or over |

. . |

15,650 |

|

Head of household |

. . . |

. . . 9,900 |

Married persons filing separately, age 65 or over |

. . |

3,000 |

|

Qualifying widow(er) |

. . . |

. . . 10,850 |

Head of household, age 65 or over |

. . |

11,050 |

|

|

|

|

Qualifying widow(er), age 65 or over |

. . |

11,750 |

|

|

|

|

|

|

|

|

What income is taxable? If you are required to file Form 515, then you are subject to local income tax on that portion

3 of your federal adjusted gross income that is derived from salary, wages or other compensation for personal services performed in any county of Maryland or Baltimore City. If you reside in New York City or Wilmington, Delaware, your wages are also subject to Maryland tax. If you have income other than wages subject to Maryland tax, you must also file Form 505. For further information and forms, call

1

4

Use of federal return. First complete your 2002 federal income tax return.

You will need the information from your federal return in order to complete your Maryland return. Therefore, complete your federal return before you continue beyond

this point. Maryland law requires that your income and deductions be entered on your Maryland return exactly as they were reported on your federal return. However,

all items reported on your Maryland return are subject to verification, audit and revi- sion by the Maryland State Comptroller’s Office.

5

6

Name and address information. Complete the “Name,” “Address” and “Social Security Number” boxes.

County, city, town information. Fill in the boxes for MARYLAND COUNTY and CITY, TOWN OR TAXING AREA based on where you were employed on the last day of the taxable period.

IF YOU WORKED IN BALTIMORE CITY:

Leave the MARYLAND COUNTY box blank.

Write “Baltimore City” in the CITY, TOWN OR TAXING AREA box.

IF YOU WORKED IN A MARYLAND COUNTY (NOT BALTIMORE CITY):

1.Write the name of the county in the MARYLAND COUNTY box.

2.Find the county in the list below.

3.If you worked in one of the areas listed under the county, write its name in the CITY, TOWN OR TAXING AREA box.

4.If you did not work in one of the areas listed for the county, leave the CITY, TOWN OR TAXING AREA box blank.

