Printable Maryland Wage Claim Template

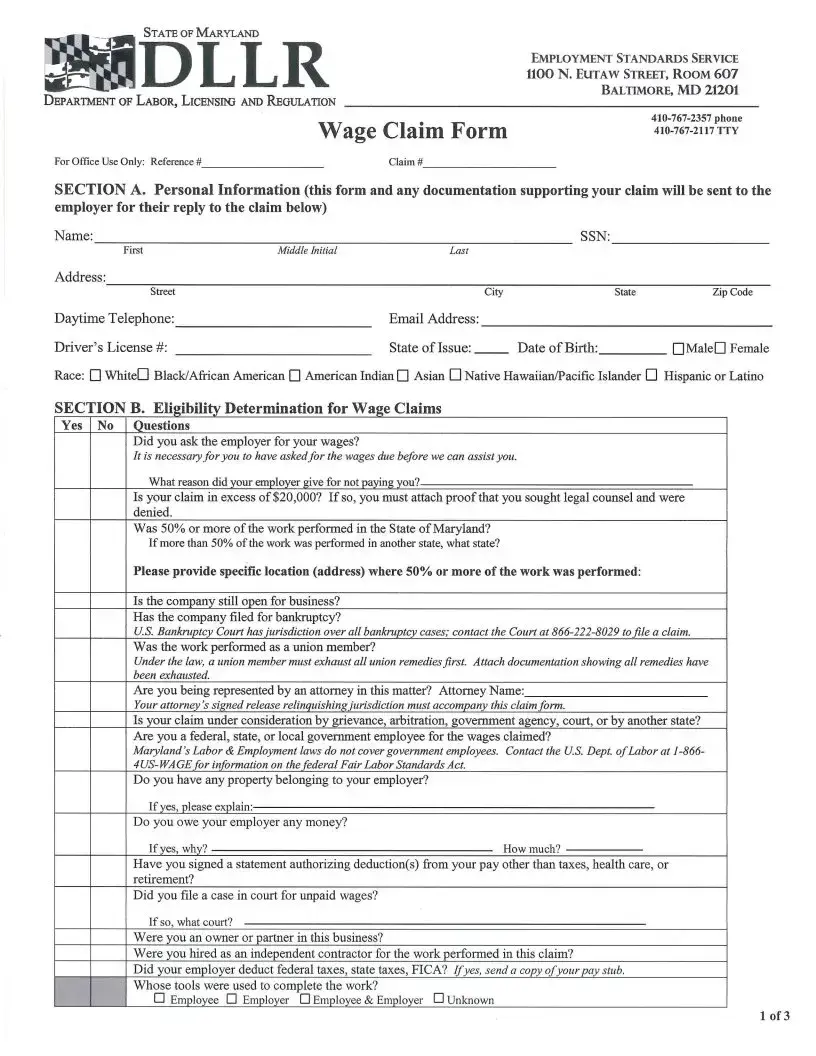

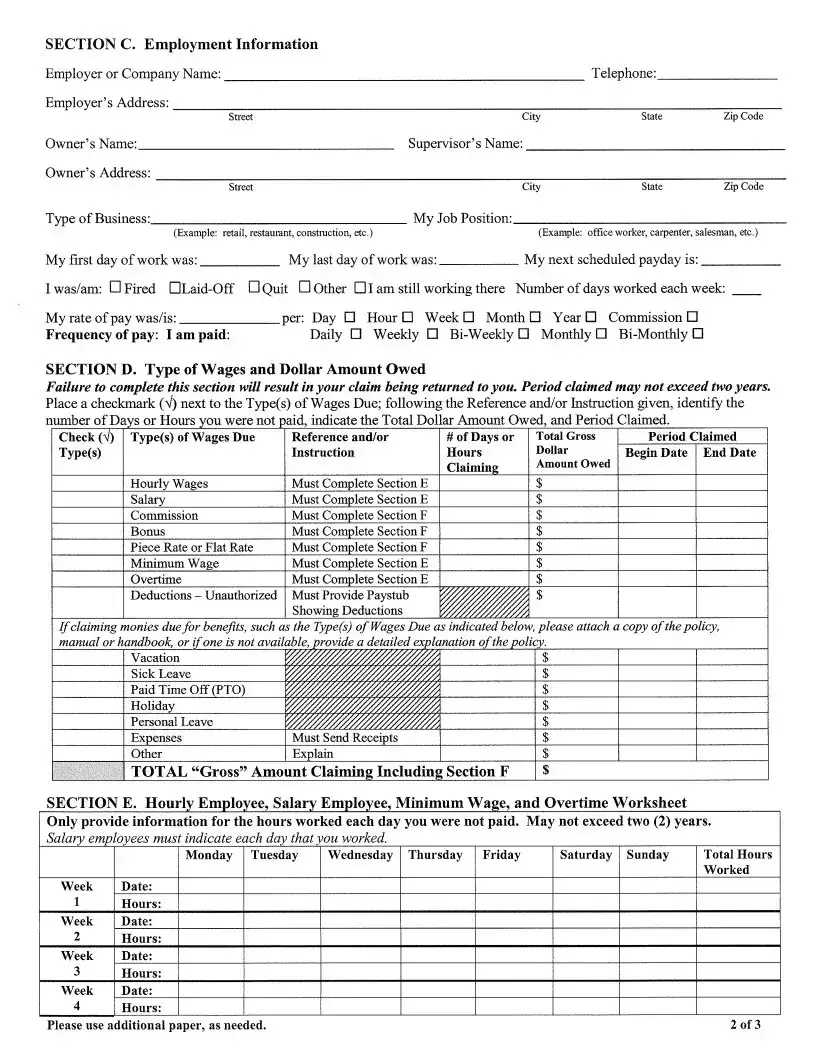

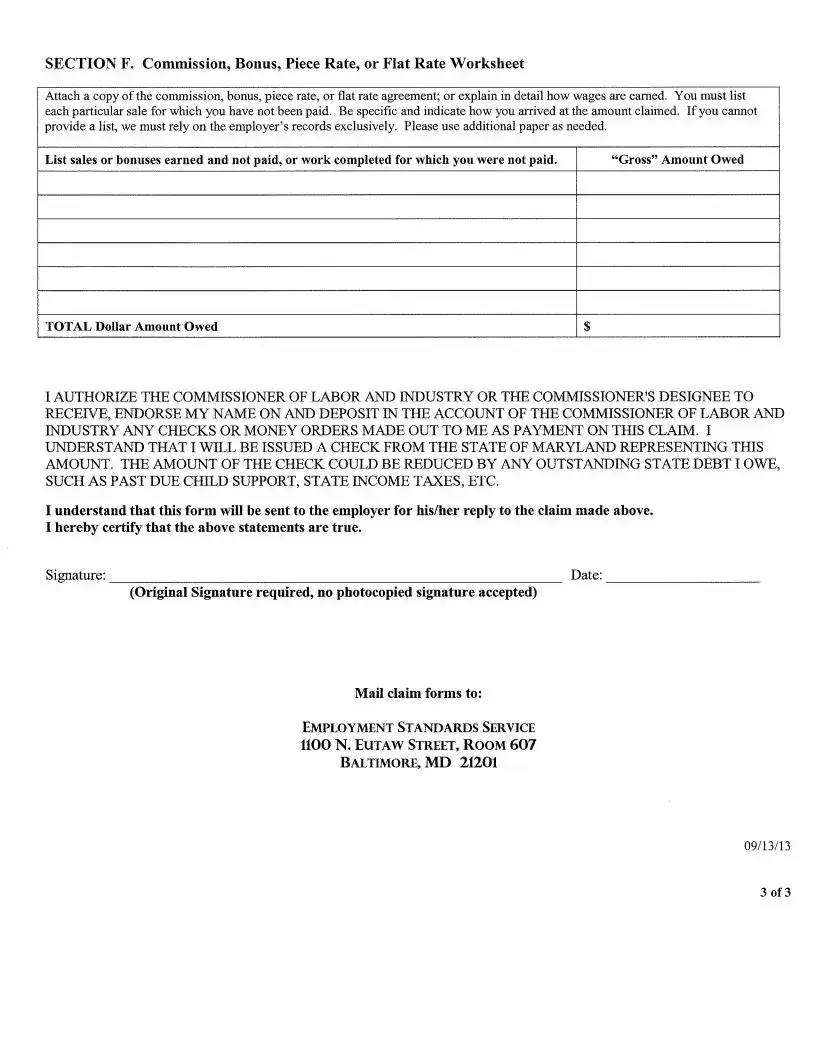

Understanding the Maryland Wage Claim form is essential for anyone seeking to recover unpaid wages from an employer. This form, issued by the Department of Labor, Licensing and Regulation (DLLR), serves as a crucial tool for employees who have not received the compensation they are owed. To initiate a claim, individuals must first ensure they have formally requested their wages from their employer and received a denial. The form requires detailed personal information, including the claimant's name, contact details, and employment history. Additionally, it asks for specific information about the employer, such as their address and contact number. Supporting documents play a significant role in the claims process, and claimants are encouraged to attach any relevant materials, such as employment contracts, pay stubs, and time records. It is important to note that claims must be filed within two years of the wage dispute, although individuals have up to three years to pursue legal action in court. The completion of this form is not merely a procedural step; it represents a vital opportunity for employees to assert their rights and seek the compensation they deserve. Acknowledgment of receipt will be provided, and the investigation will follow, emphasizing the need for thoroughness and accuracy in the submission process.

Maryland Wage Claim Preview

Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Maryland Wage Claim form is governed by the Maryland Labor and Employment Code, specifically Title 3, Subtitle 5, which addresses wage disputes and claims. |

| Filing Requirements | To file a wage claim, individuals must first request their unpaid wages from their employer and be denied. The claim must be signed and submitted with supporting documentation. |

| Time Limits | The claim period cannot exceed two years from the date the wages were due. However, claimants have three years to file a lawsuit in court if necessary. |

| Investigation Process | Upon receiving the claim, the Maryland Department of Labor will investigate in the order claims are received. A final determination will be communicated in writing. |

Other PDF Forms

Maryland Form 502 - The form calculates net Maryland modifications to arrive at Maryland modified income.

For effective legal arrangements, parents may consider using a customized Power of Attorney for a Child document, which enables designated individuals to oversee vital decisions when parents cannot be present.

Md Form 502 Instructions - Form 502X includes comprehensive guidance on amending returns to reflect changes in taxable Social Security benefits and other specific income sources.