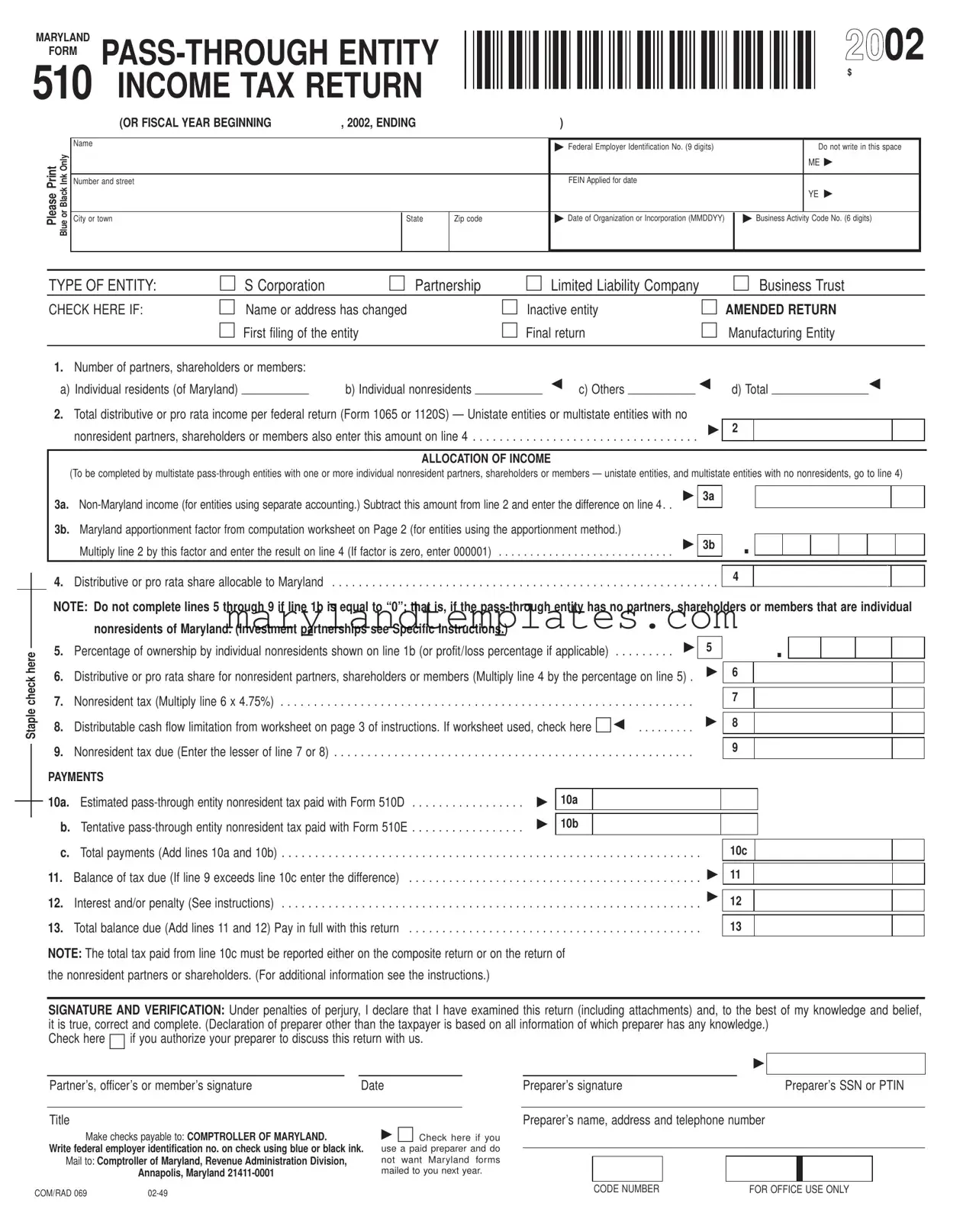

Printable Maryland Frorm 510 Template

The Maryland Form 510 is a crucial document for pass-through entities, including S Corporations, partnerships, and limited liability companies. This form allows these entities to report their income, deductions, and tax liabilities to the state of Maryland. It is specifically designed for those entities with nonresident partners, shareholders, or members, ensuring that they comply with Maryland tax regulations. Key components of the form include the identification of the entity, the calculation of distributive or pro rata income, and the allocation of income between Maryland and non-Maryland sources. Additionally, the form requires entities to detail their ownership structure, providing information on individual residents and nonresidents. The Maryland Form 510 also includes sections for calculating nonresident tax, reporting payments, and declaring any penalties or interest due. Completing this form accurately is essential for maintaining compliance and avoiding potential penalties, making it an important responsibility for pass-through entities operating in the state.