LIST OF INCORPORATED CITIES, TOWNS AND TAXING AREAS IN MARYLAND

ALLEGANY COUNTY |

CARROLL COUNTY |

|

BARTON |

HAMPSTEAD |

|

BELAIR |

MANCHESTER |

|

BOWLING |

MT. AIRY |

|

CRESAPTOWN |

NEW WINDSOR |

|

CUMBERLAND |

SYKESVILLE |

|

ELLERSLIE |

TANEYTOWN |

|

FROSTBURG |

UNION BRIDGE |

|

LAVALE |

WESTMINSTER |

|

LONACONING |

|

|

LUKE |

CECIL COUNTY |

|

McCOOLE |

CECILTON |

|

MIDLAND |

CHARLESTOWN |

|

MT. SAVAGE |

CHESAPEAKE CITY |

|

POTOMAC PARK ADDITION |

ELKTON |

|

WESTERNPORT |

NORTH EAST |

|

ANNE ARUNDEL COUNTY |

PERRYVILLE |

|

PORT DEPOSIT |

||

ANNAPOLIS |

RISING SUN |

|

HIGHLAND BEACH |

|

|

BALTIMORE COUNTY |

CHARLES COUNTY |

|

INDIAN HEAD |

||

NO INCORPORATED |

LA PLATA |

|

CITIES OR TOWNS |

PORT TOBACCO |

|

BALTIMORE CITY |

DORCHESTER COUNTY |

|

|

BROOKVIEW |

|

CALVERT COUNTY |

CAMBRIDGE |

|

CHESAPEAKE BEACH |

CHURCH CREEK |

|

NORTH BEACH |

EAST NEW MARKET |

|

|

ELDORADO |

|

CAROLINE COUNTY |

GALESTOWN |

|

DENTON |

HURLOCK |

|

SECRETARY |

||

FEDERALSBURG |

||

VIENNA |

||

GOLDSBORO |

||

|

||

GREENSBORO |

FREDERICK COUNTY |

|

HENDERSON |

||

HILLSBORO |

BRUNSWICK |

|

MARYDEL |

BURKITTSVILLE |

|

PRESTON |

EMMITSBURG |

|

RIDGELY |

FREDERICK |

|

TEMPLEVILLE |

MIDDLETOWN |

|

|

MT. AIRY |

|

|

MYERSVILLE |

|

|

NEW MARKET |

|

|

ROSEMONT |

|

|

THURMONT |

|

|

WALKERSVILLE |

|

|

WOODSBORO |

GARRETT COUNTY

ACCIDENT

DEER PARK

FRIENDSVILLE

GRANTSVILLE

KITZMILLER

LOCH LYNN HEIGHTS

MOUNTAIN LAKE PARK

OAKLAND

HARFORD COUNTY

ABERDEEN

BEL AIR

HAVRE DE GRACE

HOWARD COUNTY

NO INCORPORATED

CITIES OR TOWNS

KENT COUNTY

BETTERTON

CHESTERTOWN

GALENA

MILLINGTON

ROCK HALL

MONTGOMERY COUNTY

BARNESVILLE

BROOKEVILLE CHEVY CHASE SEC. 3 TOWN OF CHEVY CHASE (FORMERLY SEC. 4)

CHEVY CHASE SEC. 5 CHEVY CHASE VIEW CHEVY CHASE VILLAGE DRUMMOND FRIENDSHIP HEIGHTS GAITHERSBURG GARRETT PARK

GLEN ECHO

KENSINGTON

LAYTONSVILLE MARTIN’S ADDITION NORTH CHEVY CHASE OAKMONT POOLESVILLE ROCKVILLE SOMERSET TAKOMA PARK WASHINGTON GROVE

PRINCE GEORGE’S COUNTY |

TALBOT COUNTY |

|

BERWYN HEIGHTS |

EASTON |

|

BLADENSBURG |

OXFORD |

|

BOWIE |

QUEEN ANNE |

|

BRENTWOOD |

ST. MICHAELS |

|

CAPITOL HEIGHTS |

TRAPPE |

|

CHEVERLY |

|

|

COLLEGE PARK |

WASHINGTON COUNTY |

|

COLMAR MANOR |

BOONSBORO |

|

COTTAGE CITY |

CLEARSPRING |

|

DISTRICT HEIGHTS |

FUNKSTOWN |

|

EAGLE HARBOR |

HAGERSTOWN |

|

EDMONSTON |

HANCOCK |

|

FAIRMOUNT HEIGHTS |

KEEDYSVILLE |

|

FOREST HEIGHTS |

SHARPSBURG |

|

GLENARDEN |

SMITHSBURG |

|

GREENBELT |

WILLIAMSPORT |

|

HYATTSVILLE |

|

|

LANDOVER HILLS |

WICOMICO COUNTY |

|

LAUREL |

DELMAR |

|

MORNINGSIDE |

||

FRUITLAND |

||

MT. RAINIER |

||

HEBRON |

||

NEW CARROLLTON |

||

MARDELA SPRINGS |

||

NORTH BRENTWOOD |

||

PITTSVILLE |

||

RIVERDALE PARK |

||

SALISBURY |

||

SEAT PLEASANT |

||

SHARPTOWN |

||

UNIVERSITY PARK |

||

WILLARDS |

||

UPPER MARLBORO |

||

|

||

QUEEN ANNE’S COUNTY |

WORCESTER COUNTY |

|

BERLIN |

||

BARCLAY |

||

OCEAN CITY |

||

CENTREVILLE |

||

POCOMOKE CITY |

||

CHURCH HILL |

||

SNOW HILL |

||

MILLINGTON |

||

|

||

QUEEN ANNE |

|

|

QUEENSTOWN |

|

|

SUDLERSVILLE |

|

|

TEMPLEVILLE |

|

|

ST. MARY’S COUNTY |

|

|

LEONARDTOWN |

|

|

SOMERSET COUNTY |

|

|

CRISFIELD |

|

|

PRINCESS ANNE |

|

Filing status. Check the filing status box which matches the filing status you used on your federal return unless you are a

7 dependent taxpayer.

