Printable Maryland Quarterly Contribution Report Template

The Maryland Quarterly Contribution Report form is an essential tool for employers to manage their unemployment insurance contributions and employment data. This comprehensive guide outlines the necessary steps for users to navigate the online filing process efficiently. Employers must first establish a user account, which includes creating a unique username and PIN. Once registered, they can file their Unemployment Insurance Contribution and Wage Report, allowing for accurate tracking of employee wages and contributions. The form also provides options for reviewing past reports and account history, modifying account information, and obtaining annual rating notices. Employers have various filing options, including submitting a complete contribution and employment report or filing wages through a web-wage application. Additionally, the form facilitates automated services for PIN resets and offers multiple payment methods, including credit card and electronic checks. Understanding these components ensures compliance with state regulations while streamlining the reporting process.

Maryland Quarterly Contribution Report Preview

Larry Hogan |

Boyd K. Rutherford |

Governor |

Lt. Governor |

State of Maryland

Department of Labor, Licensing and Regulation

Division of Unemployment Insurance

Contributions Unit

Quarterly Contribution & Employment Report

Internet Filing

This guide will provide the information you need to find the application, establish a user name / PIN, file your Unemployment Insurance Contribution and Wage Report, and obtain additional information and services.

Rev. 12/27/2017

Table of Contents |

|

Welcome Page |

3 |

Forgot Your PIN? |

4 |

Automated PIN Reset Service |

5 |

Request My PIN Reset by |

6 |

New User Enrollment |

7 |

Related Web Sites |

9 |

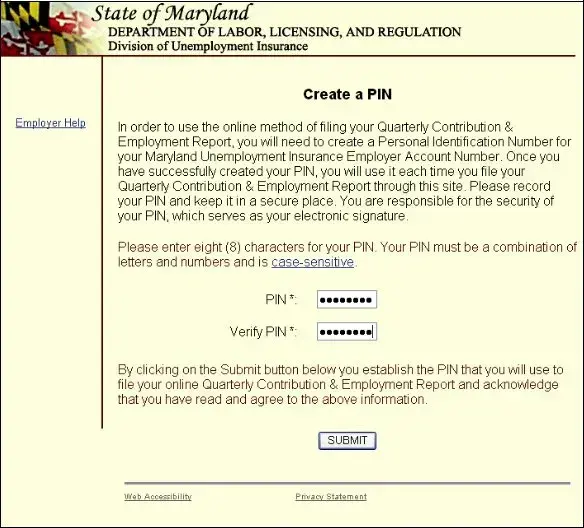

Create a PIN |

10 |

Confirmation Page for Creating a PIN Successfully |

11 |

Employer Services and Information |

12 |

Quarterly Contribution & Employment Report Main Menu |

13 |

Review my Past Online Reports |

14 |

Review my Account History |

15 |

Review my Account History – Quarter Detail |

16 |

Modify my Account Information (Change my Address) |

17 |

View and Print an Annual Rating Notice |

18 |

View and Print Quarterly Benefit Charge Statements |

19 |

Request a |

20 |

Close my Unemployment Insurance Account |

21 |

Change my PIN |

22 |

Employer Help |

23 |

Confirmation Page for Logging Off Successfully |

24 |

Filing Option 1: File Contribution and Employment Report |

25 |

Automatic Calculation of Excess Wage Amount |

28 |

Automatic Calculation of Excess Wage Worksheet |

29 |

Filing Option 2: File Only a Contribution Report |

30 |

Filing Option 3: File Wages Using the |

31 |

Acceptable Record Formats |

32 |

Warning Page for Not Entering Any Wages |

35 |

Add Employee |

36 |

Warning Page after Clicking Cancel on Add Employee Page |

37 |

Summary of Contribution Report |

38 |

Contribution Report Confirmation page |

39 |

Payment Option 1: Credit Card |

40 |

Payment Option 1: Credit Card Verification Page |

42 |

Payment Option 1: Credit Card Confirmation Page |

43 |

Payment Option 2: Direct Debit (Electronic Check) Page |

44 |

Payment Option 2: Electronic Check Payment Verification Page |

45 |

Payment Option 2: Electronic Check Payment Confirmation Page |

46 |

Print Contribution Report Page |

47 |

Print Employment Report Page |

48 |

Payment Option 3: Paper Check Confirmation Page |

49 |

2

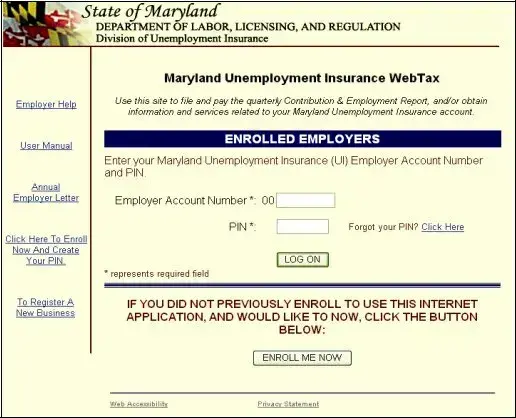

Welcome Page

In order to use this application, you must have registered as a user.

