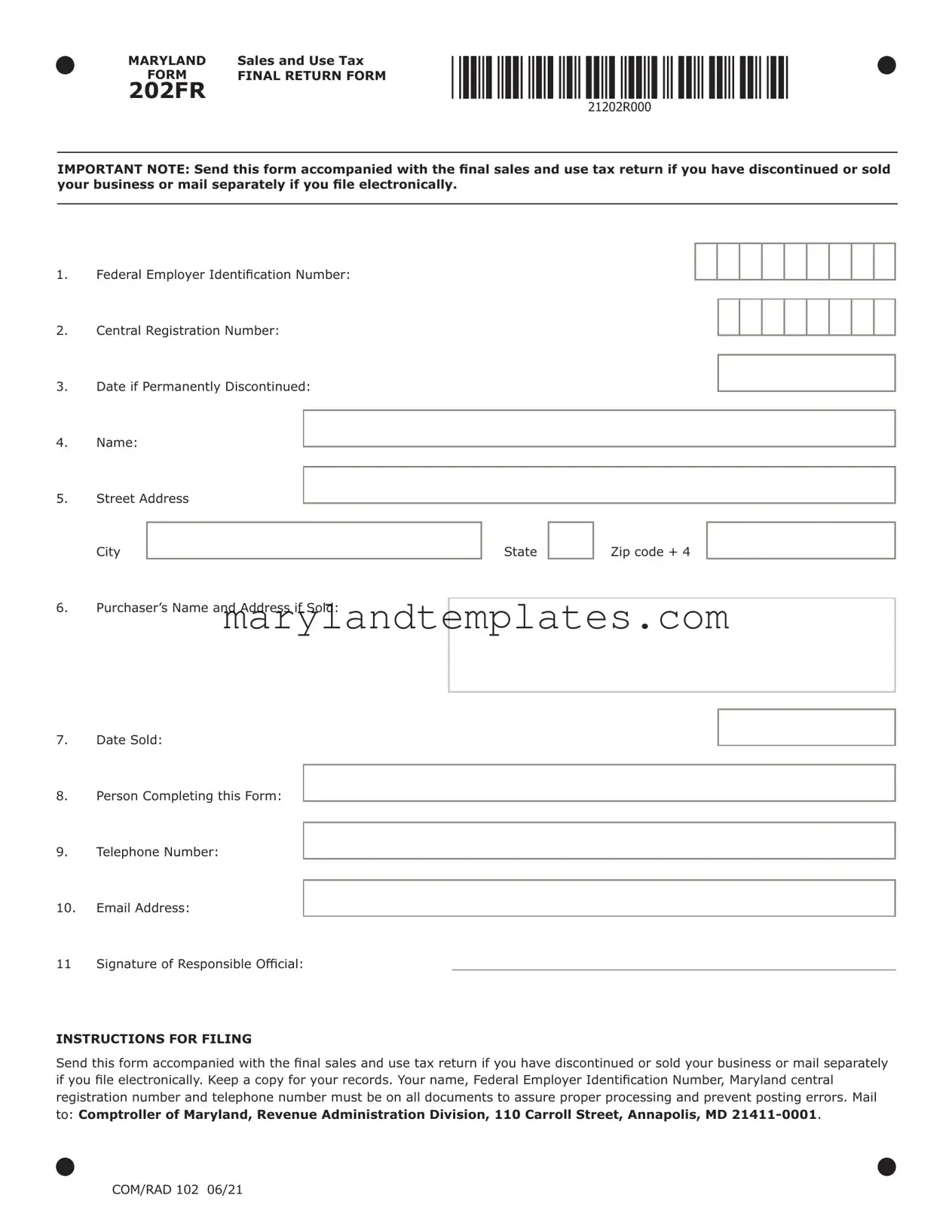

Printable Maryland Sales Use Tax 202 Template

The Maryland Sales and Use Tax Form 202 is a crucial document for business owners who are discontinuing operations or selling their business. This form serves as a final return, ensuring that all sales and use tax obligations are settled before the business ceases to exist. It requires specific information, such as the Federal Employer Identification Number and the Maryland Central Registration Number, to accurately identify the business. Additionally, the form asks for the date the business was permanently discontinued, as well as the name and address of the purchaser if the business has been sold. Completing this form involves providing contact details for the individual responsible for filing, including a telephone number and email address, and it must be signed by an authorized official. It is essential to submit this form alongside the final sales and use tax return, or separately if filing electronically. Keeping a copy of the form for personal records is highly recommended to ensure proper documentation. This process not only helps in maintaining compliance with state regulations but also prevents potential errors in tax processing.

Maryland Sales Use Tax 202 Preview

MARYLAND |

Sales and Use Tax |

FORM |

FINAL RETURN FORM |

202FR |

|

IMPORTANT NOTE: Send this form accompanied with the final sales and use tax return if you have discontinued or sold your business or mail separately if you file electronically.

1.Federal Employer Identification Number:

2.Central Registration Number:

3.Date if Permanently Discontinued:

4.Name:

5.Street Address

City

6.Purchaser’s Name and Address if Sold:

7.Date Sold:

8.Person Completing this Form:

9.Telephone Number:

10.Email Address:

11 Signature of Responsible Official:

INSTRUCTIONS FOR FILING

State

Zip code + 4

Send this form accompanied with the final sales and use tax return if you have discontinued or sold your business or mail separately if you file electronically. Keep a copy for your records. Your name, Federal Employer Identification Number, Maryland central registration number and telephone number must be on all documents to assure proper processing and prevent posting errors. Mail to: Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, MD

COM/RAD 102 06/21

Form Attributes

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used for final sales and use tax returns when a business is discontinued or sold. |

| Filing Requirement | Submit this form along with the final sales and use tax return, or mail it separately if filing electronically. |

| Key Information | Essential details required include the Federal Employer Identification Number and Central Registration Number. |

| Mailing Address | Send the completed form to the Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, MD 21411-0001. |

| Record Keeping | It is important to keep a copy of the form for your records after submission. |

| Governing Law | The Maryland Sales and Use Tax is governed by the Maryland Tax-General Article, Title 11. |

Other PDF Forms

Medical Referral Form - It encourages a multidisciplinary approach to care and services, ensuring that individuals benefit from the collective expertise of professionals across different fields.

Before you proceed with the transaction, it's essential to ensure you have all the necessary documentation, including the Washington Motorcycle Bill of Sale form, which you can obtain from WA Documents. This form will help facilitate a clear and legal transfer of ownership for your motorcycle.

Maryland Credentialing Application - With clear, step-by-step instructions, the application process is demystified, making it approachable for all aspiring and current child care professionals.