A dependent taxpayer is one who can be claimed as a dependent on another person’s federal return. If married, taxpayer and spouse must file separate returns. A dependent taxpayer may not claim a per- sonal exemption for himself. Check the box for filing status 6.

Generally, if you filed a joint federal return for 2002, you must file a joint Mary- land return. Married couples who file joint federal returns may file separate Maryland returns when one spouse is a resident of Maryland and the other spouse is a nonresident of Maryland. If you and your

spouse filed separate federal returns, you must file separate Maryland returns. A surviving spouse may file a joint return with a decedent if a joint federal return was filed.

8 Residence information. Answer all questions and fill in the appropriate boxes.

2

9

Exemptions. Determine what exemptions you are entitled to, and check the appropriate boxes on the form.

EXEMPTIONS ALLOWED

You are permitted the same number of exemptions which you are permitted on your federal return; however, the exemption amount is different on the Maryland return. Even if you are not required to file a feder- al return, the federal rules for claiming exemptions still apply to you. Refer to the

federal income tax instructions for further information.

In addition to the exemptions allowed on your federal return, you and your spouse are permitted to claim exemptions for being age 65 or over or for blindness. These additional exemptions are in the amount of $1,000 each.

NOTE: If “Other Dependents” are 65 or over, you receive an extra exemption of $2,400 which is not permitted on the feder- al return. Simply check the appropriate boxes.

Complete the exemptions area on the front of Form 515 to determine the amount of exemption allowance to enter on line 29.

10

Income and adjustments. Complete lines

Enter in the Maryland Income column all salaries or wages which were derived from Maryland sources. Enter in the Non- Maryland Income column all other income or loss. Adjustments to federal gross income

are not generally applicable to Maryland unless they pertain to compensation for services performed in Maryland.

If you have income from Maryland such as business income, rental income, lottery

winnings, etc., other than salary, wages or other compensation for services performed in Maryland, you must file two nonresident returns. The wage income is taxed on Form 515 and the

11

Additions to income. Determine which additions to income apply to you. Write the correct amounts on lines 18 and 19 and the total on line 20 of Form 515. Instructions for each line:

Line 18.

you, enter the total amount on line 19 and identify each item using the code letter.

are not subject to federal tax because of

a treaty. |

b. Pickup contributions of a state retire- |

any entry on line 22.

▼

CODE LETTER

ment or pension system member. (The |

Line 19. OTHER ADDITIONS TO INCOME. If one or more of these apply to

a. Wages, salaries or other compensation for services performed in Maryland that

pickup amount will be stated separately |

on your |

12

Subtractions from income. Determine which subtractions from income apply to you. Write the correct amounts on lines 22 and 23 and the total on line 24 of Form 515. Instructions for each line:

Line 22.

Line 23. OTHER SUBTRACTIONS FROM INCOME. If one or more of these apply to your Maryland income, enter the total amount on line 23 and identify each item using the code letter.

CODE LETTER

▼

a.Child care expenses. You may subtract the cost of caring for your dependents while you work. There is a limitation of $3,000 ($6,000 if two or more depen- dents receive care.) Copy the amount from line 3 of either federal Form 2441 or Form 1040A Schedule 2.

b.Expenses up to $5,000 incurred by a blind person for a reader, or up to $1,000

incurred by an employer for a reader for a blind employee.

c. The amount added to your taxable income for the use of an official vehicle used by a member of a state, county or local police or fire department. The amount is stated separately on Form

d.The lesser of $1,200 or the Maryland income of the spouse with the lower income if both spouses have Maryland income and you file a joint return.