Maryland Frorm 510 Preview

MARYLAND

FORM

2002

$

|

(OR FISCAL YEAR BEGINNING |

, 2002, ENDING |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

▶ Federal Employer Identification No. (9 digits) |

|

Do not write in this space |

|

|

|

|

|

|

|

|

||

PrintPlease InkBlackorBlueOnly |

|

|

|

|

|

|

ME ▶ |

|

|

|

|

|

|

|

|

|

|

Number and street |

|

|

|

FEIN Applied for date |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

YE ▶ |

|

|

|

|

|

|

|

|

|

|

|

City or town |

|

State |

Zip code |

▶ Date of Organization or Incorporation (MMDDYY) |

▶ Business Activity Code No. (6 digits) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Staple check here

TYPE OF ENTITY: |

☐ S Corporation |

☐ Partnership |

☐ Limited Liability Company |

☐ Business Trust |

CHECK HERE IF: |

☐ Name or address has changed |

☐ Inactive entity |

☐ AMENDED RETURN |

|

|

☐ First filing of the entity |

☐ Final return |

☐ Manufacturing Entity |

|

|

|

|

|

|

1. Number of partners, shareholders or members: |

|

|

|

|

a) Individual residents (of Maryland) ___________ |

b) Individual nonresidents ___________ ◀ c) Others ___________ ◀ d) Total ________________◀ |

|||

2.Total distributive or pro rata income per federal return (Form 1065 or 1120S) Ñ Unistate entities or multistate entities with no

▶ 2 nonresident partners, shareholders or members also enter this amount on line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ALLOCATION OF INCOME |

|

|

|

(To be completed by multistate |

|||

|

▶ |

3a |

|

3a. |

|

|

|

3b. Maryland apportionment factor from computation worksheet on Page 2 (for entities using the apportionment method.) |

|

|

|

|

▶ |

3b |

|

Multiply line 2 by this factor and enter the result on line 4 (If factor is zero, enter 000001) |

|

|

. |

|

|

|

4 |

4. Distributive or pro rata share allocable to Maryland |

. . . |

. . . . . |

. |

NOTE: Do not complete lines 5 through 9 if line 1b is equal to “0”; that is, if the

|

|

|

|

|

|

|

|

5 |

|

. |

|

|

|

|

5. |

Percentage of ownership by individual nonresidents shown on line 1b (or profit/loss percentage if applicable) |

▶ |

|

|

|

|

|

|

||||||

. . . |

|

|

|

|

|

|

|

|||||||

6. |

Distributive or pro rata share for nonresident partners, shareholders or members (Multiply line 4 by the percentage on line 5) . |

|

▶ |

6 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Nonresident tax (Multiply line 6 x 4.75%) |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

. . . |

. |

. . . . . |

. . . . . . . . . . . . |

. . . |

|

|

|

|

|

|

|

|

||

8. |

Distributable cash flow limitation from worksheet on page 3 of instructions. If worksheet used, check here ☐ ◀ |

|

|

▶ |

8 |

|

|

|

|

|

||||

. . . |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Nonresident tax due (Enter the lesser of line 7 or 8) |

|

|

|

|

|

|

|

9 |

|

|

|

|

|

. . . |

|

. . . . . |

. . . . . . . . . . . . |

. . . |

|

|

|

|

|

|

|

|

||

PAYMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10a. |

Estimated |

▶ |

|

10a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. |

Tentative |

▶ |

|

10b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Total payments (Add lines 10a and 10b) |

. . . |

|

. . . . . . |

. . . . . . . . . . . . |

. . . |

. |

10c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Balance of tax due (If line 9 exceeds line 10c enter the difference) |

