Printable Maryland 746 Template

The Maryland 746 form plays a crucial role in the retirement planning process for individuals who are about to receive payments from the State Retirement Agency. This form serves as an acknowledgment of receipt of the Safe Harbor Tax Notice, which outlines important tax implications related to retirement distributions. Designed to ensure that recipients understand their options, the 746 form requires individuals to confirm that they have received the Safe Harbor Tax Notice, had the opportunity to discuss it with financial advisors, and made an informed decision regarding direct rollovers. Notably, the form allows for distributions to be processed before the standard 30-day waiting period, provided the recipient has signed the form. This flexibility can be beneficial for those who need timely access to their funds. Additionally, the form emphasizes the importance of understanding the choices available, including the option to roll over funds into a traditional IRA or an eligible employer plan. For any questions or clarifications, the State Retirement Agency encourages individuals to reach out to a retirement benefits counselor, ensuring that assistance is readily available to navigate this important aspect of retirement planning.

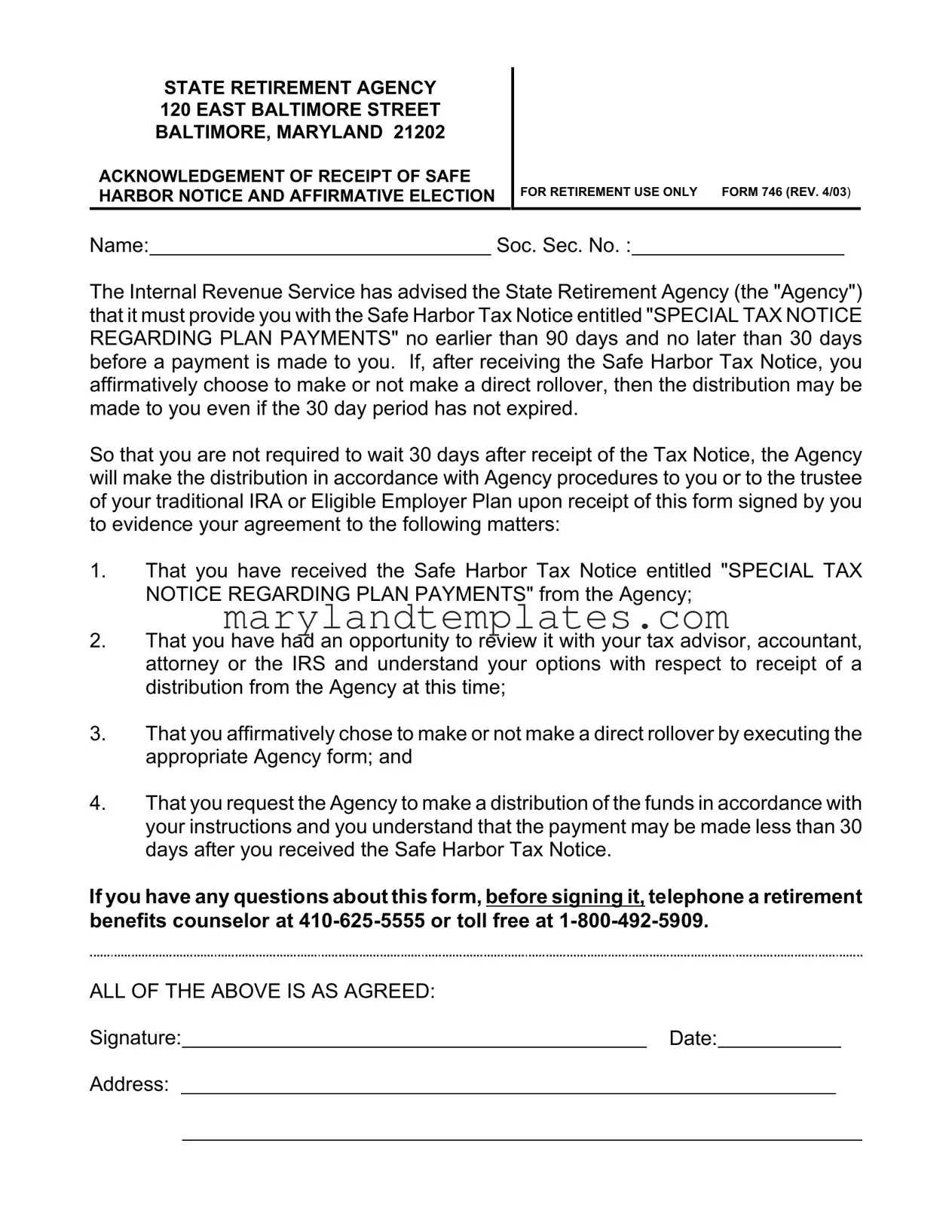

Maryland 746 Preview

STATE RETIREMENT AGENCY 120 EAST BALTIMORE STREET BALTIMORE, MARYLAND 21202

ACKNOWLEDGEMENT OF RECEIPT OF SAFE HARBOR NOTICE AND AFFIRMATIVE ELECTION

FOR RETIREMENT USE ONLY FORM 746 (REV. 4/03)

Name: |

|

Soc. Sec. No. : |

The Internal Revenue Service has advised the State Retirement Agency (the "Agency") that it must provide you with the Safe Harbor Tax Notice entitled "SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS" no earlier than 90 days and no later than 30 days before a payment is made to you. If, after receiving the Safe Harbor Tax Notice, you affirmatively choose to make or not make a direct rollover, then the distribution may be made to you even if the 30 day period has not expired.

So that you are not required to wait 30 days after receipt of the Tax Notice, the Agency will make the distribution in accordance with Agency procedures to you or to the trustee of your traditional IRA or Eligible Employer Plan upon receipt of this form signed by you to evidence your agreement to the following matters:

1.That you have received the Safe Harbor Tax Notice entitled "SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS" from the Agency;

2.That you have had an opportunity to review it with your tax advisor, accountant, attorney or the IRS and understand your options with respect to receipt of a distribution from the Agency at this time;

3.That you affirmatively chose to make or not make a direct rollover by executing the appropriate Agency form; and

4.That you request the Agency to make a distribution of the funds in accordance with your instructions and you understand that the payment may be made less than 30 days after you received the Safe Harbor Tax Notice.

If you have any questions about this form, before signing it, telephone a retirement benefits counselor at

ALL OF THE ABOVE IS AS AGREED:

Signature:Date:

Address:

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of Form | The Maryland 746 form is used to acknowledge receipt of the Safe Harbor Tax Notice and to affirmatively elect options regarding retirement distributions. |

| Governing Law | This form is governed by IRS regulations and Maryland state laws regarding retirement plan distributions. |

| Distribution Timing | Distributions can be made as soon as the form is signed, even if the 30-day review period has not expired, provided the recipient has received the Safe Harbor Tax Notice. |

| Review Opportunity | Recipients are encouraged to review the Safe Harbor Tax Notice with a tax advisor or legal professional to understand their options before signing the form. |

| Contact Information | If there are any questions regarding the form, individuals can contact a retirement benefits counselor at 410-625-5555 or toll-free at 1-800-492-5909. |

Other PDF Forms

Police Polygraph - Submission to the polygraph test is voluntary but necessary for progressing in the employment process with the Maryland State Police.

For parents looking to ensure their child's wellbeing in unforeseen circumstances, the Power of Attorney for a Child document acts as a crucial legal tool, allowing trusted individuals to make important decisions on behalf of the child when parents are unavailable.

Affidavit of Domestic Partnership Maryland - Document that clarifies the process and requirements for domestic partners in Maryland to be recognized and benefit from shared coverage.