13

Maryland income factor. You must adjust your standard or itemized deductions and exemptions based on the percentage of your income subject to Maryland tax. Complete the worksheet below to figure the percentage of Maryland income to total income. If the result is less than 0 or greater than 1.0, use 1 as your factor. NOTE: if Maryland adjusted gross income (Line 25) is 0, use 0 as your factor.

MARYLAND INCOME FACTOR WORKSHEET

1. Enter your federal adjusted gross income (from line 17, Column 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Enter your Maryland adjusted gross income (from line 25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Maryland income factor. (Divide line 2 by line 1.) If greater than 1, enter 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

3

3

14

Standard deduction. Complete line 27 and check the box for standard deduction method.

The standard deduction method gives you a standard deduction without the need to itemize deductions. Use the appropriate worksheet below to determine the total stan-

dard deduction for your filing status and Maryland income.

You must adjust the total standard deduc- tion based on the percentage of Maryland

income. Use the Maryland income factor from Instruction 13 to figure your Maryland standard deduction.

Figure your standard deduction

If your filing status is:

|

• Single |

|

|

|

|

• Married filing jointly |

|

|

||||

|

|

|

|

|

|

|

||||||

|

• Married filing separately |

|

|

|

|

• Head of household |

|

|

||||

|

|

or |

|

|

|

|

|

or |

|

|

||

|

• Dependent taxpayer |

|

|

|

|

• Qualifying widow(er) |

|

|

||||

|

Use Worksheet 1, below. |

|

|

|

|

Use Worksheet 2, below. |

|

|||||

|

|

▼ |

|

|

|

|

|

▼ |

|

|

||

|

Worksheet 1 |

|

|

|

|

Worksheet 2 |

|

|

||||

If your income on |

Your standard |

|

If your income on |

Your standard |

||||||||

line 26 is between: |

deduction is: |

|

line 26 is between: |

deduction is: |

||||||||

$1 - 10,000 |

. . . . . . . . . . . . . . . . |

.$ |

1,500 |

|

$1 - 20,000 |

. . . . . . . . . . . . . . . . |

.$ |

3,000 |

||||

|

|

or |

|

|

|

|

|

|

or |

|

|

|

|

|

|

|

|

|

|

|

|

||||

If your income on line 26 is between |

|

|

If your income on line 26 is between |

|

||||||||

Enter income from line 26: |

.$ _________ |

|

Enter income from line 26: |

.$ _________ |

||||||||

Multiply by 15 percent (.15) |

.X |

.15 |

|

Multiply by 15 percent (.15) |

.X |

.15 |

||||||

This is your standard deduction |

.$ _________ |

|

This is your standard deduction |

.$ _________ |

||||||||

|

|

or |

|

|

|

|

|

|

or |

|

|

|

|

|

|

|

|

|

|

|

|

||||

If your income on |

Your standard |

|

If your income on |

Your standard |

||||||||

line 26 is: |

deduction is: |

|

line 26 is: |

deduction is: |

||||||||

$13,333 or over |

.$ |

2,000 |

|

$26,667 or over |

.$ |

4,000 |

||||||

Enter your standard deduction on line 1 below. |

|

Enter your standard deduction on line 1 below. |

||||||||||

STANDARD DEDUCTION CALCULATION

1. Enter your standard deduction from Standard Deduction Worksheet above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Enter your Maryland income factor (from line 3, Instruction 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Total Maryland standard deduction (Multiply line 1 by line 2). Enter here and on line 27 . . . . . . . . . . . . . . . . . . . . .

1

2

3

15

Itemized deductions. If you figure your tax by the ITEMIZED DEDUCTION METHOD, complete line 27 and check the box for Itemized Deduction Method.

