Printable Maryland Tax 766 Template

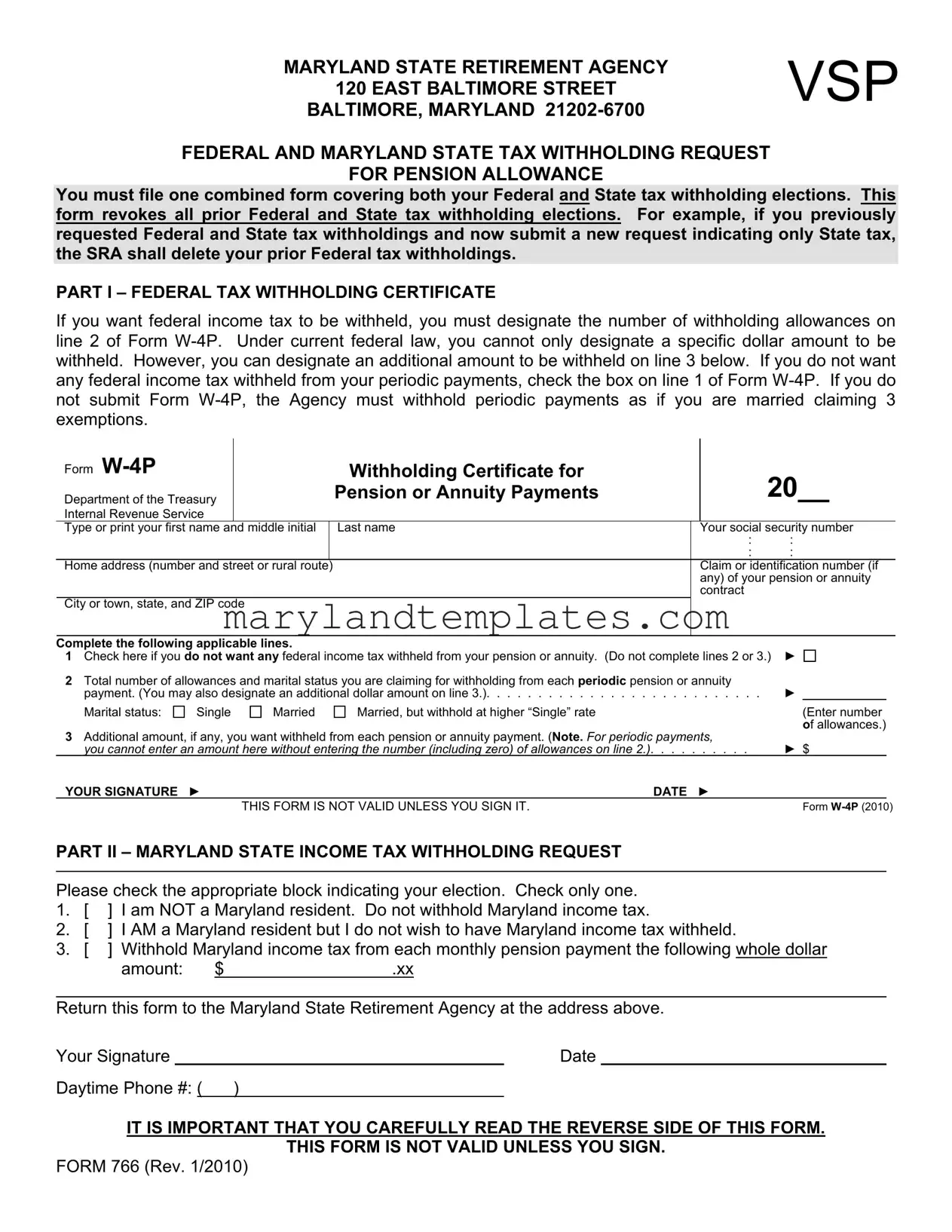

The Maryland Tax 766 form serves as a crucial tool for retirees in managing their federal and state tax withholding related to pension allowances. This combined form must be submitted to the Maryland State Retirement Agency to ensure that both federal and Maryland state income taxes are appropriately withheld from retirement payments. By filing this form, retirees can revoke any previous withholding elections, making it essential to understand the implications of their choices. The form is divided into two main parts: the first addresses federal tax withholding, where retirees can specify the number of allowances they wish to claim, or opt out of withholding altogether. The second part focuses on Maryland state income tax, allowing retirees to either decline withholding or designate a specific dollar amount to be deducted from their monthly pension payments. It is important for individuals to read the accompanying instructions carefully, as failing to submit this form or providing incorrect information can lead to unexpected tax liabilities. Additionally, retirees are encouraged to consult IRS publications and seek professional advice to ensure their tax withholding aligns with their financial situation.

