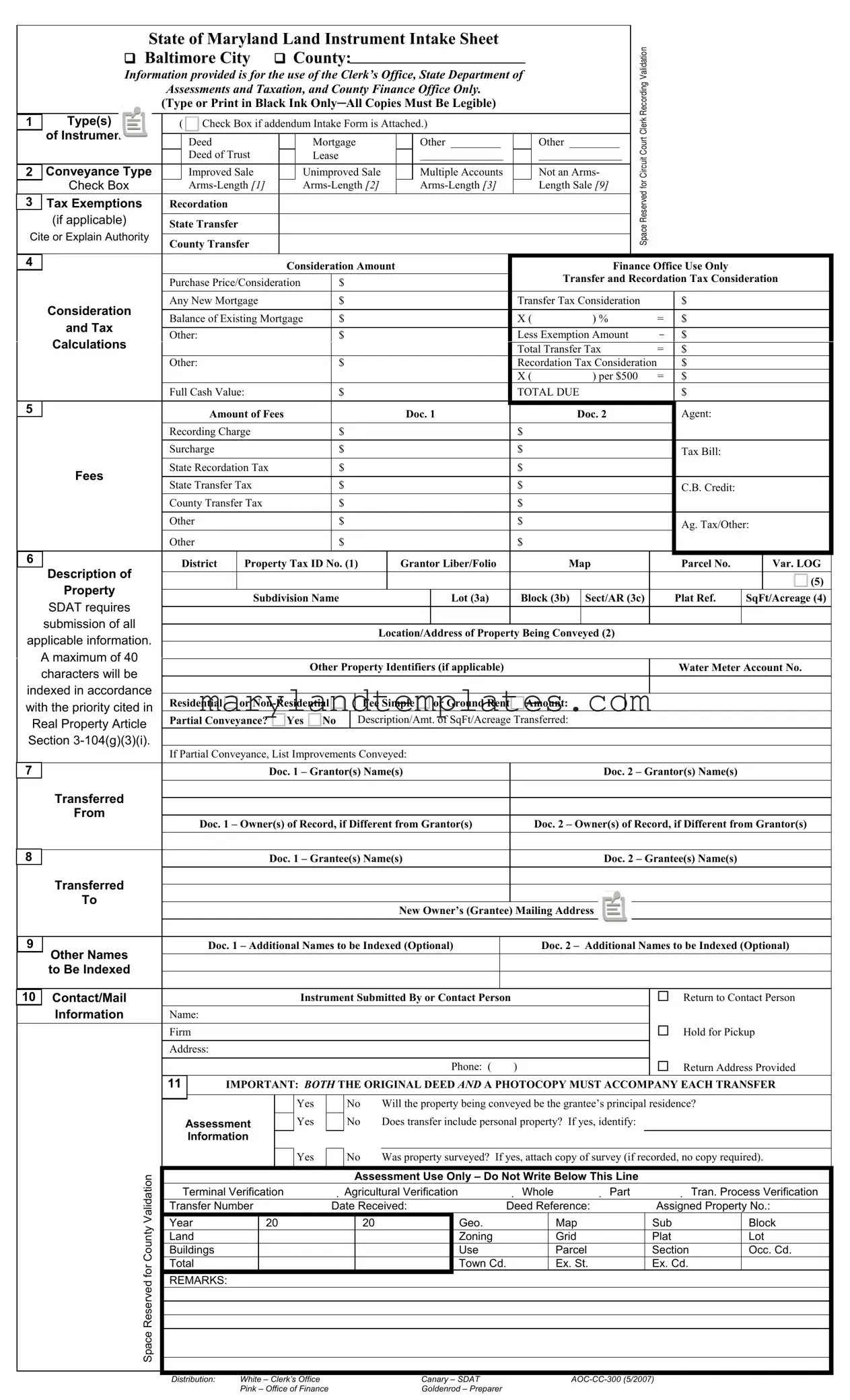

Printable Maryland Sheet Template

The Maryland Sheet form serves as a crucial document in the real estate transaction process within the state of Maryland. It is primarily used for the intake of various land instruments, including deeds, mortgages, and leases, among others. This form is essential for the Clerk’s Office, the State Department of Assessments and Taxation, and the County Finance Office, as it facilitates the recording and validation of property transactions. It requires detailed information about the property being conveyed, such as its tax identification number, location, and any applicable exemptions. Additionally, the form captures the consideration amount, which is vital for calculating transfer and recordation taxes. Various sections of the form ask for information about the grantors and grantees involved in the transaction, ensuring that all parties are properly identified. Moreover, it includes spaces for documenting fees associated with the transaction, such as recording charges and transfer taxes. The form also addresses whether the property will serve as the grantee's principal residence and if any personal property is included in the transfer. Importantly, both the original deed and a photocopy must accompany the form to ensure proper processing. Overall, the Maryland Sheet form is a comprehensive tool that streamlines the administrative aspects of property transactions while ensuring compliance with state regulations.