To use the ITEMIZED DEDUCTION METHOD, you must itemize your deductions on your federal return and complete federal Form 1040 Schedule A. Copy the amount from Schedule A, line 28, Total Itemized Deductions, onto line 1 of the Itemized Deduction Worksheet below. Complete lines 1 to 5 and enter result on line 27 of Form

515.Also, any mount deducted as contribu- tions of Preservation and Conservation Easements for which a credit is claimed on

Form 502CR must be added to line 2. NOTE: Certain

28)to total deductions (the sum of lines 4, 9, 14, 18, 19, 26 and 27) to calculate the amount of state and local taxes to be entered on line 2 of the following worksheet.

You are not required to itemize deductions

on your Maryland return simply because you itemized on your federal return. Figure your tax each way to determine which method is best for you.

Your Maryland itemized deductions are limited to those deductions related to Mary- land income. You must adjust the total item- ized deductions based on the percentage of Maryland income. Use the Maryland income factor from Instruction 13 to figure your allowable Maryland itemized deductions.

ITEMIZED DEDUCTIONS WORKSHEET

1. Total federal itemized deductions (from line 28, federal Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. State and local income taxes included in federal Schedule A, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Net deductions (Subtract line 2 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Enter your Maryland income factor (from line 3, Instruction 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Total Maryland itemized deductions (Multiply line 3 by line 4). Enter here and on line 27. . . . . . . . . . . . . . . . . . . . .

1

2

3

4

5

16

Exemption allowance computation. You must adjust the total exemption amount on line 29 based on the percentage of Maryland income. On line 30 enter the Maryland income factor from Instruction 13 to figure your Maryland exemption allowance.

4

17

Figure your Maryland taxable net income. Subtract line 31 from line 28.

18

Figure the Maryland tax. You must use the tax table if your taxable income is less than $100,000.

Find the income range in the tax table that applies to the amount you reported on line 32 of your return. Find the Maryland tax corre-

sponding to your income range. Enter the tax amount on line 33 of your return. If your tax- able income on line 32 is $100,000 or more,

use the Maryland Tax Computation Work- sheet at the end of the tax table.

19

Earned income, poverty level, and other credits for individuals and businesses. You may claim a credit on line 34 equal to

EARNED INCOME CREDIT

If you claimed an earned income credit on your federal return, then you may claim one- half (50%) of the federal credit multiplied by the Maryland income factor on your Maryland return. If you filed a joint federal return, but a separate Maryland return, you may claim a combined total of up to

This is not a refundable credit.

POVERTY LEVEL CREDIT

If your earned income and federal adjusted gross income are below the poverty level income for the number of exemptions on your federal tax return, you may be eligible for the poverty level credit.

You are not eligible for this credit if you checked filing status 6 (dependent taxpayer) on your Maryland income tax return.

Generally, if your Maryland state tax exceeds 50% of your federal earned income credit and your earned income and federal adjusted gross income are below the poverty income guidelines from the worksheet, you may claim a credit of 5% of your earned income multiplied by the Maryland income factor.

Complete Part II of the worksheet below to calculate the amount to enter on line 35 of Form 515.

This is not a refundable credit.

PERSONAL INCOME TAX CREDITS

Enter the total of your personal income tax credits as listed below. Complete and submit Form 502CR with Form 502.

a. Credits for Income Taxes Paid to Other States. This credit is not available for non- resident taxpayers.

b. Credit for Child and Dependent Care Expenses. If you were eligible for a Child and Dependent Care Credit on your feder- al income tax return and your income is below certain thresholds you are entitled to a tax credit equal to a percentage of the federal credit.

c.Quality Teacher Incentive Credit. If you are a Maryland public school teacher who paid tuition to take graduate level courses required to maintain certification, you may be eligible for a tax credit.

d.Credit for Aquaculture Oyster Floats. If you purchased a new aquaculture oyster float during the tax year on or after July 1, 2002, you may be entitled to a credit of up to $500 for the cost of the float.

