Printable Maryland Domestic Partnership Template

The Maryland Domestic Partnership form serves as a critical document for individuals seeking to establish and formalize their domestic partnership status, particularly in relation to health benefits and dependent coverage. This form requires both partners to certify their commitment to each other, affirming that they meet specific criteria, such as being at least 18 years old, not being related by blood or marriage within four degrees, and maintaining a shared primary residence. Additionally, the partners must demonstrate financial interdependence through various means, including joint ownership of property or shared financial accounts. The form also includes sections for adding dependents, allowing for the inclusion of children under certain conditions, such as biological or adopted relationships. Furthermore, it addresses tax implications, detailing criteria under which a domestic partner may qualify as an eligible tax dependent. Completing this form accurately is essential, as any false statements can lead to severe consequences, including legal action and termination of benefits. Therefore, understanding the intricacies of the Maryland Domestic Partnership form is vital for those looking to secure their rights and responsibilities within this legal framework.

Maryland Domestic Partnership Preview

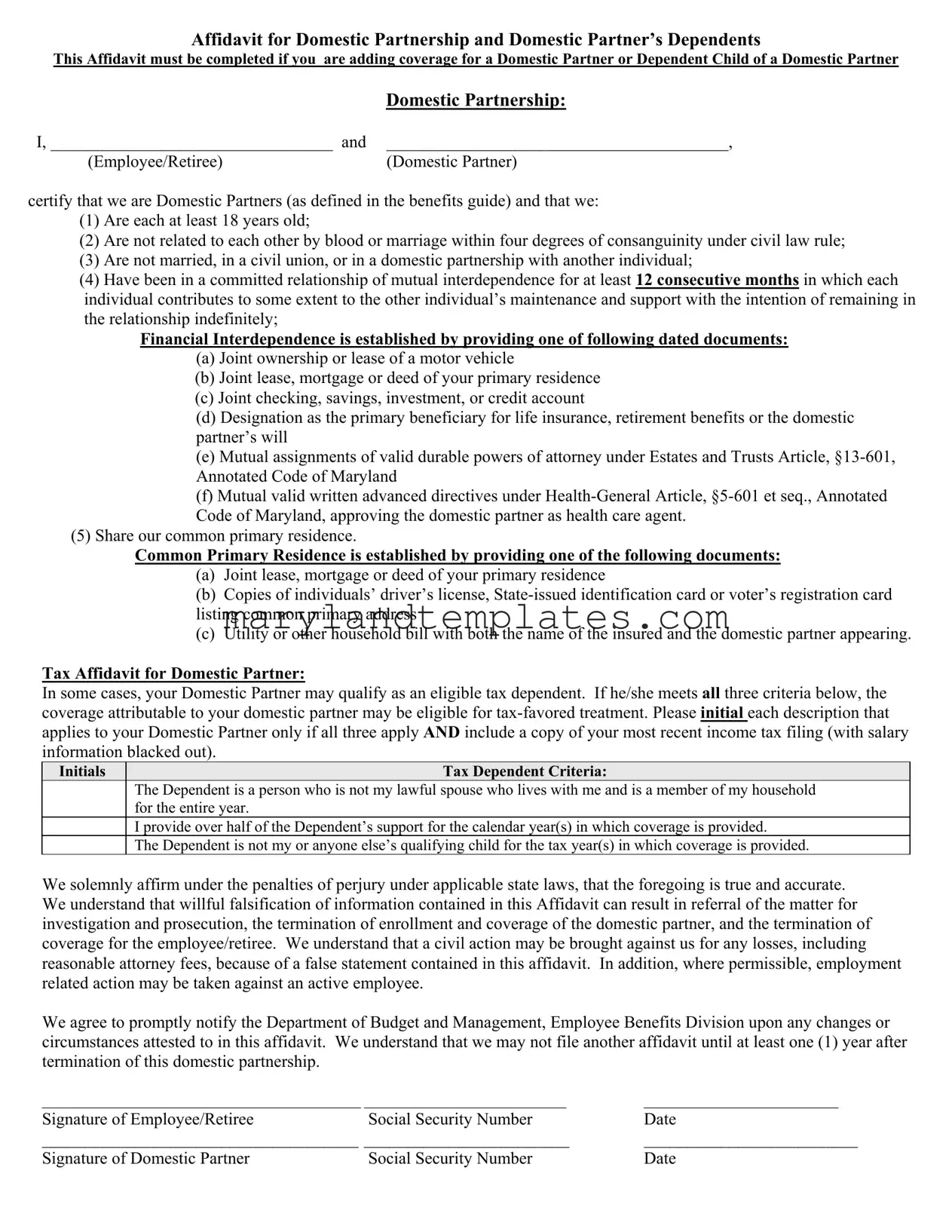

Affidavit for Domestic Partnership and Domestic Partner’s Dependents

This Affidavit must be completed if you are adding coverage for a Domestic Partner or Dependent Child of a Domestic Partner

|

Domestic Partnership: |

I, _________________________________ and |

________________________________________, |

(Employee/Retiree) |

(Domestic Partner) |

certify that we are Domestic Partners (as defined in the benefits guide) and that we:

