Printable Maryland Net Tangible Benefit Worksheet Template

The Maryland Net Tangible Benefit Worksheet is a crucial document designed to ensure that borrowers understand the implications of refinancing their mortgage loans. This form, mandated by the Commissioner of Financial Regulation, aims to provide a clear assessment of the tangible benefits associated with a new mortgage. It requires borrowers to evaluate their current loan terms against those of the proposed loan, considering factors such as interest rates, monthly payments, and potential changes in loan structure. By signing the worksheet, borrowers acknowledge their understanding of the costs involved and confirm that the new loan will offer a meaningful advantage over their existing mortgage. The worksheet also allows borrowers to identify specific benefits they may receive from refinancing, including lower interest rates, reduced monthly payments, or the elimination of private mortgage insurance. This structured approach not only protects consumers but also promotes transparency in the lending process, ensuring that borrowers make informed decisions that align with their financial goals.

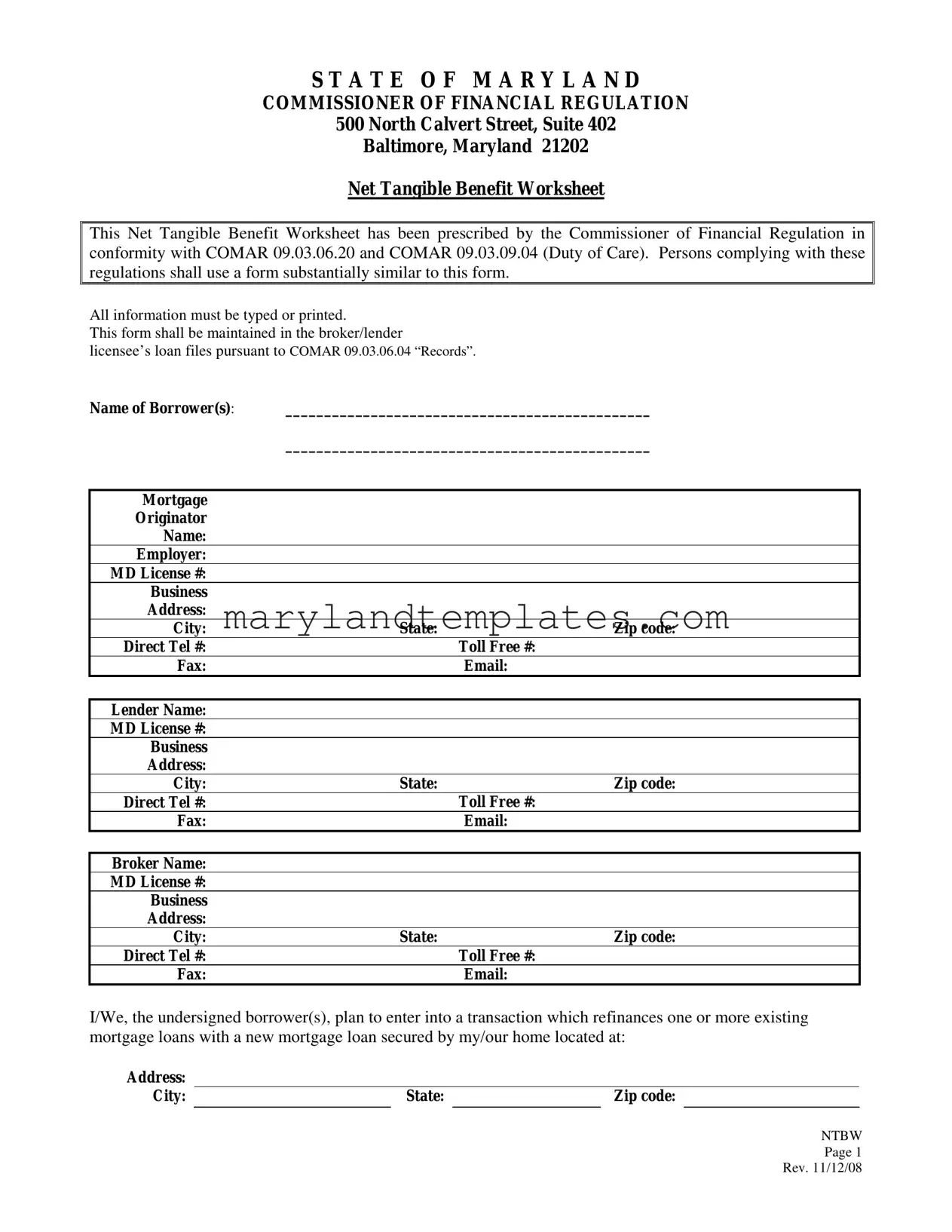

Maryland Net Tangible Benefit Worksheet Preview

S T A T E O F M A R Y L A N D

COMMISSIONER OF FINANCIAL REGULATION

500 North Calvert Street, Suite 402

Baltimore, Maryland 21202

Net Tangible Benefit Worksheet

This Net Tangible Benefit Worksheet has been prescribed by the Commissioner of Financial Regulation in conformity with COMAR 09.03.06.20 and COMAR 09.03.09.04 (Duty of Care). Persons complying with these regulations shall use a form substantially similar to this form.

