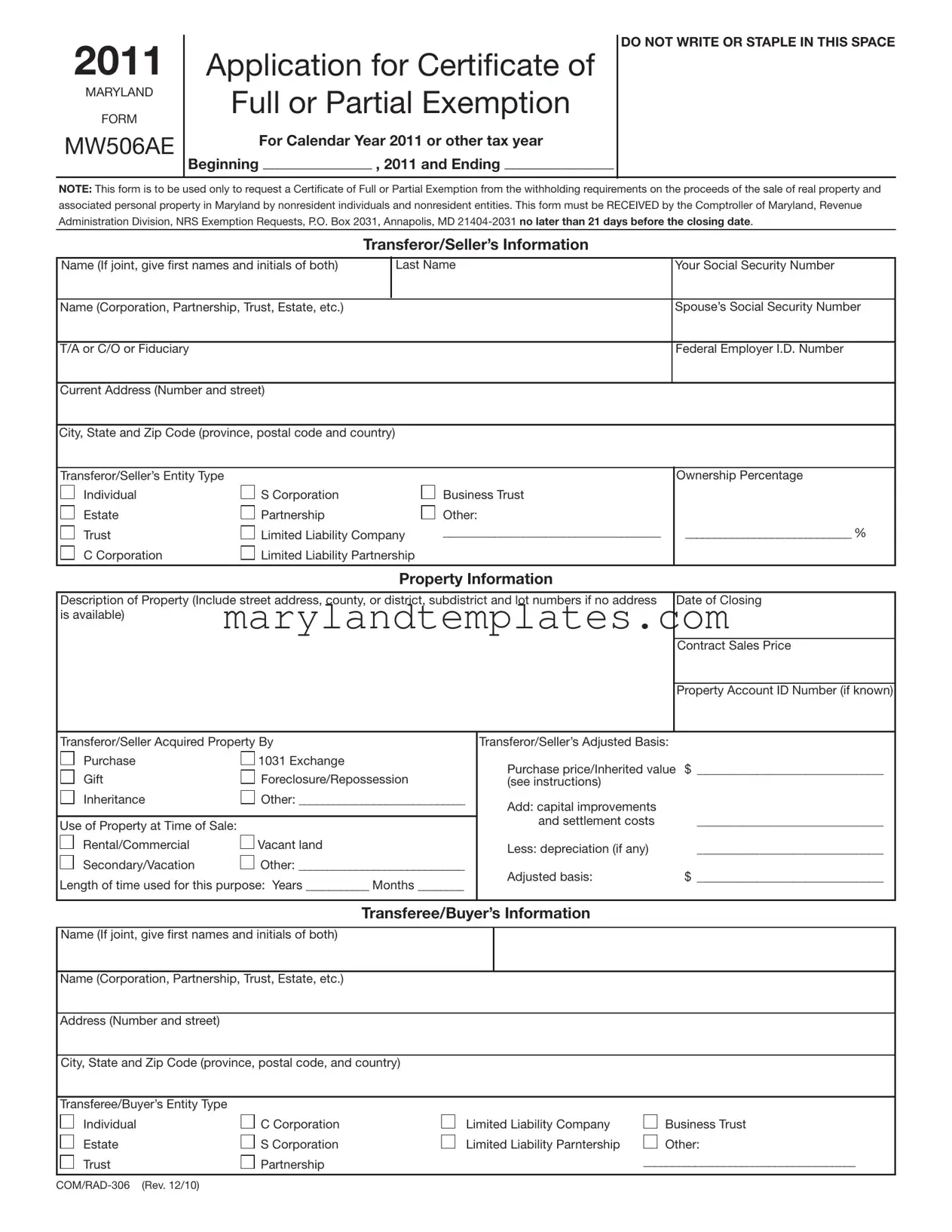

Printable Maryland Mw506Ae Template

The Maryland MW506AE form serves a crucial role for nonresident individuals and entities involved in the sale of real property within the state. Designed specifically for those seeking a Certificate of Full or Partial Exemption from withholding requirements, this form is essential for ensuring compliance with Maryland tax laws. The application must be submitted to the Comptroller of Maryland at least 21 days prior to the closing date of the transaction. The MW506AE requires detailed information about both the transferor/seller and the property being sold, including the sales price, adjusted basis, and the reason for the exemption. Common reasons for exemption include the sale of a principal residence, tax-free exchanges, or situations where the seller receives no proceeds. Completing this form accurately is vital, as it not only determines the withholding tax amount but also affects the overall tax obligations of the seller. Whether you are an individual, a corporation, or a partnership, understanding the MW506AE can help streamline your property sale process while ensuring that you meet all necessary tax requirements.