Are you a registered user? If you previously registered on this web site, log on by entering your Maryland Unemployment Insurance employer account number and your PIN and clicking the “Log On” button.

Are you new to this site? You must register and establish your PIN to use this application. To create a PIN for this application, click on the “Enroll Me Now” button.

3

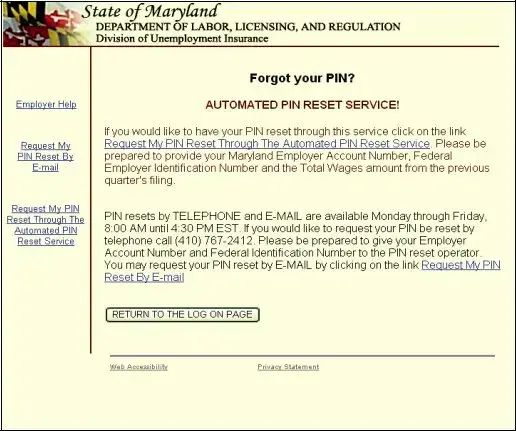

Forgot Your PIN?

Did you previously register but forget your PIN? There are three ways to reset your PIN:

1.Automated – Available 24 hours a day, seven days a week. Click on Request My PIN Reset Through The Automated PIN Reset Process. Enter your FEIN number, your Maryland UI account number, and the previous quarter’s total wages for Maryland UI. Once reset, you are able to immediately begin your session.

2.

3.Telephone – Available during normal business days, 8:00 – 4:30 by calling

(410)

4

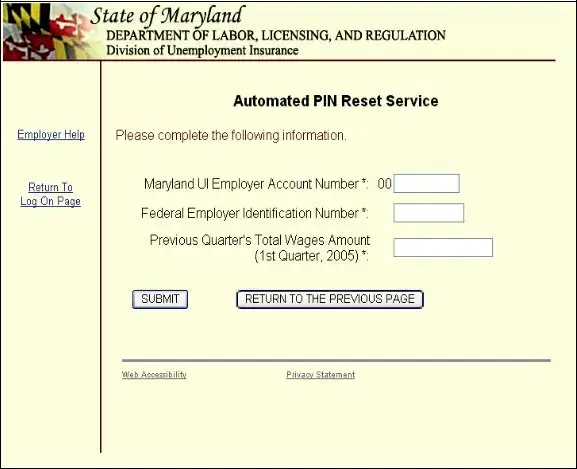

Automated PIN Reset Service

Did you forget your PIN? Now, you can

1.

2.

3.

4.

5.

6.

7.

Click on Request My PIN Reset Through The Automated PIN Reset Process Enter your Maryland Unemployment Insurance Account Number

Enter your Federal Employer Identification Number Enter your Previous Quarter’s Total Wages Amount Click “Submit”

Now you will see the “Create a PIN” page, as displayed on page 10 of this guide Follow the directions to create your new PIN