. . . |

|

. . . . . . |

. . . . . . . . . . . . |

. . . |

. |

▶ |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Interest and/or penalty (See instructions) |

|

|

|

|

|

|

▶ |

12 |

|

|

|

|

|

. . . |

|

. . . . . . |

. . . . . . . . . . . . |

. . . |

. |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Total balance due (Add lines 11 and 12) Pay in full with this return |

. . . |

|

. . . . . . |

. . . . . . . . . . . . |

. . . |

. |

13 |

|

|

|

|

|

|

NOTE: The total tax paid from line 10c must be reported either on the composite return or on the return of |

|

|

|

|

|

|

|

|

|

|||||

the nonresident partners or shareholders. (For additional information see the instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE AND VERIFICATION: Under penalties of perjury, I declare that I have examined this return (including attachments) and, to the best of my knowledge and belief, it is true, correct and complete. (Declaration of preparer other than the taxpayer is based on all information of which preparer has any knowledge.)

Check here ☐ if you authorize your preparer to discuss this return with us.

|

PartnerÕs, officerÕs or memberÕs signature |

Date |

|||

|

|

|

|

|

|

|

Title |

|

|

▶ ☐ Check here if you |

|

|

Make checks payable to: COMPTROLLER OF MARYLAND. |

|

|||

|

Write federal employer identification no. on check using blue or black ink. |

use a paid preparer and do |

|||

|

Mail to: Comptroller of Maryland, Revenue Administration Division, |

|

not want Maryland forms |

||

|

|

Annapolis, Maryland |

|

mailed to you next year. |

|

COM/RAD 069 |

|

|

|

||

|

|

|

|

◀ |

|

|

|

|

|

|

|

|

|

|

|

|

|

PreparerÕs signature |

|

PreparerÕs SSN or PTIN |

||||||

|

|

|

|

|

|

|

|

|

PreparerÕs name, address and telephone number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CODE NUMBER |

FOR OFFICE USE ONLY |

||||||

MARYLAND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 510 |

INCOME TAX RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

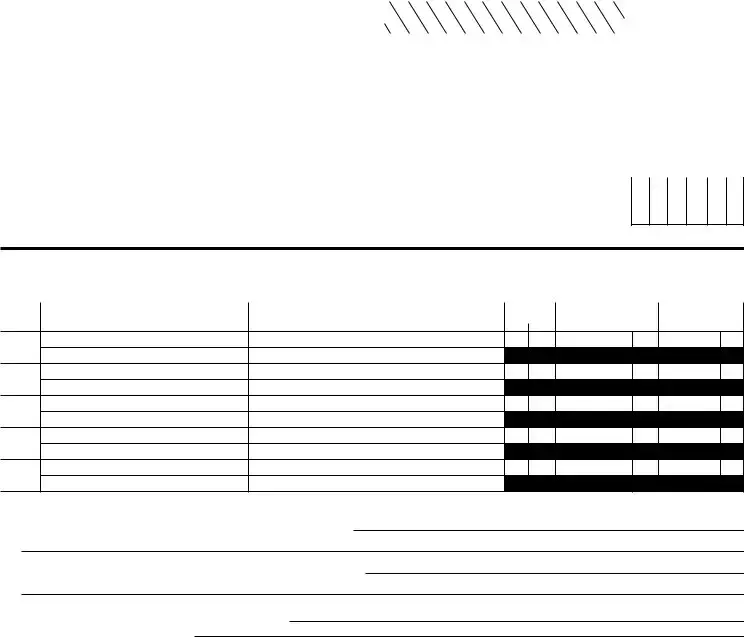

COMPUTATION OF APPORTIONMENT FACTOR |

|

|

|

|

|

|

|

|

Column 1 |

|

|

|

|

|

|

|

|

|

Column 2 |

|

|

|

|

|

|

|

Column 3 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

TOTALS |

|

DECIMAL FACTOR |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(Applies only to multistate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