EARNED INCOME CREDIT, POVERTY LEVEL CREDIT and

REFUNDABLE EARNED INCOME CREDIT WORKSHEET

PART I – Earned Income Credit

1.Maryland tax (from line 33 of Form 515) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.Federal earned income credit _________ x 50% (.50). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.Multiply line 2 by the Maryland income factor ______% (from line 30). Enter this amount here and on line 34 of Form 515. . . .

4.Subtract line 3 from line 1. If less than zero (0) enter zero (0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If line 4 is greater than zero (0), you may qualify for the Poverty Level Credit. Go to Part II.

If line 4 is zero (0), you may qualify for the Refundable Earned Income Credit. Go to Part III.

1._____________

2._____________

3._____________

4._____________

PART II – Poverty Level Credit

If you checked filing status 6 on your Maryland return, you are not eligible for this credit.

POVERTY INCOME

GUIDELINES

1.Enter the amount from line 21, of Form 515. If you checked filing status 3 (married filing separately) and you filed a joint federal return enter your joint federal adjust- ed gross income plus any Maryland additions . . . . . . . . . . . . . . . . . . . . . . . . . .

2.Enter the total of your salary, wages, tips and other employee compensation and net profit from

3.Find the number of exemptions in the chart that is the same as the number of exemptions entered on your federal tax return. Enter the income level that corre- sponds to the exemption number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.Enter the amount from line 1 or 2, whichever is larger. . . . . . . . . . . . . . . . . . . . .

Compare lines 3 and 4. If line 4 is greater than or equal to line 3, STOP HERE. You do not qualify for this credit.

If line 3 is greater than line 4, continue to line 5.

5.Multiply line 2 of Part II by 5% (.05). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.Multiply line 5 by the Maryland income factor _____% (from line 30).

Enter that amount here and on line 35 of Form 515. . . . . . . . . . . . . . . . . . . . . . .

1._____________

2._____________

3._____________

4._____________

5._____________

6._____________

Number of |

|

|

Exemptions |

|

|

on Federal |

Income |

|

Return |

|

Level |

1 |

$ |

8,860 |

2 |

$ |

11,940 |

3 |

$ |

15,020 |

4 |

$ |

18,100 |

5 |

$ |

21,180 |

6 |

$ |

24,260 |

7 |

$ |

27,340 |

8 |

$ |

30,420 |

If you have more than 8 exemptions, add $3,080 to the last income level for each addi- tional exemption.

PART III – Refundable Earned Income Credit

You must have one or more dependents who may be claimed as an exemption to claim this credit.

COMPUTE THIS CREDIT ONLY IF LINE 4 IN PART I IS ZERO.

1.Multiply your federal earned income credit ________ by the Maryland income factor ______% (from line 30). . . . . . . . . . . .

2.Multiply line 1 x 16% (.16) and enter the result. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.Enter your Maryland tax from Part I, line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.Subtract line 3 from line 2. If less than zero (0) enter zero (0). This is your refundable earned income credit. . . . . . . . . . . .

If line 4 is greater than zero, enter the amount on line 51 of Form 515.

1._____________

2._____________

3._____________

4._____________

5

e.

f.Credit for Preservation and Conservation Easements. If you donated an easement to the Maryland Environmental Trust or the Maryland Agricultural Land Preserva- tion Foundation to preserve open space, natural resources, agriculture, forest land, watersheds, significant ecosystems, viewsheds, or historic properties, you may be eligible for a credit.

g.Clean Energy Incentive Credit. If you pur- chased photovoltaic or solar water heat- ing property during the tax year, you may be entitled to a credit for a portion of the costs.

For additional information regarding any of the above personal income tax credits, see the instructions for Form 502CR, Per- sonal Income Tax Credits. Form 502CR

and instructions are available from any office of the Comptroller.

