Printable Maryland Ntbw Template

The Maryland Net Tangible Benefit Worksheet (NTBW) is an essential tool for borrowers considering refinancing their existing mortgage loans. This form is designed to ensure that borrowers understand the implications of their refinancing decisions and that they receive a tangible benefit from the new loan. It captures vital information about the borrower, the mortgage originator, and the lender involved in the transaction. The worksheet requires borrowers to acknowledge their understanding of the costs associated with the new loan and the potential differences in terms compared to their existing loans. Key benefits that borrowers might gain from refinancing, such as lower interest rates, reduced monthly payments, or the elimination of private mortgage insurance, are clearly outlined. By signing the form, borrowers confirm that they have carefully evaluated the benefits and costs, ensuring that the refinancing decision aligns with their financial situation. This process not only promotes transparency but also helps protect consumers by ensuring they make informed choices.

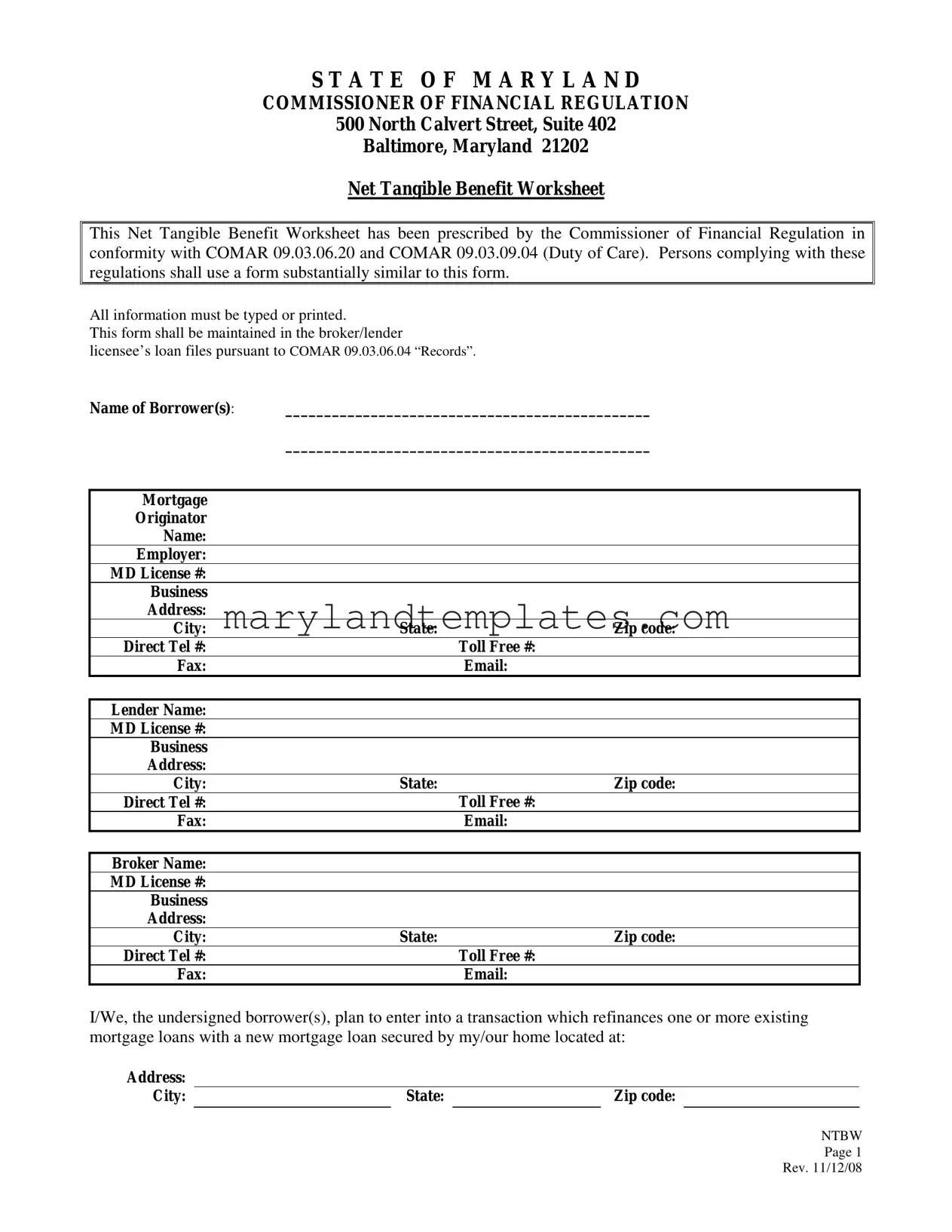

Maryland Ntbw Preview

S T A T E O F M A R Y L A N D

COMMISSIONER OF FINANCIAL REGULATION

500 North Calvert Street, Suite 402

Baltimore, Maryland 21202

Net Tangible Benefit Worksheet

This Net Tangible Benefit Worksheet has been prescribed by the Commissioner of Financial Regulation in conformity with COMAR 09.03.06.20 and COMAR 09.03.09.04 (Duty of Care). Persons complying with these regulations shall use a form substantially similar to this form.

All information must be typed or printed.

This form shall be maintained in the broker/lender

licensee’s loan files pursuant to COMAR 09.03.06.04 “Records”.

