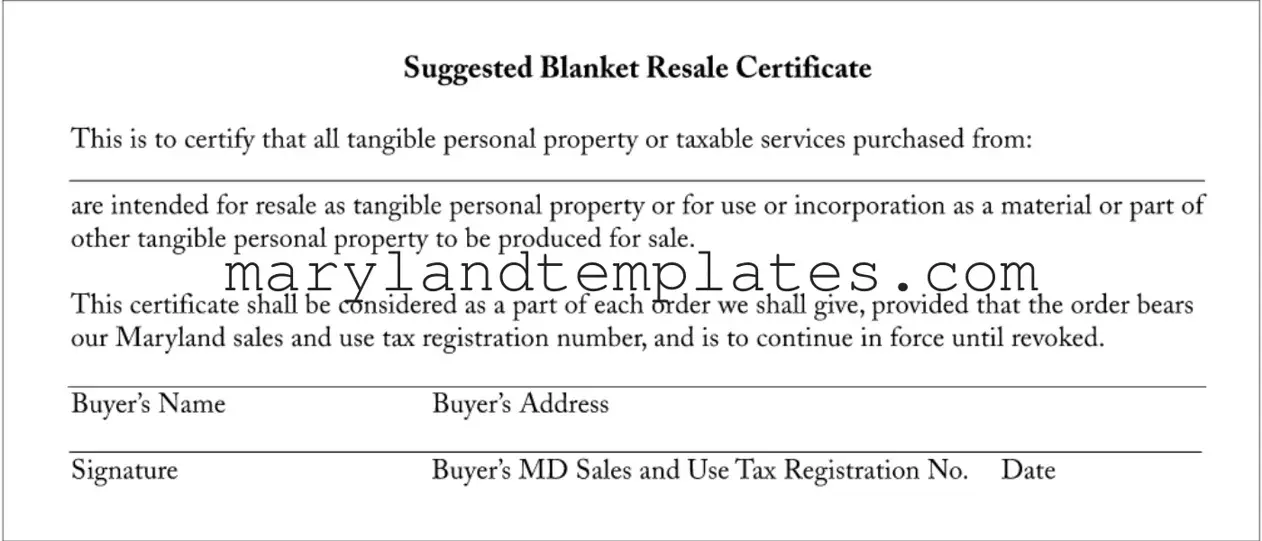

Printable Resale Certificate Maryland Template

The Resale Certificate Maryland form plays a crucial role in the state's sales tax system, allowing businesses to make tax-exempt purchases of tangible personal property and taxable services intended for resale. This certificate serves as a declaration that the items acquired will not be subject to sales tax because they are meant to be resold or incorporated into products that will eventually be sold. When completing the form, buyers must provide essential information, including their name, address, and Maryland sales and use tax registration number. The form is designed to be used as a blanket certificate, meaning it can apply to multiple purchases as long as each order references the buyer's registration number. This simplifies the purchasing process for businesses, ensuring compliance with tax regulations while streamlining operations. Importantly, the certificate remains valid until it is revoked, giving buyers the flexibility they need in their transactions.

Resale Certificate Maryland Preview

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Resale Certificate in Maryland certifies that purchased items are intended for resale, either as tangible property or as part of other products. |

| Governing Law | This form is governed by the Maryland Sales and Use Tax Law, specifically under the Maryland Code, Tax - General, Title 11. |

| Registration Requirement | To use the Resale Certificate, the buyer must provide their Maryland sales and use tax registration number on the order. |

| Validity | The certificate remains valid until it is revoked by the buyer, ensuring ongoing compliance for future purchases. |

| Buyer's Information | The form requires the buyer's name, address, and signature to authenticate the certificate. |

| Use Cases | It is commonly used by retailers and wholesalers to avoid paying sales tax on items intended for resale. |

Other PDF Forms

Ein Number Lookup Maryland - Allows for mailing address inclusion, essential for communication and document receipt.

For couples considering marriage, understanding the importance of a solid Prenuptial Agreement can be vital for their future. By exploring the nuanced aspects of the Arizona Prenuptial Agreement, partners can ensure they are making informed decisions regarding their financial rights and responsibilities.

Maryland Charitable Solicitation Registration - Designates responsibility for financial bookkeeping, ensuring accountability in financial management.

Maryland Form 502 Instructions - Aligns law enforcement actions with judicial expectations for court appearances.