WITHIN |

|

|

|

|

|

WITHIN AND |

|

|

|

Column 1 Ö Column 2 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

NOTE: Special apportionment formulas are required for rental/leasing, transportation and |

|

|

|

|

|

|

MARYLAND |

|

|

|

|

|

|

|

|

WITHOUT |

( rounded to six places ) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

manufacturing companies. Multistate manufacturers with more than 25 employees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARYLAND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

must complete Form 500MC. See Instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1A. Receipts |

a. Gross receipts or sales less returns and allowances . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

b. Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

c. Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

d. Gross rents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

e. Gross royalties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

f. Capital gain net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

g. Other income (Attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1B. Receipts |

h. Total receipts (Add lines 1A(a) through 1A(g), for Columns 1 and 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

(Enter the same factor shown on line 1A, Column 3 Ð Disregard this line if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. Property |

special apportionment formula used.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

a. Inventory |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

b. Machinery and equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

c. Buildings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

d. Land |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

e. Other tangible assets (Attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

f. Rent expense capitalized (multiplied by eight) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. Payroll |

g. Total property (Add lines 2a through 2f, for Columns 1 and 2) . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

a. Compensation of officers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

b. Other salaries and wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

c. Total payroll (Add lines 3a and 3b, for Columns 1 and 2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

4. Total of factors (Add entries in Column 3) |

. |

. |

|

. |

. |

. |

. |

|

. |

. |

|

. |

. |

. |

. . |

|

. |

. |

. |

|

. |

. |

|

. |

. |

. |

. |

|

. |

. |

. |

. |

. |

. |

|

. |

. |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

5.Maryland apportionment factor (Divide line 4 by four for

PARTNERS’, SHAREHOLDERS’ OR MEMBERS’ INFORMATION (Attach continuing schedule in same format if there are more than five partners, shareholders or members)

Name and social security number or federal |

Address |

Check here |

Distributive or |

Distributive or |

employer identification number |

|

if Maryland: |

pro rata share of income |

pro rata share of tax paid |

|

Non- |

(See Instructions) |

(See Instructions) |

|

|

|

Resident resident |

|

|

1

2

3

4

5

ADDITIONAL INFORMATION REQUIRED (Attach a separate schedule if more space is necessary)

1.Address of principal place of business (if other than indicated on page 1):

2.Address at which tax records are located (if other than indicated on page 1):

3.Telephone number of

4.State of organization or incorporation:

5.Has the Internal Revenue Service made adjustments (for a tax year in which a Maryland return was required) that were not previously reported

to the Maryland Revenue Administration Division? |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ☐ Yes |

☐ No |

|

If Òyes,Ó indicate tax year(s) here: |

|

and submit an amended return(s) together with a copy of the IRS adjustment report(s) |

|

under separate cover. |

|

|

|

6. Did the |

☐ No |

||

COM/RAD 069 |

Form Attributes

| Fact Name | Fact Description |

|---|---|

| Purpose | The Maryland Form 510 is used for reporting income tax for pass-through entities such as partnerships, S corporations, and LLCs. |

| Filing Requirement | Entities must file Form 510 if they have nonresident partners, shareholders, or members. |

| Tax Rate | The nonresident tax rate is set at 4.75% of the distributive or pro rata share of income allocated to Maryland. |

| Governing Law | This form is governed by the Maryland Tax-General Article, Section 10-402. |

| Deadline | The form is typically due on the 15th day of the fourth month following the end of the entity's tax year. |

| Amended Returns | Entities can file an amended return if they need to correct information reported on a previously filed Form 510. |

| Payment Instructions | Payments should be made to the Comptroller of Maryland, and checks must include the entity's federal employer identification number. |

| Signature Requirement | The form must be signed by a partner, officer, or member of the entity to verify its accuracy. |

Other PDF Forms

Maryland Nonresident Income Tax - Form 505NR addresses the taxation of nonresident military personnel’s income, ensuring those serving from out-of-state are fairly taxed.

Maryland Rtc 60 - Senior citizens and fully disabled renters in Maryland could be eligible for a rent relief credit, aimed at reducing the financial burden.

When buying or selling a vehicle in Texas, it is crucial to utilize the Texas Motor Vehicle Bill of Sale form to document the transaction properly. This form not only validates the sale but also protects both parties involved by clearly outlining the details of the vehicle and the agreement. For more information and to fill out the necessary document, visit texasdocuments.net/printable-motor-vehicle-bill-of-sale-form.

Md Form 505 - This form is for nonresidents of Maryland who need to file a state income tax return for the year 2005.