(1)Are each at least 18 years old;

(2)Are not related to each other by blood or marriage within four degrees of consanguinity under civil law rule;

(3)Are not married, in a civil union, or in a domestic partnership with another individual;

(4)Have been in a committed relationship of mutual interdependence for at least 12 consecutive months in which each individual contributes to some extent to the other individual’s maintenance and support with the intention of remaining in the relationship indefinitely;

Financial Interdependence is established by providing one of following dated documents:

(a)Joint ownership or lease of a motor vehicle

(b)Joint lease, mortgage or deed of your primary residence

(c)Joint checking, savings, investment, or credit account

(d)Designation as the primary beneficiary for life insurance, retirement benefits or the domestic partner’s will

(e)Mutual assignments of valid durable powers of attorney under Estates and Trusts Article,

(f)Mutual valid written advanced directives under

(5)Share our common primary residence.

Common Primary Residence is established by providing one of the following documents:

(a)Joint lease, mortgage or deed of your primary residence

(b)Copies of individuals’ driver’s license,

(c)Utility or other household bill with both the name of the insured and the domestic partner appearing.

Tax Affidavit for Domestic Partner:

In some cases, your Domestic Partner may qualify as an eligible tax dependent. If he/she meets all three criteria below, the coverage attributable to your domestic partner may be eligible for

Initials |

Tax Dependent Criteria: |

|

The Dependent is a person who is not my lawful spouse who lives with me and is a member of my household |

|

for the entire year. |

|

I provide over half of the Dependent’s support for the calendar year(s) in which coverage is provided. |

|

The Dependent is not my or anyone else’s qualifying child for the tax year(s) in which coverage is provided. |

We solemnly affirm under the penalties of perjury under applicable state laws, that the foregoing is true and accurate. We understand that willful falsification of information contained in this Affidavit can result in referral of the matter for investigation and prosecution, the termination of enrollment and coverage of the domestic partner, and the termination of coverage for the employee/retiree. We understand that a civil action may be brought against us for any losses, including reasonable attorney fees, because of a false statement contained in this affidavit. In addition, where permissible, employment related action may be taken against an active employee.

We agree to promptly notify the Department of Budget and Management, Employee Benefits Division upon any changes or circumstances attested to in this affidavit. We understand that we may not file another affidavit until at least one (1) year after termination of this domestic partnership.

_________________________________________ __________________________ |

_________________________ |

Signature of Employee/Retiree |

Social Security Number |

Date |

_____________________________________ ________________________ |

_________________________ |

|

Signature of Domestic Partner |

Social Security Number |

Date |

Dependent Tax Affidavit for Domestic Partner’s Dependents:

Name of Employee/Retiree: ________________________________ Social Security Number: __________________________

Name of Domestic Partner’s Dependent: _____________________________________________________________________

Dependent’s Date of Birth: ______________________Social Security Number: ______________________________________

Part A: Dependent Relationship, Marital Status, and Age/Capability Requirements

A. Initial the box for the correct dependent relationship for your domestic partner’s dependent listed above. If none apply, this person is NOT eligible to be added to your health benefits coverage.

Initials |

|

Dependent Relationship |

Required Documentation |

|

Biological Child of Domestic Partner |

- Copy of Child’s Official State Birth Certificate |

|

|

|

|

|

|

Adopted Child or child placed with domestic partner for adoption |

- Copy of Adoption papers indicating child’s date of birth |

|

|

by the Domestic Partner |

- For pending adoptions – see Benefits Guide |

|

|

|

|

|

|

- Copy of Child’s Official State Birth Certificate |

||

|

|

|

- Copy of domestic partner’s Official State Marriage Certificate from |

|

|

|

previous marriage |

|

Grandchild of Domestic Partner |

- Copy of Child’s Official State Birth Certificate |

|

|

|

|

- Copy of Child’s Parent’s Official State Birth Certificate (to show |

|

|

|

relationship to domestic partner) |

|

Legal Ward of Domestic Partner (permanently resides with my |

- Copy of Child’s Official State Birth Certificate |

|

|

domestic partner and my domestic partner is his/her testamentary |

- Proof of Residency (Valid Driver’s License, or |

|

|

or court appointed |

guardian for a |

Identification Card, school records or day care records certifying |

|

not less than 12 months.) |

dependent’s address, Tax Documents listing child’s name certifying |

|

|

|

|

address.) |

|

|

|

- Copy of Legal Ward/Testamentary Court |

|

|

|

Document, signed by a Judge. |

|

Other Child Relative (includes |

- Copy of Child’s Official State Birth Certificate |

|

|

Partner - dependent is related to my domestic partner by blood, |

- Proof of Residency (Valid Driver’s License, or |

|

|

permanently resides with my domestic partner, and my domestic |

Identification Card, school records or day care records certifying |

|

|

partner provides his/her sole support. |

dependent’s address, Tax Documents listing child’s name certifying |

|

|

|

|

address.) |

|

|

|

- Signature of Sole Support Affirmation (see below) |

B. Initial the box below, if the Dependent is NOT married. If this person is married, he/she is NOT eligible for State employee/retiree health benefits coverage.