Maryland Mw506Ae Preview

2011

MARYLAND

FORM

MW506AE

Application for Certificate of

Full or Partial Exemption

For Calendar Year 2011 or other tax year

Beginning ________________ , 2011 and Ending ________________

DO NOT WRITE OR STAPLE IN THIS SPACE

NOTE: This form is to be used only to request a Certificate of Full or Partial Exemption from the withholding requirements on the proceeds of the sale of real property and associated personal property in Maryland by nonresident individuals and nonresident entities. This form must be RECEIVED by the Comptroller of Maryland, Revenue Administration Division, NRS Exemption Requests, P.O. Box 2031, Annapolis, MD

Transferor/Seller’s Information

Name (If joint, give first names and initials of both) |

|

Last Name |

|

|

|

|

Your Social Security Number |

||

|

|

|

|

|

|

|

|

|

|

Name (Corporation, Partnership, Trust, Estate, etc.) |

|

|

|

|

|

|

|

Spouse’s Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

T/A or C/O or Fiduciary |

|

|

|

|

|

|

|

|

Federal Employer I.D. Number |

|

|

|

|

|

|

|

|

|

|

Current Address (Number and street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City, State and Zip Code (province, postal code and country) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Transferor/Seller’s Entity Type |

|

|

|

|

|

|

|

|

Ownership Percentage |

Individual |

S Corporation |

|

|

Business Trust |

|

|

|||

Estate |

Partnership |

|

|

Other: |

|

|

|||

Trust |

Limited Liability Company |

______________________________________ |

|

_____________________________ % |

|||||

C Corporation |

Limited Liability Partnership |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

Property Information |

|

|

||||

|

|

|

|

|

|||||

Description of Property (Include street address, county, or district, subdistrict and lot numbers if no address |

|

Date of Closing |

|||||||

is available) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract Sales Price |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Account ID Number (if known) |

|

|

|

|

|

|

|

|

||

Transferor/Seller Acquired Property By |

|

|

|

|

Transferor/Seller’s Adjusted Basis: |

||||

Purchase |

1031 Exchange |

|

|

|

|

|

Purchase price/Inherited value $ ______________________________ |

||

Gift |

Foreclosure/Repossession |

|

|

|

|||||

|

|

|

(see instructions) |

|

|

||||

Inheritance |

Other: _____________________________ |

|

|

Add: capital improvements |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and settlement costs |

______________________________ |

|

Use of Property at Time of Sale: |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Rental/Commercial |

Vacant land |

|

|

|

|

|

Less: depreciation (if any) |

______________________________ |

|

|

|

|

|

|

|

|

|||

Secondary/Vacation |

Other: _____________________________ |

|

|

Adjusted basis: |

$ ______________________________ |

||||

Length of time used for this purpose: Years ___________ Months ________ |

|

|

|||||||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||

|

|

Transferee/Buyer’s Information |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Name (If joint, give first names and initials of both) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (Corporation, Partnership, Trust, Estate, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Number and street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City, State and Zip Code (province, postal code, and country) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Transferee/Buyer’s Entity Type |