Maryland Tax 766 Preview

MARYLAND STATE RETIREMENT AGENCY |

VSP |

|

|

120 EAST BALTIMORE STREET |

|

BALTIMORE, MARYLAND |

|

FEDERAL AND MARYLAND STATE TAX WITHHOLDING REQUEST

FOR PENSION ALLOWANCE

You must file one combined form covering both your Federal and State tax withholding elections. This form revokes all prior Federal and State tax withholding elections. For example, if you previously requested Federal and State tax withholdings and now submit a new request indicating only State tax, the SRA shall delete your prior Federal tax withholdings.

PART I – FEDERAL TAX WITHHOLDING CERTIFICATE

If you want federal income tax to be withheld, you must designate the number of withholding allowances on line 2 of Form

Form |

|

|

|

Withholding Certificate for |

|

20__ |

|

||

Department of the Treasury |

|

|

Pension or Annuity Payments |

|

|

||||

|

|

|

|

|

|

|

|

||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

Type or print your first name and middle initial |

|

Last name |

|

Your social security number |

|||||

|

|

|

|

|

: |

: |

|

|

|

|

|

|

|

|

: |

: |

|

|

|

Home address (number and street or rural route) |

|

|

Claim or identification number (if |

||||||

|

|

|

|

|

|

any) of your pension or annuity |

|||

|

|

|

|

|

|

contract |

|

|

|

City or town, state, and ZIP code |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

Complete the following applicable lines. |

|

|

|

► |

|||||

1 Check here if you do not want any federal income tax withheld from your pension or annuity. (Do not complete lines 2 or 3.) |

|||||||||

2 Total number of allowances and marital status you are claiming for withholding from each periodic pension or annuity |

► |

|

|

||||||

payment. (You may also designate an additional dollar amount on line 3.) |

|||||||||

Marital status: |

Single |

Married |

Married, but withhold at higher “Single” rate |

|

|

(Enter number |

|||

|

|

|

|

|

|

|

|

of allowances.) |

|

3 Additional amount, if any, you want withheld from each pension or annuity payment. (Note. For periodic payments, |

► $ |

||||||||

you cannot enter an amount here without entering the number (including zero) of allowances on line 2.). . . . |

. . . . . . |

||||||||

YOUR SIGNATURE |

► |

|

|

DATE |

► |

|

|

|

|

|

|

THIS FORM IS NOT VALID UNLESS YOU SIGN IT. |

|

|

|

Form |

|||

PART II – MARYLAND STATE INCOME TAX WITHHOLDING REQUEST

Please check the appropriate block indicating your election. Check only one.

1.[ ] I am NOT a Maryland resident. Do not withhold Maryland income tax.

2.[ ] I AM a Maryland resident but I do not wish to have Maryland income tax withheld.

3.[ ] Withhold Maryland income tax from each monthly pension payment the following whole dollar

amount: |

$ |

.xx |

Return this form to the Maryland State Retirement Agency at the address above.

Your Signature |

|

|

Date |

|

Daytime Phone #: ( |

) |

|

||

|

|

|

|

|

IT IS IMPORTANT THAT YOU CAREFULLY READ THE REVERSE SIDE OF THIS FORM.

THIS FORM IS NOT VALID UNLESS YOU SIGN.

FORM 766 (Rev. 1/2010)

2

Part I

FEDERAL INCOME TAX WITHHOLDING

The monthly retirement payments you receive from the Maryland State Retirement and Pension System may be subject to Federal income tax withholding. For further information, please refer to Internal Revenue Service Publication 575 regarding the taxability of pension and annuity income.

As a retiree, the following Federal income tax withholding alternatives are available to you:

1.You may elect not to have Federal income tax deducted from your monthly retirement payment, or

2.You may claim a certain number of exemptions and have the Maryland State Retirement and Pension System deduct the appropriate amount, if any, in accordance with the Federal income tax tables and you may designate an additional specific whole dollar amount to be withheld from your monthly retirement payment.

If you elect not to have Federal withholding apply to your monthly retirement payments, or if you do not have enough Federal income tax withheld, you may be responsible for payment of estimated tax. You may incur penalties under the Internal Revenue Service estimated tax rules if your withholding and estimated tax payment are not sufficient. New retirees, especially, should see IRS Publication 505.

Part II

MARYLAND STATE INCOME TAX WITHHOLDING

The monthly retirement payments you receive from the Maryland State Retirement and Pension System may be subject to Maryland income tax withholding.

As a retiree and a Maryland resident, the following Maryland income tax withholding alternatives are available to you:

1.You may elect not to have Maryland income tax deducted from your monthly retirement payment, or

2.You may designate a specific whole dollar amount to be withheld from your monthly retirement payment.

If you elect not to have Maryland withholding apply to your monthly retirement payments, or if you do not have enough Maryland income tax withheld, you may be responsible for payment of estimated tax.

An election of any one of the alternatives will remain in effect until you revoke it. You may revoke or change your election at any time by filing a new Federal and Maryland State Tax Withholding Request.

