Printable Maryland W4 Template

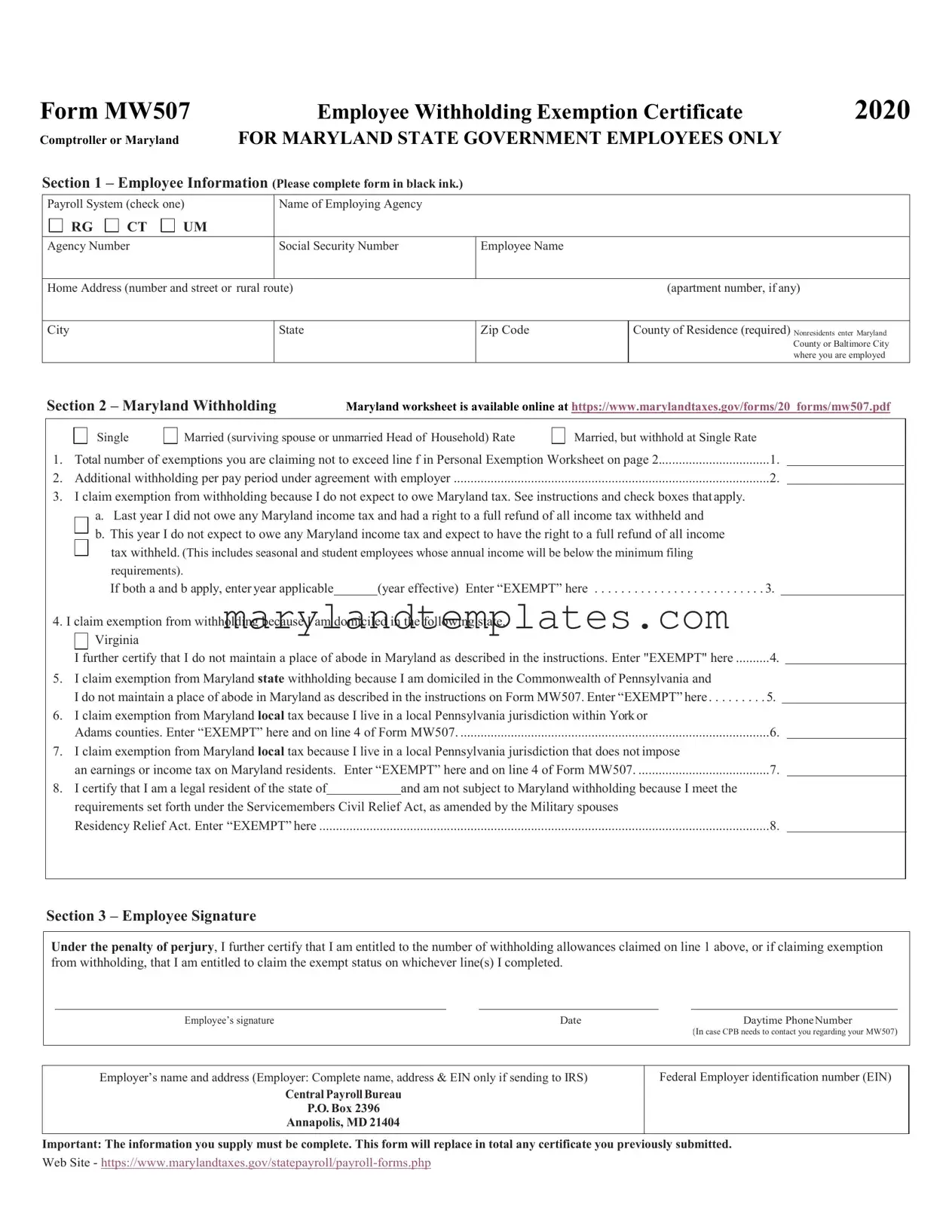

The Maryland W4 form, officially known as Form MW507, is essential for employees in Maryland to determine their state income tax withholding. This form is specifically designed for Maryland state government employees and must be completed in black ink. It requires personal information, including the employee's name, Social Security number, and home address. Additionally, employees must indicate their marital status and the number of exemptions they are claiming, which cannot exceed the limit specified in the Personal Exemption Worksheet. There are also provisions for additional withholding amounts if agreed upon with the employer. Certain employees may claim exemption from withholding if they meet specific criteria, such as not expecting to owe Maryland tax based on their previous year's tax situation or if they are domiciled in another state, like Virginia or Pennsylvania. The form concludes with a certification section where employees must sign and date, affirming the accuracy of their claims. For further assistance, employees can access the Maryland withholding worksheet online, ensuring they have the most up-to-date information for completing the form correctly.