Maryland Sheet Preview

|

|

|

State of Maryland Land Instrument Intake Sheet |

|

|

|

|

|

|

|

|

Validation |

|

|

|

|||||||||||||||||

|

|

|

Baltimore City |

|

County: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Information provided is for the use of the Clerk’s Office, State Department of |

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

Assessments and Taxation, and County Finance Office Only. |

|

|

|

|

|

|

|

|

Recording |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

(Type or Print in Black Ink Only─All Copies Must Be Legible) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clerk |

|

|

|

||||

1 |

Type(s) |

( Check Box if addendum Intake Form is Attached.) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

of Instruments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Deed |

|

|

|

Mortgage |

|

Other _________ |

|

|

|

Other _________ |

|

Court |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

Deed of Trust |

|

|

Lease |

|

|

|

|

|

_______________ |

|

|

|

_______________ |

|

|

Circuit |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2 |

Conveyance Type |

|

Improved Sale |

|

|

Unimproved Sale |

|

Multiple Accounts |

|

|

|

Not an Arms- |

|

|

|

|

||||||||||||||||

|

|

|

Check Box |

|

|

|

|

|

|

|

Length Sale [9] |

|

for |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reserved |

|

|

|

|

3 |

Tax Exemptions |

Recordation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

(if applicable) |

State Transfer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Space |

|

|

|

|||

|

|

Cite or Explain Authority |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

County Transfer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

4 |

|

|

|

|

|

|

Consideration Amount |

|

|

|

|

|

|

|

|

|

Finance Office Use Only |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer and Recordation Tax Consideration |

|||||||||

|

|

|

|

Purchase Price/Consideration |

|

$ |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Consideration |

Any New Mortgage |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Transfer Tax Consideration |

$ |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance of Existing Mortgage |

|

$ |

|

|

|

|

|

|

|

|

X ( |

) % |

|

|

= |

$ |

|

|

|||||||||||

|

|

|

and Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other: |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Less Exemption Amount |

|

− |

$ |

|

|

|||||||||

|

|

|

Calculations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Transfer Tax |

= |

$ |

|

|

||||||||

|

|

|

|

Other: |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Recordation Tax Consideration |

$ |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X ( |

|

) per $500 |

= |

$ |

|

|

|||||

|

|

|

|

Full Cash Value: |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

TOTAL DUE |

|

|

$ |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5 |

|

|

Amount of Fees |

|

|

|

|

|

Doc. 1 |

|

|

|

|

Doc. 2 |

|

|

Agent: |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

Recording Charge |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Surcharge |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Tax Bill: |

|

|

||

|

|

|

Fees |

State Recordation Tax |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Transfer Tax |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

C.B. Credit: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

County Transfer Tax |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

Ag. Tax/Other: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Other |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

6 |

Description of |

|

District |

|

Property Tax ID No. (1) |

|

Grantor Liber/Folio |

|

|

|

Map |

|

|

Parcel No. |

|

Var. LOG |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

|

|

|

|

Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subdivision Name |

|

|

Lot (3a) |

|

Block (3b) |

|

Sect/AR (3c) |

|

Plat Ref. |

SqFt/Acreage (4) |

||||||||||||||||

|

|

|

SDAT requires |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

submission of all |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location/Address of Property Being Conveyed (2) |

|

|

|

|

|

||||||||||||||

|

|

applicable information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

A maximum of 40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Property Identifiers (if applicable) |

|

|

|

|

|

|

|

|

|

|

Water Meter Account No. |

||||||||||||

|

|

|

characters will be |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

indexed in accordance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

with the priority cited in |

Residential |

or |

|

|

Fee Simple or Ground Rent |

|

|

Amount: |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Real Property Article |