The Maryland State Retirement Agency can not assist you in the preparation of tax returns. Please contact the Internal Revenue Service at

To receive additional copies of the Federal and Maryland State Tax Withholding Request form, or for other information concerning your retirement benefits, call

SEE REVERSE SIDE FOR FEDERAL AND MARYLAND STATE TAX WITHHOLDING REQUEST

FORM 766 (Rev. 1/2010)

Additional Instructions:

Section references are to the Internal Revenue Code. Agency refers to the Maryland State Retirement Agency.

When should I complete the form? Complete Form

Other income. If you have a large amount of income from other sources not subject to withholding (such as interest, dividends, or capital gains), consider making estimated tax payments using Form

Withholding From Pensions and Annuities

Generally, federal income tax withholding applies to the taxable part of payments made from pension,

Because your tax situation may change from year to year, you may want to refigure your withholding each year. You can change the amount to be withheld by using lines 2 and 3 of Form

Choosing not to have income tax withheld. You (or in the event of death, your beneficiary or estate) can choose not to have federal income tax withheld from your payments by using line 1 of Form

Caution. There are penalties for not paying enough federal income tax during the year, either through withholding or estimated tax payments. New retirees, especially, should see Pub. 505. It explains your estimated tax requirements and describes penalties in detail. You may be able to avoid quarterly estimated tax payments by having enough tax withheld from your pension or annuity using Form

Periodic payments. Withholding from periodic payments of a pension or annuity is figured in the same manner as withholding from wages. Periodic payments are made in installments at regular intervals over a period of more than 1 year. They may be paid annually, quarterly, monthly, etc.

If you want federal income tax to be withheld, you must designate the number of withholding allowances on line 2 of Form

3

designate an additional amount to be withheld on line 3. If you do not want any federal income tax withheld from your periodic payments, check the box on line 1 of Form

Caution. If you do not submit Form

If you submit a Form

taxpayer identification number (TIN), the payer must withhold as if you are single claiming zero withholding allowances even if you choose not to have federal income tax withheld.

There are some kinds of periodic payments for which you cannot use Form

For periodic payments, your Form

Changing Your “No Withholding” Choice

Periodic Payments. If you previously chose not to have federal income tax withheld and you now want withholding, complete another Form

Payments to Foreign Persons and

Payments Outside the United States

Unless you are a nonresident alien, withholding (in the manner described above) is required on any periodic or nonperiodic payments that are delivered to you outside the United States or its possessions. You cannot choose not to have federal income tax withheld on line 1 of Form

In the absence of a tax treaty exemption, nonresident aliens, nonresident alien beneficiaries, and foreign estates generally are subject to a 30% federal withholding tax under section 1441 on the taxable portion of a periodic or nonperiodic pension or annuity payment that is from U.S. sources. However, most tax treaties provide that private pensions and annuities are exempt from withholding and tax. Also, payments from certain pension plans are exempt from withholding even if no tax treaty applies. See Pub.

Statement of Federal Income Tax Withheld From Your Pension or Annuity

By January 31 of next year, your payer will furnish a statement to you on Form

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of Form | The Maryland Tax 766 form is used to request federal and state tax withholding for pension allowances, allowing retirees to manage their tax obligations effectively. |

| Combined Filing Requirement | Retirees must file a single form that covers both federal and Maryland state tax withholding elections, revoking any previous elections made. |

| Federal Tax Withholding | To have federal income tax withheld, retirees must specify the number of allowances on line 2 of Form W-4P. If they choose not to withhold, they can check a specific box on the form. |

| Maryland Residency Status | Form 766 allows individuals to indicate their residency status, which affects whether Maryland state tax is withheld from their pension payments. |

| Withholding Options | Retirees can choose to withhold a specific dollar amount from their pension payments or opt out of withholding entirely, depending on their financial situation. |

| Revocation of Elections | Any withholding election remains in effect until revoked by filing a new request. This allows retirees flexibility in managing their tax withholdings. |

| Governing Laws | The Maryland Tax 766 form is governed by both federal tax laws and Maryland state tax regulations, ensuring compliance with applicable tax codes. |

| Contact Information | For assistance, retirees can reach out to the Maryland State Retirement Agency or consult the IRS for guidance on tax withholding and obligations. |

Other PDF Forms

Ccs Maryland - Underline your commitment to education by listing both part-time and full-time jobs held.

Sales Tax Md - Detailed breakdown for submitting Maryland's sales and use tax form during business changes.

To ensure your business interests are safeguarded, it's essential to have a solid understanding of the Washington Non-disclosure Agreement and to utilize resources like WA Documents which can help you create and manage these crucial legal contracts effectively.

How Much Back Child Support Is a Felony in Maryland - Delivers a method for Maryland citizens to report violations directly to the court, seeking appropriate legal remedies.