All information must be typed or printed.

This form shall be maintained in the broker/lender

licensee’s loan files pursuant to COMAR 09.03.06.04 “Records”.

Name of Borrower(s): |

_______________________________________________ |

|

|

_______________________________________________ |

|

|

|

|

Mortgage |

|

|

Originator |

|

|

Name: |

|

|

Employer: |

|

|

MD License #: |

|

|

Business |

|

|

Address: |

|

|

City: |

State: |

Zip code: |

Direct Tel #: |

|

Toll Free #: |

Fax: |

|

Email: |

|

|

|

Lender Name: |

|

|

MD License #: |

|

|

Business |

|

|

Address: |

|

|

City: |

State: |

Zip code: |

Direct Tel #: |

|

Toll Free #: |

Fax: |

|

Email: |

|

|

|

Broker Name: |

|

|

MD License #: |

|

|

Business |

|

|

Address: |

|

|

City: |

State: |

Zip code: |

Direct Tel #: |

|

Toll Free #: |

Fax: |

|

Email: |

I/We, the undersigned borrower(s), plan to enter into a transaction which refinances one or more existing mortgage loans with a new mortgage loan secured by my/our home located at:

Address: |

|

|

City: |

State: |

Zip code: |

NTBW

Page 1

Rev. 11/12/08

I/We acknowledge that:

I/We understand the costs associated with the new loan;

The new loan may have different terms (including duration of term and rate of interest) than my/our existing loan(s); and

The new loan will provide a reasonable, tangible net benefit to me/us after taking into account the terms of both the new and existing loan(s), the cost of the new loan, and my/our particular circumstances.

By refinancing my/our existing loan(s), the following benefits apply to me/us (each borrower should initial any benefit that applies):

______ |

______ Obtaining a lower interest rate. |

______ |

______ Obtaining a lower monthly payment, including principal, interest, taxes, and insurance. |

______ |

______ Obtaining a shorter amortization schedule. |

______ |

______ Changing from an adjustable rate to a fixed rate. |

______ |

______ Eliminating a negative amortization feature. |

______ |

______ Eliminating a balloon payment feature. |

______ |

______ Receiving |

|

connection with the loan. |

______ |

______ Avoiding foreclosure. |

______ |

______ Eliminating private mortgage insurance. |

______ |

______ Consolidating other existing loans into a new mortgage loan. |

______ |

______ Other (please specify): ________________________________________________________ |

|

__________________________________________________________________________ |

I/We have considered the terms of both the existing and new loans, the cost of the new loan, and my/our personal circumstances. I/We believe the overall benefits of the new loan make the new loan beneficial to me/us for the reason or reasons identified above. By signing below, I/we certify that I/we have read and understand this Net Tangible Benefits Worksheet.

Borrower: ____________________________________________ |

Date: _____________________ |

Borrower: ____________________________________________ |

Date: _____________________ |

|

NTBW |

|

Page 2 |

|

Rev. 11/12/08 |

Form Attributes

| Fact Name | Details |

|---|---|

| Governing Law | This form is governed by COMAR 09.03.06.20 and COMAR 09.03.09.04. |

| Purpose | The worksheet is designed to assess the net tangible benefits of refinancing a mortgage. |

| Required Use | It must be used by persons complying with the specified regulations. |

| Information Format | All information on the form must be typed or printed clearly. |

| Record Keeping | The form should be maintained in the broker/lender licensee’s loan files. |

| Borrower Acknowledgment | Borrowers must acknowledge understanding the costs and terms of the new loan. |

| Benefits Listing | Borrowers can select multiple benefits that apply to their refinancing situation. |

| Signature Requirement | Borrowers must sign the form to certify understanding and agreement. |

| Revision Date | The current version of the form was revised on November 12, 2008. |

Other PDF Forms

Maryland Unclaimed Property Reporting - The form includes sections for documenting primary and secondary insurance coverages.

This vital document for Power of Attorney for a Child is crucial for ensuring that your child's welfare is prioritized even when you're not physically present to make decisions for them. It provides peace of mind to parents and guardians alike, facilitating essential arrangements during unforeseen circumstances.

Police Polygraph - The form includes a section for written permission by the applicant to undertake the polygraph test, emphasizing confidentiality and legal releases.