Maryland W4 Preview

Form MW507 |

Employee Withholding Exemption Certificate |

2020 |

|||||

Comptroller or Maryland |

FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY |

|

|||||

|

Section 1 – Employee Information (Please complete form in black ink.) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

Payroll System (check one) |

|

Name of Employing Agency |

|

|

|

|

|

RG CT |

UM |

|

|

|

|

|

|

Agency Number |

|

|

Social Security Number |

Employee Name |

|

|

|

|

|

|

|

|||

|

Home Address (number and street or rural route) |

|

(apartment number, if any) |

||||

|

|

|

|

|

|

|

|

|

City |

|

|

State |

Zip Code |

County of Residence (required) Nonresidents enter Maryland |

|

|

|

|

|

|

|

|

County or Baltimore City |

|

|

|

|

|

|

|

where you are employed |

|

|

|

|

|

|

||

|

Section 2 – Maryland Withholding |

Maryland worksheet is available online at https://www.marylandtaxes.gov/forms/20_forms/mw507.pdf |

|||||

Single

Married (surviving spouse or unmarried Head of Household) Rate

Married, but withhold at Single Rate

1. |

Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet on page 2 |

1. |

2. |

Additional withholding per pay period under agreement with employer |

2. |

3.I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions and check boxes thatapply.

a.Last year I did not owe any Maryland income tax and had a right to a full refund of all income tax withheld and

b.This year I do not expect to owe any Maryland income tax and expect to have the right to a full refund of all income

|

tax withheld. (This includes seasonal and student employees whose annual income will be below the minimum filing |

|

||||

|

requirements). |

|

|

|

||

|

If both a and b apply, enter year applicable |

(year effective) Enter “EXEMPT” here |

3. |

|||

|

|

|

|

|||

4. I claim exemption from withholding because I am domiciled in the following state. |

|

|||||

|

Virginia |

|

|

|

||

|

I further certify that I do not maintain a place of abode in Maryland as described in the instructions. Enter "EXEMPT" here |

4. |

||||

5. |

I claim exemption from Maryland state withholding because I am domiciled in the Commonwealth of Pennsylvania and |

|

||||

|

I do not maintain a place of abode in Maryland as described in the instructions on Form MW507. Enter “EXEMPT” here |

5. |

||||

6. |

I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction within Yorkor |

|

||||

|

Adams counties. Enter “EXEMPT” here and on line 4 of Form MW507 |

6. |

||||

7. |

I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose |

|

||||

|

an earnings or income tax on Maryland residents. Enter “EXEMPT” here and on line 4 of Form MW507 |

7. |

||||

8. |

I certify that I am a legal resident of the state of |

|

and am not subject to Maryland withholding because I meet the |

|

||

|

|

|

|

|

|

|

|

requirements set forth under the Servicemembers Civil Relief Act, as amended by the Military spouses |

|

||||

|

Residency Relief Act. Enter “EXEMPT” here |

|

8. |

|||

Section 3 – Employee Signature

Under the penalty of perjury, I further certify that I am entitled to the number of withholding allowances claimed on line 1 above, or if claiming exemption from withholding, that I am entitled to claim the exempt status on whichever line(s) I completed.

Employee’s signature |

Date |

Daytime PhoneNumber |

|

|

(In case CPB needs to contact you regarding your MW507) |

Employer’s name and address (Employer: Complete name, address & EIN only if sending to IRS)

CentralPayrollBureau

P.O. Box 2396

Annapolis, MD 21404

Federal Employer identification number (EIN)

Important: The information you supply must be complete. This form will replace in total any certificate you previously submitted.

Web Site -

Form Attributes

| Fact Name | Details |

|---|---|

| Form Name | The Maryland W4 form is officially known as Form MW507, Employee Withholding Exemption Certificate. |

| Governing Law | This form is governed by the Maryland Tax Code, specifically under Title 10 of the Tax-General Article. |

| Purpose | It is used by employees to claim exemptions from Maryland state income tax withholding. |

| Eligibility | Employees who do not expect to owe Maryland income tax can claim exemption. |

| Filing Requirement | Employees must complete the form in black ink and provide accurate personal information. |

| Exemption Conditions | Exemptions can be claimed based on residency in certain states or specific conditions outlined in the form. |

| Signature Requirement | Employees must sign the form under penalty of perjury, certifying the accuracy of the information provided. |

| Submission | The completed form should be submitted to the employer and may also need to be sent to the IRS in some cases. |

| Resources | Additional information and the Maryland worksheet can be found online at the Maryland Comptroller's website. |

Other PDF Forms

Maryland State 100 Application - Mandates the attachment of a self-addressed, stamped envelope for applicants desiring a receipt of their application.

By utilizing a comprehensive document like the Washington Non-disclosure Agreement, businesses can ensure that their proprietary information remains secure, and for those looking to formalize such an agreement, we recommend visiting WA Documents for an efficient solution.

How Many Hours Can a Minor Work in Illinois - Aids in the prevention of underage labor violations by outlining a clear process for legal employment.

Ccs Maryland - Reflect on your academic and personal journey by listing past colleges attended and future academic aspirations.