The Dependent is NOT married

C. Initial the box by the statement that describes the Dependent. If neither statement accurately describes this Dependent, this person is not eligible for State employee/retiree health benefits coverage.

The Dependent is under the age of 25.

The Dependent is any age and is incapable of

Sole Support Affirmation for Other Child Relative Dependent ONLY:

I certify by my signature below that the dependent child listed on this form is supported solely by me and/or my domestic partner.

___________________________________________ |

_____________________ |

Domestic Partner’s Signature |

Date |

Part B: Tax Criteria:

In some cases, the dependent of your Domestic Partner may qualify as your eligible tax dependent. If he/she meets all four criteria for the Qualifying Child Test or all three criteria for the Qualifying Relative Test on the following page the coverage attributable to your domestic partner’s dependent may be eligible for

Initials |

Qualifying Child Test Criteria – must meet all four criteria |

|

The child is my biological child or adopted child (or placed for adoption by me), my legal ward or child placed with me |

|

under court order (not temporary for less then 12 months), sibling, or descendent of my child or sibling (i.e. grandchild, |

|

niece, nephew, etc); and |

The child lives with me for more than half of the year (more than six months) or is my biological or adopted child and meets the following residence exceptions:

-The child received over half of the child’s support during the calendar year from the child’s parents, who (1) are divorced or legally separated under a decree of divorce or separate maintenance, or (2) are separated under a written separation agreement, or (3) live apart at all times during the last six months of the calendar year; and

-The child is in the custody of one or both of the child’s parents for more than half of the calendar year; and

-

The Child (1) has not attained age 19 as of the close of the calendar year(s) in which coverage is provided, or (2) is a full- time student for at least five months of the calendar year who has not attained age 24 as of the end of the calendar year(s) in which coverage is provided, or (3) is permanently and totally disabled; and

|

The child has not provided more than half of the child’s own support for the calendar year(s) in which coverage is provided. |

|

|

|

|

|

||

|

|

|

Initials |

Qualifying Relative Test Criteria – must meet all three criteria |

|

|

The Dependent has a specified relationship to me: my biological child, my adopted child (or placed for adoption by me), |

|

|

my |

|

|

me and is a member of my household for the entire year (this includes a legal ward); and |

|

|

|

|

|

I provide over half of the Dependent's support for the calendar year(s) in which coverage is provided; and |

|

|

|

|

|

The Dependent is not my or anyone else's qualifying child for the tax year(s) in which coverage is provided. If this child meets |

|

|

criteria for the Qualifying Child Test, this statement is not true. |

|

We solemnly affirm under the penalties of perjury under applicable state laws, that the foregoing is true and accurate.

We understand that willful falsification of information contained in this Affidavit will result in our termination of enrollment. We understand that a civil action may be brought against us for any losses, including reasonable attorney fees, because of a false statement contained in this affidavit.

_________________________________________ |

_________________________ |

Signature of Employee/Retiree |

Date |

_________________________________________ |

_________________________ |

Signature of Domestic Partner |

Date |

Rev 9/1/09 |

|

Form Attributes

| Fact Name | Details |

|---|---|

| Eligibility Age | Both partners must be at least 18 years old to qualify for a domestic partnership in Maryland. |

| Relationship Restrictions | Partners cannot be related by blood or marriage within four degrees of consanguinity. |

| Previous Partnerships | Neither partner can be married, in a civil union, or in another domestic partnership. |

| Duration of Relationship | A committed relationship must last for at least 12 consecutive months. |

| Financial Interdependence | Proof of financial interdependence can include joint accounts or shared ownership of property. |

| Common Residence | Partners must share a common primary residence, verified by specific documentation. |

| Tax Dependent Criteria | A domestic partner may qualify as a tax dependent if specific criteria are met, including support requirements. |

| Legal Compliance | Falsifying information on the affidavit can lead to legal consequences, including termination of coverage. |

Other PDF Forms

Maryland Medicaid Income Limits - Applicants must provide detailed patient demographics, including name, DOB, and social security number.

When entering into a transaction involving the sale of a vehicle, it is crucial to use the proper documentation to facilitate ownership transfer. The Washington Motor Vehicle Bill of Sale not only serves as proof of the transaction but also protects both the buyer and seller. For those looking to simplify this process, you can find the necessary form at WA Documents, ensuring that all pertinent information is included and accurately recorded.

Maryland State Compliance Application - Compliance with the outlined regulations is essential not just for licensure but for maintaining high standards of laboratory practice.