|

|

|

|

|

|

|

|

|

Individual |

C Corporation |

|

|

|

Limited Liability Company |

Business Trust |

|||

Estate |

S Corporation |

|

|

|

Limited Liability Parntership |

Other: |

|||

Trust |

Partnership |

|

|

|

_____________________________________ |

||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

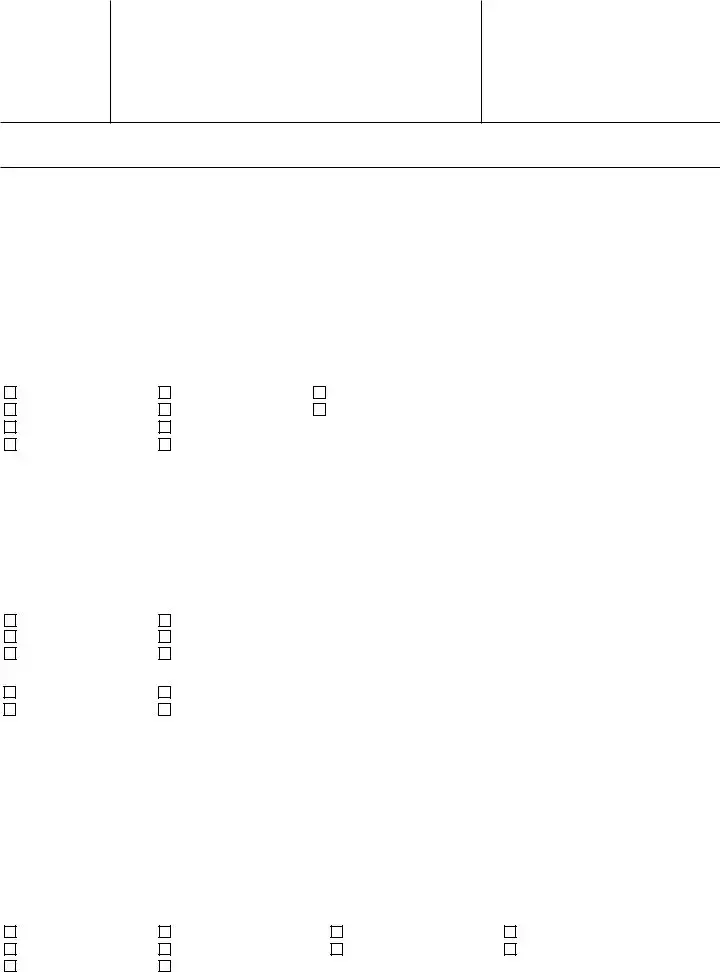

MARYLAND FORM |

Application for Certificate of Full or Partial Exemption |

2011 |

|

MW506AE |

|||

Page 2 |

Transferor/Seller’s Name

Your Social Security Number/FEIN

Reason for Full or Partial Exemption from Withholding

(Attach documentation and calculation)

1.☐ Transfer is of a principal residence as defined in IRC §121.

2.☐ Transfer is a

☐simultaneous without boot,

☐simultaneous with boot, or

☐delayed, with funds in escrow for acquiring replacement property.

3.☐ Transfer is pursuant to an installment sale under IRC §453 and the transferor/seller will receive less than the full purchase price during the taxable year.

4.☐ Transfer of inherited property is occurring within 6 months of date of death.

5.☐ Transferor/Seller is receiving zero proceeds from this transaction.

6.☐ Transfer is pursuant to a transaction under a specific section of the Internal Revenue Code or other code. Place code letter for your transaction in the box below. (See instructions for detailed descriptions):

☐

7. ☐ Other. Provide a brief explanation in the space provided:

Calculation of Tax to be Withheld

1. |

Enter the amount subject to tax witholding. Subtract adjusted basis from contract sales price |

|

2. |

Enter tax rate, whichever applies. |

|

|

a. If you are a business entity, enter 8.25% |

........................................................... ....................................... |

|

|

|

|

b. If you are an individual, enter 6.75% |

........................................................... |

|

|

|

3. |

Amount of tax to be withheld at closing. Line 1 multiplied by line 2. (This line MUST be completed.) |

|

1

2

3

Please

Sign

Here

Under the penalties of perjury, I declare that I have examined this application, including any schedules or statements attached, and to the best of my knowledge and belief, it is true, correct and complete. If prepared by a person other than taxpayer, the declaration is based on all information of which the preparer has any knowledge.

_____________________________________________ |

___________________________ |

___________________________ |

Signature |

Applicant’s phone number |

Date |

_____________________________________________ |

___________________________ |

___________________________ |

Signature |

Applicant’s phone number |

Date |

_____________________________________________ |

___________________________ |

___________________________ |

Signature |

Applicant’s phone number |

Date |

(Rev. 12/10)

MARYLAND FORM |

INSTRUCTIONS FOR APPLICATION FOR |

2011 |

|

MW506AE |

|||

CERTIFICATE OF FULL OR PARTIAL EXEMPTION |

|||

|

|

The Comptroller’s decision to issue or deny a certificate and the amount of tax is final and not subject to appeal.

GENERAL INSTRUCTIONS

Purpose of Form

Use Form MW506AE to apply for a Certificate of Full or Partial Exemption from the withholding requirements on the proceeds of the sale of real property and associated personal property in Maryland by nonresident individuals and nonresident entities. A nonresident entity is defined to mean an entity that: (1) is not formed under the laws of Maryland; and (2) is not qualified by or registered with the Department of Assessments and Taxation to do business in Maryland.

Who May File an Application

An individual, fiduciary, C corporation, S corporation, limited liability company, or partnership transferor/seller may file Form MW506AE. Unless the transferors/ sellers are a husband and wife filing a joint Maryland income tax return, a separate Form MW506AE is required for each transferor/seller.

IMPORTANT: The completed Form MW506AE must be received by the Comptroller of Maryland no later than 21 days before the closing date of the sale or transfer to ensure timely receipt of a Certificate of Full or Partial Exemption.