BUSINESS TAX CREDITS

a.Business tax credits (as calculated on Form 500CR) are as follows: Enterprise Zone Tax Credit, Employment Opportuni- ty Tax Credit, Maryland Disability Employ- ment Tax Credit, Job Creation Tax Credit, Neighborhood Partnership Program Tax Credit, Businesses That Create New Jobs Tax Credit, Water Quality Improve- ment Credit, Employer Provided Long- term Care Insurance Credit,

For additional information regarding the above income tax credits, see the instructions provided for Form 500CR- Business Tax Credits. Form 500CR is available from any office of the Comp- troller.

REFUNDABLE EARNED

INCOME CREDIT

If

20

Local income tax and local credits. Maryland counties and Baltimore City may levy an income tax which is a per- centage of Maryland taxable income. Use the LOCAL TAX RATE CHART and the LOCAL TAX WORKSHEET to figure your local income tax. Use the county (or Baltimore City) in which you were employed on the last day of the tax year and which you showed in the box at the top of Form 515.

Local earned income credit. If you calculat- ed an earned income credit on line 34 of Form 515, complete the LOCAL EARNED

INCOME CREDIT WORKSHEET. |

complete the LOCAL |

POVERTY LEVEL |

Local poverty level credit. If you calculated |

CREDIT WORKSHEET. |

|

|

|

|

a poverty level credit on line 35 of Form 515, |

|

|

Example for LOCAL TAX WORKSHEET

A married couple filing a joint return has taxable net income on line 32 of Form 515 in the amount of $57,473.32. They work in Baltimore City and have a local tax rate of .0251.

They will calculate their local tax as follows: |

|

$57,473.32 |

|

|

x .0256 |

|

|

___________ |

before rounding |

|

$ 1,471.3169 |

rounded to the nearest cent |

= |

1,471.32 |

or rounded to the nearest whole dollar |

= |

1,471.00 |

Sample LOCAL TAX WORKSHEET

Multiply the taxable net income by your local tax rate from the LOCAL TAX RATE CHART for the county in which you were employed on the last day of the taxable period. Enter the result on line 40 of Form 515. This is your local income tax.

1. Taxable net income from line 32 of Form 515. . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$57,473.32

2. Local tax rate from the Local Tax Rate Chart. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..0

3. Local income tax (Multiply line 1 by line 2.) Enter this amount on line 40 of Form 515

rounded to the nearest cent or whole dollar. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$1,471.32

LOCAL TAX WORKSHEET

Multiply the taxable net income by your local tax rate from the LOCAL TAX RATE CHART for the county in which you were employed on the last day of the taxable period. Enter the result on line 40 of Form 515. This is your local income tax.

1.Taxable net income from line 32 of Form 515. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_____________

2.Local tax rate from the LOCAL TAX RATE CHART. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 0

3.Local income tax (Multiply line 1 by line 2.) Enter this amount on line 40 of Form 515

rounded to the nearest cent or whole dollar. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$________________