Name of Borrower(s): |

_______________________________________________ |

|

|

_______________________________________________ |

|

|

|

|

Mortgage |

|

|

Originator |

|

|

Name: |

|

|

Employer: |

|

|

MD License #: |

|

|

Business |

|

|

Address: |

|

|

City: |

State: |

Zip code: |

Direct Tel #: |

|

Toll Free #: |

Fax: |

|

Email: |

|

|

|

Lender Name: |

|

|

MD License #: |

|

|

Business |

|

|

Address: |

|

|

City: |

State: |

Zip code: |

Direct Tel #: |

|

Toll Free #: |

Fax: |

|

Email: |

|

|

|

Broker Name: |

|

|

MD License #: |

|

|

Business |

|

|

Address: |

|

|

City: |

State: |

Zip code: |

Direct Tel #: |

|

Toll Free #: |

Fax: |

|

Email: |

I/We, the undersigned borrower(s), plan to enter into a transaction which refinances one or more existing mortgage loans with a new mortgage loan secured by my/our home located at:

Address: |

|

|

City: |

State: |

Zip code: |

NTBW

Page 1

Rev. 11/12/08

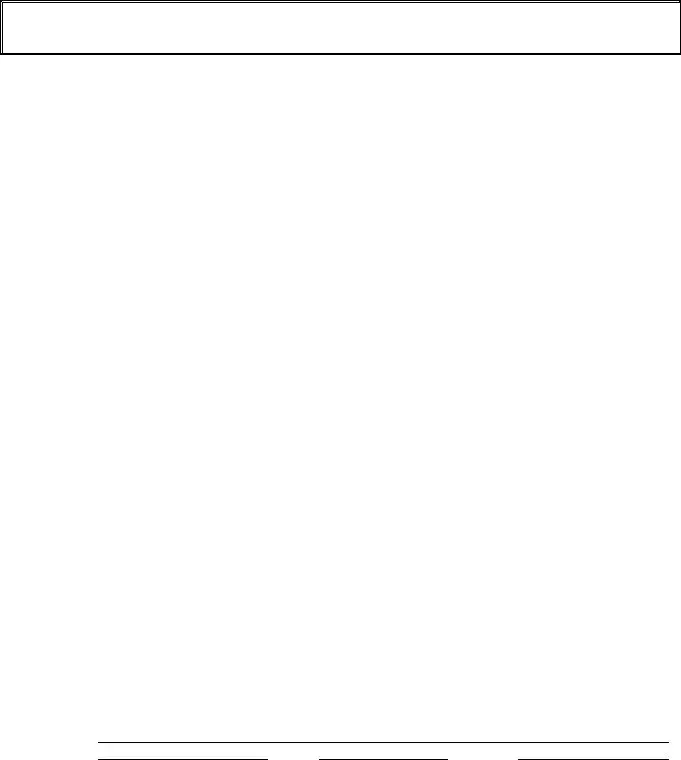

I/We acknowledge that:

I/We understand the costs associated with the new loan;

The new loan may have different terms (including duration of term and rate of interest) than my/our existing loan(s); and

The new loan will provide a reasonable, tangible net benefit to me/us after taking into account the terms of both the new and existing loan(s), the cost of the new loan, and my/our particular circumstances.

By refinancing my/our existing loan(s), the following benefits apply to me/us (each borrower should initial any benefit that applies):

______ |

______ Obtaining a lower interest rate. |

______ |

______ Obtaining a lower monthly payment, including principal, interest, taxes, and insurance. |

______ |

______ Obtaining a shorter amortization schedule. |

______ |

______ Changing from an adjustable rate to a fixed rate. |

______ |

______ Eliminating a negative amortization feature. |

______ |

______ Eliminating a balloon payment feature. |

______ |

______ Receiving |

|

connection with the loan. |

______ |

______ Avoiding foreclosure. |

______ |

______ Eliminating private mortgage insurance. |

______ |

______ Consolidating other existing loans into a new mortgage loan. |

______ |

______ Other (please specify): ________________________________________________________ |

|

__________________________________________________________________________ |

I/We have considered the terms of both the existing and new loans, the cost of the new loan, and my/our personal circumstances. I/We believe the overall benefits of the new loan make the new loan beneficial to me/us for the reason or reasons identified above. By signing below, I/we certify that I/we have read and understand this Net Tangible Benefits Worksheet.

Borrower: ____________________________________________ |

Date: _____________________ |

Borrower: ____________________________________________ |

Date: _____________________ |

|

NTBW |

|

Page 2 |

|

Rev. 11/12/08 |

Form Attributes

| Fact Name | Fact Description |

|---|---|

| Governing Laws | The Net Tangible Benefit Worksheet is governed by COMAR 09.03.06.20 and COMAR 09.03.09.04. |

| Purpose | This form is designed to ensure borrowers understand the tangible benefits of refinancing their mortgage loans. |

| Mandatory Use | Persons complying with the regulations must use a form that is substantially similar to this worksheet. |

| Information Requirements | All information on the form must be typed or printed clearly for legibility. |

| Record Keeping | The form must be maintained in the broker or lender’s loan files as per COMAR 09.03.06.04. |

| Borrower Acknowledgment | Borrowers must acknowledge understanding the costs and terms associated with the new loan. |

| Benefits Listing | Borrowers can indicate applicable benefits by initialing specific options related to the new loan. |

| Certification | By signing the form, borrowers certify that they have read and understood the worksheet. |

| Revision Date | The current version of the form was last revised on November 12, 2008. |

Other PDF Forms

Maryland Unclaimed Property Reporting - The form serves as an important document for health care reimbursement within the state plan.

What Is the Sales Tax in Maryland - It is a binding declaration that places responsibility on the buyer to truthfully declare the intended use of purchased goods in line with Maryland tax laws.

For those looking to secure their sensitive information, utilizing a Non-disclosure Agreement form, such as the one provided by WA Documents, is essential in maintaining confidentiality and preventing unauthorized disclosure between parties.

Md Form 505 - Identify the correct number of exemptions to claim, which could include yourself, your spouse, and dependents.