The Comptroller’s decision to issue or deny a Certificate of Full or Partial Exemption and the determination of the amount of tax to be withheld if a partial exemption is granted are final and not subject to appeal.

SPECIFIC INSTRUCTIONS

Enter the tax year of the transferor/ seller if other than a calendar year.

Transferor/Seller’s Information

Enter the name, address and identification number (Social Security number or federal employer identification number) of the transferor/ seller applying for the exemption.

If the transferor/seller was issued

an individual taxpayer identification number (ITIN) by the IRS, enter the ITIN.

Check the box indicating the transferor/seller’s entity type.

Enter the transferor/seller’s ownership percentage of the property.

Property Information

Enter the description of the property, including the street address(es) for the property as listed with the State Department of Assessments and Taxation (SDAT), including county. If the property does not have a street address, provide the full property account ID numbers used by SDAT to identify the property.

Enter the date of closing for the sale or transfer of the property.

Enter the contract sales price of the property being sold or transferred.

Enter the property account ID number, if known. If the property is made up of more than one parcel and has more than one property tax account number, include all applicable property account ID numbers.

Check the box that describes the transferor/seller’s acquisition of the property. Check the box that describes the transferor/seller’s use of the property at the time of the current sale, and enter the length of time

the property has been used for this purpose.

Complete the transferor/seller’s adjusted basis section by entering the purchase price when the transferor/ seller acquired the property, adding the cost of capital improvements (including acquisition costs such as commissions and state transfer taxes), and subtracting depreciation, if applicable. If inherited property, use the Date of Death value of the property.

Transferee/Buyer’s Information

Enter the name and address.

Check the box indicating the transferee/buyer’s entity type.

Attach schedule if there are multiple transferees/buyers.

Reason for Full or Partial Exemption from Withholding

Check the box in the “Reason for Exemption” column that indicates the reason you are requesting a full or partial exemption from the income tax withholding requirements.

Specific Line Instructions for Reason for Full or Partial Exemption

Line 1. Transfer is of your principal residence as defined in §121 of the Internal Revenue Code, which means it has been your principal residence for two of the last five years.

Required Documentation: Copy of contract of sale or copy of estimated

Line 2. Transfer is a

Required documentation: Letter signed by the qualified intermediary, or by the person authorized to sign on behalf of a business entity acting as the qualified intermediary, which states the name(s) of the transferor(s), the property description, that the individual or business will be acting as the qualified intermediary for

the transferor(s) as part of a §1031 exchange of the property, whether there will be any boot, and if so, the amount of boot. The amount of any boot must be stated on the application as the taxable amount.

Line 3. Transfer is pursuant to an installment sale under §453 of the Internal Revenue Code.

Required documentation: Copy of contract of sale or copy of

Line 4. Transfer of inherited property is occurring within 6 months of date of death.

Required Documentation: Provide a copy of the death certificate and a copy of the estimated HUD-

1 settlement sheet from the title company.

Line 5. Transferor/seller is receiving zero proceeds from this transaction.

Required Documentation: A copy of a letter from the transferor/seller to the title company advising they are to receive zero proceeds from the sale and advising to whom the proceeds are to go; a copy of the acknowledgment letter from the title company to the transferor/seller.

Line 6. Transfer is one of the following transactions. Please note the code letter and record it in the box on page 2 of Form MW506AE.

a. Transfer is to a corporation con- trolled by the transferor for purposes of §351 of the Internal Revenue Code.

Required documentation: Copy of the agreement of sale; Certificate of Good Standing of transferee is- sued by the state in which transferee is incorporated; notarized affidavit executed on behalf of transferee by its President and its Treasurer stating that immediately after the exchange the transferor(s) will own stock in the transferee possessing at least eighty percent (80%) of the total combined voting power of all classes of trans- feree’s stock entitled to vote and at least eighty percent (80%) of the total number of shares of all other classes of stock of the transferee; and an apprais- al establishing the fair market value,

at the time of the exchange, of any

property other than stock in the trans- feree which is part of the consideration for the exchange. The fair market value of any such other property and/or any money which is part of the con- sideration for the exchange must be stated on the application as the taxable amount.

b. Transfer is pursuant to a

Required documentation: Copy of agreement governing the transfer between transferor and transferee; Cer- tificates of Good Standing of transferor and transferee issued by the state(s) in which transferor and transferee are incorporated; copy of the plan or reor- ganization showing that transferor and transferee are parties to the reorgani- zation; and an appraisal establishing the fair market value, at the time of the exchange, of any property other than stock or securities in the transferee which is part of the consideration for the exchange and will not be distribut- ed by the transferor in pursuance of the plan of reorganization. The fair market value of any such other property and/or any money which is part of the con- sideration for the exchange must be stated on the application as the taxable amount.

c. Transfer is by a

Required documentation: Copy of determination by the Internal Revenue Service that transferor is a

d. Transfer is to a partnership in exchange for an interest in the part- nership such that no gain or loss is recognized under §721 of the Internal Revenue Code.