Partial Conveyance? |

|

Yes No |

|

|

Description/Amt. of SqFt/Acreage Transferred: |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Section |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If Partial Conveyance, List Improvements Conveyed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

7 |

|

|

|

|

|

Doc. 1 – Grantor(s) Name(s) |

|

|

|

|

|

Doc. 2 – Grantor(s) Name(s) |

|

|

||||||||||||||||||

|

|

|

Transferred |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Doc. 1 – Owner(s) of Record, if Different from Grantor(s) |

|

|

|

Doc. 2 – Owner(s) of Record, if Different from Grantor(s) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

8 |

|

|

|

|

|

Doc. 1 – Grantee(s) Name(s) |

|

|

|

|

|

Doc. 2 – Grantee(s) Name(s) |

|

|

||||||||||||||||||

|

|

|

Transferred |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Owner’s (Grantee) Mailing Address |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

9 |

Other Names |

|

Doc. 1 – Additional Names to be Indexed (Optional) |

|

|

|

|

Doc. 2 – Additional Names to be Indexed (Optional) |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to Be Indexed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

10 |

Contact/Mail |

|

|

|

|

|

|

Instrument Submitted By or Contact Person |

|

|

|

|

|

|

|

|

|

|

Return to Contact Person |

|||||||||||||

|

|

|

Information |

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Firm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hold for Pickup |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone: ( |

) |

|

|

|

|

|

|

|

|

|

Return Address Provided |

|||

11IMPORTANT: BOTH THE ORIGINAL DEED AND A PHOTOCOPY MUST ACCOMPANY EACH TRANSFER

|

|

|

|

|

|

|

|

Yes |

|

No |

Will the property being conveyed be the grantee’s principal residence? |

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Assessment |

|

|

Yes |

|

No |

Does transfer include personal property? If yes, identify: |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Yes |

|

No |

Was property surveyed? |

If yes, attach copy of survey (if recorded, no copy required). |

|||||||

|

Validation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Assessment Use Only – Do Not Write Below This Line |

|

|

|

|||||||

|

|

Terminal Verification |

|

Agricultural Verification |

Whole |

Part |

|

Tran. Process Verification |

|||||||||||

|

|

|

|

|

|||||||||||||||

|

|

|

Transfer Number |

|

|

|

Date Received: |

Deed Reference: |

Assigned Property No.: |

||||||||||

|

County |

|

Year |

20 |

|

|

20 |

|

Geo. |

|

|

Map |

Sub |

|

Block |

||||

|

|

Land |

|

|

|

|

|

|

|

Zoning |

|

|

Grid |

Plat |

|

Lot |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Buildings |

|

|

|

|

|

|

|

Use |

|

|

Parcel |

Section |

|

Occ. Cd. |

||

|

for |

|

Total |

|

|

|

|

|

|

|

Town Cd. |

|

Ex. St. |

Ex. Cd. |

|

|

|||

|

|

REMARKS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Space Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution: |

White – Clerk’s Office |

Canary – SDAT |

|

|

Pink – Office of Finance |

Goldenrod – Preparer |

|

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Maryland Sheet form, also known as the Land Instrument Intake Sheet, is used for recording various land-related transactions, such as deeds and mortgages, in the state of Maryland. |

| Governing Law | This form is governed by the Maryland Real Property Article, specifically Section 3-104(g)(3)(i), which outlines the requirements for property conveyance documentation. |

| Submission Requirements | Both the original deed and a photocopy must accompany each transfer. This ensures that the Clerk’s Office has the necessary documentation for processing. |

| Tax Considerations | The form includes sections for calculating transfer and recordation taxes, which are based on the purchase price or consideration amount of the property being conveyed. |

| Property Identification | Users must provide detailed property information, including tax ID numbers, property descriptions, and any relevant identifiers to ensure accurate processing and record-keeping. |

Other PDF Forms

Maryland Form 502 - Companies may need to add back state and local income taxes or other specified additions.

To ensure that your legal preferences are honored, you can utilize resources such as the WA Documents that provide guidance on completing the Washington Power of Attorney form effectively.

Md Tax Extension - Each corporation must enter the same taxable year or period used for their federal return on the 500E form.

Police Polygraph - This Maryland State Police form is for applicants undergoing a polygraph examination for positions ranging from Trooper to Civilian roles.