6

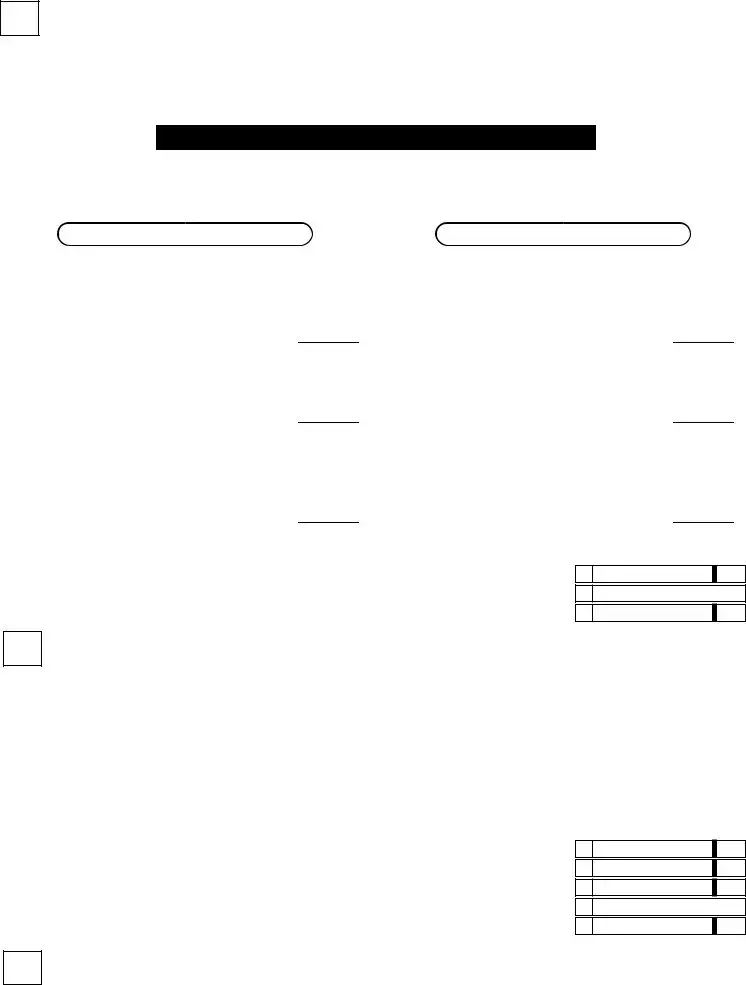

2002 LOCAL TAX RATE CHART

Subdivision |

Rate |

Subdivision |

Rate |

Subdivision |

Rate |

Baltimore City |

.0305 |

Charles County |

.0290 |

Prince George’s County . . . . |

.0310 |

Allegany County |

.0293 |

Dorchester County |

.0262 |

Queen Anne’s County |

.0285 |

Anne Arundel County |

.0256 |

Frederick County |

.0296 |

St. Mary’s County |

.0310 |

Baltimore County |

.0283 |

Garrett County |

.0265 |

Somerset County |

.0315 |

Calvert County |

.0260 |

Harford County |

.0306 |

Talbot County |

.0179 |

Caroline County |

.0263 |

Howard County |

.0245 |

Washington County |

.0280 |

Carroll County |

.0285 |

Kent County |

.0258 |

Wicomico County |

.0310 |

Cecil County |

.0280 |

Montgomery County |

.0295 |

Worcester County |

.0125 |

LOCAL EARNED INCOME CREDIT WORKSHEET

1. |

Enter federal earned income credit from your federal return. |

. . . . . . . . . . . . . . . . . . . . . . . . . . .1._____________ |

|||||||

2. |

Enter your local tax rate |

. . . . . . . . . . . . . . . . . . . . . . . . . . .2.. |

0 |

|

|

|

|

|

|

3. |

Multiply line 2 by 10 and enter on line 4 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .3. |

|

|

|

|

x10 |

||

|

Example: |

.0256 |

Note: In lieu of multiplying by 10 you |

|

|

|

|

s |

|

x 10 |

d may simply move the decimal point one |

|

.256 |

||

|

|

|

place to the right and enter on line 4. |

4. Local earned income credit rate . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4.. |

|

5.Multiply line 1 by line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5._____________

6.Multiply line 5 by the Maryland income factor________% (from line 30). Enter here and

on line 41 of Form 515. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6._____________

LOCAL POVERTY LEVEL CREDIT WORKSHEET

Refer to the STATE POVERTY LEVEL CREDIT WORKSHEET in Instruction 19. If the amount on line 3 of that worksheet is greater than the amount on line 4, you are eligible to claim the local poverty level credit. Complete this worksheet to calculate the amount of your credit.

A. Enter the amount from line 2 of the STATE POVERTY LEVEL CREDIT WORKSHEET. . . . . . . .A._____________

B. Enter your local tax rate from line 2 of the LOCAL TAX WORKSHEET. . . . . . . . . . . . . . . . . . . .B._____________0

C. Multiply line A by line B. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .C._____________