Required documentation: Copy of agreement governing transfer between transferor and transferee; copy of the partnership agreement of the trans- feree.

e. Transfer is by a partnership to a partner of the partnership in accor- dance with §731 of the Internal Rev- enue Code.

Required documentation: Copy of agreement governing transfer between transferor and transferee; copy of the partnership agreement of the transferor.

f. Transfer is treated as a transfer by a real estate investment trust for pur- poses of §857 of the Internal Revenue Code.

Required documentation: Copy of agreement governing transfer between transferor and transferee; certified copy of Articles of Incorporation of trans- feror; Certificate of Good Standing of transferor issued by the state in which transferor is incorporated.

g. Transfer is pursuant to a condem- nation and conversion into a similar property for purposes of §1033 of the Internal Revenue Code.

Required documentation: Copy of agreement governing transfer between transferor and government body or authority condemning the property; notarized affidavit executed by trans- feror stating that transferor will identify and purchase replacement property within the time limits required by §1033 of the Internal Revenue Code, or copy of contract of sale if transferor has already identified replacement property. If proceeds from condemnation exceed price of replacement property, the ex- cess must be stated on the application as the taxable amount.

h. Transfer is between spouses or in- cident to divorce for purposes of §1041 of the Internal Revenue Code.

Required documentation: Copy of marriage license or divorce decree; copy of deed which will be recorded to accomplish the transfer; if incident to divorce, copy of section of court order or separation agreement governing transfer of the property.

i. Transfer is treated as a transfer by an S corporation for purposes of §1368 of the Internal Revenue.

Line 7. Other. The transfer is otherwise fully or partially exempt from the recognition of gain in accordance with provided explanation.

Required documentation: Attach any and all documents necessary to show that the transfer is fully or partially exempt from tax. This may include a copy of contract of sale or copy of estimated

Calculation of Tax to be Withheld

Complete this section if you are requesting a partial exemption. This section must be completed or the application for partial exemption will be denied.

Signature(s)

Form MW506AE must be signed by an individual (both taxpayer and spouse, if filing a joint Maryland income tax return), or a responsible corporate officer.

Please include a daytime telephone number where you can be reached between 8:00 AM and 5:00 PM.

Your signature(s) signifies that your application, including all attachments, is, to the best of your knowledge and belief, true, correct and complete, under the penalties of perjury.

If a power of attorney is necessary, complete federal Form 2848 and attach to your application.

Where to File

Mail the completed form and all attachments to:

Comptroller of Maryland

Revenue Administration Division

Attn: NRS Exemption Requests

P.O. Box 2031

Annapolis, MD

Additional Information

For additional information visit www.marylandtaxes.com,

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The MW506AE form is used to apply for a Certificate of Full or Partial Exemption from withholding requirements on real property sales in Maryland. |

| Eligibility | Nonresident individuals and entities can file this form to seek exemption from withholding on property sales. |

| Filing Deadline | The form must be received by the Comptroller of Maryland at least 21 days before the closing date of the sale. |

| Governing Law | This form is governed by Maryland tax laws, specifically under the Maryland Tax Code. |

| Required Information | Applicants must provide details like names, addresses, Social Security numbers, and property descriptions. |

| Reasons for Exemption | Common reasons include the sale of a principal residence or a tax-free exchange under IRC §1031. |

| Tax Calculation | If requesting a partial exemption, applicants must calculate the tax to be withheld based on the contract sales price and adjusted basis. |

| Final Decision | The Comptroller's decision on the exemption application is final and not subject to appeal. |

Other PDF Forms

What Does It Mean to Be Exempt From Withholding - Exemptions for servicemembers under the Servicemembers Civil Relief Act are specifically catered to in the form.

Maryland Dc 70 - Requesters must accurately fill out the form to ensure proper consideration of their postponement request.

Completing the Washington Motor Vehicle Bill of Sale is crucial for anyone looking to sell or purchase a vehicle in the state, as it formalizes the transfer of ownership and protects both parties involved. To assist you in this process, you can refer to the guidelines provided by WA Documents, ensuring that all necessary information is accurately captured for a successful transaction.

How Much Back Child Support Is a Felony in Maryland - Ensures the legal system is accessible for individuals seeking to enforce compliance with protective measures ordered by the courts.