5

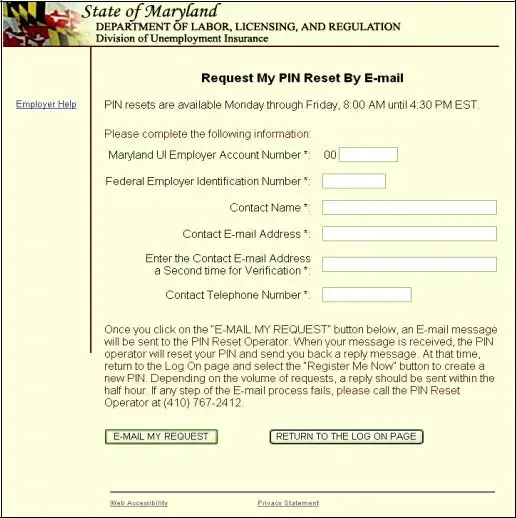

Request My PIN Reset by

If you want to contact us by

6

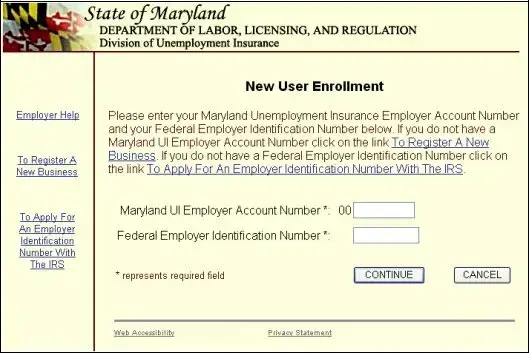

New User Enrollment

When you click “Enroll Me Now” on the Welcome page, you will see the New User Enrollment page. You must know your Maryland Unemployment Insurance Fund (MUIF)

Do you have a MUIF number?

!If you have a MUIF number, enter it now. The two leading zeros are

!If you do not have a MUIF number, you must register with the Division of Unemployment Insurance and obtain an account number before you use this application. There are two ways you can register and get a MUIF account number:

Online

For other State of Maryland

For other Maryland unemployment insurance related services visit www.mdunemployment.com .

7

Telephone – You may register by telephone if you call (410)

Do you know your FEIN?

!If you have a FEIN, enter your

!If you do not have FEIN, you must register with the Internal Revenue Service and obtain a FEIN before you use this application. You can find information for registering with the Internal Revenue Service at

8

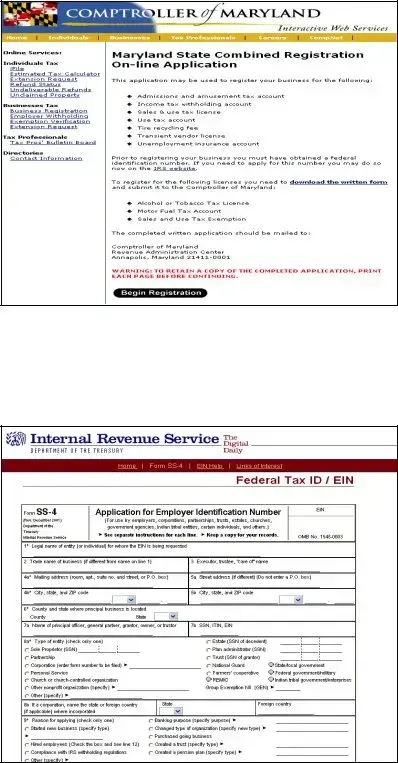

Related Web Sites

When you click on the “To Register A New Business” link to register your business online with the State of Maryland, you will see this page. After completing the Maryland State Combined Registration

When you click on the “To Apply For An Employer Identification Number With The IRS” link to register your business with the Internal Revenue Service, you will see this page. Please complete this information as requested.

9

Create a PIN

Clicking on the “Enroll Me Now” button from the Welcome page will display the Create a PIN page. Follow the instructions on the page to establish a permanent PIN for this application. Your PIN will remain unchanged unless you choose to modify it within this application. (For more information about changing your PIN, refer to the Change Your PIN section on page 22)

When you have recorded your PIN and are ready to confirm the action, click “Submit”.

10

Form Attributes

| Fact Name | Details |

|---|---|

| Governing Authority | The Maryland Quarterly Contribution Report is governed by the Maryland Unemployment Insurance Law. |

| Purpose | This report is used by employers to report wages and contributions to the state’s unemployment insurance program. |

| Filing Frequency | Employers must file this report quarterly, detailing employee wages and contributions for the previous quarter. |

| Online Access | The report can be filed online through the Maryland Department of Labor's website, ensuring convenience and efficiency. |

| PIN Requirement | Employers must create a Personal Identification Number (PIN) to access and submit the report online. |

| Resetting Your PIN | If a PIN is forgotten, it can be reset through an automated service, via email, or by phone during business hours. |

| Payment Options | Employers have multiple payment options, including credit card, electronic check, and paper check for any contributions owed. |

| Confirmation of Submission | After filing, employers receive a confirmation page to ensure their report was successfully submitted. |

Other PDF Forms

Maryland Income Tax Forms - Optimizes the submission process with contact information fields for efficient document handling.

An employment verification form is a document used by employers to confirm a prospective or current employee's job history and qualifications. This form typically includes information such as job title, dates of employment, and reasons for leaving a position. Understanding the purpose and components of this form can help both employees and employers streamline the hiring and verification process. For convenient resources, consider checking out PDF Templates Online.

Maryland Llc Tax Filing Requirements - Nonresident entities have their share of taxes detailed, allowing for clear understanding of fiscal responsibilities to Maryland.